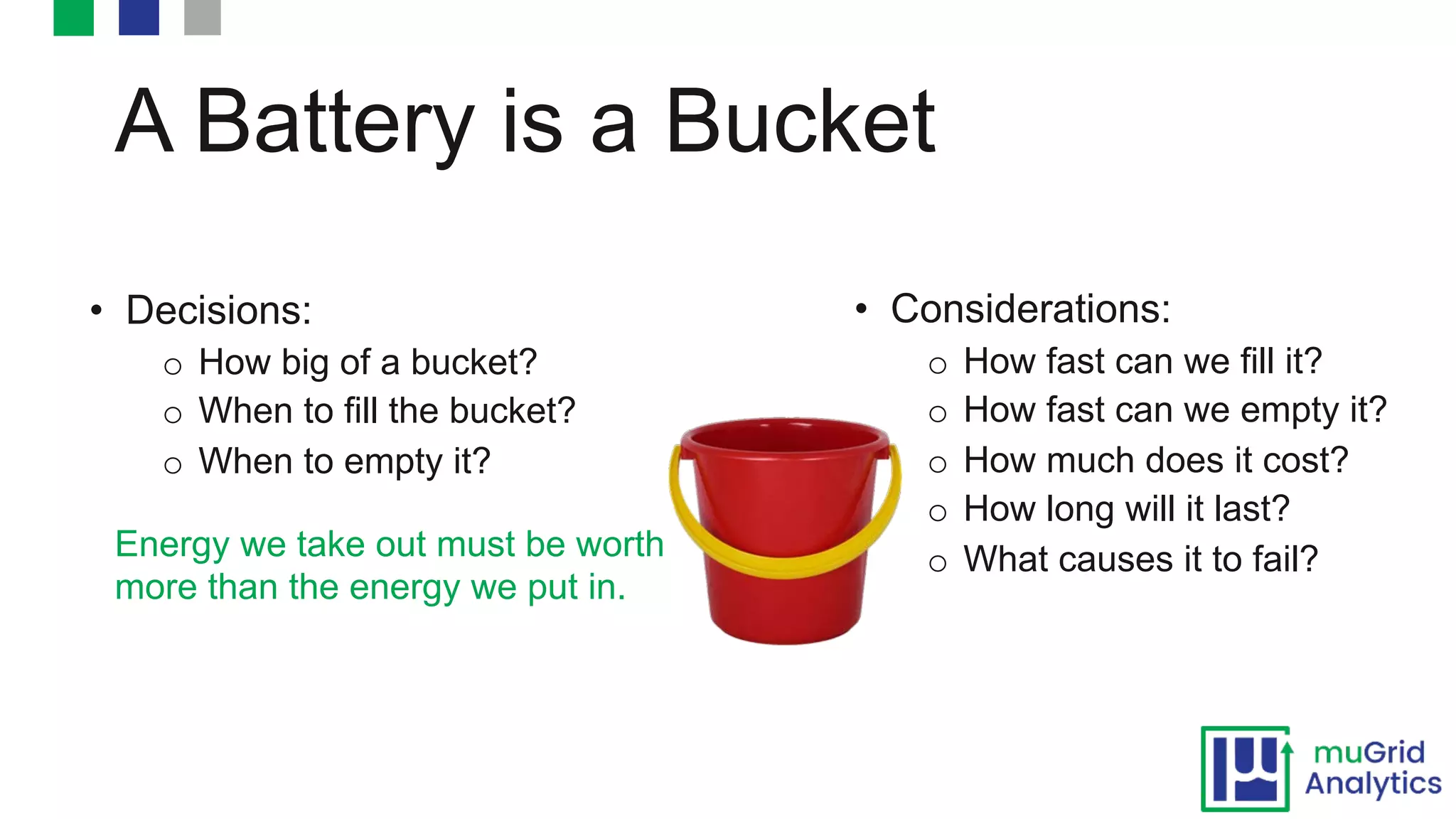

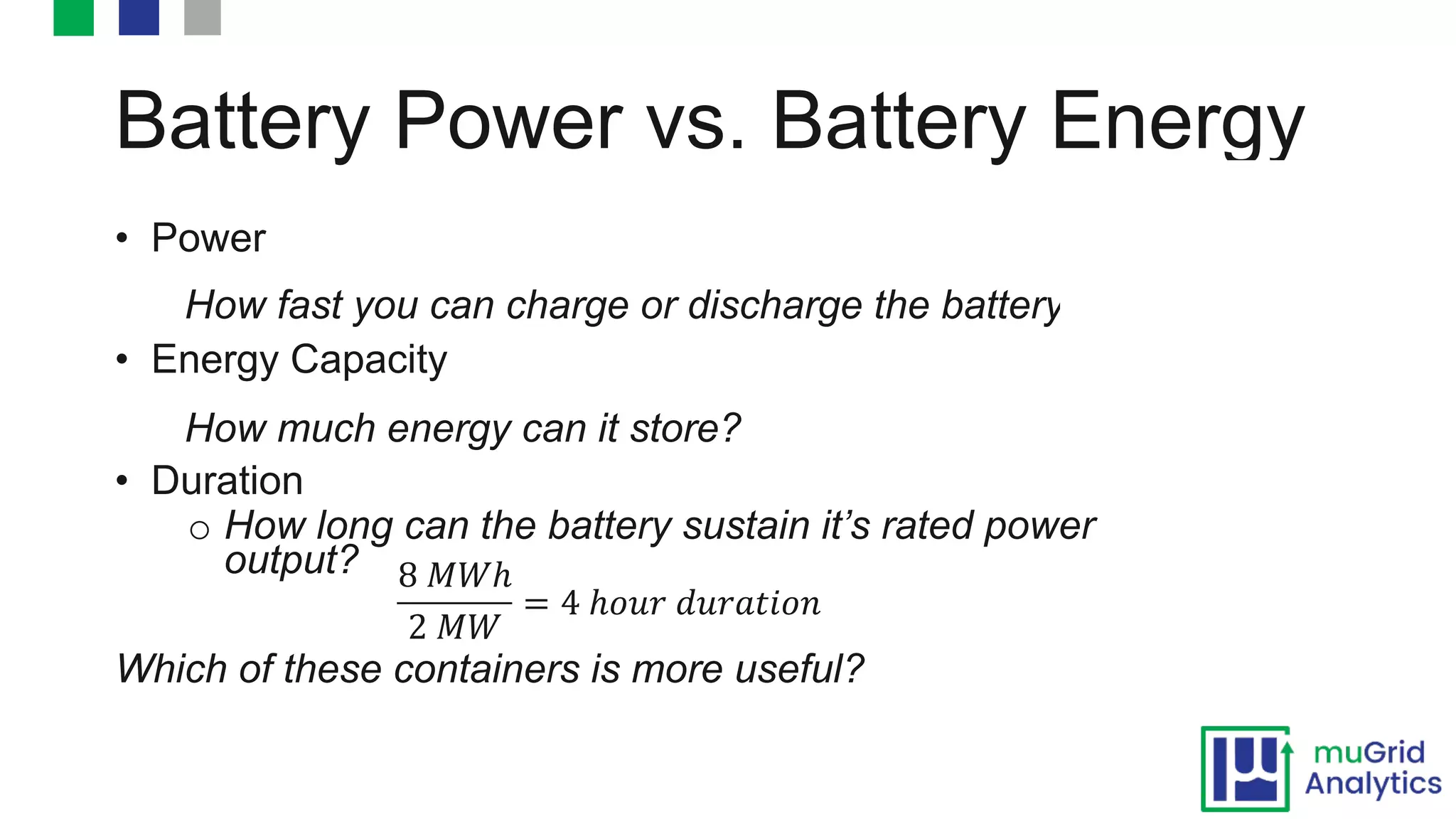

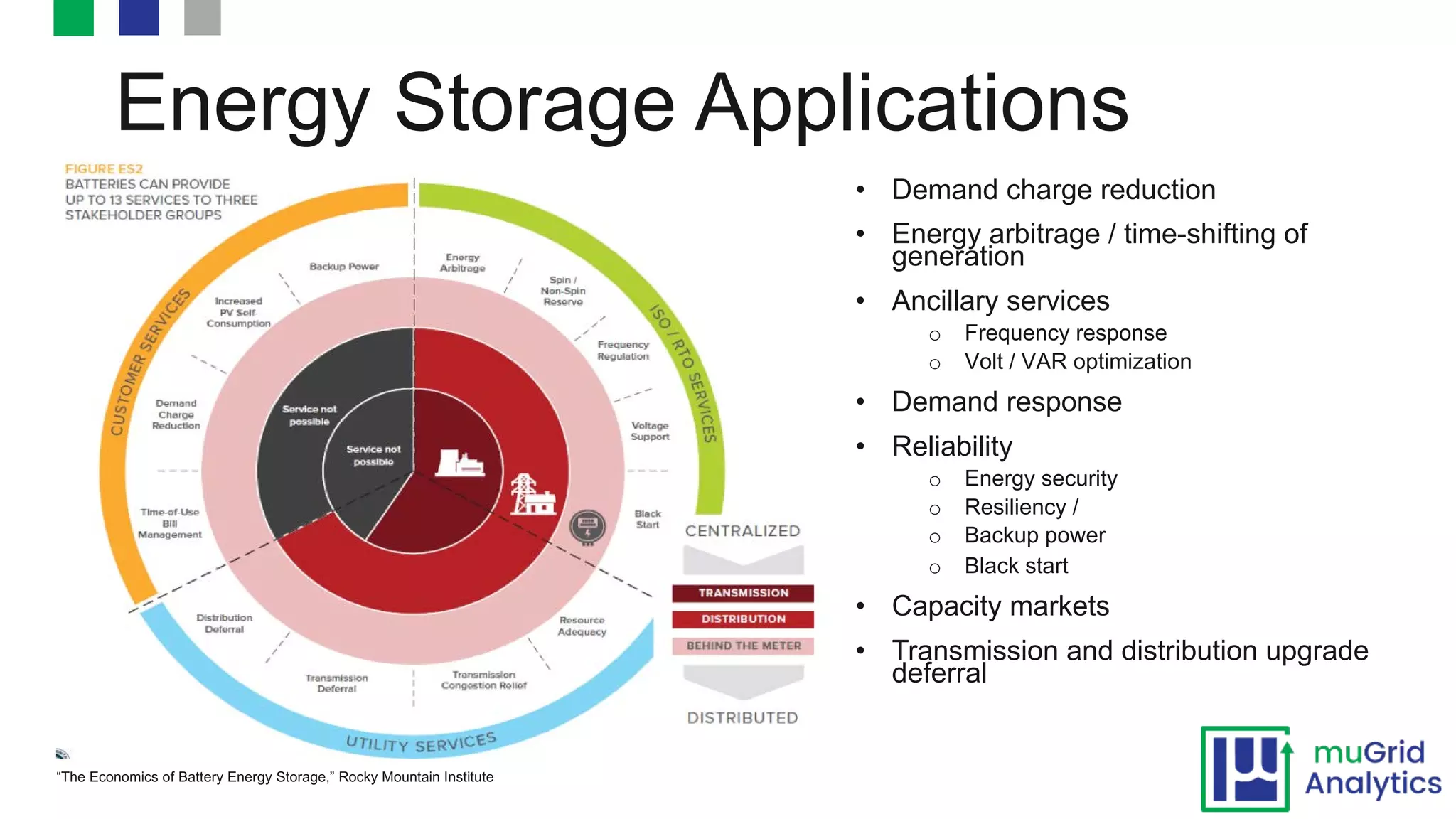

