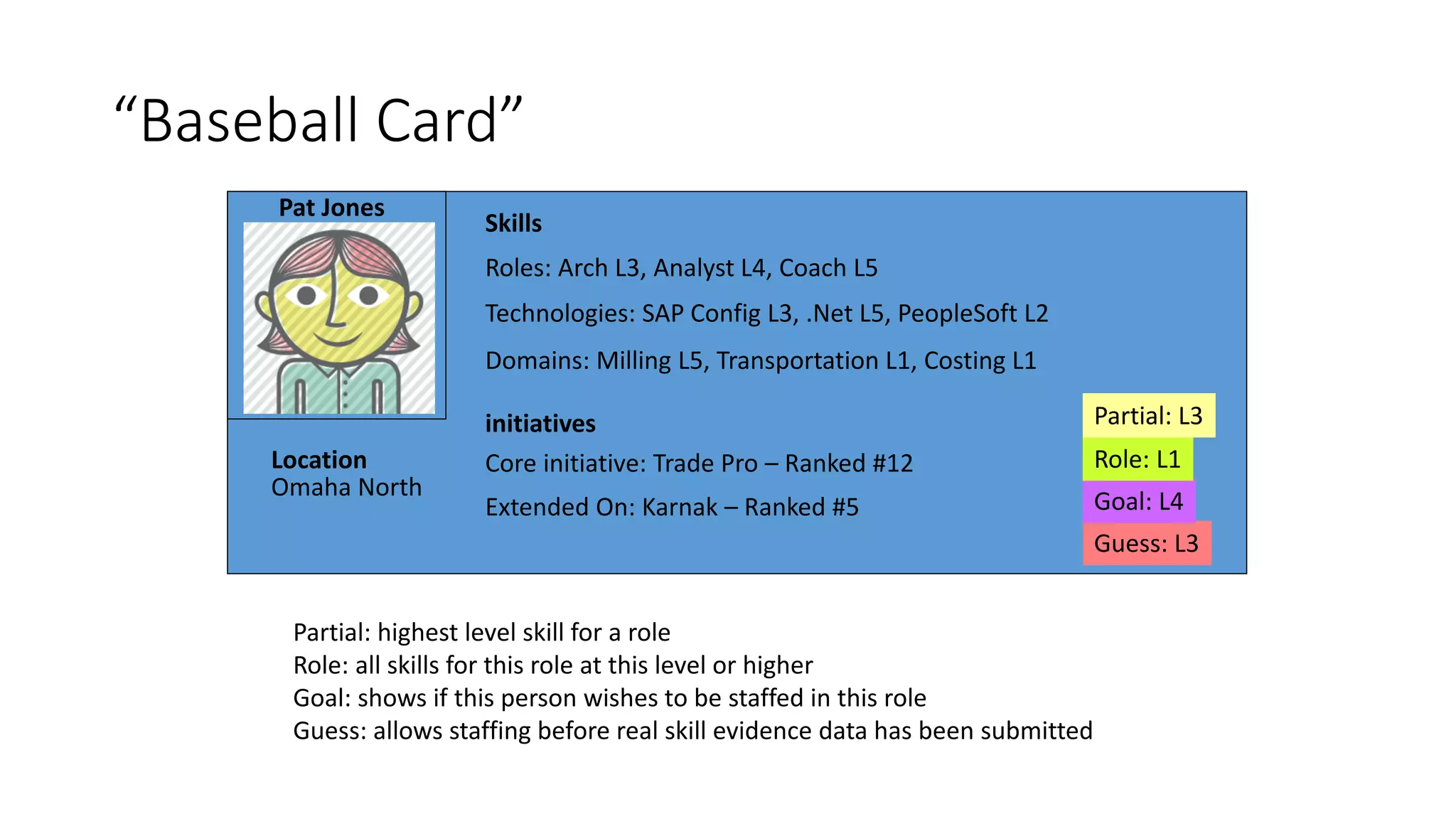

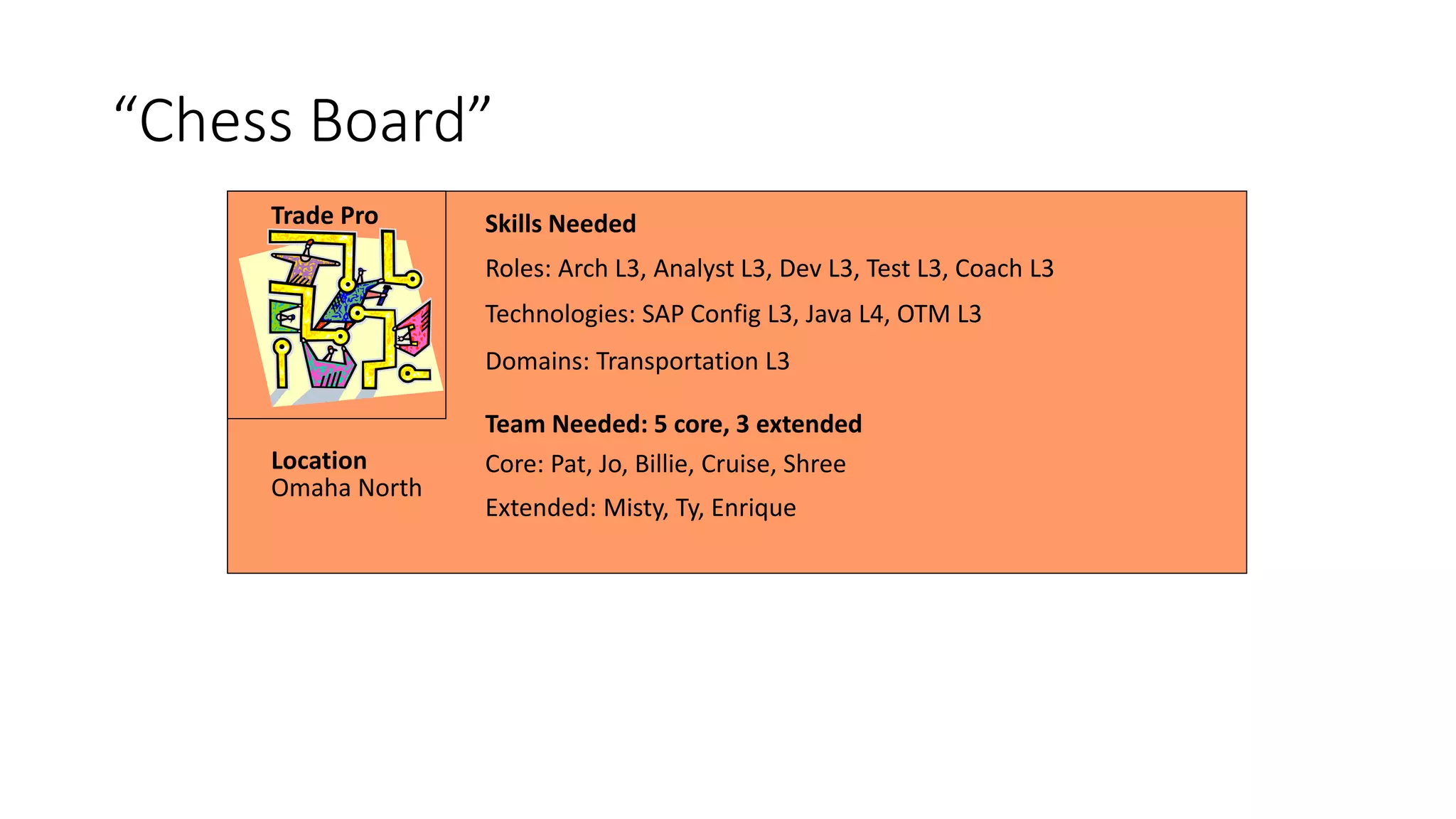

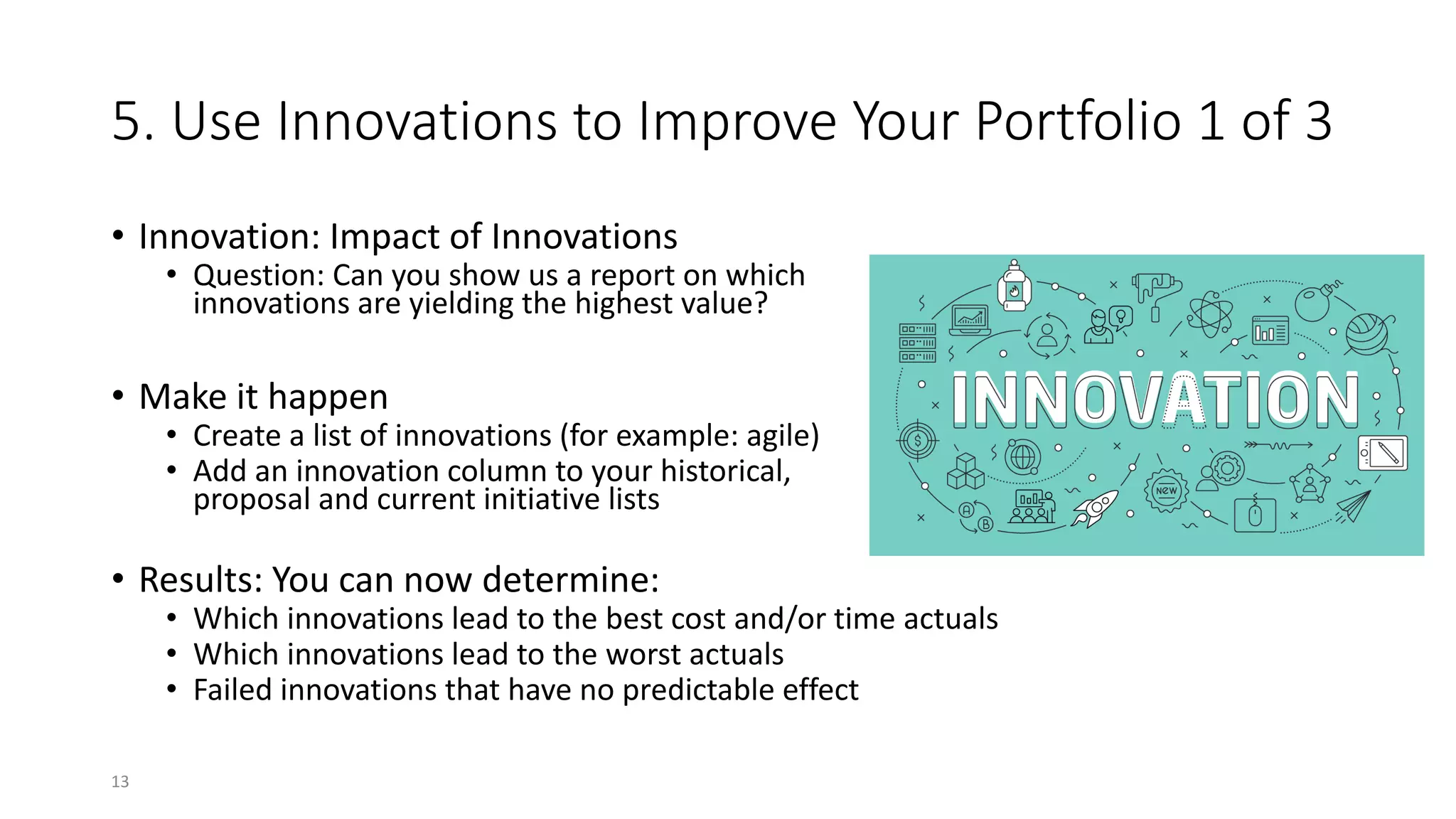

