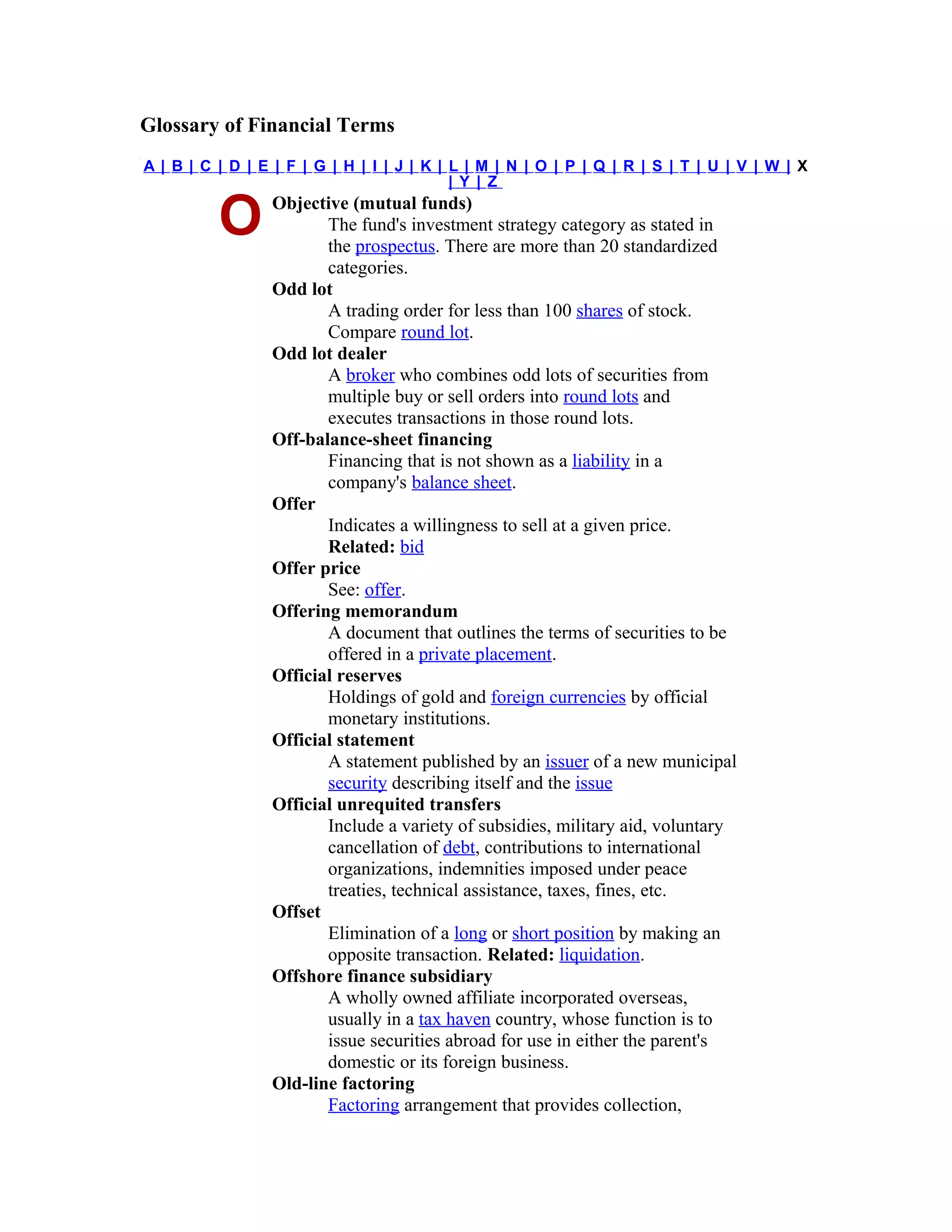

This document defines financial terms from A to O. It provides definitions for terms like objective (mutual funds), odd lot, odd lot dealer, off-balance-sheet financing, offering memorandum, official reserves, and more. The definitions are concise explanations of what each term means within the context of finance.