Embed presentation

Downloaded 63 times

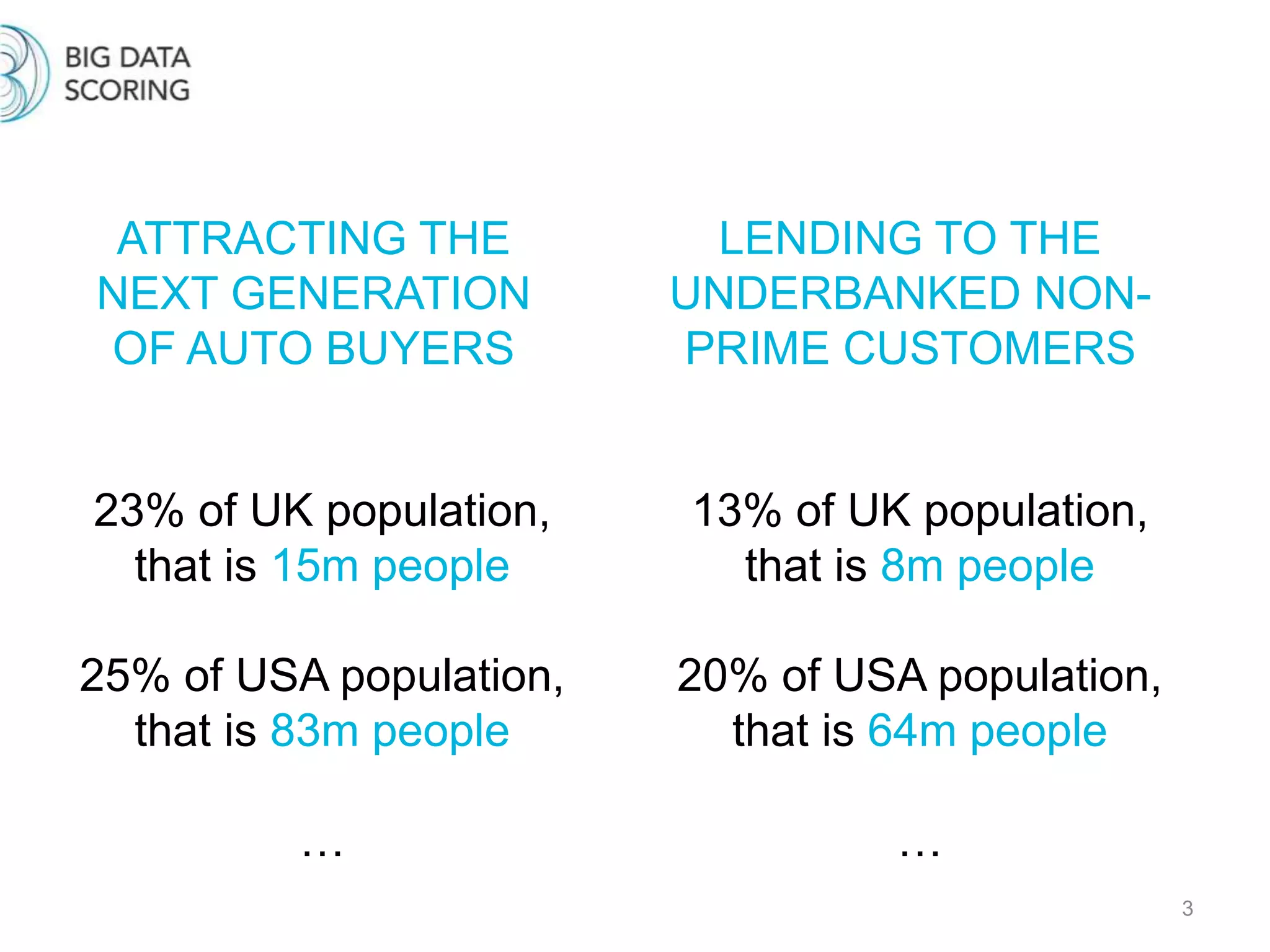

