FIG Initiation

- 1. RBC Capital Markets, LLC Bulent Ozcan, CFA (Associate Analyst) (212) 863-4818 bulent.ozcan@rbccm.com Eric N. Berg, CPA (Analyst) (212) 618-7593 eric.berg@rbccm.com Outperform NYSE: FIG; USD 7.22 Price Target USD 9.00 Scenario Analysis* Downside Scenario 6.00 14% Current Price 7.22 Price Target 9.00 28% Upside Scenario 10.00 42% *Implied Total Returns Key Statistics Shares O/S (MM): 236.7 Dividend: 0.24 Market Cap (MM): 1,709 Yield: 3.3% Priced as of market close ET, July 16, 2013. RBC Estimates FY Dec 2012A 2013E 2014E Distributable Earnings 0.48 0.85 0.98 Revenue (MM) 757.0 1,094.9 1,287.7 FEAUM (MM) 53,430 61,836 69,256 DPS 0.20 0.33 0.48 Div Yield 2.8% 4.6% 6.6% Distributable Earnings Q1 Q2 Q3 Q4 2012 0.10A 0.09A 0.11A 0.19A 2013 0.19A 0.21E 0.22E 0.23E 2014 0.24E 0.24E 0.25E 0.25E Revenue (MM) 2012 170.0A 161.0A 181.0A 245.0A 2013 248.0A 273.9E 282.1E 290.8E 2014 309.4E 317.1E 326.0E 335.3E All values in USD unless otherwise noted. July 16, 2013 Fortress Investment Group LLC Initiating Coverage: With Catalysts Abundant, Valuation Seems Compelling Our View: We are initiating coverage on Fortress Investment Group with an Outperform rating and a $9 price target. We believe that the alternative asset management industry, in general, and Fortress specifically, is deeply discounted versus traditional asset managers and could provide significant upside. Attractive valuations and improving fundamentals make Fortress Investment Group a compelling opportunity, in our opinion. Key Points: • Fortress’s shares are very attractively valued: In an undervalued sector, Fortress appears to be the least-appreciated stock. We think investors in Fortress could get an option on incentive-based earnings at little cost. Assuming fee-based earnings of $0.30 during the next 12 months and applying a mean traditional asset management 2013 P/E multiple of 16x, we estimate the shares should be worth $4.80. In addition, the company has $2.95 of net cash and investments on its balance sheet. On top of that, there is about $1.50 of undistributed incentive income, which we believe could grow over time. Assuming a 50% discount on undistributed incentive income, investors buying the shares around $7 are potentially getting value of $8.50 with the optionality of growing undistributed incentive income. This seems compelling to us. • Fortress has a very strong credit franchise: With a net internal rate of return (IRR) of 22% since inception, Fortress has one the of the best credit franchises in the sector. There is about $645 million of gross unrealized incentive income embedded in the business and management has said that it could increase realizations. • Hedge fund performance is very strong and could lead to earnings surprises: As of 1Q13, about 95.4% of incentive-eligible assets were above their high-water mark and we would expect this figure to be close to 100%, given the strong performance numbers in 2Q12. The firm's largest hedge fund, the Macro Fund, is up 13.2% year to date. As a comparison, the fund produced returns of 17.8% for all of 2012. • Restructuring of Newcastle could accelerate incentive income emergence: With the creation of New Residential, Fortress has reset the clock and high-water marks, positioning the firm to generate promote sooner. Incentive income can now be generated as soon as the performance hurdle rate has been passed. • Logan Circle Partners could be another longer term catalyst: Given the lack of earnings, we don't believe that investors assign any value to Logan Circle. Fortress bought Logan Circle in 2010 for $21 million and has almost doubled the assets since then. With the expansion into equities, fee rates could increase and growth of assets under management (AUM) could accelerate. We would expect earnings to emerge as Logan Circle achieves economies of scale. Priced as of prior trading day's market close, EST (unless otherwise noted). For Required Conflicts Disclosures, see Page 55.

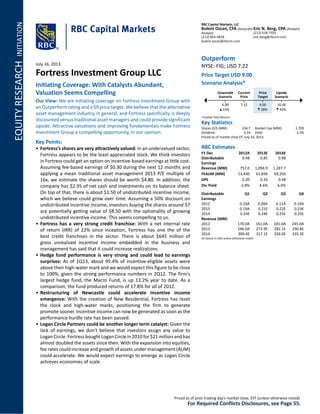

- 2. Target/Upside/Downside Scenarios Exhibit 1: Fortress Investment Group LLC 12.00 10.00 8.00 6.00 4.00 2.00 0.00 Current Share Price 7.22 Price Target 9.00 Upside Scenario 10.00 Downside Scenario 6.00 SharePrice(USD/sh) Source: RBC Capital Markets estimates Target Price/ Base Case Our base case scenario results in 2013 distributable earnings (DE) of $0.85. This is broken down as follows: $0.29 in management fee DE and $0.56 in incentive income DE. We are applying a P/E multiple of 16x to management DE and 8x to incentive income DE to arrive at our $9 price target. These are our assumptions: private equity multiple on invested capital (MOIC) of 1.2x and Credit PE MOIC of 1.4x; an annual fund performance of 14.0% for the Castles; hedge fund returns of 3.5% per quarter and an organic growth rate of 5.0% per quarter for assets managed by Logan Circle. Upside Scenario Our upside scenario results in 2013 distributable earnings (DE) of $0.97. This is broken down as follows: $0.29 in management fee DE and $0.68 in incentive income DE. We are applying a P/E multiple of 16x to management DE and 8x to incentive income DE to arrive at our $10 scenario value. These are our assumptions: Private equity MOIC of 1.4x and Credit private equity MOIC of 1.7x when exiting; annual fund performance of 15.4% for the Castles; hedge fund returns of 3.9% per quarter; and an organic growth rate of 5.5% per quarter for assets managed by Logan Circle Partners. Downside Scenario Our downside scenario results in 2013 distributable earnings (DE) of $0.76. This is broken down as follows: $0.29 in management fee DE and $0.47 in incentive income DE. We are applying a P/E multiple of 12x to management DE and 6x to incentive income DE to arrive at our $6 scenario value. These are our assumptions: Private equity MOIC of 1.1x and Credit private equity MOIC of 1.3x when exiting; annual fund performance of 11.2% for the Castles; hedge fund returns of 2.8% per quarter; and an organic growth rate of 4.0% per quarter for assets managed by Logan Circle Partners. Investment Thesis The alternative asset management industry in general, but Fortress in particular, appears deeply discounted vs. traditional asset managers and could provide significant upside. Fortress’ shares appear attractively valued. In an undervalued sector, FIG seems to be the least appreciated stock. Investors in FIG get the optionality on incentive- based earnings at little cost. Assuming fee-based earnings of $0.30 over the next 12 months and applying a 16x PE- multiple, we estimate the shares should be worth at least $4.80. In addition, the company has $2.95 of net cash and investments on its balance sheet. On top, there is about $1.50 of gross undistributed incentive income today, which we believe could grow over time. Assuming a 50% discount on undistributed incentive income, investors buying the shares around $7 are potentially getting value of $8.50 - with the optionality of growing undistributed incentive income. This seems compelling to us. Potential catalysts for the shares: • Hedge fund performance is very strong and could lead to earnings surprises. With more assets eligible for incentive income and strong year-to-date performance, incentive income could exceed expectations. • Restructuring of Newcastle and Eurocastle could accelerate incentive income generation. Fortress has recently reset high watermarks and could earn incentive income. • Very strong credit franchise. With a net internal rate of return of 22% since inception and diminishing investment opportunities, realizations could accelerate. There is about $645 million of unrealized incentive income embedded in the business. • Logan Circle Partner could increase AUM and fee rates as it expands into equities. We believe that market ascribes no value to Logan Circle Partners. Key risks to our thesis: • Continued weak private equity fund performance could lead to weaker than expected realizations and distributable earnings. • Potential tax reforms could result in carried interest being taxed as ordinary income. • Limited investor interest due to K-1 filing requirements and associated back office burdens could keep demand for FIG shares low. • Lack of liquidity and float could keep interest in alternative asset managers muted. • Complexity of the sector and difficulty in analyzing companies within the sector could lead to limited interest in alternative asset managers. July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 2 Fortress Investment Group LLC

