1. The document provides an overview of various learning modules for trading, organized into sections on risk management, candlesticks, trade size, margin trading, basics, trading psychology, entering trades, indicators, Fibonacci, channels, volume, footprint charts, tools and charts, patterns, and strategies.

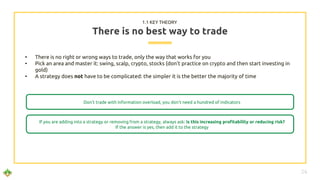

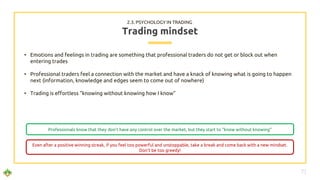

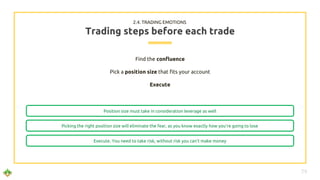

2. The basics section covers key theory around developing a trading edge, risk management, trade planning, support and resistance levels, and daily routines.

3. Support and resistance levels are important to map on charts, and when they are broken, they flip to provide the opposite level of support or resistance. Market structure and key price levels dictate how markets move.

![134

Average Directional Index –

Example

4.1. INDICATORS

BTCUSD 4h

In TradingView the ADX indicator is under the name

‘Average Directional Index with DI+ and DI-’

medium uptrend

medium-strong

downtrend

sideway action,

no strong trend

Check for trend confirmations

study("Average Directional Index with DI+ and DI-", shorttitle="ADX/DI+/DI-")

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Length")

dirmov(len) =>

up = change(high)

down = -change(low)

truerange = rma(tr, len)

plus = fixnan(100 * rma(up > down and up > 0 ? up : 0, len) / truerange)

minus = fixnan(100 * rma(down > up and down > 0 ? down : 0, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

adxHigh(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

plus

adxLow(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

minus

sig = adx(dilen, adxlen)

sigHigh = adxHigh(dilen, adxlen)

sigLow = adxLow(dilen, adxlen)

plot(sig, color=blue, title="ADX")

plot(sigHigh, color=green, title="DI+")

plot(sigLow, color=red, title="DI-")](https://image.slidesharecdn.com/tradingtechniquescc-221124005330-5f6d7e76/85/Trading-Techniques-CC-pdf-134-320.jpg)

![138

Advanced RSI – Example

4.1. INDICATORS

BTCUSD 5 min

Look for divergences and overbought/oversold signals

study(title="CM_Ultimate RSI MTF", shorttitle="CM_Ult_RSI_MTF", precision=0)

src = close

len = input(14, minval=1, title="Length")

upLine = input(70, minval=50, maxval=90, title="Upper Line Value?")

lowLine = input(30, minval=10, maxval=50, title="Lower Line Value?")

sml = input(true, title="Show Mid Line?")

sbh = input(true, title="Show Back Ground Highlights When RSI is Above/Below High/Low Lines?")

sch = input(true, title="Show Back Ground Highlights When RSI Cross?")

sl = input(true, title="Show 'B' and 'S' Letters When RSI Crosses High/Low Line?")

useCurrentRes = input(true, title="Use Current Chart Resolution?")

resCustom = input(title="Use Different Timeframe? Uncheck Box Above", type=resolution, defval="60")

ssRSI = input(false, title="Show 2nd RSI?")

resCustom2 = input(title="Use 2nd RSI? Check Box Above", type=resolution, defval="D")

useCurrentRes2 = input(false, title="Use 2nd RSI Plot On Samet Timeframe?")

len2 = input(14, minval=1, title="2nd RSI Length")

res = useCurrentRes ? period : resCustom

res2 = useCurrentRes2 ? period : resCustom2

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

outRSI = security(tickerid, res, rsi)

up2 = rma(max(change(src), 0), len2)

down2 = rma(-min(change(src), 0), len2)

rsi2 = down2 == 0 ? 100 : up2 == 0 ? 0 : 100 - (100 / (1 + up2 / down2))

outRSI2 = security(tickerid, res2, rsi2)

aboveLine = outRSI > upLine ? 1 : 0

belowLine = outRSI < lowLine ? 1 : 0

crossUp = outRSI[1] < lowLine and outRSI > lowLine ? 1 : 0

crossDn = outRSI[1] > upLine and outRSI < upLine ? 1 : 0

bgcolor(sbh and aboveLine ? red : na, transp=70)

bgcolor(sbh and belowLine ? green : na, transp=70)

bgcolor(sch and crossUp ? lime : na, transp=40)

bgcolor(sch and crossDn ? red : na, transp=40)

plot(outRSI, title="RSI", style=line, linewidth=3, color=aqua)

plot(ssRSI and outRSI2 ? outRSI2 : na, title="2nd RSI -

Different Time Frame?", style=linebr, linewidth=4, color=orange)

p1 = plot(upLine, title= "Upper Line", style=solid, linewidth=3, color=red)

p2 = plot(lowLine, title= "Lower Line", style=solid, linewidth=3, color=lime)

plot(sml and 50 ? 50 : na, title="Mid Line", style=linebr, linewidth=2, color=gray)

plotchar(sl and crossUp ? crossUp : na, title="Buy Signal", char='B', location=location.bottom,

color=lime, transp=0, offset=0)

plotchar(sl and crossDn ? crossDn : na, title="Sell Signal", char='S', location=location.top, color=red,

transp=0, offset=0)

fill(p1, p2, color=silver, transp=70)

Local RSI indicates oversold, but

the daily is still in overbought,

so the uptrend might not start

or persist less than expected

Overbought both in local

(5 min) RSI and in daily

RSI, confirmation of a

possible downtrend](https://image.slidesharecdn.com/tradingtechniquescc-221124005330-5f6d7e76/85/Trading-Techniques-CC-pdf-138-320.jpg)

![146

MFI – Example

4.1. INDICATORS

BTCUSD 4h

Look in particular for two consecutive green bars in

the 4hr time frame for a trend confirmation

study("Market Facilitation Index - MFI")

MFI = (high - low) / volume

PreMFI = (high[1] - low [1]) / volume[1]

greenbar = (MFI > PreMFI) and (volume > volume[1])

fadebar = (MFI < PreMFI) and (volume < volume[1])

fakebar = (MFI > PreMFI) and (volume < volume[1])

squatbar = (MFI < PreMFI) and (volume > volume[1])

bar_color = greenbar ? green : fadebar ? maroon : fakebar ? blue : squatbar ? fuchsia : na

plot(MFI, color=bar_color, style=columns)

two green bars in a row: probable

continuation of the uptrend

blue bars in uptrend: possible

local trend reversal](https://image.slidesharecdn.com/tradingtechniquescc-221124005330-5f6d7e76/85/Trading-Techniques-CC-pdf-146-320.jpg)