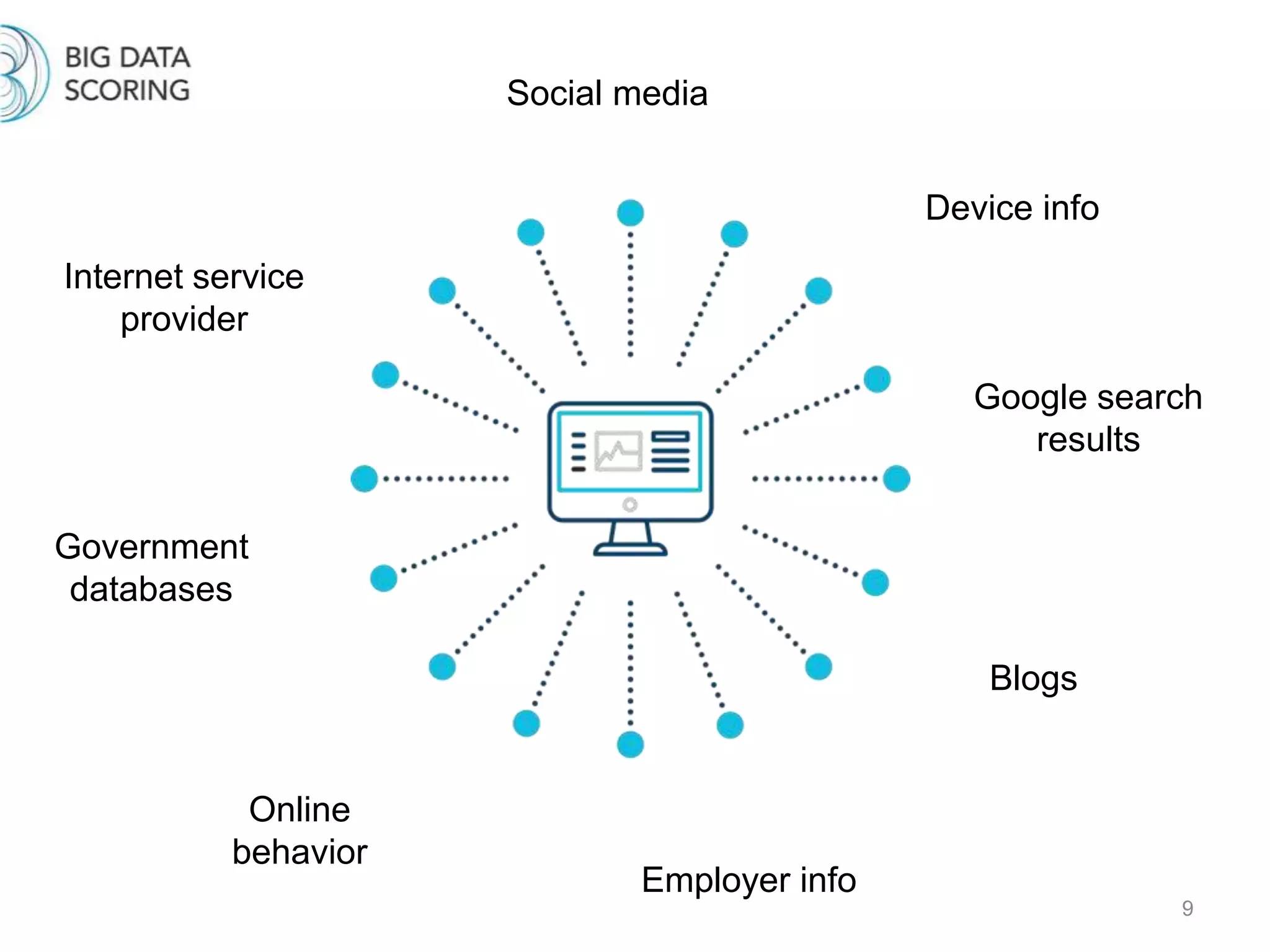

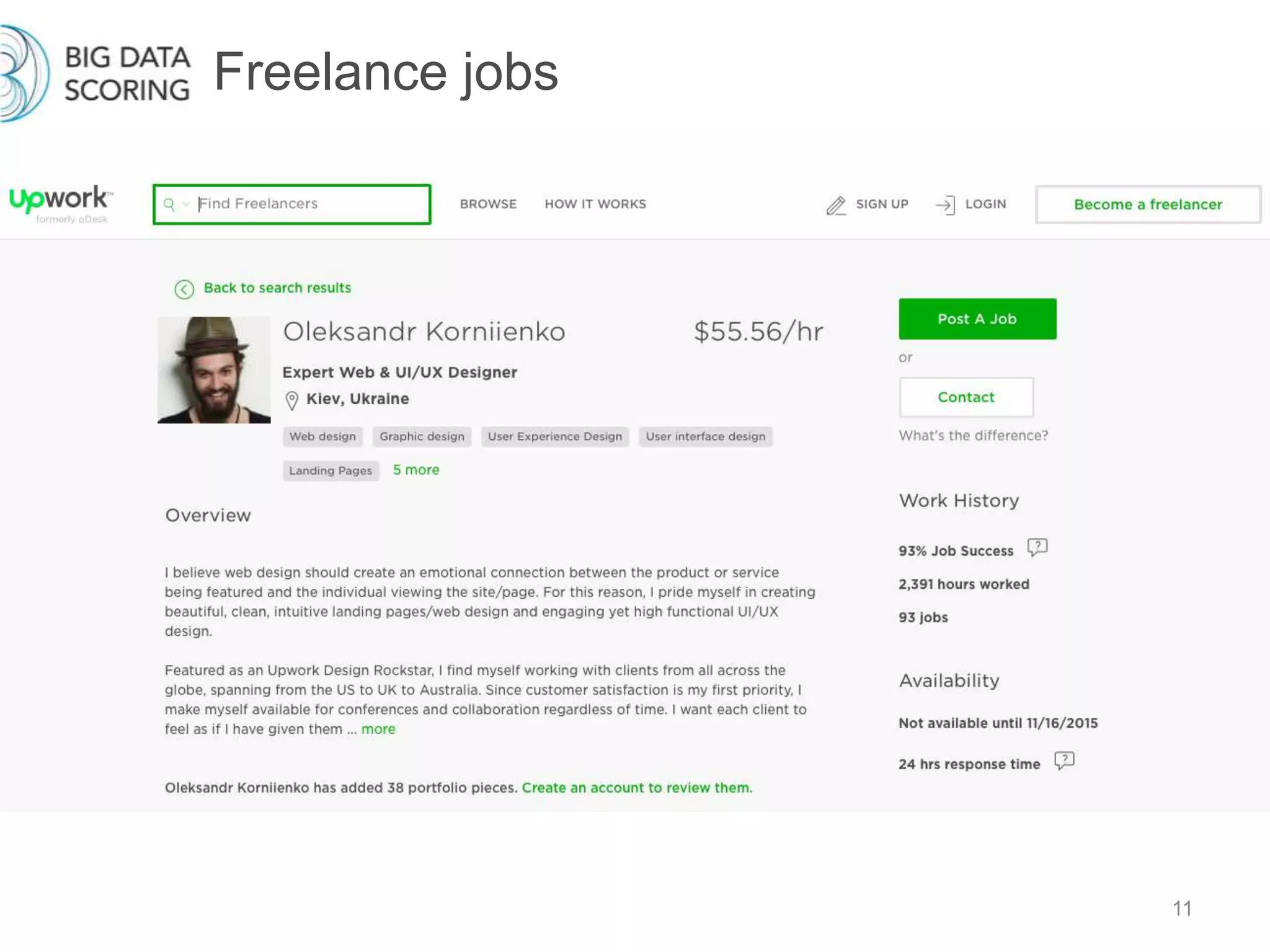