- 3. Table of Contents Table of Contents ......................................................................................................................................................................3 Key Questions............................................................................................................................................................................4 Quick Background on Fortress Investment Group LLC................................................................................................................6 Investment Thesis – Key Positives .............................................................................................................................................7 Fortress’s shares are very attractively valued – too compelling to ignore ..................................................................................7 Successful credit franchise should generate strong promote....................................................................................................15 Performance of hedge funds is strong and could lead to significant incentive income, which is not priced in ........................16 New Residential could generate incentive income immediately after the Newcastle asset spin-off (there is also option value)..........................................................................................................................................................................................18 Optionality on upside of Logan Circle Partners at no charge.....................................................................................................20 Despite challenges in PE, Fortress has not had problems raising capital...................................................................................23 Fortress has one of the youngest management teams..............................................................................................................23 Investment Thesis – Key Negatives..........................................................................................................................................25 Private equity fund performance is weak (but improving) ........................................................................................................25 Finding opportunities in credit is more difficult.........................................................................................................................26 Potential tax rate changes could be an issue.............................................................................................................................27 Requirement to file K-1 is holding back investors......................................................................................................................28 Liquidity and float are low; hard to build a position ..................................................................................................................29 Analyzing companies within the sector is difficult given inconsistent accounting & utilization of non-GAAP measures across the sector and the difficulty of projecting realizations...................................................................................................29 Company Description ..............................................................................................................................................................31 Milestones...............................................................................................................................................................................32 Business segments & Recent Financial Results..........................................................................................................................32 Assets Under Management (AUM) ..........................................................................................................................................44 Organizational structure ............................................................................................................................................................48 Management Team .................................................................................................................................................................50 Valuation Framework..............................................................................................................................................................51 Risks and Price Target Impediments ........................................................................................................................................53 July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 3 Fortress Investment Group LLC

- 4. Key Questions Our View 1. Will private equity realizations pick up given a lack of fund performance? While Fortress’s private equity (PE) performance has not been stellar, we believe that realizations could pick up if portfolio company valuations improve. Fortress’s funds have significant exposure to financial services companies and real estate. As the economy improves, we would expect the value of companies such as Nationstar, CW Financial Services, Italfondiaro or Walker & Dunlop to appreciate, leading to exits and realizations. The underlying value of Fortress’s PE funds increased 25% in 2012, followed by an increase of 5% in 1Q13. We believe that two funds (FHIF & Fund III) could generate promote in the near term, as they approach their respective investment income thresholds. 2. Can Fortress raise capital for new funds given the lack of PE fund performance? Fortress’s traditional buyout capital-raising activities had been dormant since 2008, as management was focused on restructuring portfolio companies and its funds. Now, management is re-focusing on raising capital. Fortress has raised $1.4 billion year-to-date for its PE funds. Fortress is currently in the market, raising capital for a second infrastructure fund. We also like the fact that Wes Edens, principal and co- founder of FIG, set a soft target of $5 billion in PE capital raises. This is encouraging as alternative asset managers generally do not like to give guidance. PE performance does not appear to have affected the firm’s ability to raise capital. 3. Aren’t the funds overexposed to financial services and a recovery in real estate? It is difficult to estimate how big the exposure to financial services and real estate is, but we believe it is significant. However, given a benign economic backdrop and a slow-but-steady recovery, we would consider the exposure to be beneficial since valuations of real estate holdings could improve. Furthermore, more assets could be acquired at attractive prices as financial services firms continue to divest non-strategic assets. Likewise, increased regulation could lead to further delevering of banks, with assets being put up for sale. Having established portfolio companies that can capitalize on these opportunities is a positive in this environment. 4. Should investors be concerned about investment opportunities in Credit? Is the best performing business coming under pressure? The opportunity to put capital to work has declined significantly in the Credit business line compared to 2008 and 2009. Fewer investment opportunities meet Fortress’s hurdle rates. Nonetheless, we believe assets will become available that meet minimum-return requirements. European banks, for instance, are still highly levered compared to their US counterparts and could be forced to sell assets to meet more stringent capital requirements. Moreover, while it becomes more difficult to find attractive “targets”, tighter markets could lead to an increase in realizations. So far, about $645 million of gross unrealized investment income could be harvested during the coming quarters, according to the company. We believe that this figure is likely to increase. 5. Could Fortress’s shares become less attractive if Congress changes tax treatment of carried interest? While carried interest has been an issue since 2007, it seems more likely that Congress could move forward and change the tax treatment of carried interest. The Senate Finance Committee released its 8 th tax reform discussion paper on June 6, 2013, focusing on tax treatment of carried interest. The Committee stated that tax code reforms are needed to reduce or eliminate differences in overall tax burdens across different types of entities, owners and income. Higher taxes could lead to lower payouts and dividend yields. However, any change in the tax law would come with a 10-year transition period that would allow the firm to optimize its corporate structure. Changing the corporate structure and reorganizing as a corporation could increase institutional demand for Fortress shares, potentially offsetting the negative impact associated with higher taxes. July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 4 Fortress Investment Group LLC

- 5. Key Questions (continued) Our View 6. A number of institutional clients cannot own limited partnerships. What are the alternatives? We agree that the limited partnership structure makes investing in alternative asset managers difficult, if not impossible. Some investors do not want to deal with the additional administrative burdens that come with owning limited partnerships. Others cannot own the shares due to fund mandates. Nonetheless, investors interested in alternative asset managers can gain synthetic exposure to the securities by entering total return swaps or buying notes that provide synthetic ownership. 7. Nomura owns 25% of Fortress’s shares outstanding. Could Nomura exit its holding, leading to a decline in the share price? We agree that Nomura’s large ownership could be an overhang. Determining the timing of an exit is difficult. Prior to the IPO in 2007, Nomura agreed to buy about 55 million shares (or 15% of Fortress) for $888 million. This would imply that Nomura paid over $16 for the shares. In 2009, Nomura increased its ownership to 25% by buying about 5 million shares at an offering price of $5. Thus, we estimate that Nomura’s weighted average cost basis is now in excess of $15. Economically, it would make little sense to sell the shares at current levels. However, there is the risk that Nomura might sell its holding as it might consider the ownership in Fortress as non-core. In any sale, we would expect Fortress’s management team to be deeply involved and either repurchase the shares from Nomura or find another strategic owner. July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 5 Fortress Investment Group LLC

- 6. Quick Background on Fortress Investment Group LLC Fortress Investment Group LLC (NYSE:FIG) is a global alternative asset management company specializing in asset-based investing. FIG has about $55.6 billion of assets under management as of March 31, 2013. Headquartered in New York, it has seven offices in the US and eight offices around the world. While the company’s roots are in private equity (PE), Fortress has evolved into a diversified asset management company over time. Its primary business is to sponsor various investment funds and companies and provide investment management services, including related managed accounts. Fortress offers private equity funds, liquid hedge funds, and credit funds. In 2010, Fortress acquired Logan Circle Partners, which offers traditional investment products. While Logan Circle Partners initially offered only fixed income-oriented strategies, Fortress made the decision to expand the product offering to include equity products. In April 2013, Logan Circle Partners launched a growth equities investment business offering concentrated portfolios of publicly traded US equities. Exhibit 2: Overview of Fortress Investment Group LLC Private Equity Castles Private Equity Hedge Funds Liquid Markets Logan Circle Partners AUM ($ in bn) $11.1 $4.4 $7.0 $5.6 $5.5 $21.9 Strategy General buyout and sector- specific funds focused on control- oriented investments in cash-flow generating assets and asset-based businesses in North America, Western Europe and Asia Publicly traded permanent capital vehicles, that invest in a wide variety of real estate related assets including securities, loans, real estate properties and mortgage servicing rights Distressed and undervalued assets (some with limited current cash flows and long investment horizons) and tangible & intangible assets (real estate, capital assets, natural resources and intellectual property) Opportunitic lending situations & securities Invest globally in fixed income, currency, equity and commodity markets, and related derivatives to capitalize on imbalances in the financial markets Actively managed fixed income and growth equity investment strategies Life of Business PE Invesmtent funds: 10 years Mortgage funds: 5 years Perpetual Various (3 to 25 years) Perpetual Perpetual Not applicable Redemption Rights None None None Annual redemptions Monthly redemptions Not applicable Private Equity Credit Source: Company reports While PE and Logan Circle Partners comprise the majority of AUM, the Credit and Liquid Markets lines of business have been the main contributors to total revenues - due to increased realization activity and strong hedge fund performance. July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 6 Fortress Investment Group LLC

