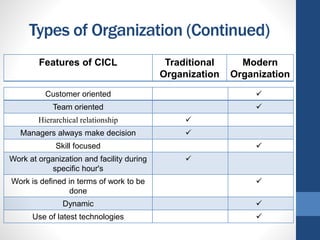

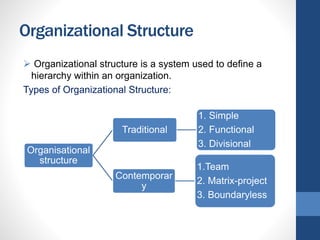

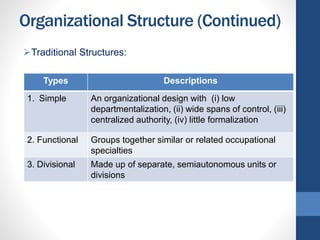

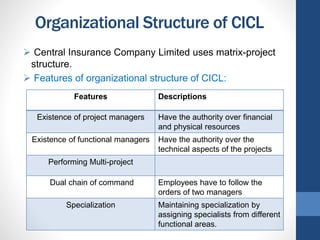

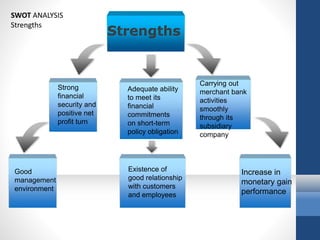

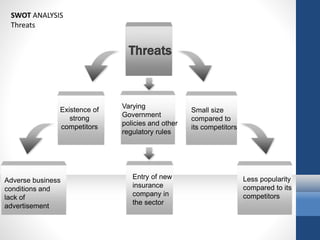

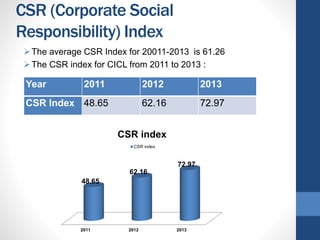

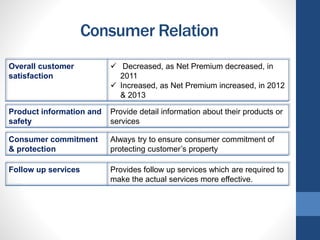

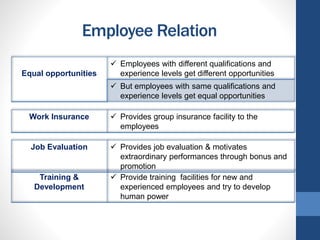

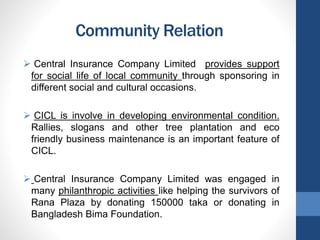

The presentation discusses the organizational structure and corporate social responsibility of Central Insurance Company Limited (CICL), a leading non-life insurance firm in Bangladesh established in 1987. It covers the company's mission, vision, various insurance services, SWOT analysis, and CSR index from 2011 to 2013, highlighting its strengths, weaknesses, opportunities, and threats. The presentation emphasizes CICL's commitment to social responsibility through community support and environmental initiatives.