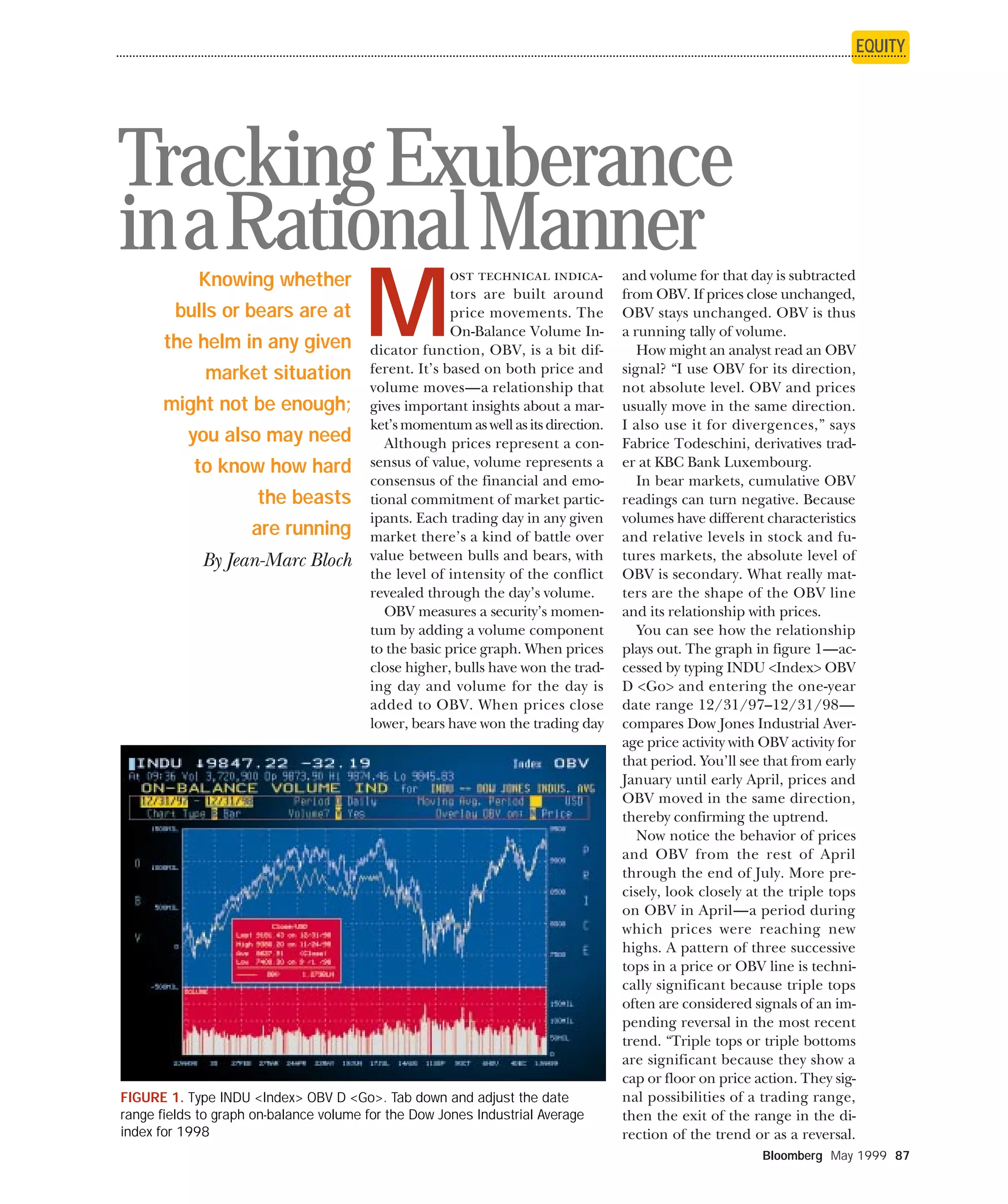

The document discusses the On-Balance Volume (OBV) indicator, which measures a security's momentum by incorporating volume into the basic price graph. When prices close higher, volume is added to the OBV total, and when prices close lower, volume is subtracted. Divergences between the OBV line and price movements can signal potential trend reversals. The document analyzes the OBV for the Dow Jones Industrial Average in 1998, identifying divergences in April-May and June-July that correctly predicted coming declines in the Dow after it had reached new highs.