- 7. Investment Thesis – Key Positives Fortress’s shares are very attractively valued – too compelling to ignore In general, markets are efficient and “price in” the depth and breadth of management talent and a company’s competitive positioning. However, we believe that Fortress might be one of the rare instances where the market does not fully appreciate a company’s earnings power. Thus, we see a compelling opportunity that should not be ignored. In general, we would consider the alternative asset management sector to be undervalued relative to traditional asset managers. Exhibit 3: NTM P/E - Alternative asset managers trading at a discount to traditional asset managers 0.0x 5.0x 10.0x 15.0x 20.0x 25.0x 30.0x 35.0x 40.0x 45.0x 50.0x 04/02/2007 11/13/2007 06/30/2008 02/12/2009 09/28/2009 05/13/2010 12/27/2010 08/10/2011 03/26/2012 11/08/2012 06/26/2013 Traditional AM Alternative AM FIG Source: FactSet; RBC Capital Markets (Priced as of market close ET, July 12, 2013) In an undervalued sector, Fortress seems to be the least expensive alternative asset manager. Why is that? Fortress was the first alternative asset manager in the United States to go public, in 2007, followed by Blackstone and Och-Ziff the same year. While the IPOs were priced at a premium to traditional asset managers, the group’s appeal faded with doubts rising around realizations given the onset of the financial crisis. Industry-wide realizations had decreased, no doubt. However, while realizations started to increase from 2009 to 2010, valuations have remained depressed. Alternative asset managers have been trading at a 35% discount to traditional asset managers, on average, since 2010. We believe that the alternative asset management sector, in general, and Fortress Investment Group LLC specifically, are very attractively valued relative to traditional asset managers July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 7 Fortress Investment Group LLC

- 8. Exhibit 4: Distribution cycle – industry-wide exits have increased since 2009 ($ in billions) $165 $268 $122 $86 $237 $337 $289 $0 $50 $100 $150 $200 $250 $300 $350 $400 2006 2007 2008 2009 2010 2011 2012 Source: Carlyle Group Investor Presentation; RBC Capital Markets This discount has increased to over 37% as of July 12, 2013, based on the average next- twelve month (NTM) P/E ratio. While traditional asset managers have recovered from the financial crisis, alternative asset managers seem to have fallen behind in terms of re- valuation. We believe that investors apply a discount to alternative asset managers given some of the negative aspects of owning alternative asset managers, including having to deal with K-1s, low liquidity and float, potential changes to tax rates and the limited partnership structure, and the general complexity of analyzing alternative asset managers. In addition, investors have not experienced a full harvesting cycle yet, given the difficult operating environment for portfolio companies and the inability of PE funds to monetize holdings at appropriate returns. However, we believe that there are factors that need to be considered and could offset the negative aspects mentioned above: The average management fee for mutual funds is lower than for alternative asset classes. Management fees are charged by mutual funds to cover portfolio management, fund administration and compliance, shareholder services, recordkeeping, certain distribution expenses and other operating costs. We estimate that the average management fee for domestic equity funds is 70 basis points (bps)-75 bps; the average management fee for international equity funds is 85 bps-90 bps; and the average management fee for fixed income mutual funds is about 45 bps-50 bps. Management fees for separately managed accounts are even lower. With the increasing popularity of exchange-traded funds (ETFs), mutual fund companies might be forced to lower their fees even further, considering that the average expense ratio for ETFs is about 40 bps-45 bps. For some, these expense ratios are even lower. For instance, Vanguard ETFs have an average expense ratio of 15 bps. Exhibit 5 depicts the decline in expense ratios charged by mutual funds. The trend is unmistakable. Expense ratios for traditional asset managers have been declining for some time. We do not believe that alternative asset managers are exposed to the same degree to price competition as traditional asset managers July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 8 Fortress Investment Group LLC

- 9. Exhibit 5: Expense ratios are declining 0bps 20bps 40bps 60bps 80bps 100bps 120bps 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 Equity Funds Hybrid Funds Bond Funds Money Market Funds Source: Investment Company Institute; Lipper; RBC Capital Markets Some of the decline in expense ratios could be attributed to an increase in AUM and achieving economies of scale. However, we believe that the demand for inexpensive ETFs has also been a contributing factor. The average expense ratio incurred by investors in mutual funds in 2012 was 77 bps based on data published by the Investment Company Institute (ICI). In contrast, alternative asset managers earned an average of 102 bps in management fees during the same period. Exhibit 6: Management fees exceed that of traditional asset managers (2012) 104.3 104.5 105.6 98.7 98.8 94bps 96bps 98bps 100bps 102bps 104bps 106bps 108bps Apollo Global Mgmt Blackstone Carlyle Group KKR Fortress ManagementFees Source: Company reports; RBC Capital Markets Management fees are lower for Fortress as it has expanded into the traditional asset management sector. Management fees are more predictable for alternative asset managers. Another advantage alternative asset managers enjoy over their traditional asset manager counterparts is that assets are stickier. Alternative asset managers can lock in assets for an extended period, whereas traditional asset managers often experience inflows and outflows on a daily basis; Alternative asset managers charge higher fees and assets that have longer lock-up period than traditional asset managers July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 9 Fortress Investment Group LLC

- 10. their investor base is less patient and more willing to withdraw funds when performance deteriorates. Lock-up periods at Fortress vary by asset class, with 51% of fee-earning assets under management having a lock-up period of one year or more. Exhibit 7: 49% of fee-earning assets can be redeemed daily or monthly (1Q13) Perpetual 8% 3 yrs -25 yrs 13% 5 yrs -10 yrs 20% 1 year 10% Monthly 10% none 39% Source: Company reports; RBC Capital Markets Dividend yields exceed those of traditional asset managers and the S&P 500 Index. Investors in the alternative asset management segment are acquiring income-generating securities. In fact, the dividend yield for alternative asset managers exceeds that of the broader market – as well as the yield one could generate owning traditional asset managers. Exhibit 8: Average dividend yield of alternative asset managers twice that of traditional asset managers 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 2008/01/02 2009/01/02 2010/01/02 2011/01/02 2012/01/02 2013/01/02 Trad Asset Mgrs Alt Asset Mgrs Avg Alt Asset Mgrs S&P 500 Source: SNL Financial; FactSet; RBC Capital Markets (Priced as of market close ET, July 12, 2013) Thus, we would consider alternative asset managers inexpensive relative to traditional asset managers. It is peculiar that alternative asset managers should trade at a discount to On average, dividend yields of alternative asset managers have exceeded that of traditional asset managers and that of the broader market July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 10 Fortress Investment Group LLC

