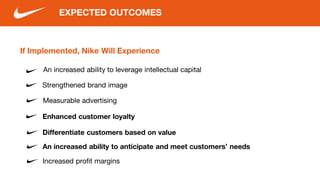

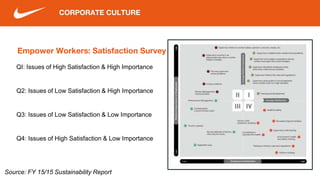

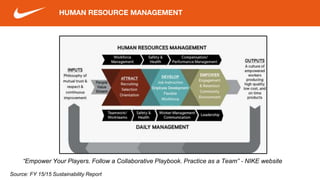

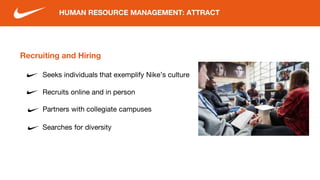

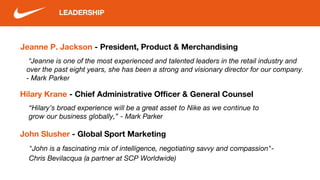

Nike has a corporate culture defined by passion for sports and innovation. It aims to attract creative employees across all roles who are focused on serving athletes. The culture fosters collaboration and chemistry between diverse teams. Nike also prioritizes sustainability, with goals to reduce carbon emissions across its value chain through innovation, collaboration, and advocacy. Key leaders share the vision of using sports, design, and innovation to help people reach their full potential.