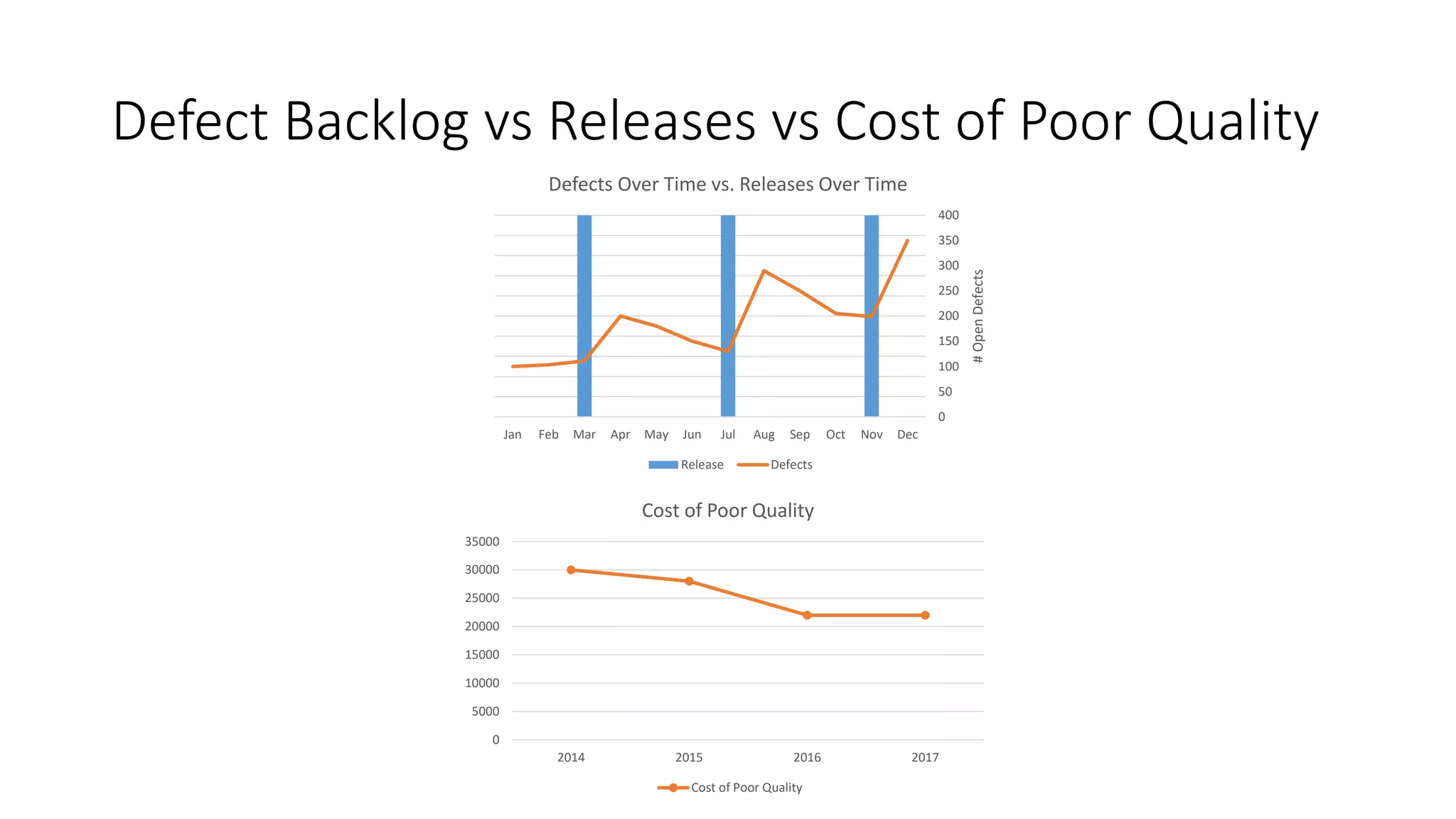

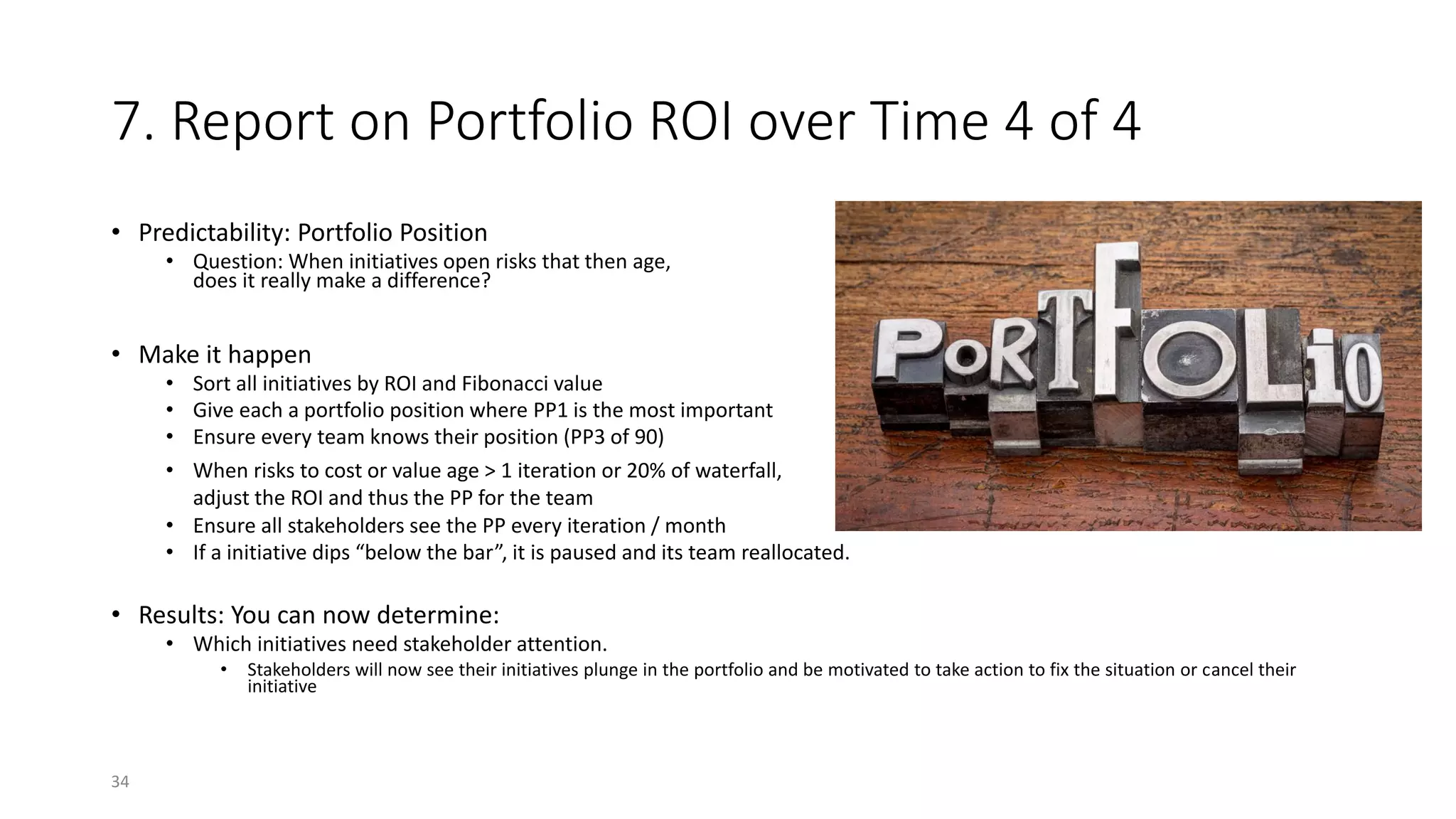

The document outlines techniques for optimizing portfolio performance using agile methods and tools like Jira, focusing on elements such as historical baselines, current and future state estimates, and alignment with business objectives. It emphasizes metrics for assessing quality, predictability, and productivity, and suggests innovations to enhance portfolio management. Additionally, it provides strategies for evaluating return on investment (ROI) and streamlining resource allocation within IT budgets.

