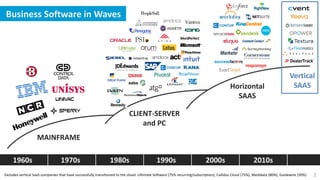

Vertical software companies are increasingly moving to cloud platforms, allowing them to deliver software that is more usable, cheaper, easier to maintain, and accessible from any device. This document outlines several "plays" or strategies that industry cloud companies can employ to drive growth, such as replacing outdated incumbent software, helping customers find new ways to grow their revenue, attacking the small and medium business market, tapping into large data sources, and building platforms to lock in customers. It also discusses characteristics these companies look for in potential investments, such as total addressable markets over $500 million in annual recurring revenue.