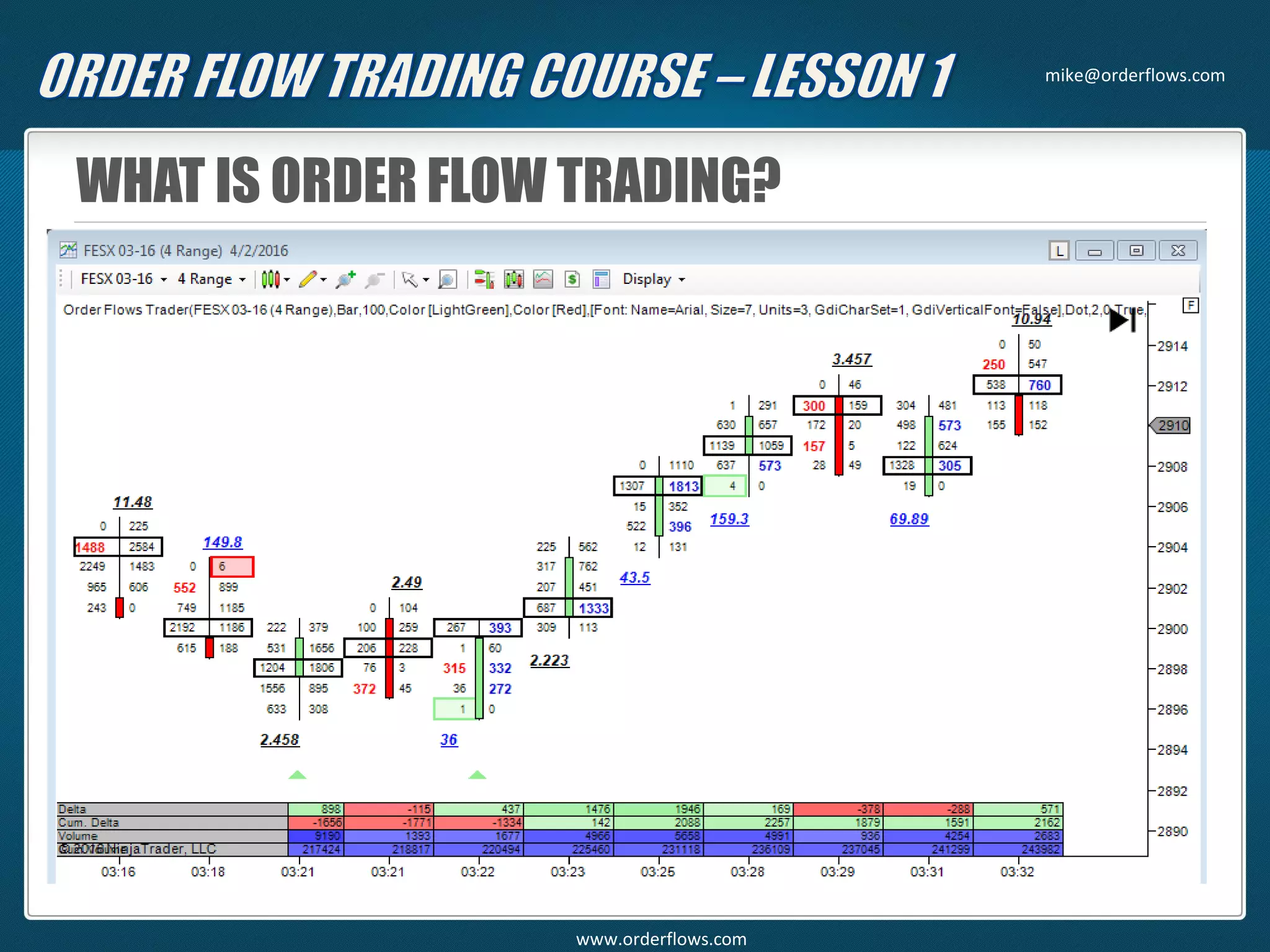

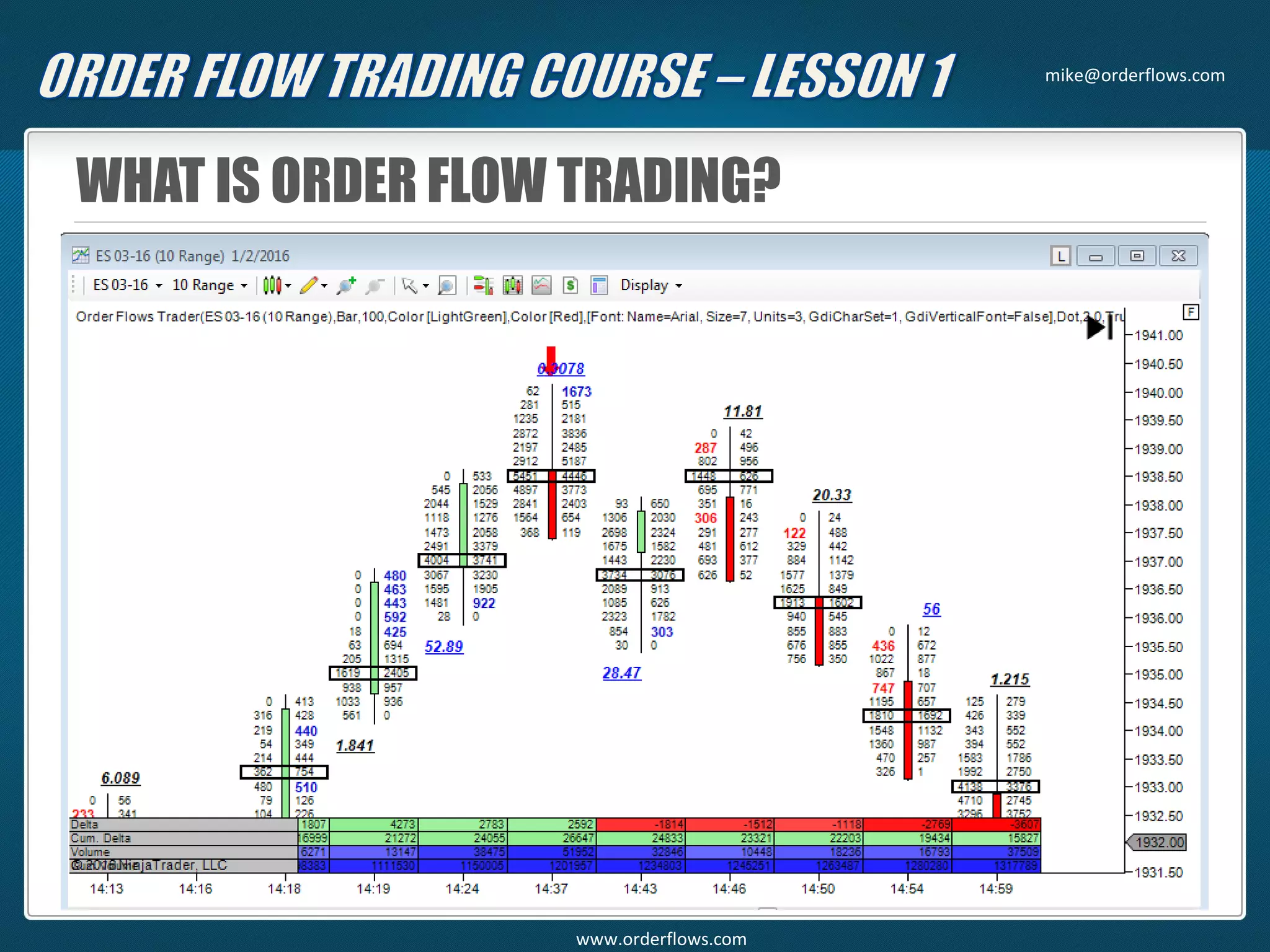

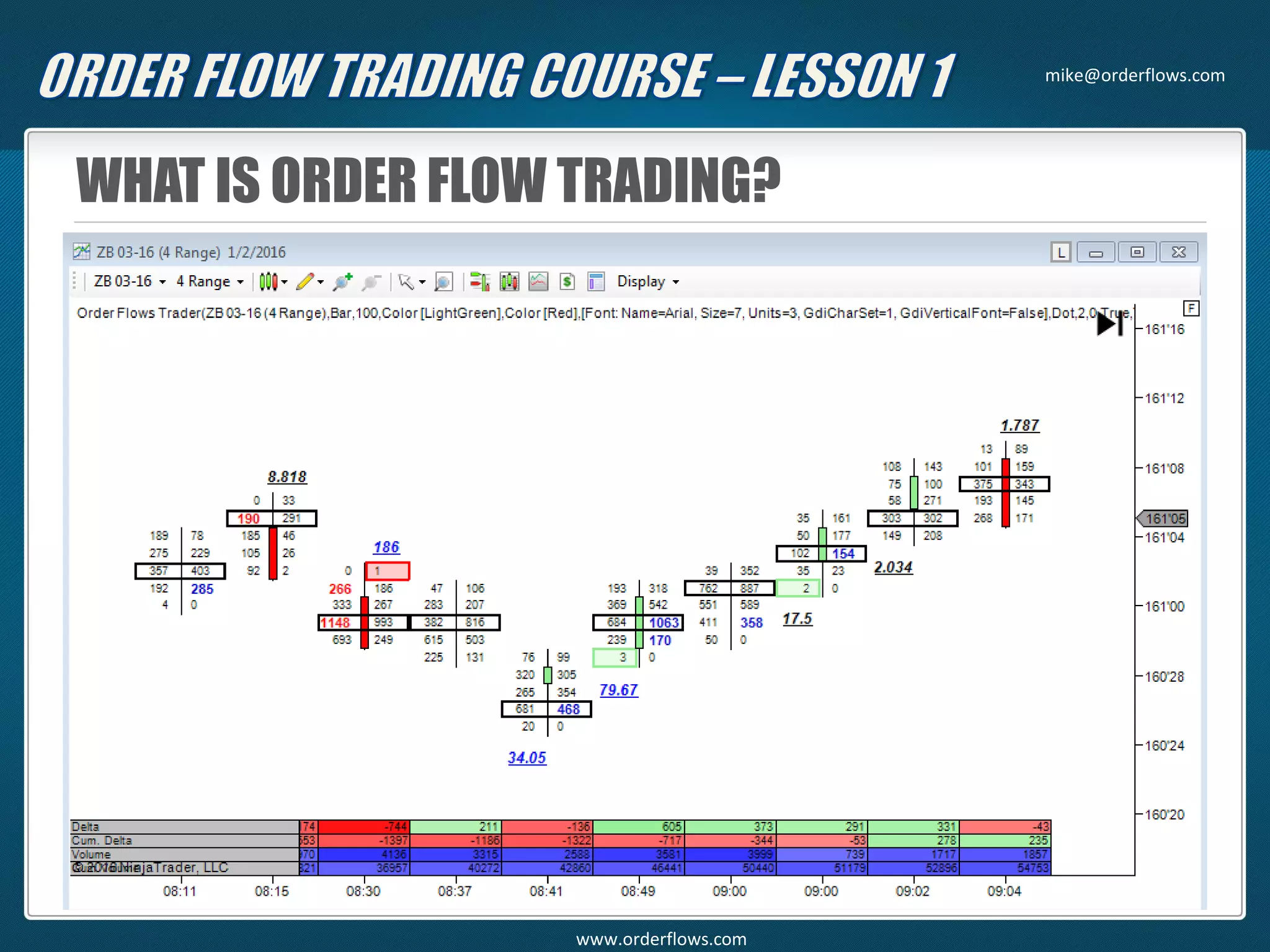