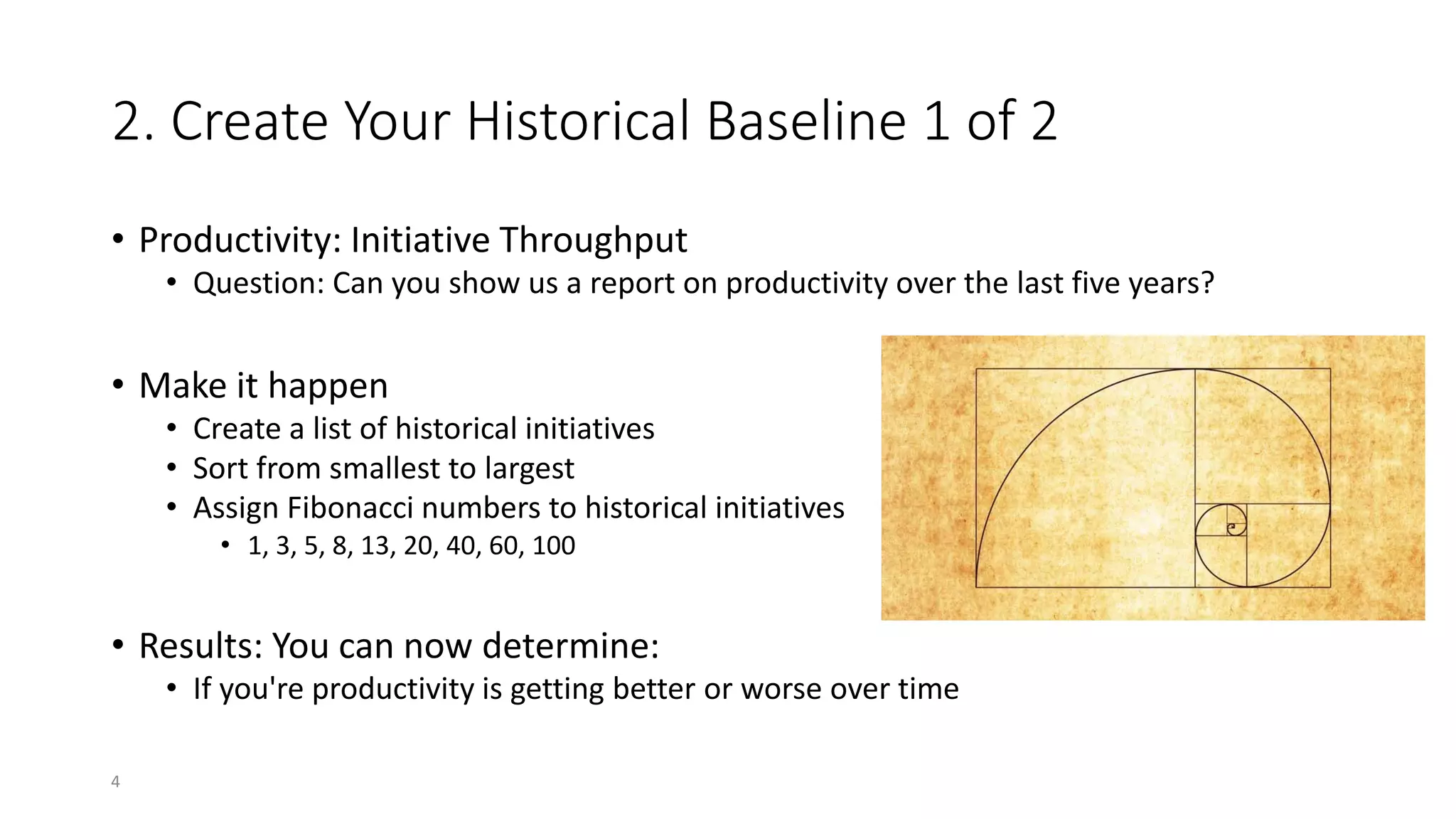

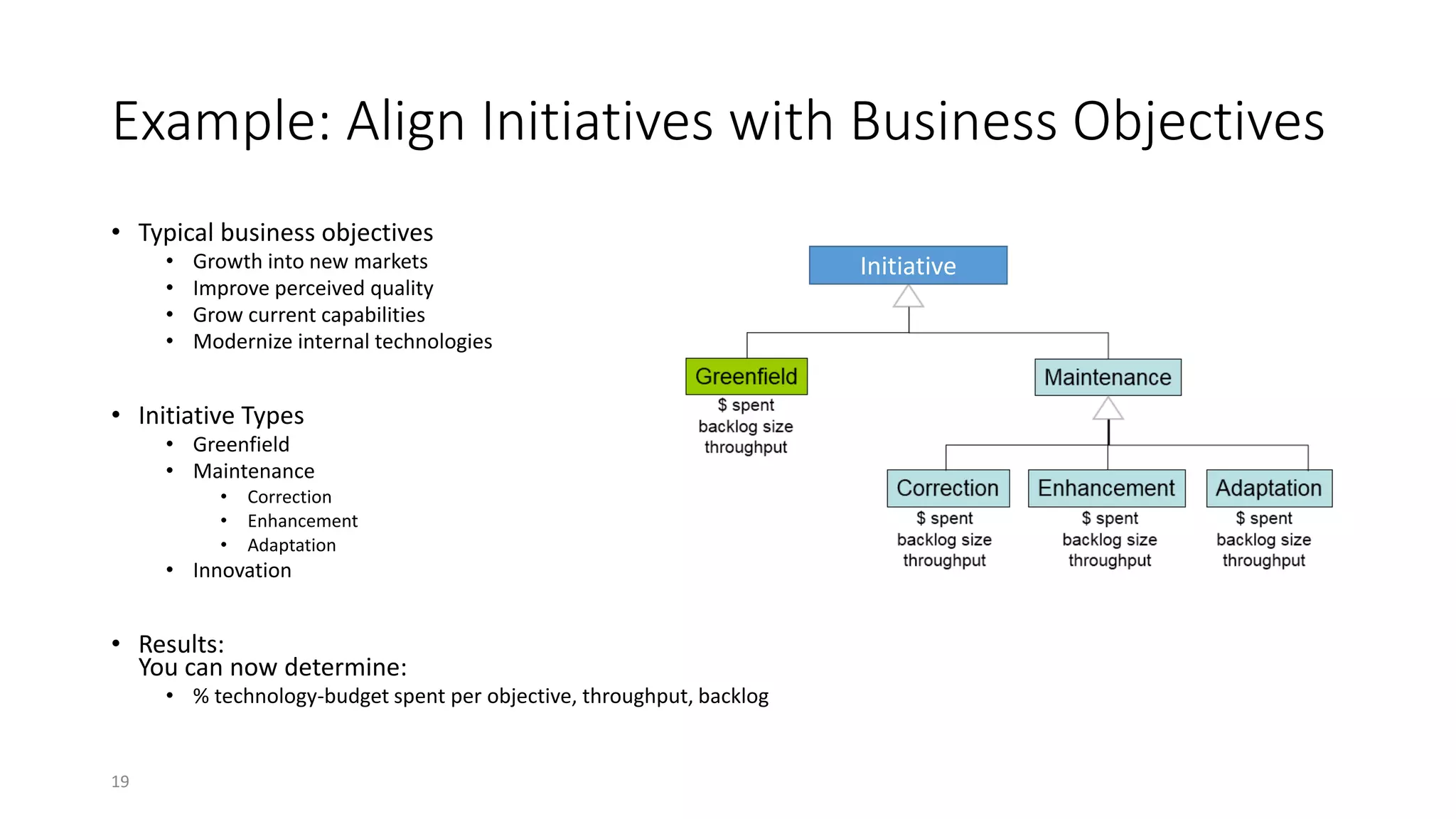

![Example: ROI Report

• Revenue generators: 1.25 (spent $1M, generated $1.25M) [30% of total spend]

• Cost reduction: 1.15 (spent $1M, estimated reduction $1.15M) [40%]

• Others (spent x) [30%]

• Value points predictability: .85 (planned 1000VP, actual 850VP)

• Non dollar value delivered: 2.5 (spent $1M, estimated value of $2.5M)

• Decrease first quarter post release usability defects by 40% (2000 defects, from 5000 to 3000)

• Increased the number of users by 100% (from 1M to 2M users)

• Note: often these CAN be monetized.

• Portfolio Spend Per initiative Type

• Cost of failed initiatives: ($x) 11%

• Cost of poor quality: ($y) 12%

• Invested in new markets: ($z) 9%

• Invested in current capabilities: ($a) 49%

• Invested in modernization: ($b) 10%

• Invested in innovations ($c) 9%

36

Revenue

Generation

30%

Cost Reduction

40%

Others

30%

% IT Budget 2015

1.245 1.285

1.4375

1.1 1.13

1.25

1.08 1.11 1.15

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1 2 3

ROI

ROI Trend Last Three Years

Average ROI Revenue Generation Cost Reduction

Cost of Failed

Projects

11%

Cost of Poor

Quality

12%

Invested in

Markets

9%

Invested in

Current

Capabilities

49%

Invested in

Modernization

10%

Invested in

Innovations

9%

% IT Budget](https://image.slidesharecdn.com/agileportfoliomanagementfinal-180405185322/75/Optimize-Portfolio-Performance-with-Simple-Agile-Techniques-and-Jira-Part-1-2-22-2048.jpg)