- 11. traditional asset managers given better dividend yields, higher effective fee rates on average assets under management and longer asset lock up periods. There is a large amount of volatility in the dividend yields for alternative asset managers. This makes sense as realizations contribute significantly to distributable earnings, and thus, to dividend payments. However, we would argue that investors with a long-term horizon could get a better return through a buy-and-hold strategy. We arrive at our conclusion based on the fact that a basket of traditional asset managers would have yielded 2% from January 1, 2008 to July 12, 2013. In comparison, a basket consisting of alternative asset managers would have yielded 4.8% over the same time period. This should appeal to income-oriented investors. Are alternative asset managers paying higher dividends because they are riskier or due to a lack of growth opportunities? The data does not support this assertion. Using FactSet data as of July 12, 2013, we observed an average beta of 1.38x for traditional asset managers, compared to 1.27x for the alternative asset managers. Furthermore, utilizing data from the Investment Company Institute, we compared the five-year constant growth rates for assets and contrasted that with fee-earning asset growth for the following five alternative asset managers: Fortress, Apollo, Blackstone, Carlyle, and KKR. Our conclusion is that from 2007 to 2012, alternative asset managers grew their assets almost 6x faster than traditional asset managers. Exhibit 9: While total AUM grew at 2.6% for traditional asset managers from 2007 to 2012, alternative asset managers generated a five-year constant average growth rate of 14.9% 1.7% (3.2%) 6.3% 2.6% 14.9% 17.1% (10.0%) (5.0%) 0.0% 5.0% 10.0% 15.0% 20.0% Mutual Funds Closed-End Funds ETFs UITs Total Alt Asset Mgrs CAGR Source: Investment Company Institute; RBC Capital Markets Note: Alt. Asset Mgrs group comprised of BX, KKR, CG, APO and FIG We would expect the growth in assets under management for alternative asset managers to exceed that of traditional asset managers. As we had written in our initiation on asset managers (July 24, 2012), we would expect continued demand by institutional investors who have to meet certain hurdle rates. We had pointed out in our initiation note that David Swenson, an iconoclastic author and investor who as the head of the endowment at Yale has argued for years that the traditional approach to diversification – buying a basket of stocks, bond, and cash – needs to be modified to include alternatives. When Harvard University, which also has a history of embracing the unconventional in investing, began using alternatives, institutional investors everywhere responded by considering adopting such an "endowment model." The exhibit below makes the need for going beyond traditional asset classes clear. Most pension funds assume a return of 7.5% to 8%. However, a research report July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 11 Fortress Investment Group LLC

- 12. published by a large broker shows that returns over the next 5 years will not be sufficient to meet these goals. Exhibit 10: Five year projected returns could be below the 7.5%-8% overall return assumptions 0.0% 2.0% 4.0% 6.0% 4.5% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% Treasuries Investment Grade Bonds High Yield Equities 60/40 Portfolio Source: Goldman Sachs estimate as of January 2013 US public pension funds have been revising their allocation to alternative assets in order to boost their returns and reduce earnings volatility. The table below shows targeted allocation to alternative asset classes. Exhibit 11: Allocation to alternative asset classes by US pension funds has increased since 2007 ($ in billion) Target Alternatives Allocation Target PE Allocation AUM US Public Pension Plan 2007 2009 2012 2007 2009 2012 DB Total California Public Employees Retirement System 14% 25% 29% 6% 10% 14% $243 $245 CalSTRS 13% 24% 26% 4% 11% 12% 155 156 New York State Common Retirement Fund 19% 19% 27% 8% 8% 10% 150 150 State Board of Administration -- Florida 12% 13% 17% 5% 4% 4% 127 156 New York City Retirement 5% 11% 17% 4% 9% 13% 122 132 Teachers Retirement System of Texas 9% 17% 29% 4% 7% 12% 112 112 New York State Teachers Retirement System 13% 17% 17% 5% 7% 7% 89 89 Wisconsin Investment Board 11% 14% 18% 4% 6% 6% 83 89 Ohio Public Employees 11% 19% 33% 3% 5% 10% 79 80 North Carolina Retirement System 8% 11% 24% 3% 5% 7% 77 84 New Jersey Division of Investment 15% 15% 23% 5% 6% 7% 72 75 Washington State Investment Board 29% NA 38% 17% NA 25% 59 70 State Teachers' Retirement System of Ohio 3% 7% 15% NA 5% 5% 65 66 Oregon Public Employees Retirement Fund 12% 16% 21% NA 16% 16% 60 61 Virginia Retirement System 10% 15% 9% 6% 8% 9% 55 57 State of Michigan Retirement Systems 13% 16% 16% 7% 9% 9% 51 56 University of California Retirement System 4% 9% 13% 3% 7% 8% 43 56 Minnesota State Board of Investment 12% 18% 18% 7% 10% 10% 48 53 Massachusetts Pension Reserves Investment Management Board NA 20% 22% NA 10% 12% 51 51 Pennsylvania Public School Employees' Retirement System 9% 17% 22% 6% 12% 16% 49 49 Average 12% 16% 22% 6% 8% 11% Source: KKR Investor Day Presentation - 2013; RBC Capital Markets Pension funds and other investors are increasingly being attracted to a barbell strategy utilizing cheap beta, i.e. exchange traded funds and overlaying this with actively managed strategies provided by alternative asset managers. Increased demand for alternative asset classes is not just a US phenomenon. McKinsey & Company published a survey called “The Mainstreaming of Alternative Investments” making two important points: A) alternative July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 12 Fortress Investment Group LLC

- 13. investments have grown at over 7 times the pace of traditional asset managers; and B) institutional investors expect to increase allocation to almost all alternative classes. Exhibit 12: From 2005 to 2011, alternative assets have grown at a CAGR of 14.2%. This compares to 1.9% for non-alternative assets $2.9 $4.2 $5.7 $5.0 $5.6 $6.2 $6.5 $34.8 $39.8 $43.0 $35.4 $38.9 $43.6 $38.9 $- $10 $20 $30 $40 $50 $60 2005 2006 2007 2008 2009 2010 2011 Alternatives Non-Alternatives Source: McKinsey & Company Exhibit 13: Institutional investors to allocations increasingly to alternative asset classes 3.1% 4.2% 4.1% 1.0% 6.2% 6.4% 5.9% 3.2% 6.8% 6.8% 6.5% 3.5% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% Private Equity Hedge Funds Real Estate Inf.& Comm. 2009 2010 2013E Source: McKinsey & Company Thus, we would expect alternative asset managers to benefit from a secular trend towards cheap beta exposure and a search for actively managed asset classes that help institutional clients achieve their targeted returns. To summarize, alternative asset managers’ shares trade at a discount to traditional asset managers while providing higher dividend yields over time. Additionally, asset growth for alternative asset managers exceeded that of traditional asset managers during the past five years. We think that the pace of growth could remain high as demand for alternative asset July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 13 Fortress Investment Group LLC

- 14. classes should benefit from a secular trend described above. In addition, alternative asset managers could deepen existing client relationships and look for growth opportunities outside of their traditional target market of institutional and high-net-worth clients. Avenues of growth could include defined contribution plans and retail clients. Exhibit 14: Retail alternative products are expected to gain market share $5.1 $6.5 $8.0 $0.7 $1.4 $2.1 $0.5 $0.9 $1.5 $1.7 $0.2 $0.6 $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 2005 2010 2015E Active ETFs/Passive Solutions Retail Alternatives Source: McKinsey & Company Thus, we would argue that the alternative asset management sector is attractively valued. So how does Fortress measure up to others within the sector? We believe that Fortress’s shares remain undervalued perhaps because it had its challenges during the financial crisis and had to suspend dividends from 3Q08 to 4Q11. Interestingly, for a company that has its roots in private equity, performances of its traditional buy-out funds have been somewhat weak. Nonetheless, we believe that this and some more is already priced into the shares. We arrive at our conclusion by doing a simple sum-of-the-parts analysis. Exhibit 15 shows that multiple investors are assigning to pre-tax incentive income based on the last 12 months’ earnings. We are assuming that investors are willing to pay 17x P/E for fee-based earnings. In the case of Fortress, this value equals $3.91. Then, we add net cash and investments that the alternative asset managers carry on their balance sheet. This is equal to $2.95 for Fortress. Finally, we estimate the pre-tax P/E multiple by taking the difference between the current value (as of July 12, 2013) and our valuation based on fee income and net cash & investments on hand and applying this to incentive income generated during the past 12 months. Interestingly, investors do not appear to assign any value to incentive income generated by Fortress, despite the fact that the company generated an estimated pre-tax incentive income of $0.62 per class A share over the past 4 quarters. This suggests to us that investors are questioning whether Fortress can generate promote on a consistent basis in the future. Investors seem to think that past performance is no guarantee of future results. We have to admit that this should not come as a big surprise given that Fortress’s private equity funds have generated an IRR of about 3% net of fees since inception, on average. Comparing alternative asset managers, we concluded that the market does not assign much value to incentive income generated by Fortress July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 14 Fortress Investment Group LLC

