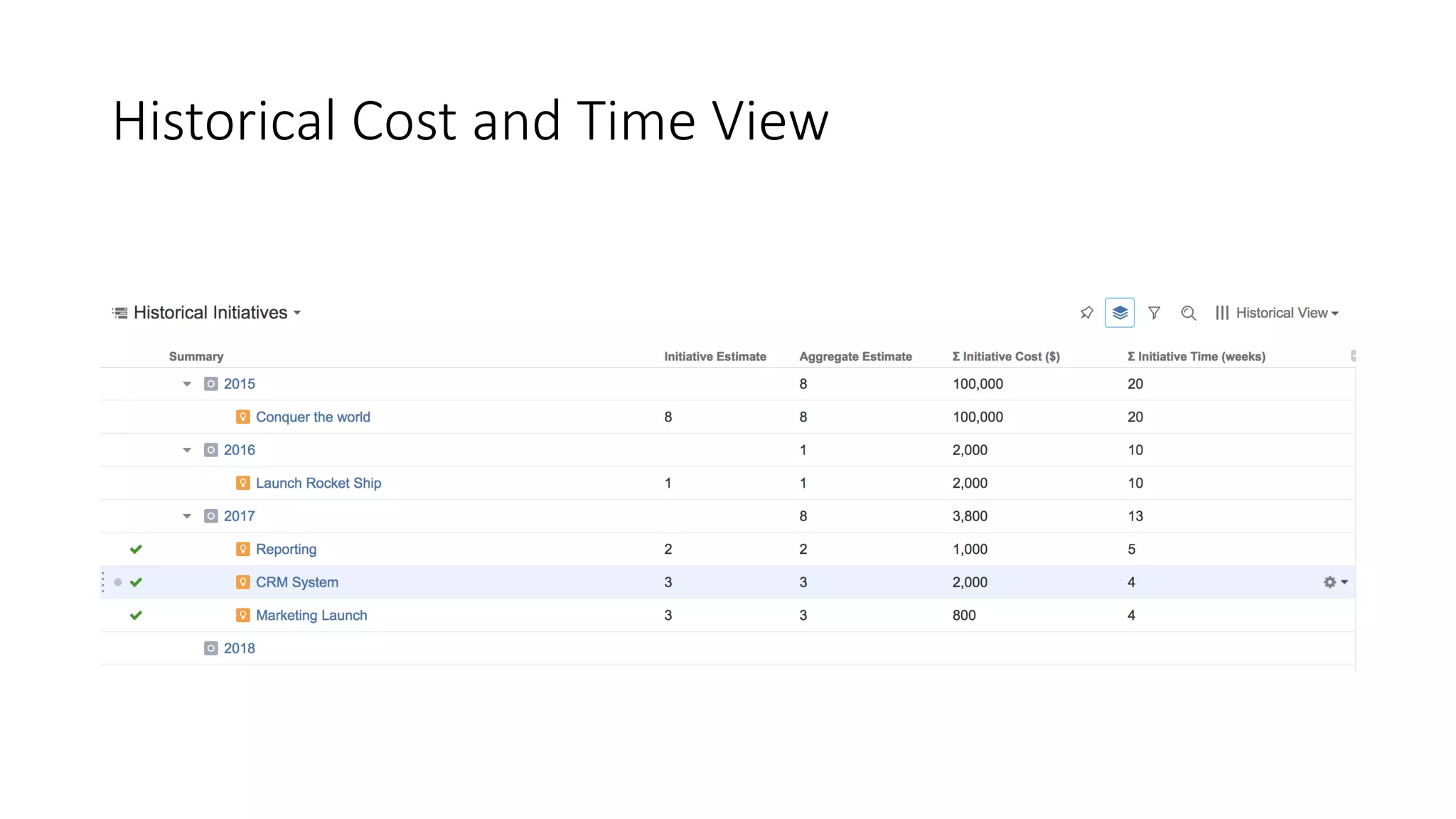

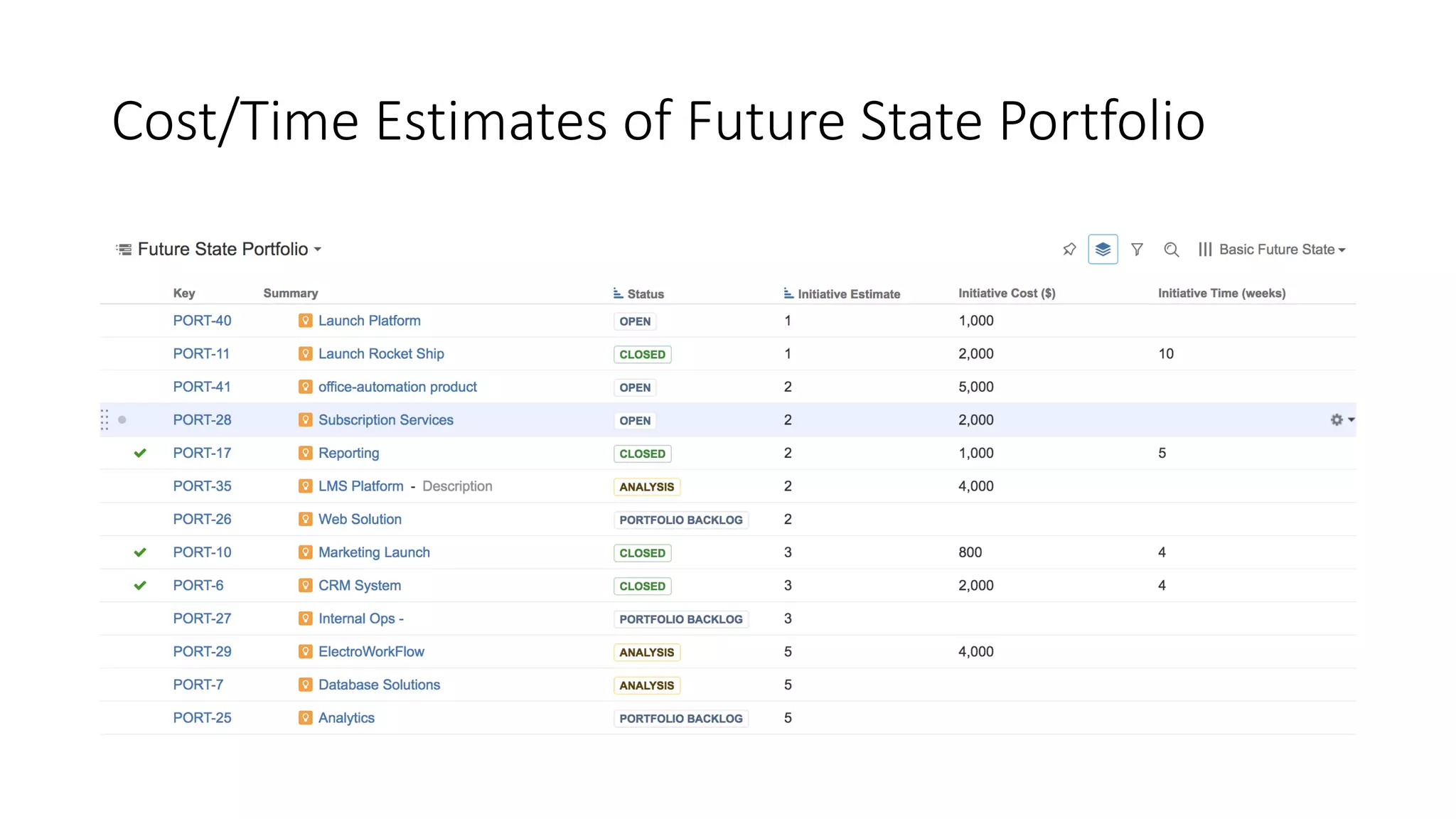

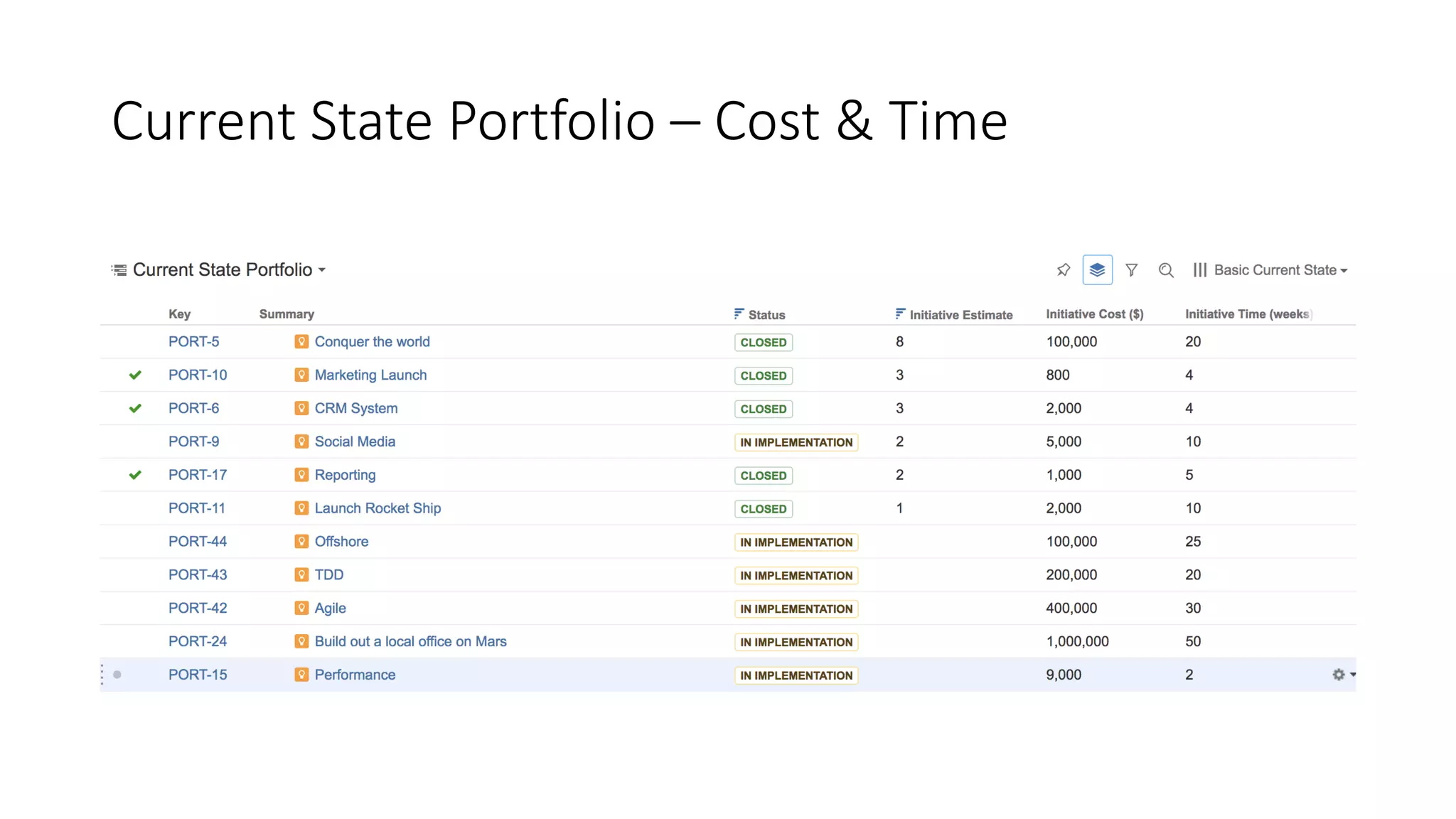

This document outlines strategies for optimizing portfolio performance using agile techniques and Jira, focusing on managing IT resources to maximize ROI. It covers the creation of historical baselines, estimation of future portfolios, and validation of current initiatives, utilizing methods like Fibonacci scoring for productivity and cost accuracy. Key results included significant reductions in time and cost for estimates at a large international bank.