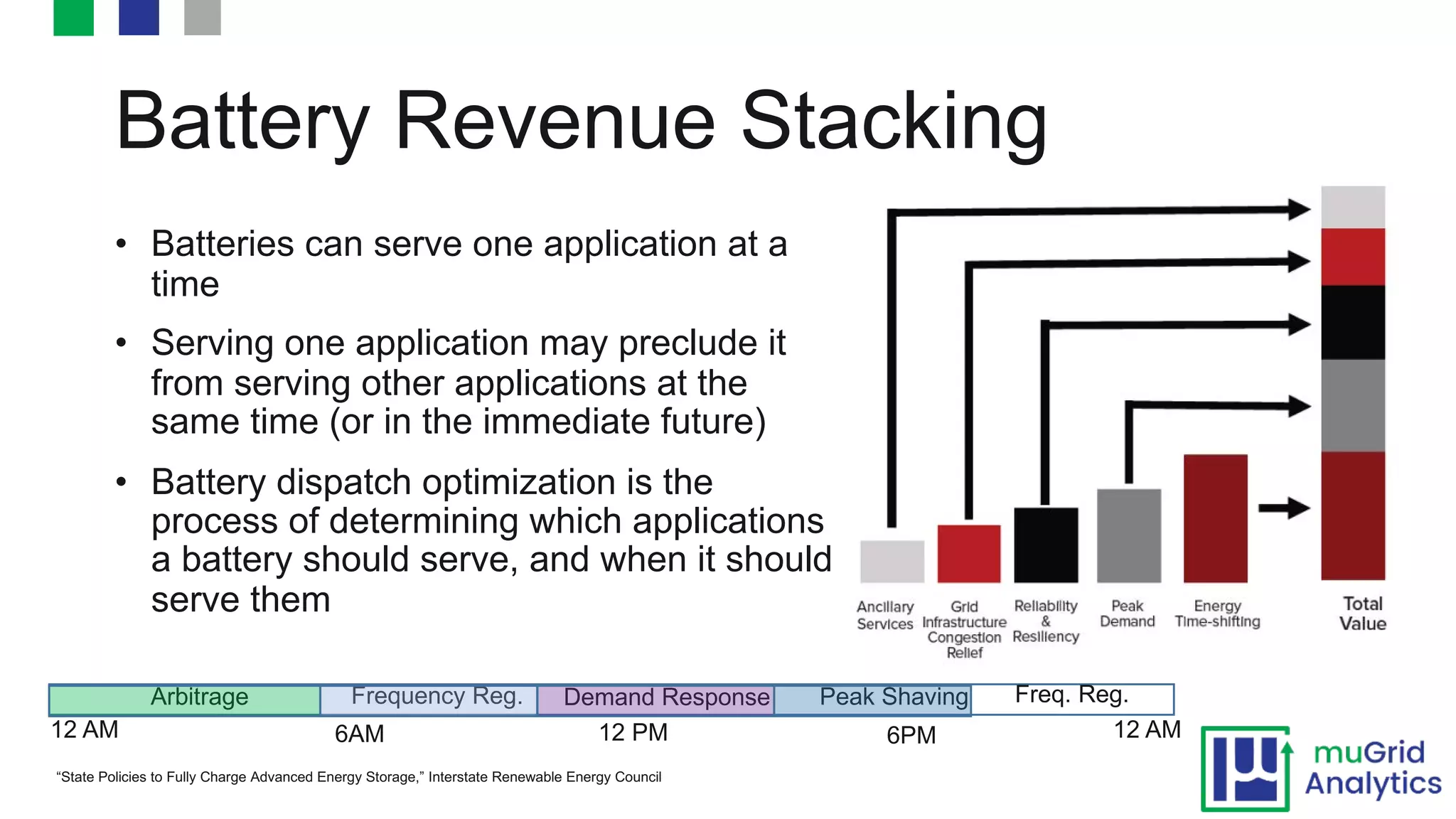

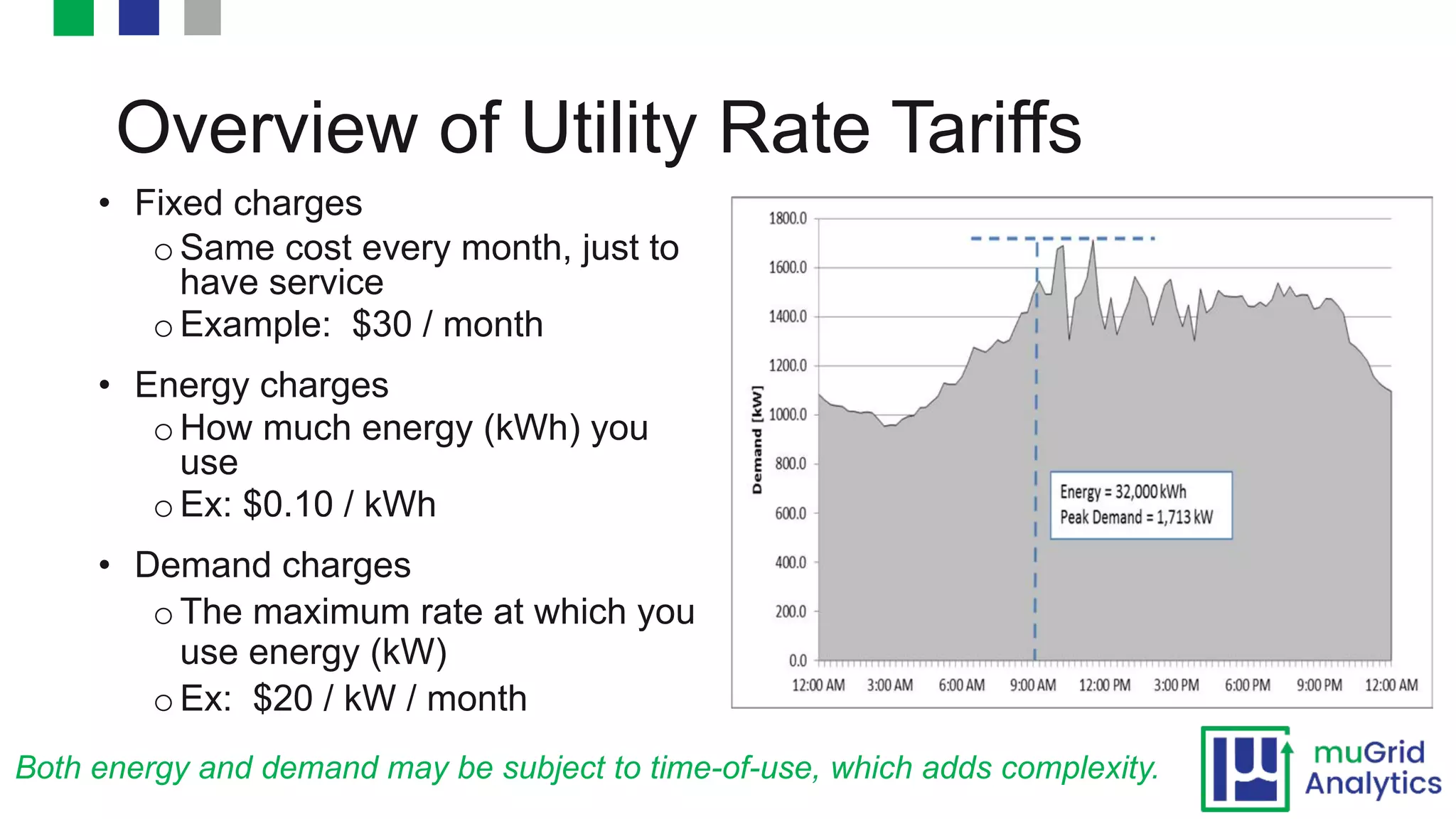

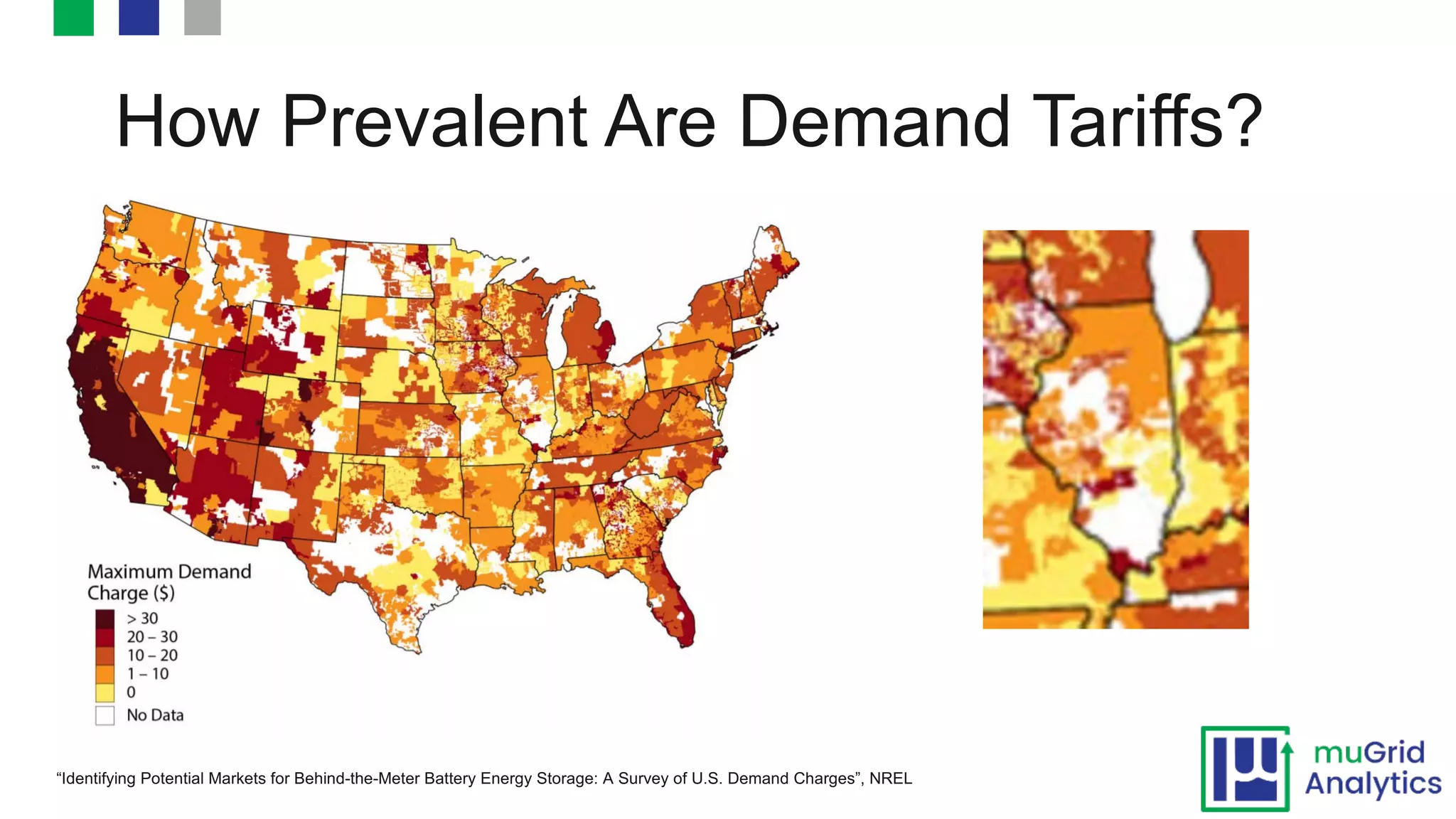

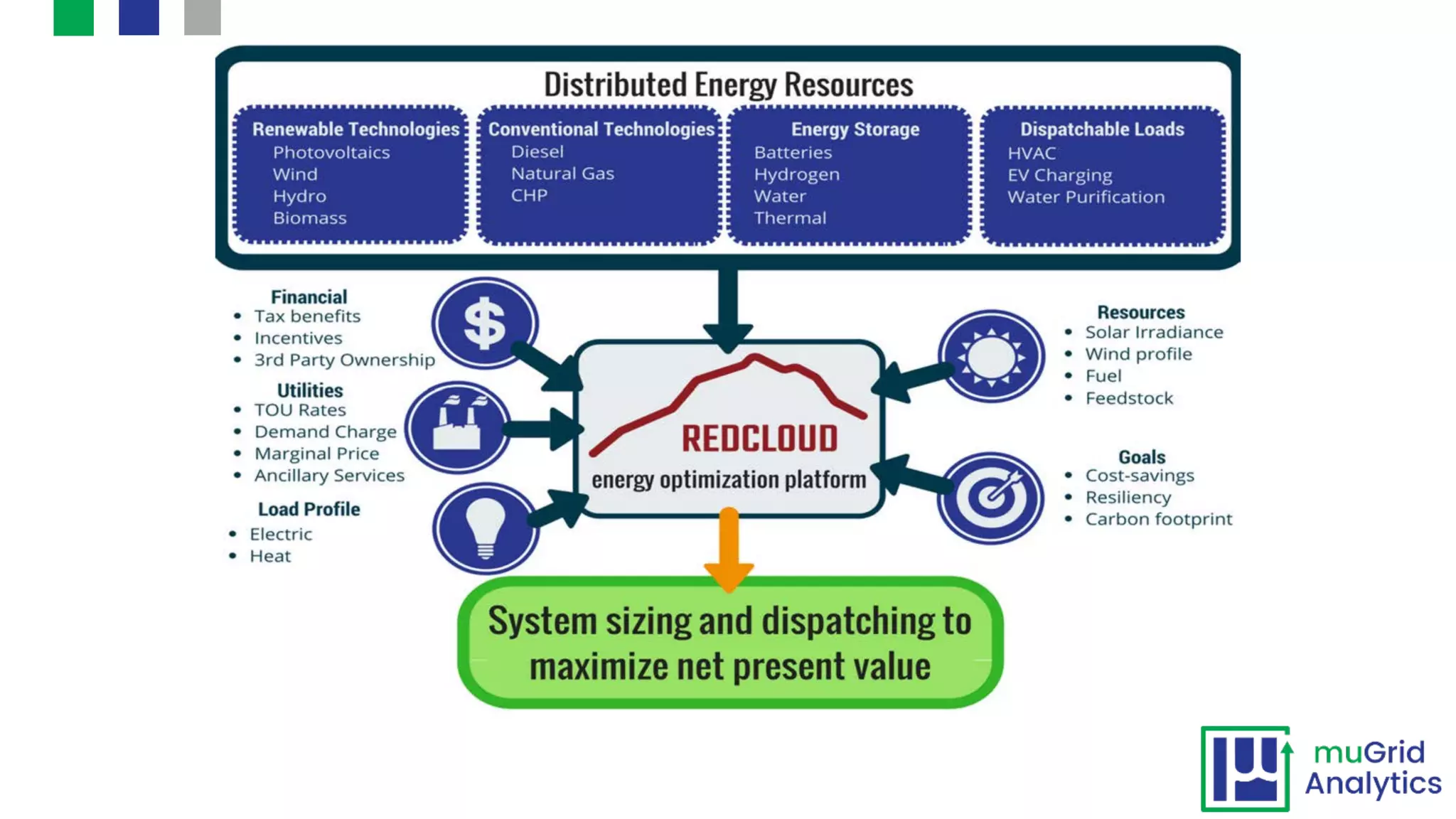