- 15. Exhibit 15: Market appears to assign no value to the incentive income Fortress generates Ticker LTM Mgmt Fee Earnings Multiple Assigned Value Cash & Investments Valuation ex. Incentive Income Current Price Pre-tax LTM Incentive Income Multiple assigned to Inc. Income APO $0.65 17.0x $11.11 $5.27 $16.38 $24.99 $1.36 6.3x BX $0.61 17.0x $10.37 $4.43 $14.80 $21.98 $1.14 6.3x CG $0.52 17.0x $8.89 $4.41 $13.30 $26.75 $1.54 8.7x KKR $0.47 17.0x $8.07 $9.00 $17.07 $20.46 $1.12 3.0x FIG $0.23 17.0x $3.91 $2.95 $6.86 $7.14 $0.62 0.5x Source: Company reports; FactSet; RBC Capital Markets (Priced as of market close ET, July 12, 2013) As shown above, investors seem to assign little value to incentive income generated by Fortress. However, one should not ignore that Fortress was able to generate pre-tax incentive income of $0.62 per class A share in an improving, but difficult economy. Concerns about the company’s ability to generate incentive income could be overdone, in our view. Management disclosed during its 1Q13 earnings call that it has $545 million of unrealized incentive income in its credit PE funds. Management also said that it has another $100 million of unrealized PE-style incentive income in the liquidating Redeemable Capital Account (RCA) classes of its credit hedge funds. In total, there is about $731 million of gross undistributed incentive income, or about $1.50 of undistributed incentive income in today’s money. One difference between Fortress and its peers is that the company does not show net accrued performance fees as an asset on its balance sheet. In order to do a like-for-like comparison, we excluded these from net cash and investments for the competitors. As a result, Fortress looks even cheaper compared to its peers after these adjustments. Exhibit 16: Fortress appears even cheaper excluding net accrued performance fees Ticker LTM Mgmt Fee Earnings Multiple Assigned Value Cash & Investments Valuation ex. Incentive Income Current Price Pre-tax LTM Incentive Income Multiple assigned to Inc. Income APO $0.65 17.0x $11.11 $1.62 $12.73 $24.99 $1.36 9.0x BX $0.61 17.0x $10.37 $2.43 $12.80 $21.98 $1.14 8.0x CG $0.52 17.0x $8.89 ($0.20) $8.69 $26.75 $1.54 11.7x KKR $0.47 17.0x $8.07 $7.70 $15.76 $20.46 $1.12 4.2x FIG $0.23 17.0x $3.91 $2.95 $6.86 $7.14 $0.62 0.5x Source: Company reports; FactSet; RBC Capital Markets (Priced as of market close ET, July 12, 2013) Successful credit franchise should generate strong promote While there have been performance issues in the traditional private equity business, driven by the large exposure to financial services and real estate, Fortress’s credit segment has flourished. A majority of the investments were made between 2008 and 2009, which certainly contributed to the strong performance. Using public information, we have calculated net IRRs for various credit-related assets. Based on these data, we believe that Fortress is one of the most successful private equity investors in the credit sector. Net IIRs of 22% since inception for the Credit business are the strongest among its peers July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 15 Fortress Investment Group LLC

- 16. Exhibit 17: FIG’s credit funds have generated net IIRs of 22% since inception 15% 18% 11% 9% 22% 0% 5% 10% 15% 20% 25% Apollo Global Management Blackstone Group Carlyle Group KKR & Co Fortress Investment Group NetIIRsSinceInception Source: Company reports; RBC Capital Markets Management disclosed that it has $545 million of gross unrealized investment income embedded in its credit private equity funds. We believe that these could be harvested over the coming quarters. In addition, management disclosed that it has another $100 million of unrealized private equity-style incentive income in the liquidating RCA classes of its credit hedge funds. Credit private equity and credit hedge funds make up Fortress’s credit line of business. Thus, while the company does not get much credit for it in terms of valuation, Fortress has in its credit business unrealized incentive income of about $645 million. This does not show on its balance sheet. Likewise, incentive income is recognized on the income statement only after realization events, with marks having no impact on earnings. Performance of hedge funds is strong and could lead to significant incentive income, which is not priced in We believe that Fortress’s earnings could be boosted by significant incentive income during the coming quarters. More than $4 billion of total AUM, or 95.3% of incentive-eligible assets, is above their respective high-water marks. In 1Q13, Fortress generated about $32 million of incentive income. Given strong 2Q13 returns, we could see an uptick in incentive income, which the market does not appear to ascribe much value to. After all, given recent performance and despite a weaker month of June, management indicates that nearly all incentive eligible assets are above their high-water marks (note that the FPF fund investments, which are included in Liquid Markets AUM are predominantly private equity style investments which generate incentive income only when realized.) As of 1Q13, the company had about $36 million of undistributed incentive income. In 2Q13, Fortress generated returns of 9.4% in the Macro Fund and 10.1% in the Asia Macro Fund. While returns for the Asia Convex Fund were up only 1.57% and “weak” relative to the Macro and Asia Macro Fund, we note that this fund is fairly small in terms of incentive income-eligible NAV. July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 16 Fortress Investment Group LLC

- 17. Exhibit 18: Liquid hedge funds could generate strong promote (as of 1Q13) PE Fund ($ in'000) Incentive Income Eligible NAV Gain to Cross Incentive Income Threshold Percentage of Incentive Income Eligible NAV Above Incentive Income Threshold Undistributed Incentive Income YTD Incentive Income Crystallized Macro Funds Main Fund Investments $1,928,957 $303 98.6% $15,541 $1,552 Sidepocket Investments 22,430 14,002 n/a 454 - Sidepocket Investments - Redeemers 223,422 133,596 n/a 4,385 - Managed Accounts 1,077,530 12 99.9% 8,993 1,150 Asia Macro Funds Main Fund Investments $675,295 $0 100.0% $4,377 $72 Managed Accounts 106,022 - 100.0% 619 - Fortress Convex Asia Funds Main Fund Investments $75,063 $2,137 0.0% $0 $0 Fortress Partners Funds Main Fund Investments $69,348 $29,856 0.1% $1 $0 Sidepocket Investments $138,465 $22,259 n/a $1,855 - Total 4,316,532 202,165 95.3% 36,225 2,774 Source: Company reports; RBC Capital Markets The company reported in July that the year-to-date net returns for its largest fund, the Fortress Macro Fund, was 13.2%. As a comparison, net returns for the full-year 2012 were 17.8%. Exhibit 19: Strong year-to-date liquid hedge funds performance ($ in mm) April May June YTD 1Q13 AUM Macro Fund 4.78% 4.62% -0.58% 13.2% $3,055 Asia Macro Fund 4.25% 4.41% 0.83% 12.9% $792 Convex Asia -0.31% 0.76% 1.18% 0.67% $75 Partners Funds -1.43% 0.73% n/a 1.43% Partners Offshore Funds -0.86% 1.25% n/a 3.53% $1,226 Source: Company reports; RBC Capital Markets Given recent fund performance, we would expect fundraising and inflows to accelerate in the Liquid Markets segment. There are currently three hedge funds around the core macro philosophy – the Macro Fund, Asia Macro Fund and Convex Asia Fund – and we could see the number of hedge funds increase to five that use a macro strategy, based on the conversations we had with the management team. Management also said that it would like to see AUM of $2 billion-$5 billion for each fund. Partners Funds, the second-largest fund by AUM, was launched in 2006 and had about $1.7 billion in AUM as of 2010. Since then, AUM has declined to about $1.2 billion as of 1Q13. The fund is currently being revamped. Partners Funds could start attracting assets after repositioning July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 17 Fortress Investment Group LLC

