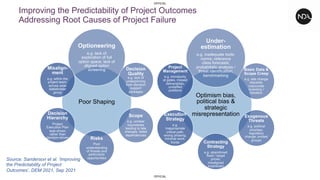

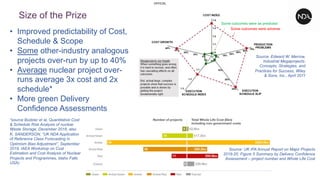

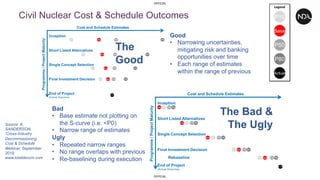

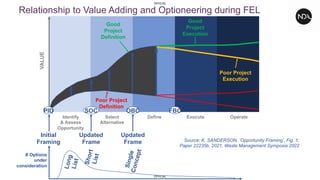

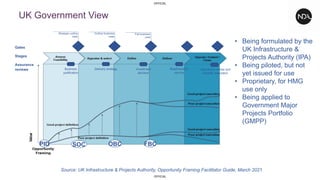

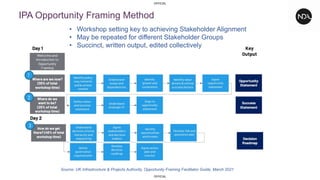

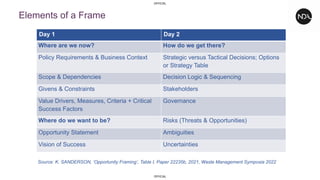

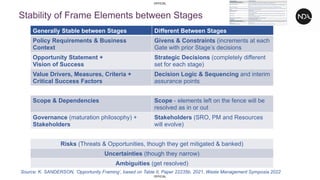

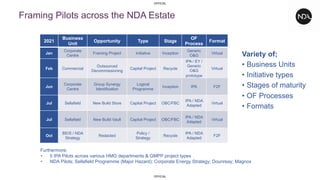

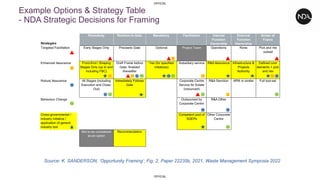

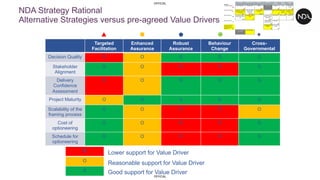

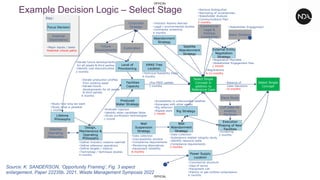

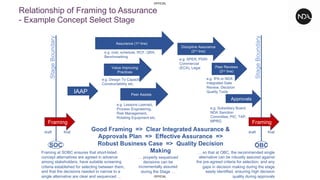

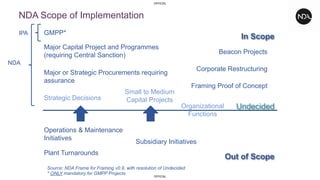

The document discusses the concept of opportunity framing in project management, particularly within the energy sector and the Nuclear Decommissioning Authority (NDA), highlighting its role in improving project outcomes and mitigating risks associated with poor project definition. It emphasizes the importance of stakeholder alignment and providing decision-driven tools during project inception and execution phases. Furthermore, it outlines various business units and initiatives using opportunity framing and its potential to standardize practices across industries and government projects.