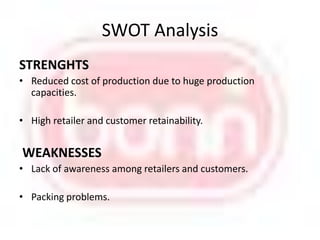

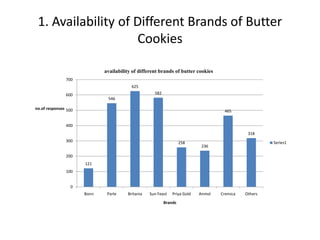

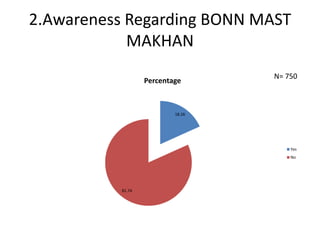

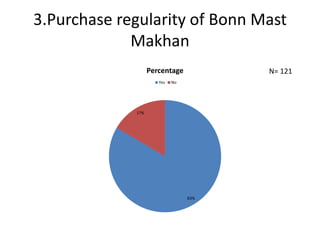

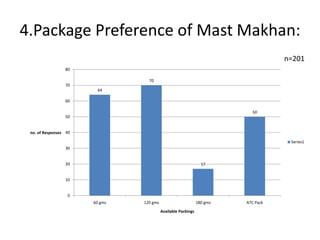

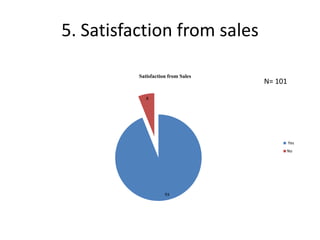

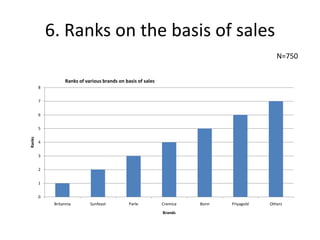

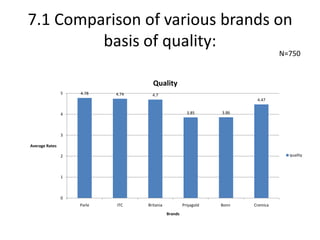

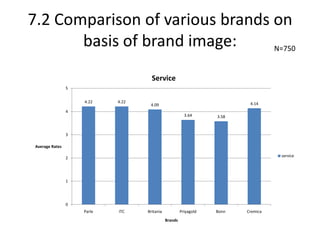

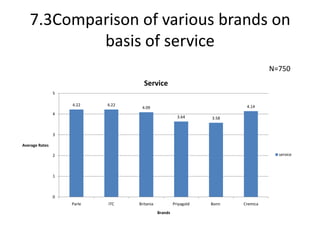

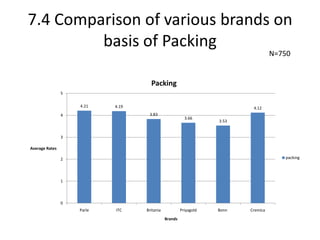

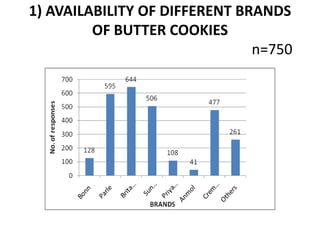

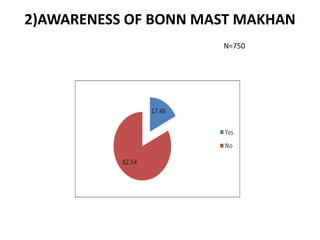

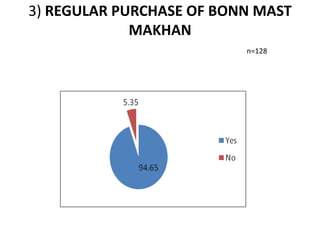

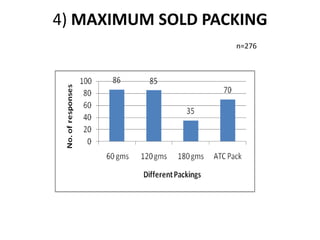

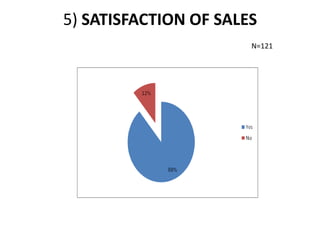

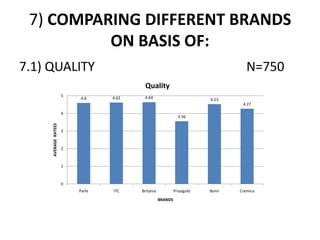

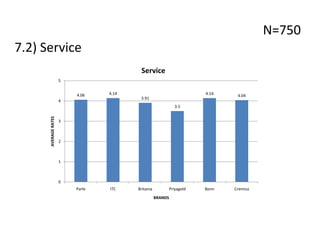

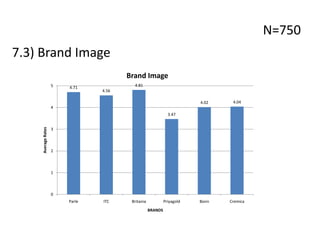

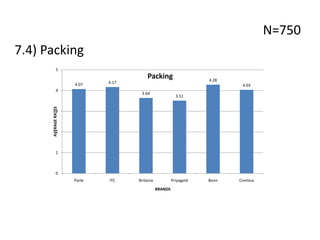

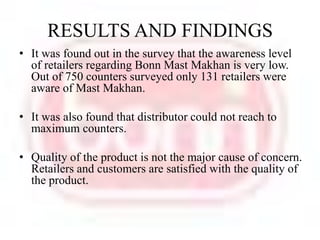

This document presents the results of a study comparing Bonn Mast Makhan butter cookies to other brands in Ludhiana, Jalandhar, and Amritsar. The study found that awareness of the Bonn brand among retailers was low. It also found that Bonn enjoyed high retailer retainability and satisfaction with quality, though awareness of the product name could be improved. The study evaluated the brands on various metrics like quality, brand image, packaging, and service to retailers.