- 18. Exhibit 20: Partners Funds AUM has been declining since 2010 $0.3b $1.4b $1.3b $1.6b $1.7b $1.5b $1.4b $1.2b $- $0.2b $0.4b $0.6b $0.8b $1.0b $1.2b $1.4b $1.6b $1.8b $2.0b 2006 2007 2008 2009 2010 2011 2012 1Q13 AUM Source: Company reports; RBC Capital Markets The Partners Funds, which are in essence fund-of-funds, allocate capital to hedge funds, private equity funds, long-only strategies and can make tactical direct investments when the opportunity arises. Demand for this product has been declining since 2010. Fortress wants to restructure this fund to include a number of basic alternative investment strategies. The objective is to provide a customized portfolio to the client with different weighting & exposures to the various funds underneath the Partners Funds. The focus will be on institutional clients, offering them broader capabilities and special-situation funds. We believe that this customized solutions-oriented approach could potentially lead to a turnaround in net flows and AUM growth. Under the traditional fund of funds approach, clients would have little influence over the investment strategy, making risk management difficult for them. Under the proposed approach, clients can determine the allocation to the various investment strategies offered by Partners Funds. This allows for customization, which in turn enables the client to do a better job managing their risk and asset exposure. Stuart Bohart, President of Liquid Markets and Head of Strategy, said he could also envision offering products to retail investors and defined contribution plans. Over time, we could see Fortress targeting a broader client base. New Residential could generate incentive income immediately after the Newcastle asset spin-off (there is also option value) Fortress manages three permanent capital vehicles it calls “Castles” (Newcastle, Eurocastle and New Residential). These are public REIT-type structures with aggregate AUM of about $4.4 billion. In addition to providing comfort about reliability of future management fees, permanent capital vehicles allow the firm to raise capital quickly when opportunities arise. As the exhibit below shows, it takes about 18 months to achieve a final close for a traditional private equity fund. Thus, being able to raise and put it to work quickly could allow the company to capitalize on opportunities it might miss otherwise. According to management, raising a few hundred million dollars through secondary offerings could take less than a week using the permanent capital structure. While the company could use its own balance sheet to invest, having a permanent vehicle structure reduces earnings volatility. This is important, especially during down markets. July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 18 Fortress Investment Group LLC

- 19. Exhibit 21: On average, it takes about 18 months to achieve a final close 11.1 11.7 14.5 16.9 18.2 16.2 17.7 18.2 0 4 8 12 16 20 2006 2007 2008 2009 2010 2011 2012 1Q13 Avg.TimeSpentinMarket-Months Source: Preqin; RBC Capital Markets In an effort to increase the pace of realizations, Fortress has carved out all of Newcastle’s residential assets into a new publicly traded company called New Residential (NRZ). These assets include excess mortgage-servicing rights, residential mortgage-backed securities, non- performing loans and other residential real estate. The carve-out reset any high-water marks and allows Fortress to earn incentive income once the performance hurdle rate has been passed. Thus, Fortress is now more likely to earn incentive income and earn it sooner than it would have been absent of any restructuring. Newcastle (NCT), the original permanent capital vehicle, will now focus on commercial real estate investments, along with senior housing and other real estate debt. As for Eurocastle (ECT), the company’s third permanent capital vehicle, Fortress has restructured the balance sheet and lowered management fees expenses it charges for its services. Whereas it used to charge management fees of 1.5% on equity capital of roughly $1.9 billion, it now charges management fees of 1.5% on equity capital of about $.5 billion. We believe lower fees could make the fund more attractive and lead to capital contributions as management fees declined from about $7 million to $2 million per quarter. The company disclosed that it raised $140 million (which is part of the $0.5b) since restructuring the balance sheet. No doubt, the recapitalization has lowered management fee revenues to the tune of $5 million per quarter. However, we believe that Fortress could offset the decline in revenues by raising additional capital over time. With the restructuring, ECT has also reset the capital base upon which its entitlement to incentive income is calculated and any high water marks. Unlike NCT and NRZ, ECT has an 8% preferred return threshold. Management indicated that there are still some attractive investment opportunities, especially in Italy. The company owns Italfondiario SpA, a primary and special servicer of residential and commercial loans. This view is consistent with what some of Fortress’s competitors have been saying, which is that there should be plenty of opportunities to invest for private equity firms given that banks have to “delever” due to the adoption of Basel III. With the implementation of Basel III, we would expect assets to come to the market as financial institutions could choose to reduce risk-weighted assets instead of raising capital. This could be an opportunity for private equity firms with a financial services focus. As for new capital raises, the company said there will be additional permanent vehicle structures going public in the near term. Wes Edens, who runs the private equity business, disclosed during last quarter’s earnings call that Fortress will float the $400 million Restructuring of permanent capital vehicles could accelerate incentive income generation Transitioning to running a balance sheet light company continues. This should provide downside protection July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 19 Fortress Investment Group LLC

- 20. transportation infrastructure fund (Worldwide Transportation Infrastructure) later this year. He said he is optimistic about the fund and its ability to grow assets under management as he estimates that there are about $2.4 trillion of assets in that sector. He also mentioned that there are two other vehicles that have good prospects of going public “in the relative near term.” Management indicated that Fortress could spin off the senior living facility assets currently residing in Newcastle. The ultimate goal is to grow the assets under management from $4 billion currently to about $10 billion to $20 billion across a limited number of strategies around the world. Clearly, the focus has changed. Whereas Fortress invested its balance sheet significantly in the past, it has changed its strategy during the financial crisis. Whereas Fortress used to invest anywhere from 2% to 5% in the funds, it now co-invests less than 2% in private equity funds. It uses permanent capital vehicles instead of its own balance sheet. We believe that while this solution provides less of an upside during times of economic prosperity, it provides downside protection when the economy starts contracting. Unlike some of its competitors, Fortress does not recognize undistributed incentive income on its balance sheet. As of 1Q13, Fortress had about $730 million of gross undistributed incentive income. About $69 million of this was due to the value of options Fortress received from Newcastle for raising capital. Newcastle granted Fortress the option to purchase 5,750,000 shares of Newcastle’s common stock at the public offering price of $9.35 in January 2013. In addition, Newcastle granted Fortress the option to purchase 2,300,000 shares of Newcastle’s common stock with a strike price of $10.48 in February 2013. These options were fully vested upon issuance, became exercisable over 30 months and have a 10- year term. The main takeaway is that the $730 million of gross undistributed incentive income that has not been recognized in distributable earnings could grow as the valuation of Newcastle rises. Optionality on upside of Logan Circle Partners at no charge With demand for alternative asset strategies increasing, traditional asset managers such as BlackRock are pushing harder to gain a foothold in the alternative asset space. Fortress, on the other hand, is approaching growth from the other end of the spectrum and is building out its traditional asset management offering. Fortress acquired Logan Circle Partners in April 2010 for about $21 million in cash. Logan Circle offers core fixed income products, including short, intermediate and long duration, core/core plus, investment-grade credit, high yield and emerging market debt. When it was acquired, AUM stood at $11.7 billion. As of March 31, 2013, AUM had grown to $21.9 billion. July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 20 Fortress Investment Group LLC

- 21. Exhibit 22: Logan Circle Partners’ AUM has almost doubled since acquisition ($B) $11.7 $13.5 $20.7 $21.9 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 2010 2011 2012 1Q13 Source: Company reports; RBC Capital Markets Logan Circle Partners appeared to be in the “penalty box” after it was acquired by Fortress. This is a business that is 95% driven by consultants (gatekeepers) and consultants do not like to see changes. In our view, this explains the sharp increase in AUM from 2011 to 2012, the year consultants became interested in Logan Circle again after realizing that the investment teams would not pack up and leave. The fact that 14 out of 15 funds beat their respective benchmarks since inception most likely contributed to asset growth, as well. Fortress appears to be dedicated to growing this business as management said that it would like to build it out for the long term. When Logan Circle Partners was acquired, Fortress made a decision not to downsize the platform. Based on management, the platform can support five to six times Logan Circle’s current AUM. This led to losses, with the current quarter finally coming close to a breaking even. Could this business have been profitable after the acquisition? Fortress says yes, and that it deliberately decided not to cut expenses and shrink the platform. We believe that the lack of earnings is one reason most investors do not assign any value to the business. On the surface, Logan Circle Partners appears to be a money losing business that just broke even. This could change. Management wants to grow assets under management and invest for the long term, which is most likely why it did not try to cut costs and maintained an underutilized platform. Consequently, we think investors buying Fortress’s shares are getting a traditional asset management business essentially for free. Fortress paid $21 million for Logan Circle. Now, with assets almost doubled and a “multiple expansion” since 2010, we estimate Logan Circle could be worth at least twice the amount Fortress paid for it. Fortress is saying that it wants to add new products to the platform with the goal of fully utilizing this scalable platform. The company is also pushing cross-selling. Stuart Bohart took on the additional responsibility of raising capital for Logan Circle Partners. While Logan Circle Partners had net flows of $841 million in 2011, net flows increased to $5.7 billion in 2012. We project net flows of $4.6 billion for 2013. In April 2013, Logan Circle Partners announced that it was launching a growth equities business focused on investing and managing concentrated portfolios of publicly traded US equities. This new group is led by David Shell out of Tampa, Florida. He joined Logan Circle Partners from Goldman Sachs Asset Management (GSAM), where he managed over $20 Logan Circle Partners could grow assets and average effective fee rate as it is adding equity funds and new products to a scalable platform July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 21 Fortress Investment Group LLC