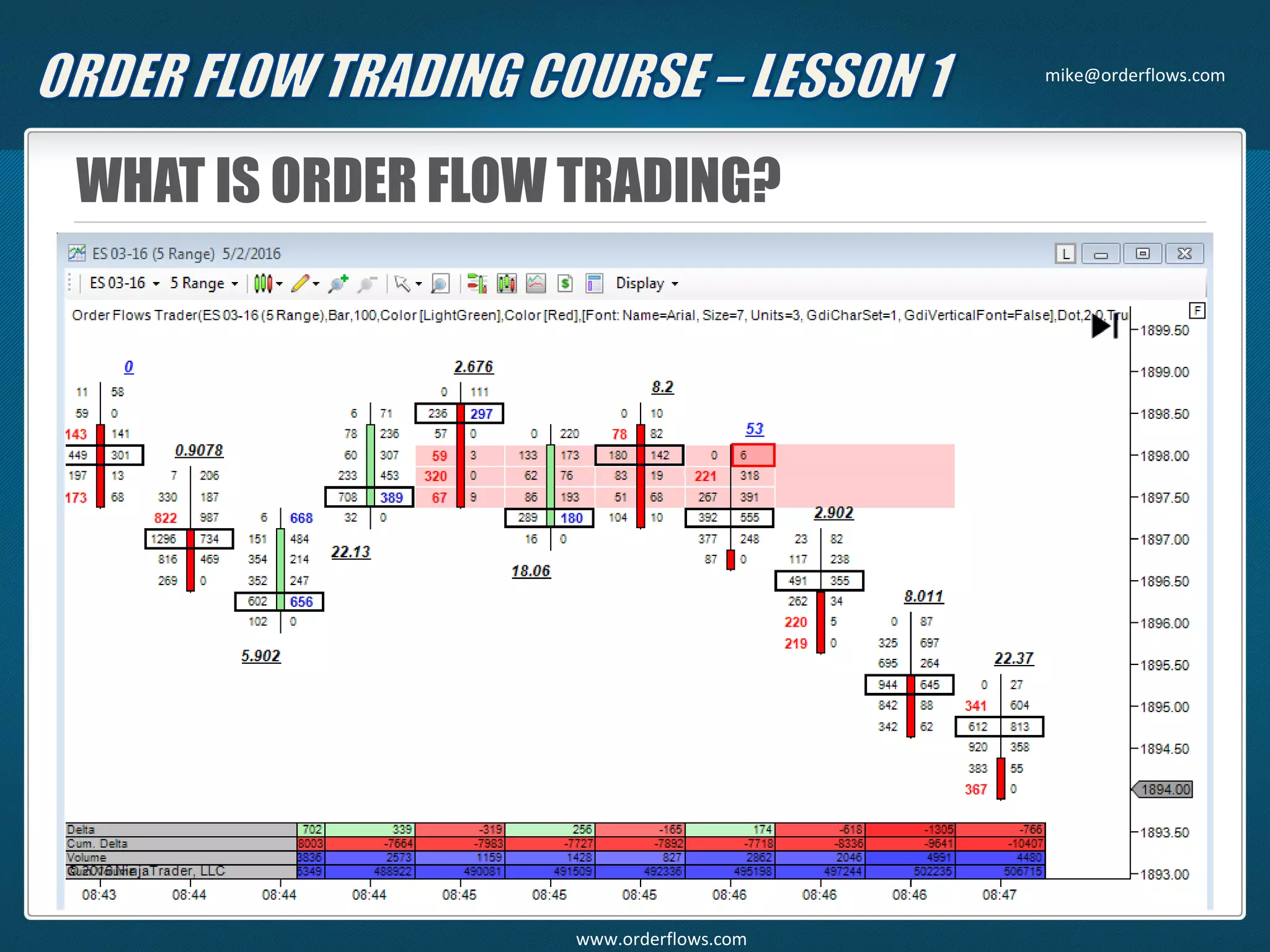

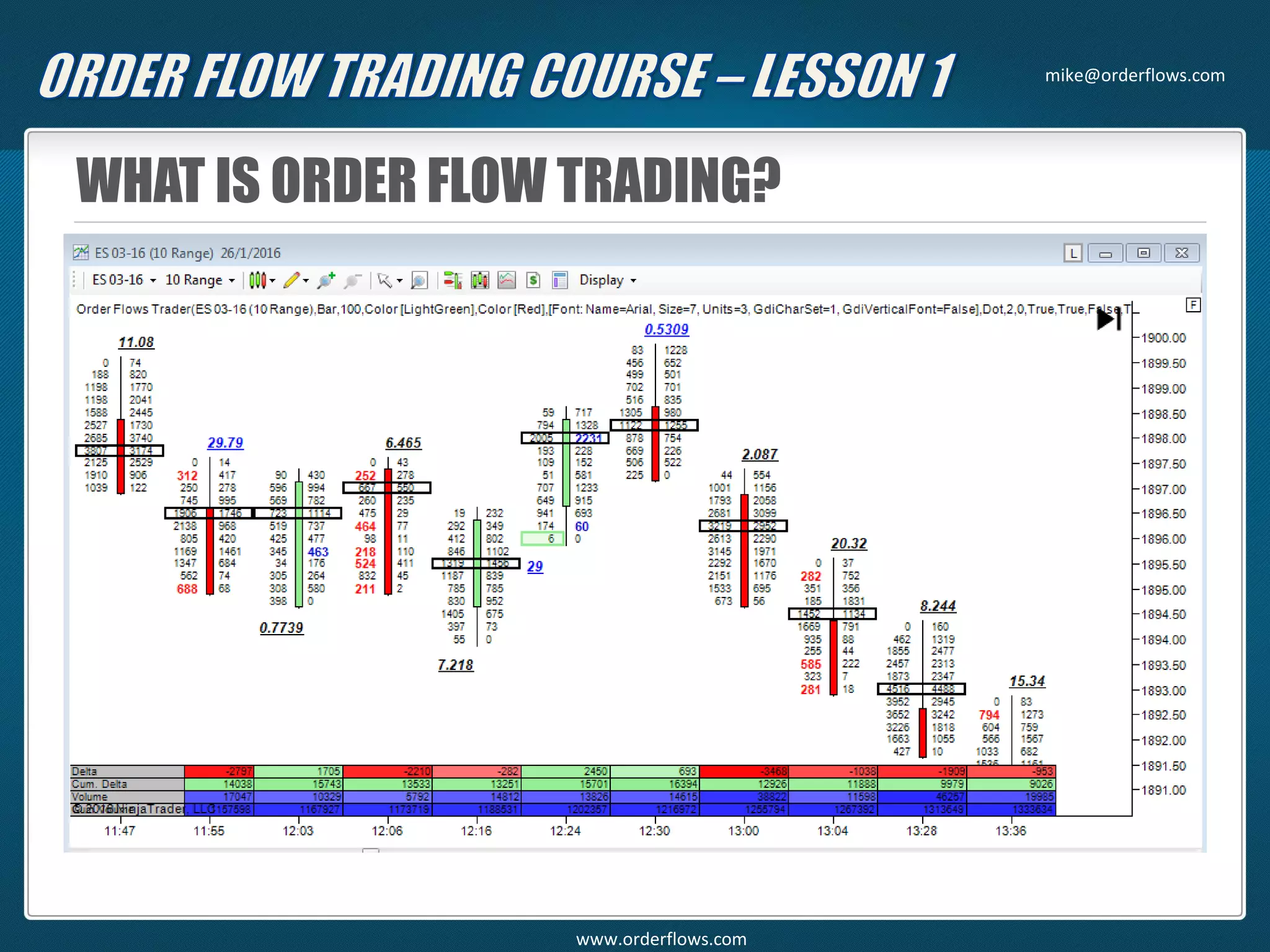

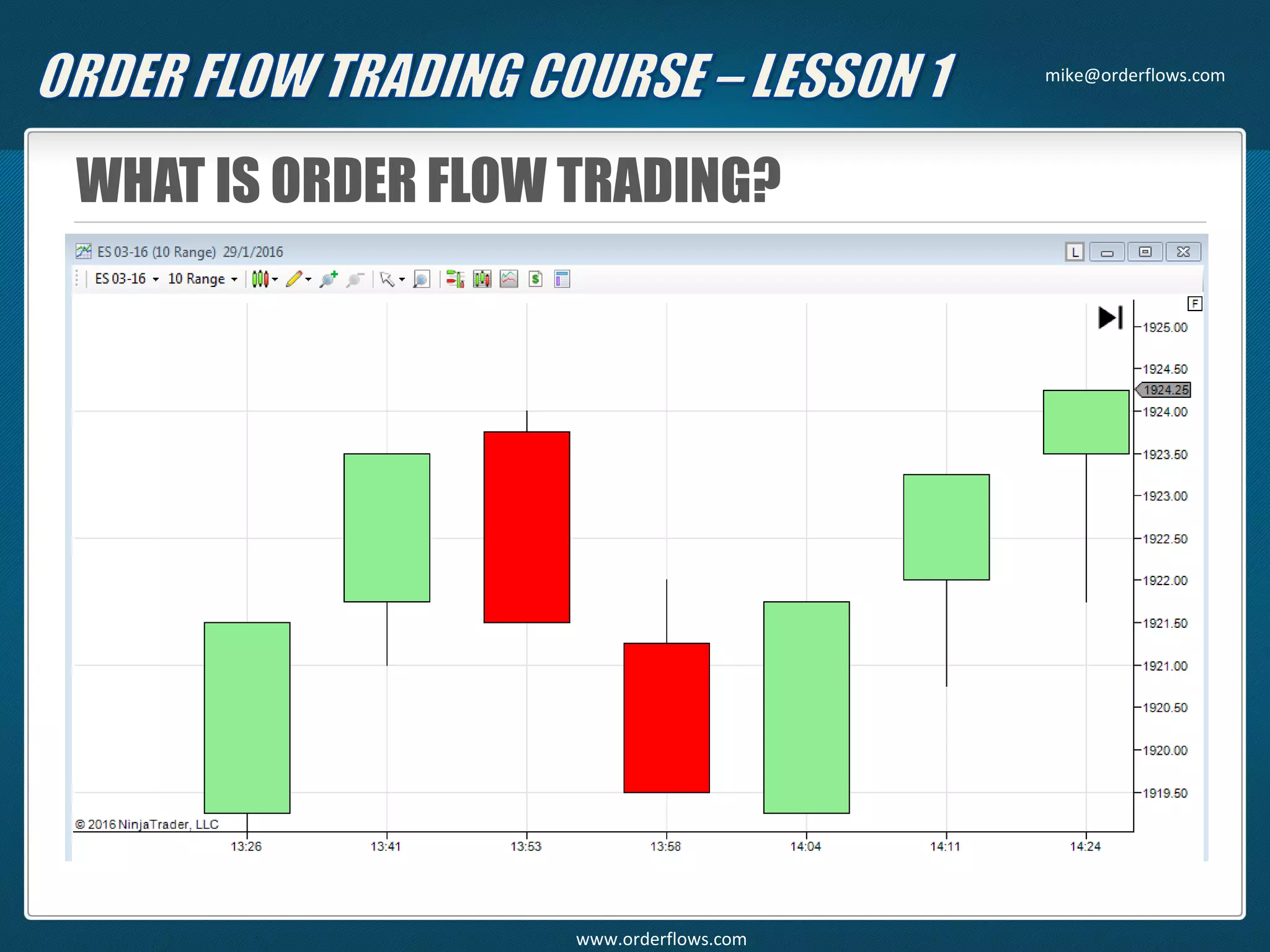