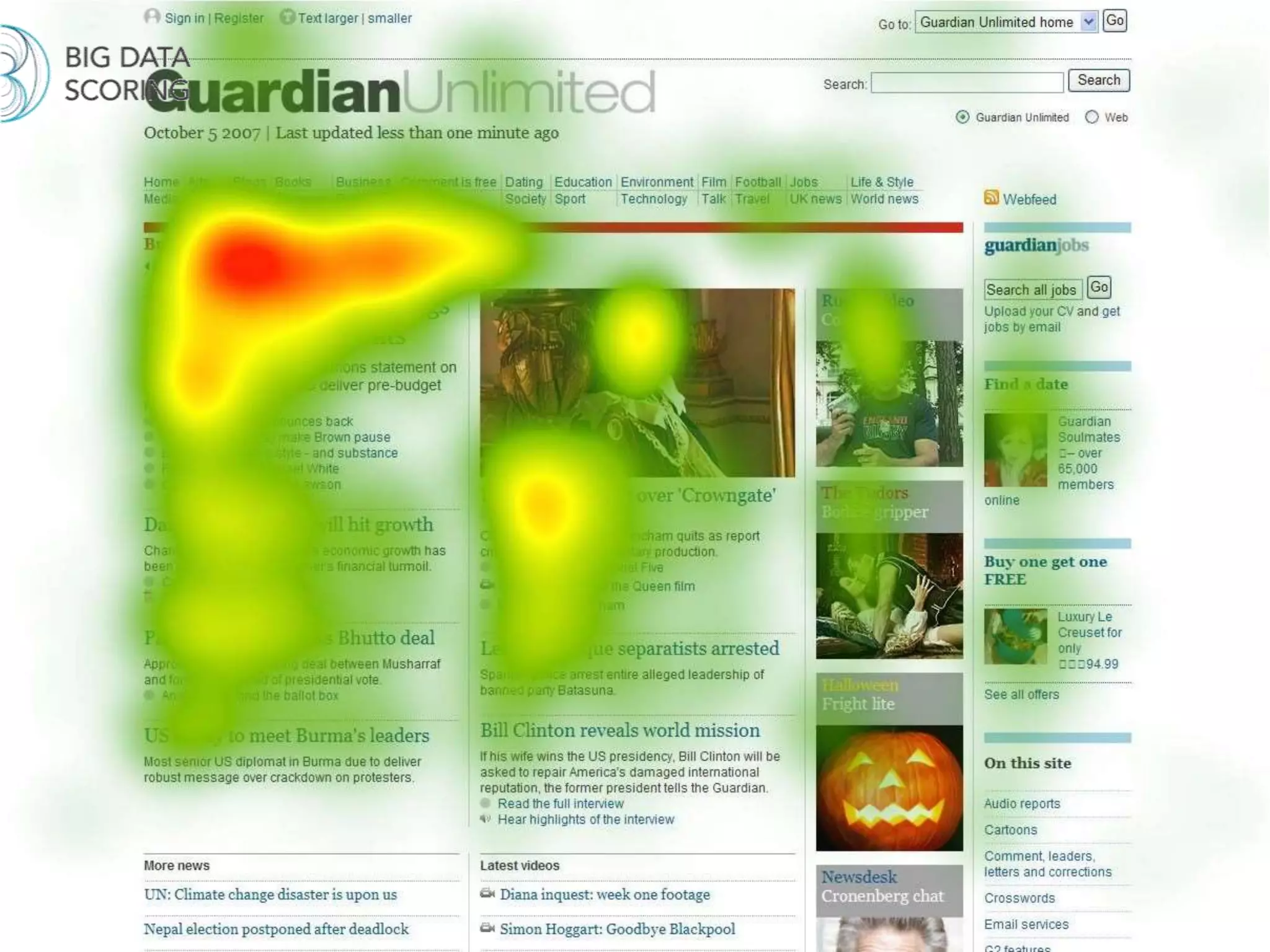