- 22. billion in assets. Other investment professionals include Joseph Hudepohl, Scott Kolar, Warrant Fisher and Gregory Frasca – all GSAM alumni. Having an equities offering should lead to higher revenues as the average fee on the fixed income products is about 16 bps versus about 75 bps for equity-oriented strategies. Logan Circle Partners’ client base – high-net-worth clients, 401k plan sponsors, subadvisory relationships, pension funds, insurance companies, among others – could be receptive to this new offering. Management indicated that over time, they could also offer 40Act funds. Consequently, effective investment management fees at Logan Circle will increase as the company gathers assets in equity strategies. Fortress believes that it could attract about $20 billion in AUM over time. Fortress provided the following sensitivity table of distributable earnings when it participated at KBW’s Asset Management Conference June 5, 2013. This table assumes that AUM doubles and shows the impact on distributable earnings based on various operating margins. Exhibit 23: Logan Circle Partners could be accretive to earnings if AUM doubles ($ in millions) $40,000 $40,000 $40,000 Mgmt Fee Rate (bps) 16 16 16 Gross Annual Mgmt Fees $64 $64 $64 Operating Margin 30% 40% 50% Annual Fund Mgmt DE $19 $26 $32 Annual Fund Mgmt DE/Share $0.03 $0.05 $0.07 LCP AUM Growth to $40 Billion Source: Company reports; RBC Capital Markets What this table did not incorporate was changes in mix of assets. We recreated the sensitivity table assuming equities (75 bps fee) contribute increasingly to total AUM of $40 billion. Taking a different asset mix, one can see that earnings could exceed the earnings sensitivity provided by management in June. Exhibit 24: Logan Circle Partners’ earnings based on various asset mix combinations 20% 30% 40% 50% 25% $0.04 $0.07 $0.09 $0.12 30% $0.04 $0.07 $0.10 $0.13 35% $0.05 $0.08 $0.11 $0.14 40% $0.05 $0.09 $0.12 $0.15 45% $0.06 $0.09 $0.13 $0.16 50% $0.06 $0.10 $0.14 $0.18 55% $0.07 $0.11 $0.15 $0.19 OperatingMargins Equity as % of Total AUM Source: Company reports; RBC Capital Markets estimates The above table assumes that equities earn an average management fee of 75 bps and fixed income funds earn an average management fee of 16 bps. We believe that demand for equities could increase in the near term, allowing the growth equities team to gather assets. This team used to manage nearly $20 billion at Goldman Sachs. Thus, we think it is likely that equities could make up 30% to 40% of total AUM over With $40b in AUM and a change in asset mix, we estimate Logan Circle Partners could add about $0.10 to earnings on an annual basis. At a 16x P/E multiple, that could add $1.60 to valuation July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 22 Fortress Investment Group LLC

- 23. the next few years and that margins could be around 35%. This should add about 8 cents to 11 cents to distributable earnings. Despite challenges in PE, Fortress has not had problems raising capital While there have been issues with the performance of Fortress’s PE funds, as we will discuss in more detail under “Key Negatives”, investors seem to understand why performance was weak. At least this is our view, as Fortress started raising capital in 2012 after pretty much halting capital-raising efforts in 2008. Fortress’s capital raise has attracted not only existing, but also new investors; the company disclosed that about one-third of capital raised in 2012 was from new customers. Year to date, Fortress has raised about $2.5 billion in capital. About $1.4 billion was raised in private equity alone – with $960 million flowing into Newcastle, $140 million assigned to Eurocastle and $340 million being raised for the transportation and infrastructure fund (WWTAI). Furthermore, the company is raising an infrastructure fund that could close in 3Q13. This fund will be more focused on infrastructure investments and de-emphasize investments in transportation. Fortress is also raising a second mortgage servicing rights (MSR) fund. Wes Edens mentioned during last quarter’s earnings call that capital-raising efforts are going well and that he would expect to have a closing by 2Q13. Wes Edens has set a soft target of $5 billion in private equity raises for 2013. He also mentioned during a recent conference that raising sector funds is a much quicker process than the 18 months needed to close on a more traditional private equity fund. In fact, he said that the fund-raising effort takes only a few months for sector funds. While it remains to be seen whether Fortress can achieve its goal, there should be no doubt that fund-raising efforts were not impacted to the degree investors might have expected given weak fund performance. More importantly, Wes Edens believes that he can raise a multiple of the $5 billion in the coming years. We like the fact that Fortress seems to be able to raise capital in private equity after almost four years of abstinence while it was fixing issues with its existing funds. Fortress has one of the youngest management teams A question that comes up frequently with respect to alternative asset managers is succession planning. This is not surprising given that these firms are run by individuals with charisma and vision. Leaders who are willing to roll up their sleeves and create value for their investors. As such, one of the major concerns of investors is what could happen if one of the founding members everyone associates with the firm leaves. Will the funds still be able to generate strong returns? Will the firm be able to retain assets? Will the firm be able to raise new capital? These are all legitimate questions and one of the major risks associated with investing in the sector is key man risk. We admit that there is a large pool of talent that publicly traded private equity firms can fall back on to identify the next person to head the business. This pool has probably become larger as talent started leaving investment banks due to increased regulation and potentially lower compensation. Nonetheless, whether the risk is perceived or real, a founding partner leaving the firm could affect share price performance. Fortress raised $1.4b in private equity capital year to date. FIG is currently in the process of raising an infrastructure fund and a second MSR fund With one of the youngest leadership teams, key man risk appears to be less of an risk at Fortress July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 23 Fortress Investment Group LLC

- 24. We believe that this is less of a risk at Fortress than it might be for other firms because the average age of the co-founders is 50. Exhibit 25: Fortress has one of the youngest leadership teams in the industry 50 yrs 55 yrs 64 yrs 64 yrs 69 yrs 0 10 20 30 40 50 60 70 80 FIG APO BX CG KKR Age Source: Company reports; RBC Capital Markets We need to emphasize that all these leaders have the stamina, focus and vision to continue doing their job for years to come. They all perform at the highest level. However, key man risk remains one of the major concerns on investors’ mind and can affect stock performance. In a sense, it is similar to what Logan Circle Partners experienced when it was acquired by Fortress. While the investment management team stayed, concerns about potential changes and the possibility of portfolio managers leaving led consultants to use their products less than they would have if ownership had not changed. July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 24 Fortress Investment Group LLC

