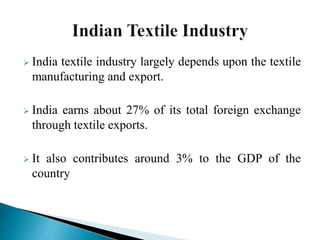

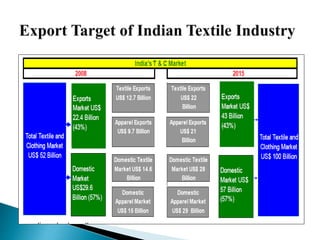

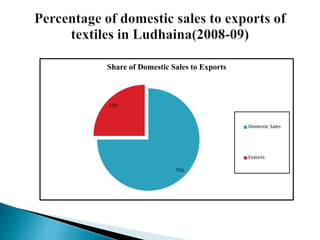

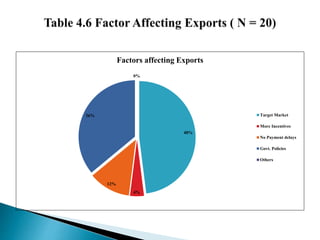

The document discusses the Nahar Group, a textile company established in 1949 in Ludhiana, India. It began with three brothers and 800 spindles, and has now grown to over 66,200 spindles with a turnover of Rs. 2,500 crore. The group includes companies like Oswal Woollen Mills Ltd. and Nahar Spinning Mills Ltd. It produces products like yarn, fabrics, and knitwear. It exports to markets around the world and contributes to social programs in India. The textile industry in Ludhiana contributes significantly to India's economy and exports.