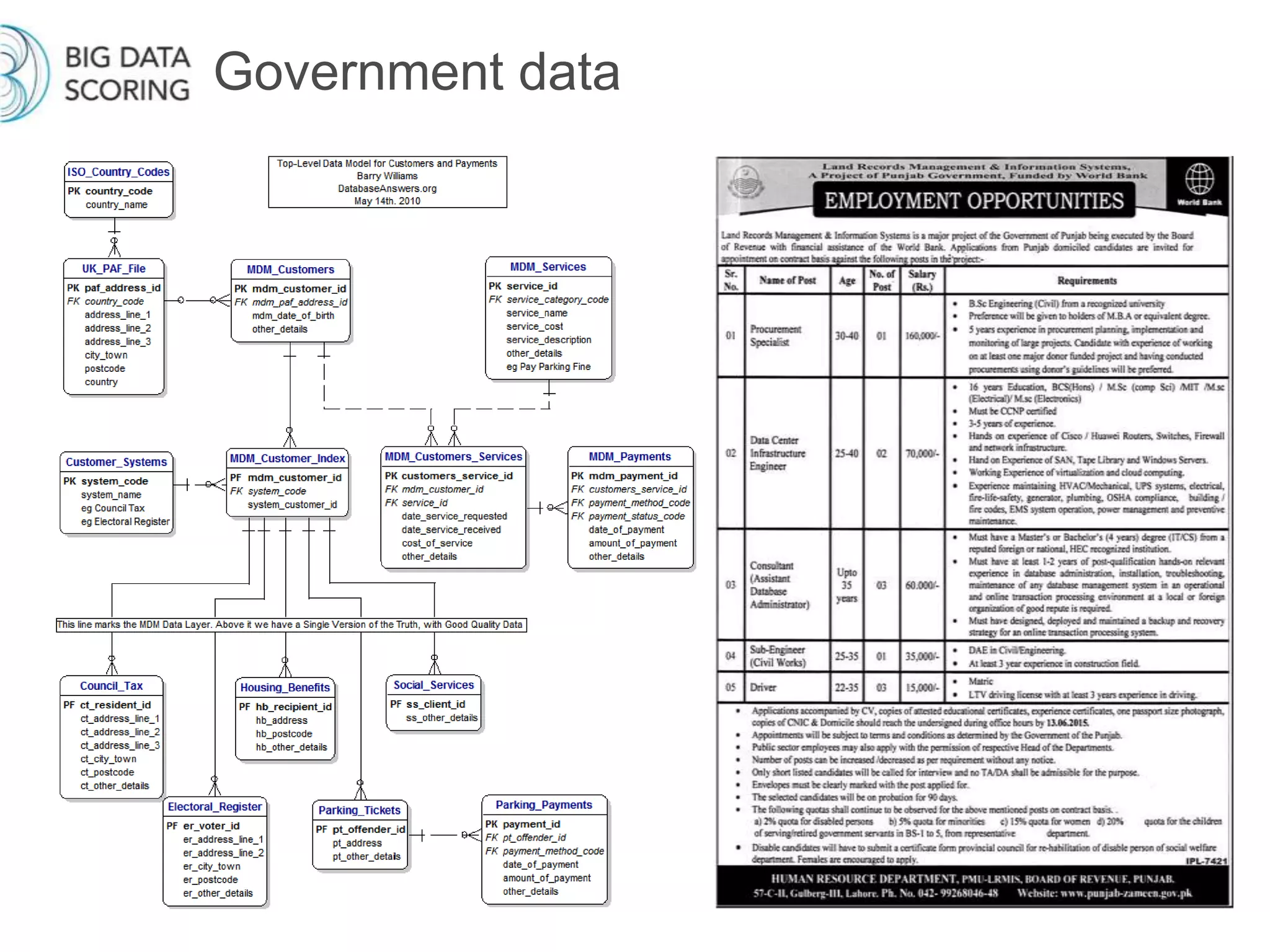