- 25. Investment Thesis – Key Negatives Private equity fund performance is weak (but improving) We would agree that private equity fund performance has not been stellar: there were performance issues with the 2005, 2006 and 2007 vintages. We believe the firm’s exposure to financial services firms and real estate is significant (Fortress initially operated as a real estate private equity investment partnership), although it is difficult to be precise. For instance, Fortress owns Florida East Coast Railway. This company is in the business of transporting freight, operates 351 miles of track, and owns many real estate assets in Florida. Thus, the valuation of Florida East Coast Railway is not only impacted by how much freight it transports, but is also a function of the land that it owns. According to management, Florida East Coast Railway owns about 30% of total industrial real estate in South Florida (Broward and Dade County). Potential future promote is driven by what happens to valuations of companies such as Nationstar (one of the largest mortgage servicers and lenders), CW Financial Services (commercial real estate finance and investment management company), Springleaf (consumer lending, credit insurance, other credit-related products), Italfondiaro (special servicer with expertise in management of secured and unsecured loan portfolios), and Walker & Dunlop (commercial real estate finance). Exhibit 26: Major portfolio company holdings in PE funds PE Fund Key Drivers of Potential Future Value Generation NIH Fund I Italfondiaro Fund II GAGFAH Fund III Nationstar, GAGFAH, Eurocastle, Gatehouse Fund III Coinvestment Nationstar, Holiday, Florida East Coast & Flagler, Eurocastle, GAGFAH, Gatehouse Fund IV Florida East Coast & Flagler, Springleaf, Penn National Gaming, CW Financial, Brookdale, Nationstar Fund IV Coinvestment Florida East Coast & Flagler, Springleaf, Penn National Gaming, CW Financial, Brookdale, Nationstar Fund V Penn National Gaming, Walker & Dunlop Fund V Coninvestment Penn National Gaming, Walker & Dunlop GAGACQ Fund GAGFAH FRID GAGFAH FRIC FICO FHIF FECI Source: Company reports; RBC Capital Markets The key takeaway here is that investors should not write off these investments as portfolio valuations could improve with an improving economy. Furthermore, these portfolio companies could grow their assets as financial services firms are disposing of their non-core business or limiting financing. The Wall Street Journal reported June 10 that Springleaf is in talks with bankers about a possible IPO. An improving operating environment allowed Springleaf to raise money in the high-yield debt market in May for the first time in many years. It could go public by the end of this year or early next year. Fortress paid $120 million for 80% ownership in 2010. In 1Q13, the underlying value of its PE funds increased 5.2% or $800 million, following an appreciation of over 25% last year. Management also disclosed that the private equity portfolio appreciated over $100 million in the month of April. The table below shows that there are two private equity funds that could cross their respective incentive income threshold, namely Fund III (2004 vintage) and FHIF. Weak PE fund performance and significant exposure to the financial services sector has been a headwind July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 25 Fortress Investment Group LLC

- 26. Exhibit 27: FHIF and Fund III could generate promote (1Q13) PE Fund ($ '000) Vintage Maturity Net Asset Value MOIC Estimate Gain to Cross Incentive Income Threshold Appreciation Needed to Generate Promote 1Q13 Private Equity Funds FHIF 2006 Jan-17 2,240,908 1.5x 85,563 3.8% Fund III 2004 Jan-15 2,297,125 1.4x 561,563 24.4% Fund IV 2006 Jan-17 3,891,801 1.2x 1,240,431 31.9% Fund V 2007 Feb-18 3,934,856 1.0x 1,729,240 43.9% Fund IV Coinv. 2006 Jan-17 626,263 1.0x 451,776 72.1% Fund III Coinv. 2004 Jan-15 129,859 1.1x 167,921 129.3% FECI 2007 Feb-18 908,830 0.9x 606,737 66.8% FRID 2005 Apr-15 587,260 0.9x 873,000 148.7% Fund V Coninv. 2007 Feb-18 636,162 0.6x 806,422 126.8% FRIC 2006 May-16 242,146 0.8x 283,589 117.1% FICO 2006 Jan-17 (58,222) -0.1x 1,220,614 n/m NIH 1998 Indefinite $8,461 2.0x n/a n/a Fund I 1999 Apr-10 55,485 2.8x n/a n/a Fund II 2002 Feb-13 154,136 1.7x n/a n/a GAGACQ Fund 2004 Nov-09 n/a n/a n/a n/a Total 15,655,070 1.2x 8,026,856 Source: Company reports; RBC Capital Markets Wes Edens said during a recent investor conference that he still expects private equity funds to return twice the invested money to investors and generate returns of over 20%. While many factors drive the exit multiple and returns, we like management’s enthusiasm and focus. Over time, the private equity business could generate performance fees of $1 billion to $2 billion, according to Mr. Edens. As we had indicated above, we do not believe that incentive fees are priced into the shares of Fortress. Even achieving half the incentive fees indicated by management, Fortress should be able to generate interest in its shares. Finding opportunities in credit is more difficult One of the challenges for Fortress and other in the sector will be finding investment opportunities in credit. Dean Dakolias, who runs the Credit business, said that investment opportunities that meet Fortress’s return objectives are scarce. Credit private equity is targeting returns in excess of 20% and credit hedge funds have a minimum target of 10%. Investment discipline explains why the net IRR since inception has been about 22%, the highest among its peers. Peter Briger, Principal and Co-Chairman, said during the March earnings call that opportunities in credit “are not there today”, and that the market has become more competitive in the last quarter. In addition, with interest rates and financing costs increasing, it seems that opportunities will remain few. There is about $5.9 billion of dry powder in credit as of the end of the first quarter and capital-raising activity in Credit is dormant now with the team focusing on traditional private equity. We believe, however, that investors should not be overly concerned about the limited opportunities available to the Credit business. Given that banks in Europe are going through a long process of de-levering, we would expect more opportunities to come. Bank balance sheets there are two times higher levered than in the US. New regulation and higher capital With pricing up, fewer investment opportunities meeting targeted IIRs, realizations could pick up July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 26 Fortress Investment Group LLC

- 27. requirements could force banks to sell assets at prices that could meet Fortress’s hurdle rates. Basel III rules could be a catalyst. Furthermore, a lack of opportunities implies that investments might be ripe for harvesting. As mentioned above, there is about $645 million in gross unrealized incentive income embedded in the credit business. With an improving economy and continued appreciation in capital markets, we believe that this amount could grow. Potential tax rate changes could be an issue The tax treatment of carried interest has been in the spotlight for some time now. With the need to raise tax revenues and reduce the budget deficit, we would expect this debate to continue. This is despite the fact that as the Private Equity Growth Capital Council pointed out, changing the tax treatment of carried interest would only pay for 3.1 hours a year in federal government operations. Private equity firms generate income in two ways. They receive a management fee, which is taxed as ordinary income, and carried interest. Private equity funds receive 20% of partnerships profit when the return exceeds a certain hurdle rate, i.e., carried interest. Currently, carried interest qualifies to be treated as long-term capital gains. In 2007, the Congress held hearings on this topic. The Obama Administration’s 2008 Budget Blueprint included a sentence that carried interest should be taxed as ordinary income. In 2010, the US House of Representatives passed HR 4213, the American Jobs and Closing Tax Loopholes Act. While it is difficult to predict whether the tax treatment of carried interest will change and be a part of a tax reform bill, if passed, taxing carried interest as ordinary income could have an adverse impact on capital distributions and dividend yields as it would significantly raise the amount of taxes owed. HR 4213 could prevent Fortress from completing certain types of internal reorganization transactions or converting to a corporation on a tax-free basis. The proposed legislation could also increase the ordinary income portion of any gain realized from the sale of class A shares. However, there is a 10-year transition period before capital gains could be taxed as ordinary income. Thus, the impact of any changes would not be immediate and there could be sufficient time to revise any tax law changes under a new administration. Furthermore, it is difficult to predict how the company’s shares would react to any changes in the tax law. Currently, there is a reluctance to own shares of alternative asset managers as institutional investors don’t want to be burdened with filing K-1s, cannot own them due to fund mandates or due to the float not being sufficient. This is why a large number of institutional investors are not investing in alternative asset managers. Alternative asset managers could reconsider their corporate structure and reorganize as a corporation, if carried interest is taxed as ordinary income. This, in turn, could increase demand for their shares and liquidity, helping offset some of the negative effect of having to pay ordinary income taxes. Investors could remain on the sidelines until there is more clarity about tax treatment of carried interest. However, any change in tax treatment would require a 10-year transition period July 16, 2013 Bulent Ozcan (212) 863-4818; bulent.ozcan@rbccm.com 27 Fortress Investment Group LLC