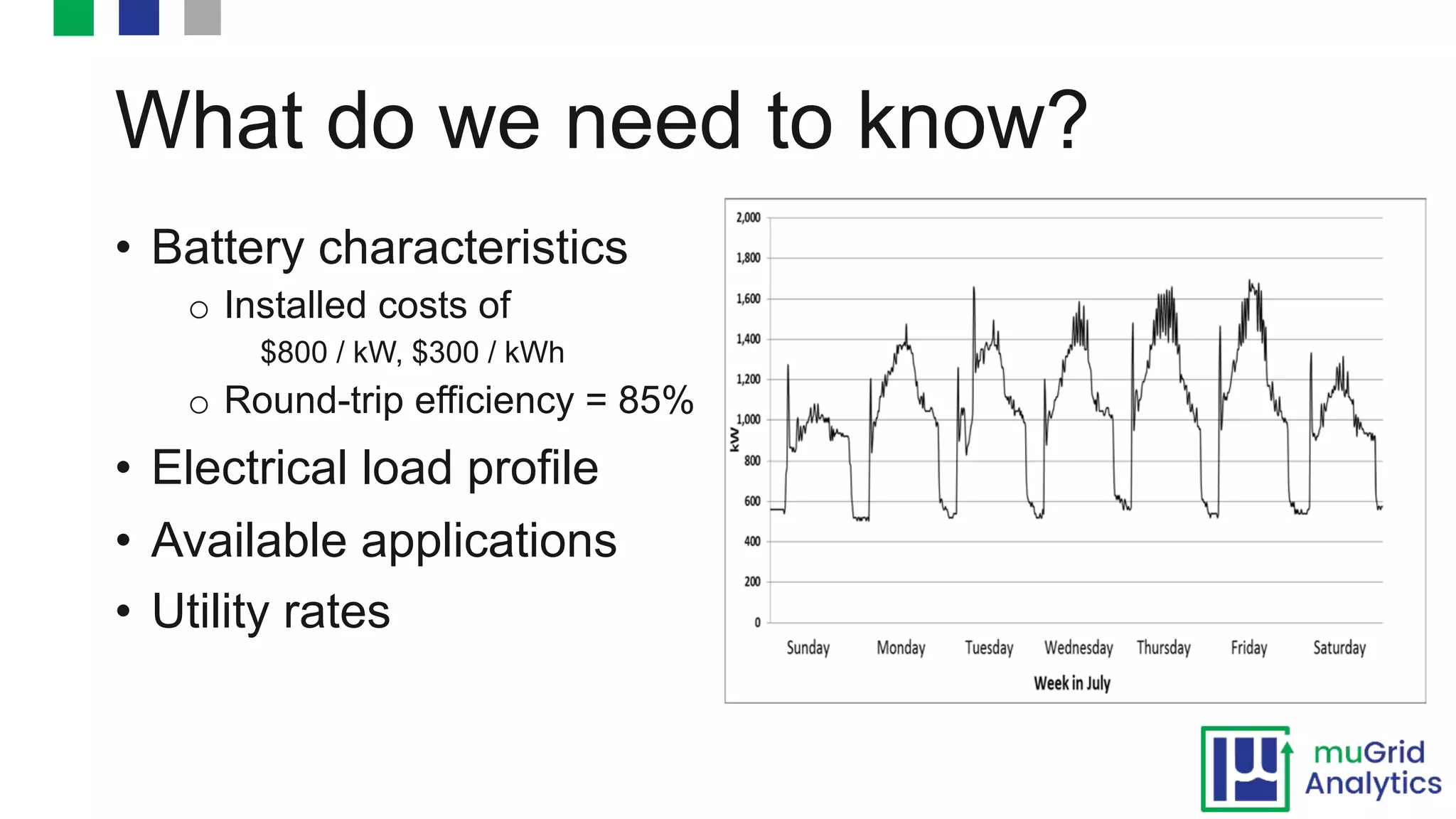

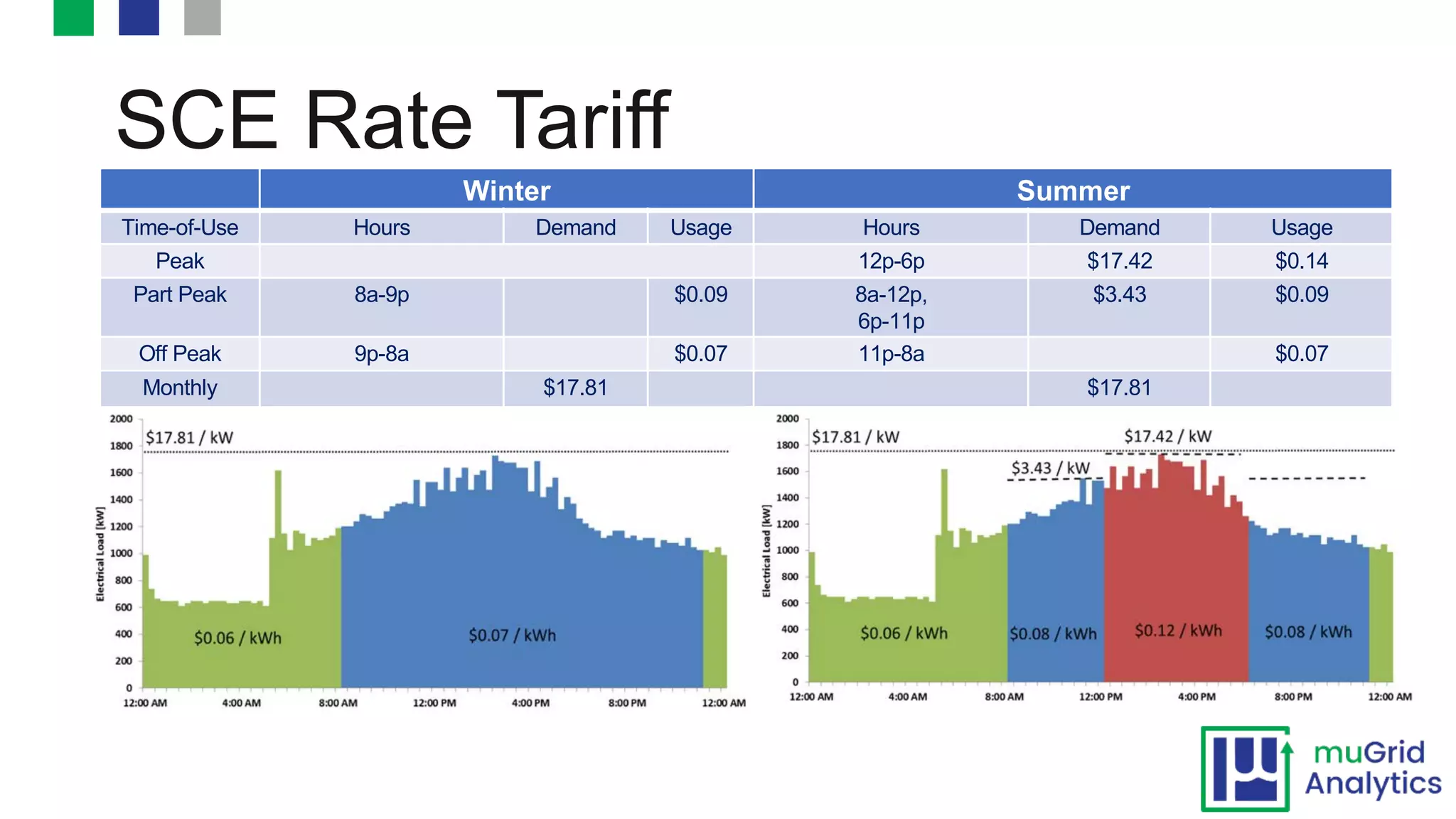

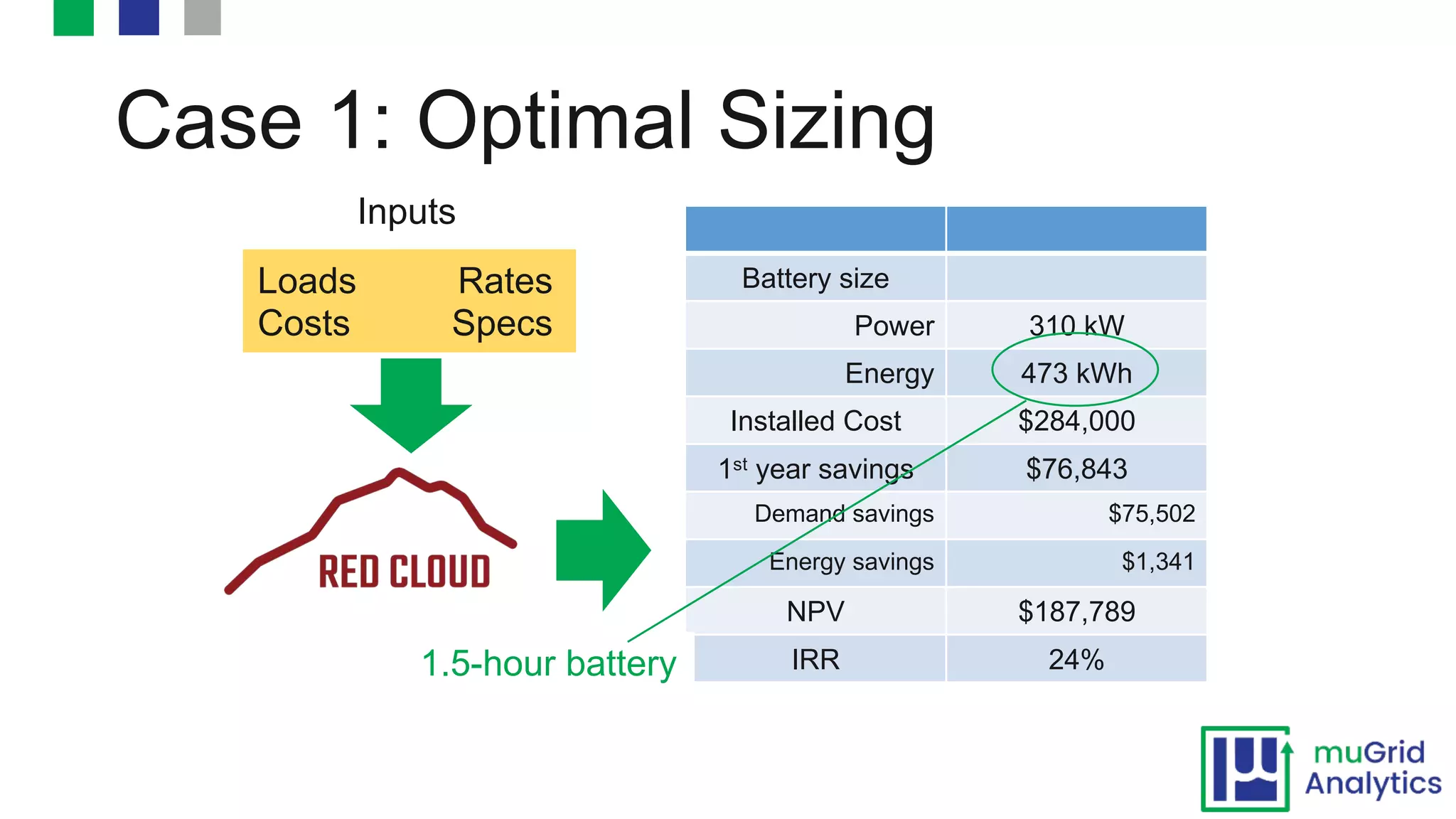