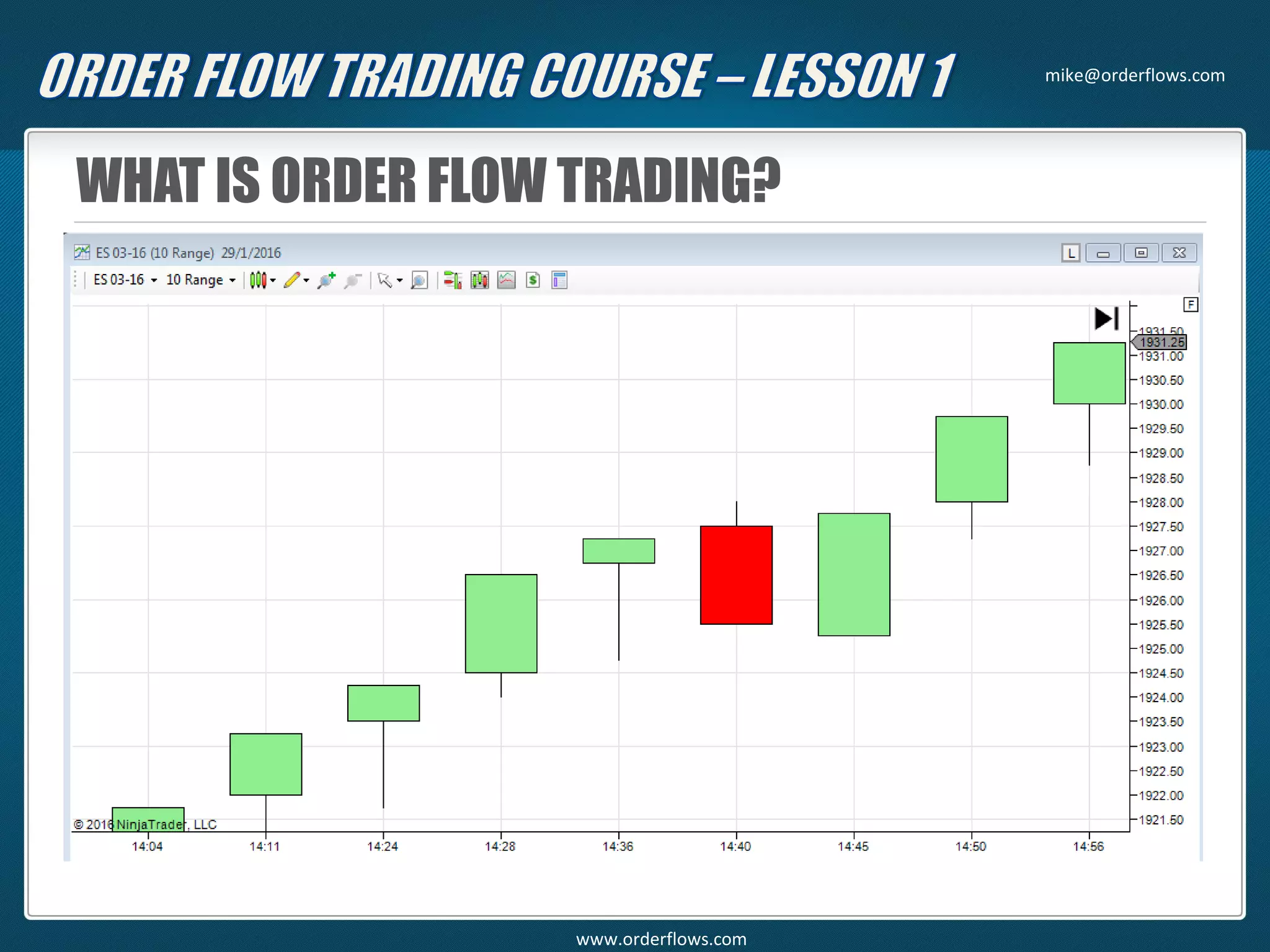

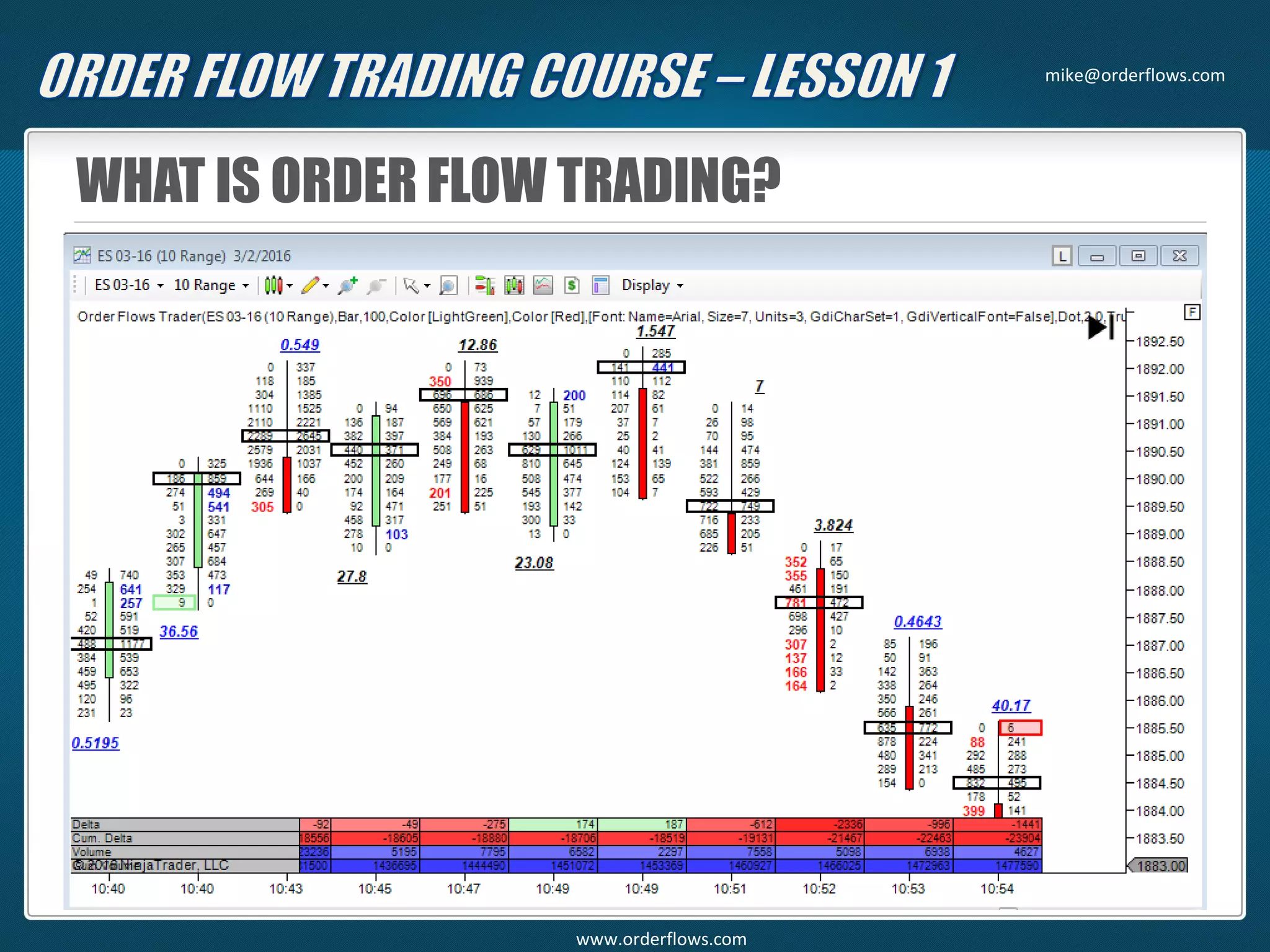

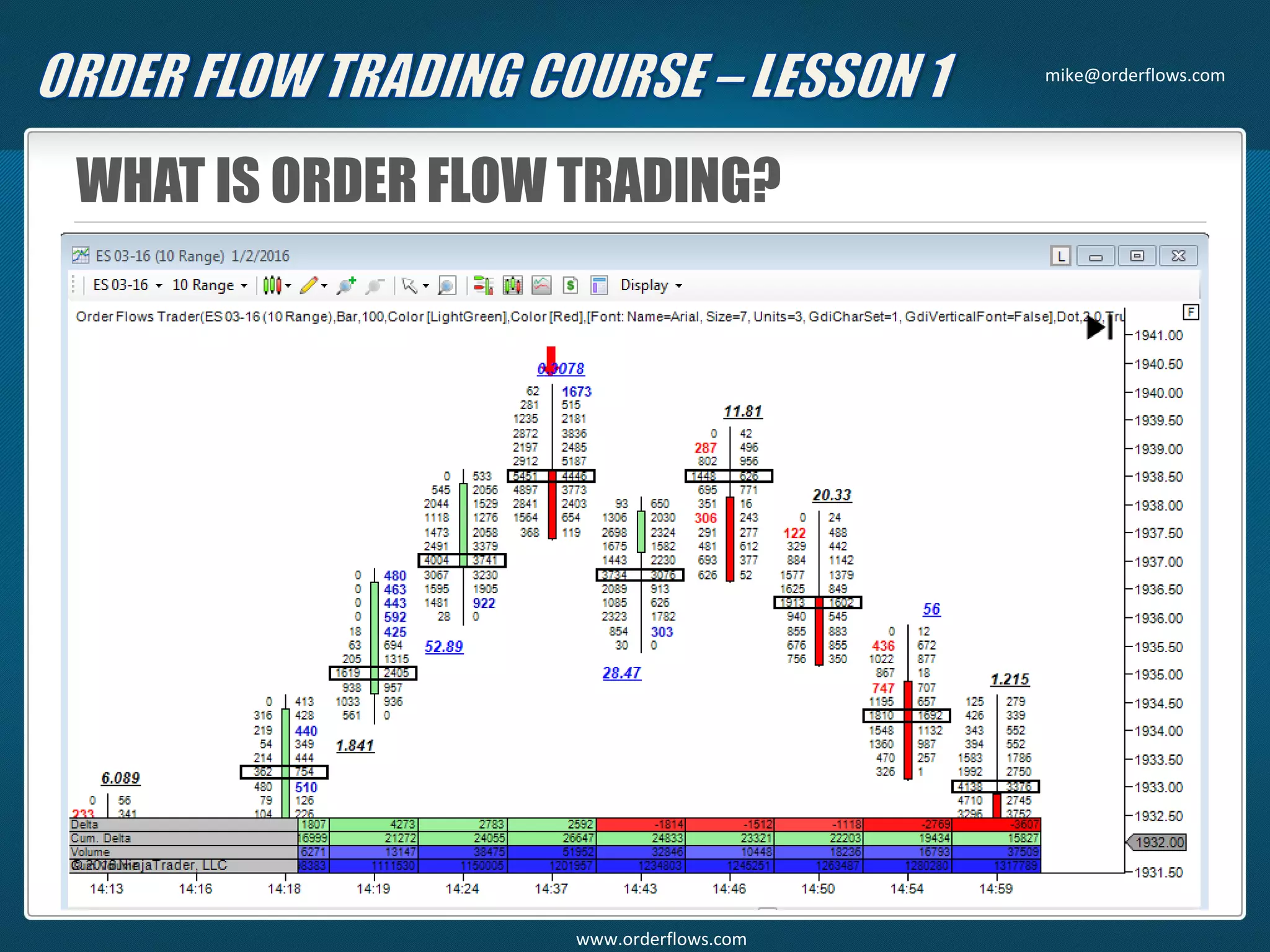

