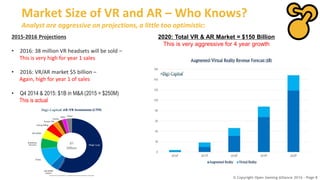

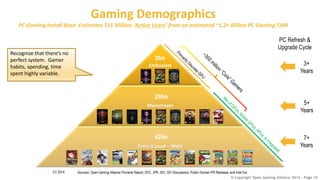

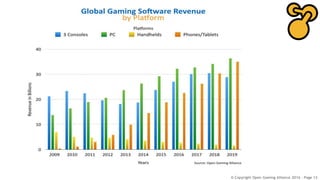

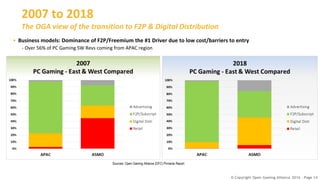

The Open Gaming Alliance (OGA) is a non-profit trade association dedicated to supporting the business of the gaming industry, advocating for diversity, and providing resources for developers. Key focus areas include promoting VR and AR technologies, analyzing industry growth, and facilitating collaboration among various market segments. The document outlines the state of gaming, market projections, hardware estimates, and the ongoing transition to free-to-play and digital distribution models.