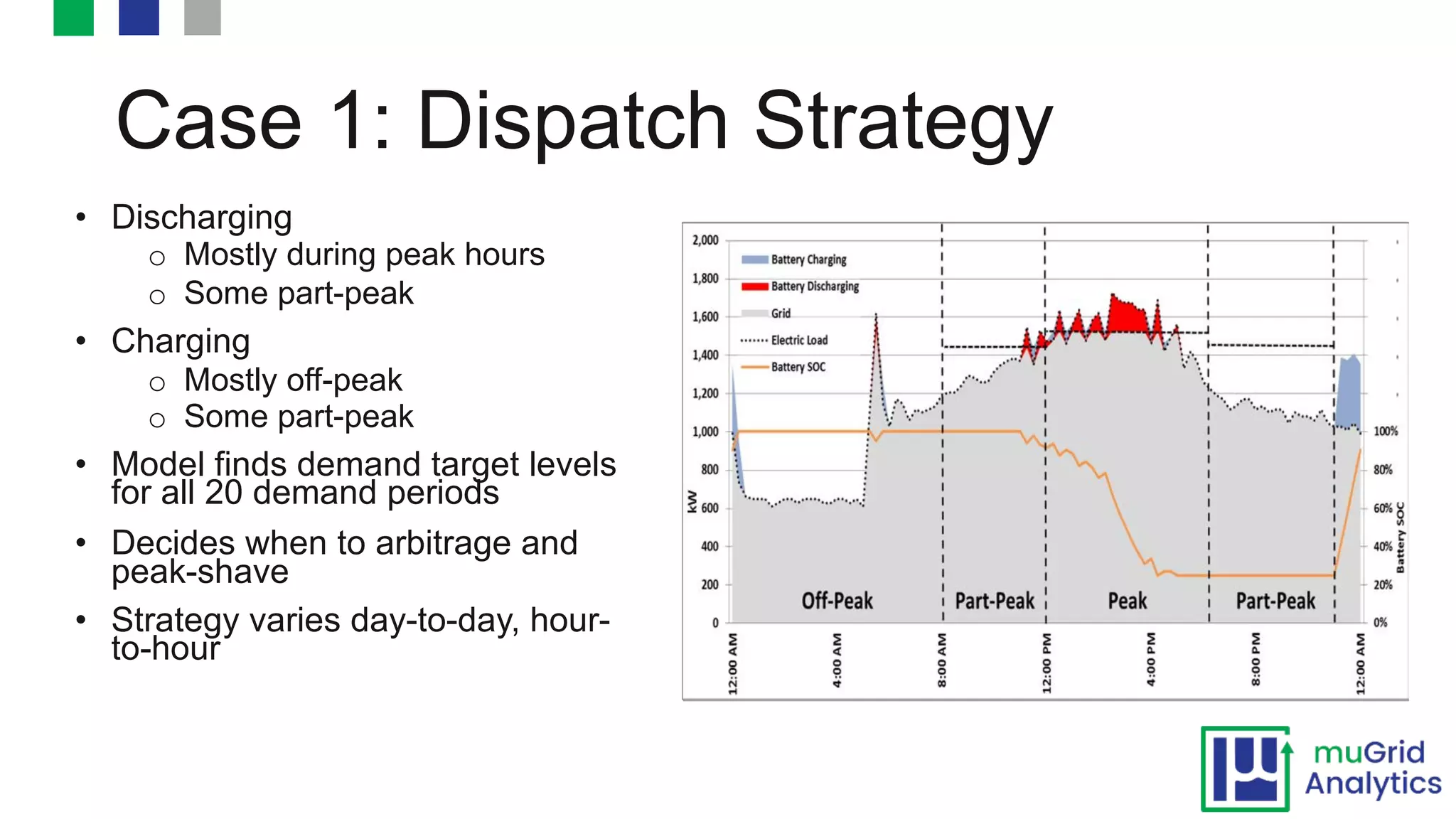

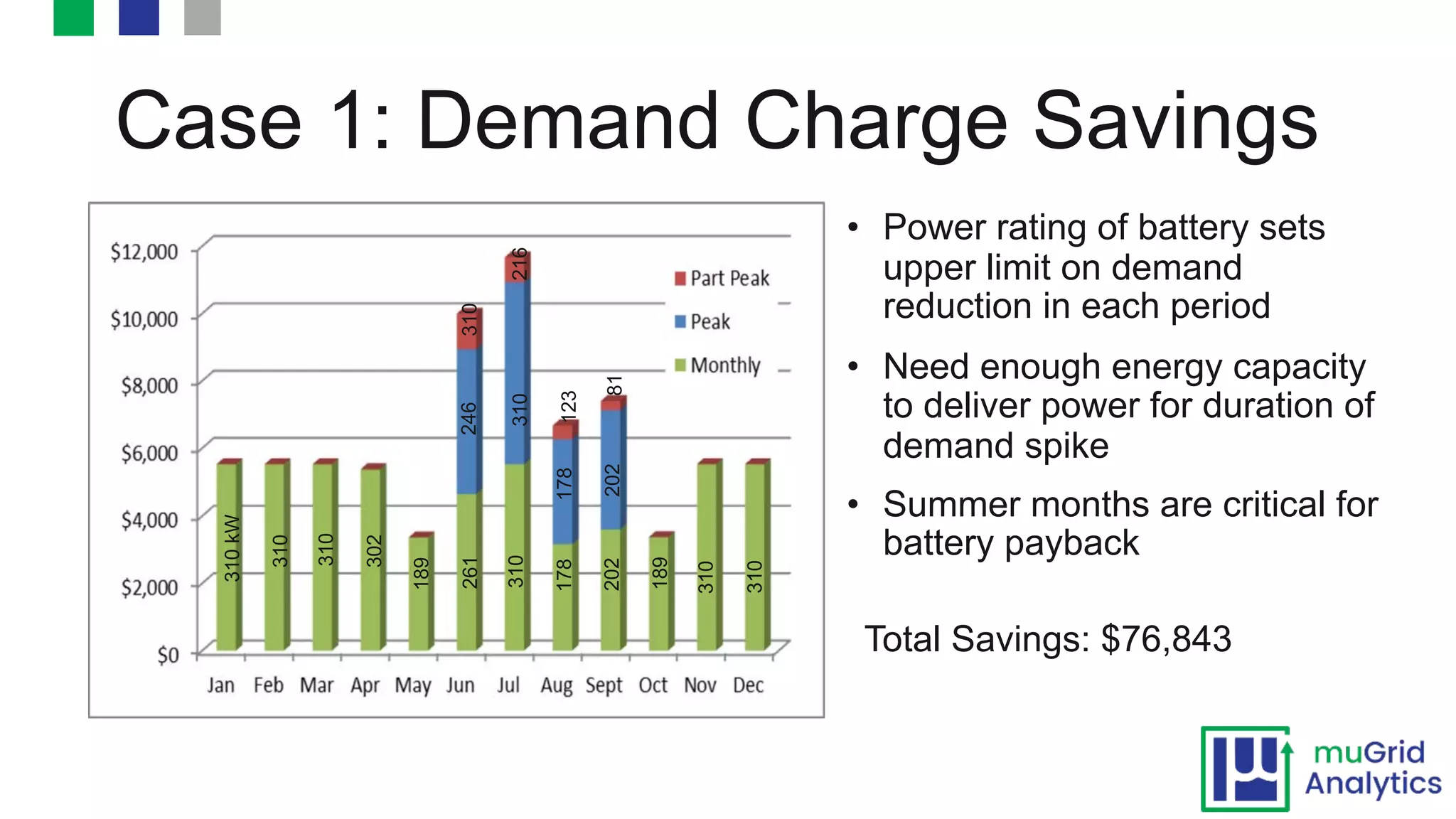

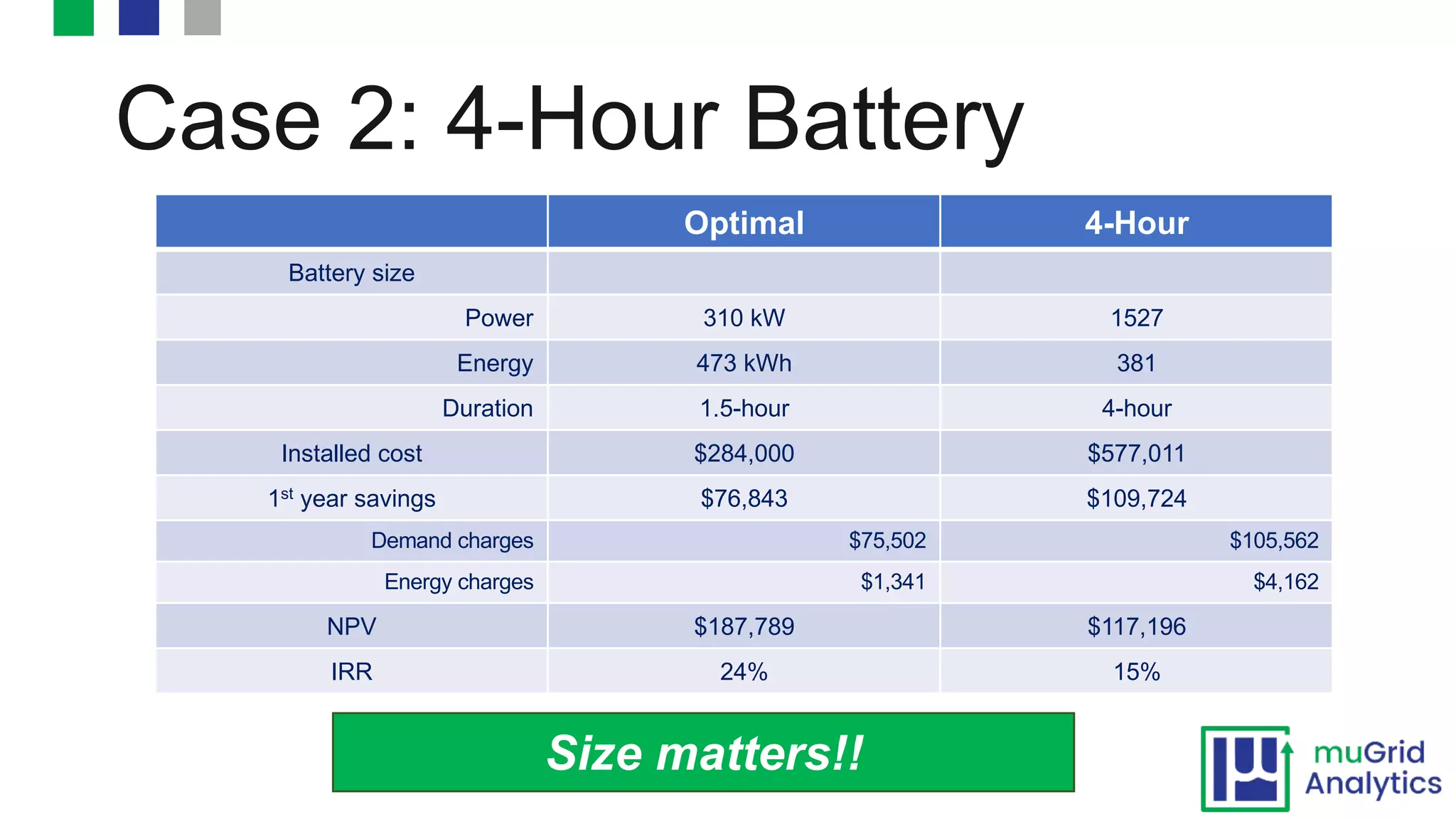

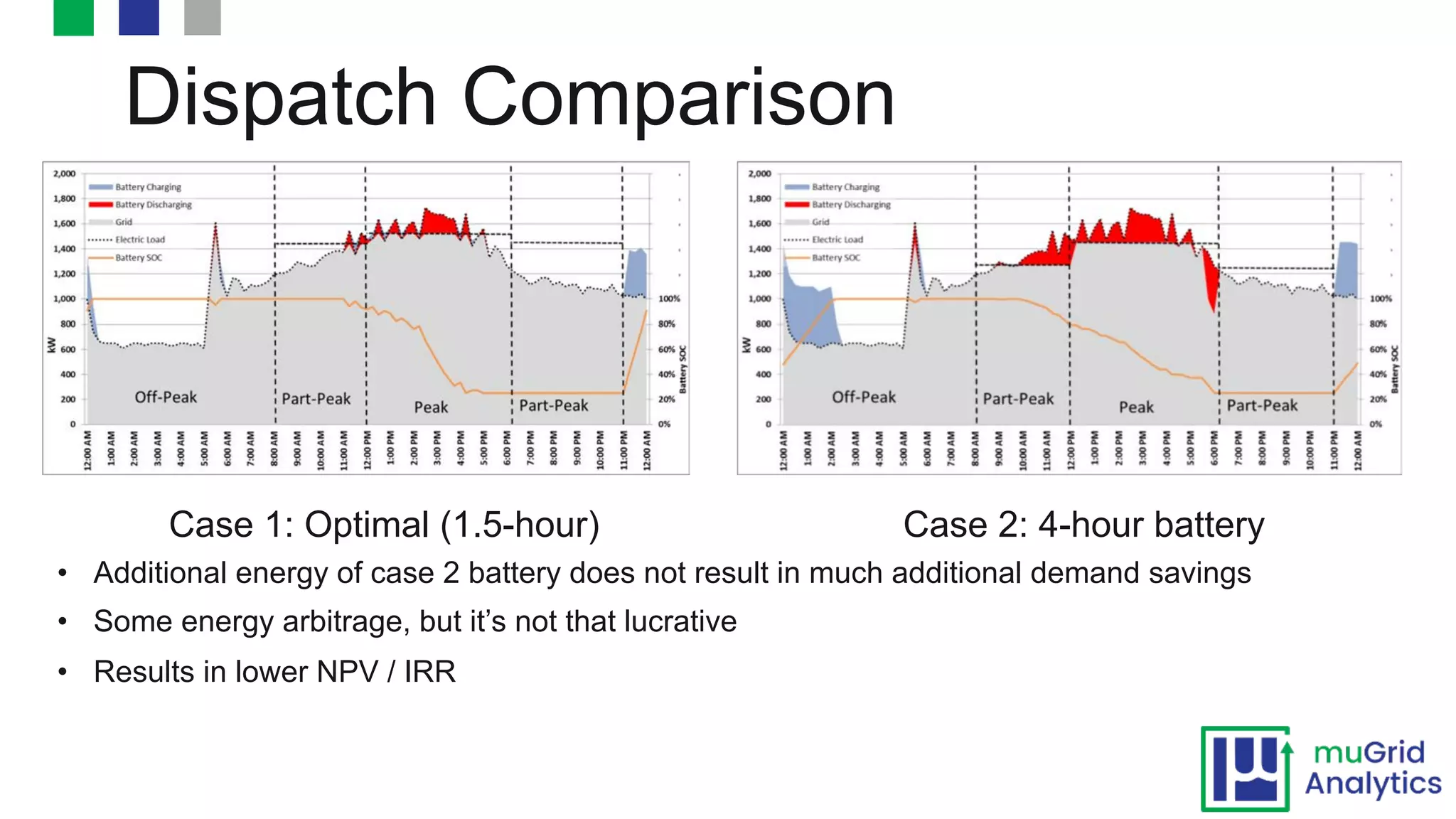