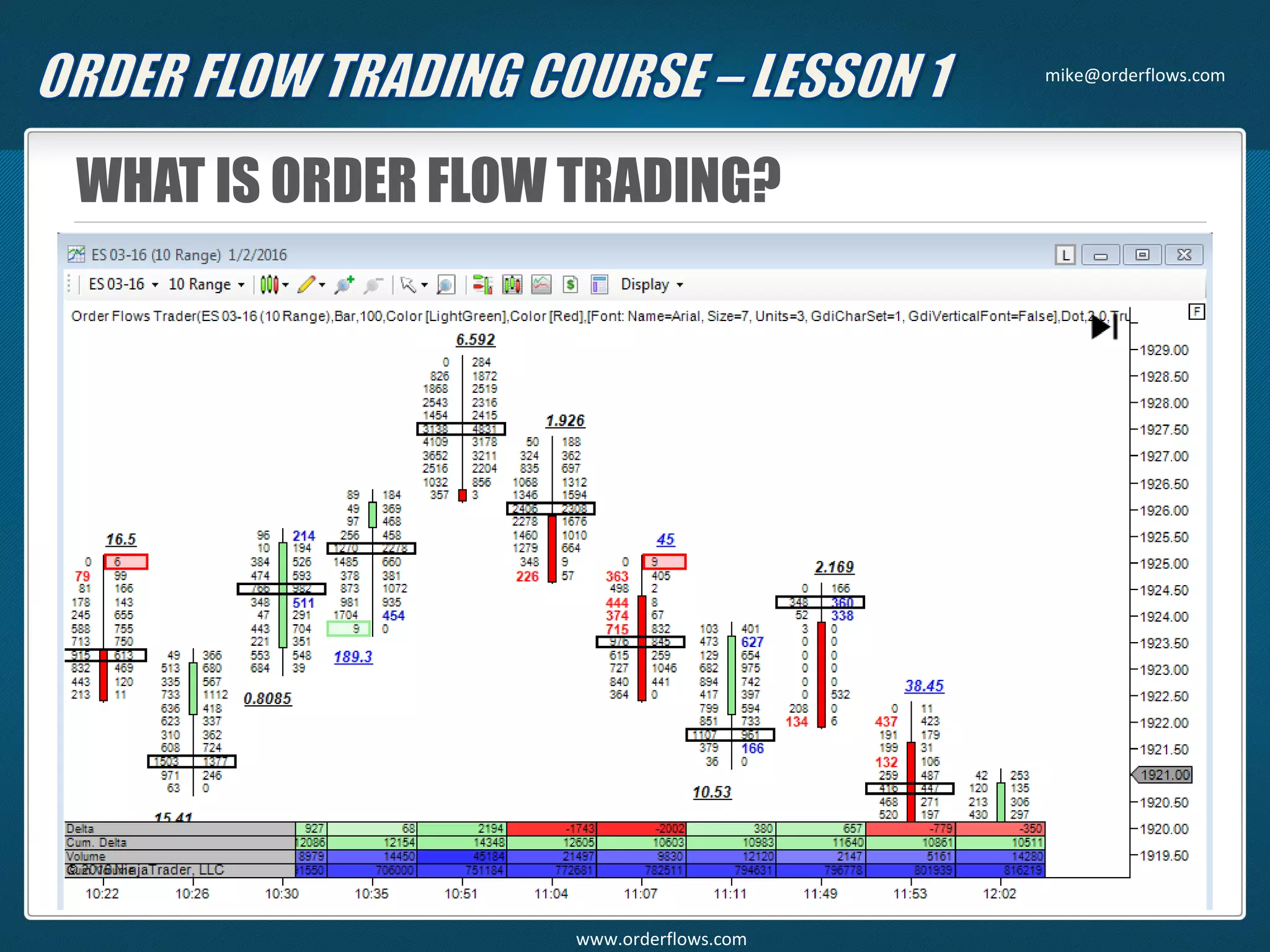

Michael Valtos provides a course on order flow trading based on the order flow strategies he has developed over 20 years of trading futures markets. He does not use indicators like moving averages and relies solely on his own order flow method. The course introduces order flow trading, which analyzes the buy and sell orders in the market to determine if buyers or sellers are in control. It focuses on reading order flow charts to anticipate price movements in real-time rather than trying to predict the market. The next lesson will discuss different order flow software options for traders.