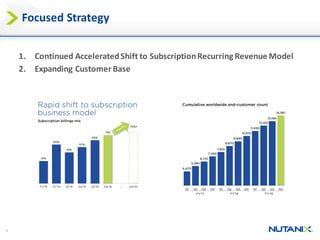

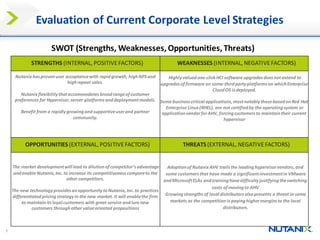

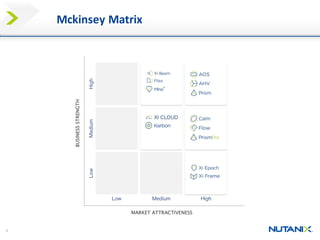

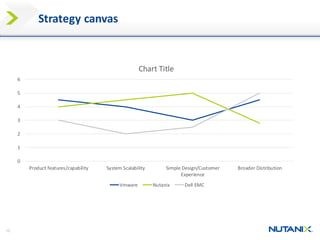

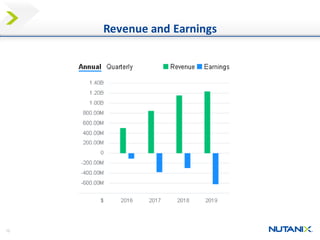

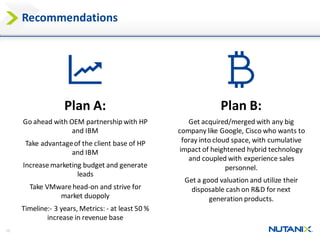

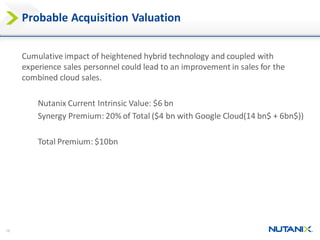

The document outlines Nutanix's strategies for modernizing data centers and expanding their market reach through partnerships and the shift to a subscription model. It highlights a SWOT analysis detailing the company's strengths and opportunities, alongside potential threats from competitors and market dynamics. Recommendations include pursuing OEM partnerships for increased revenue or considering acquisition by larger tech firms to enhance R&D and market position.