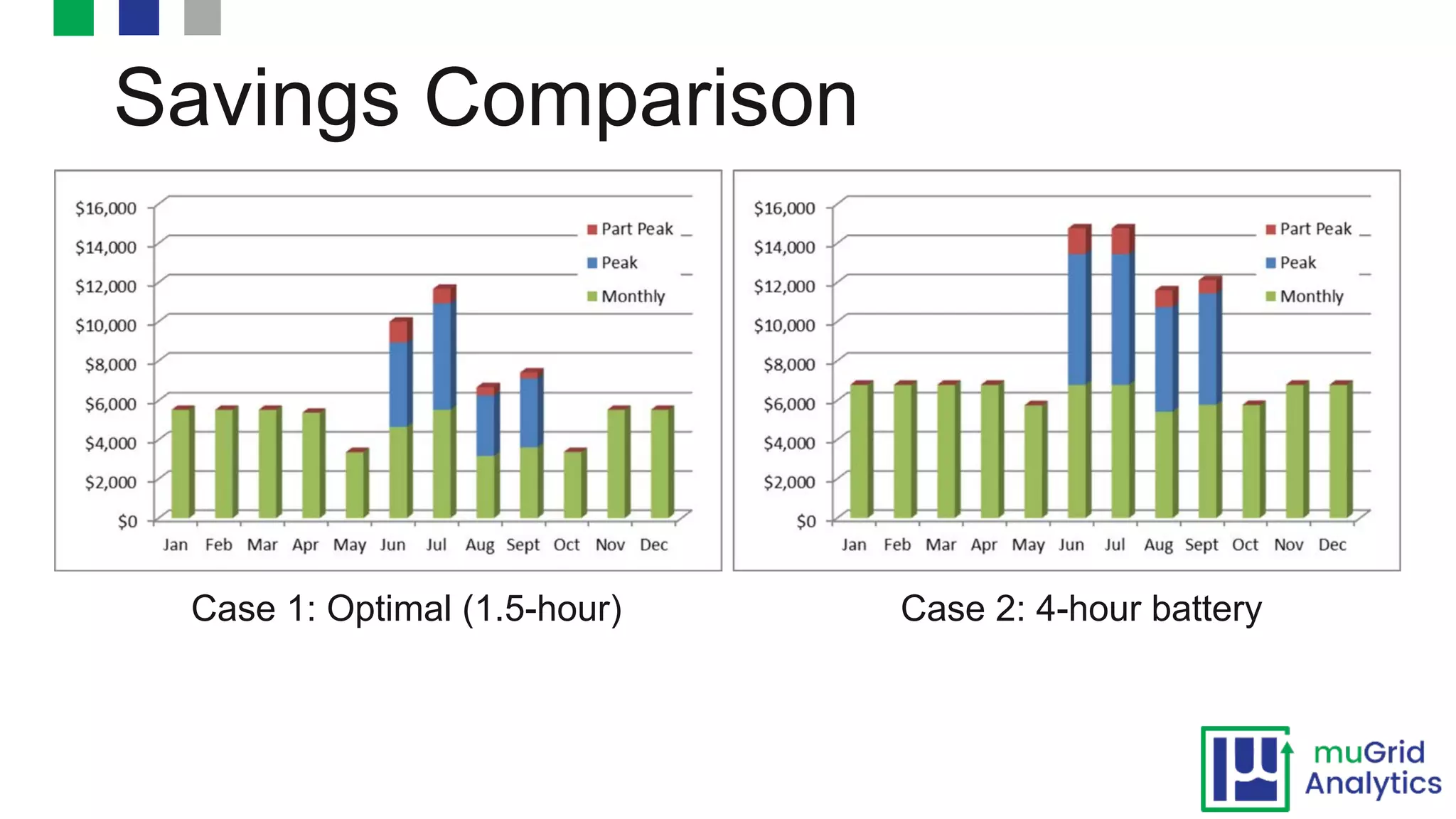

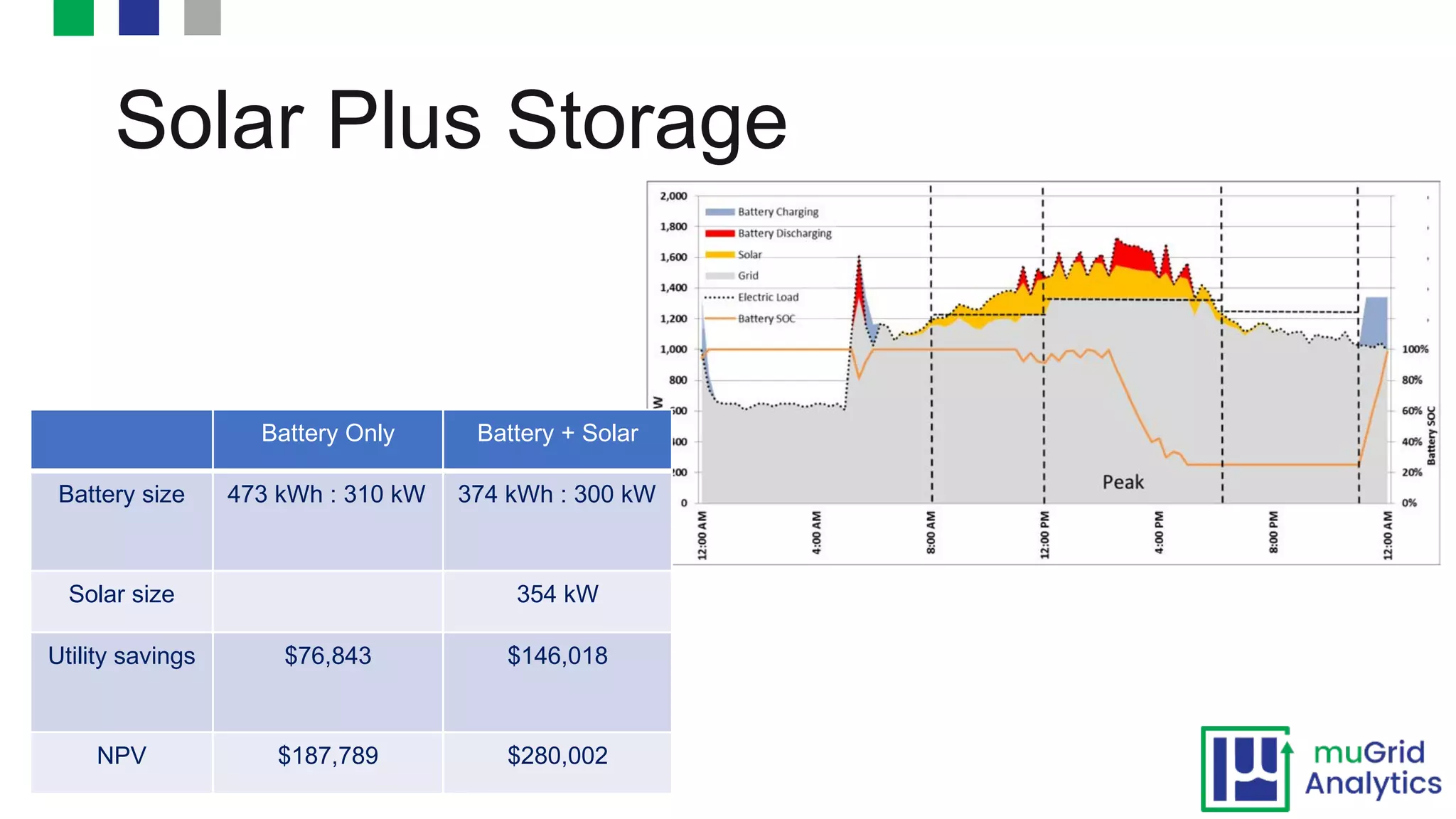

The document discusses how battery energy storage can enhance the economics of solar projects through multiple revenue streams and optimal dispatching strategies. It highlights the importance of mathematical optimization in determining battery operation decisions and demonstrates case studies on battery sizing, savings, and operational strategies in actual office settings. The conclusion emphasizes the potential economic benefits and complexities of integrating battery storage with solar energy.