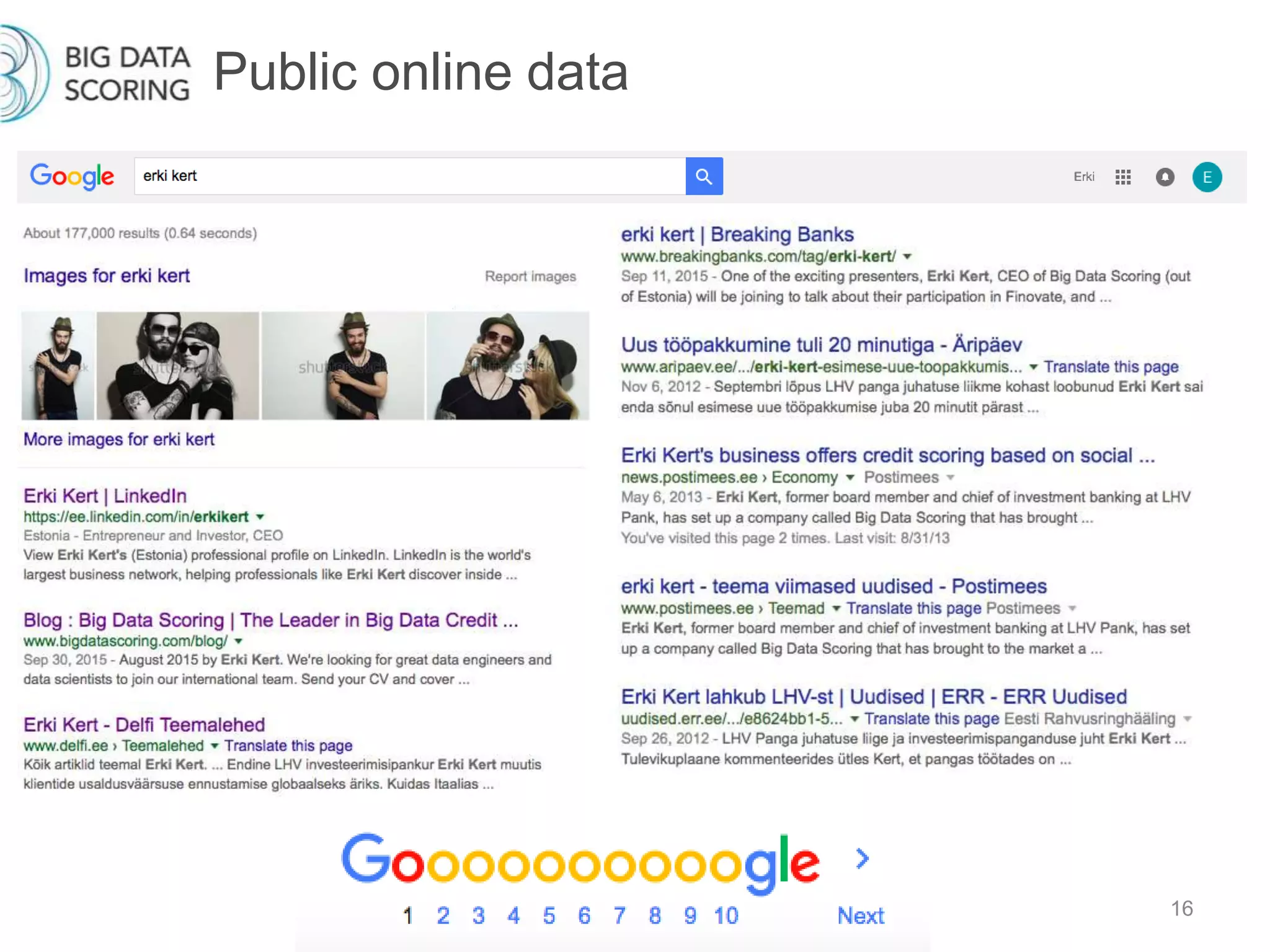

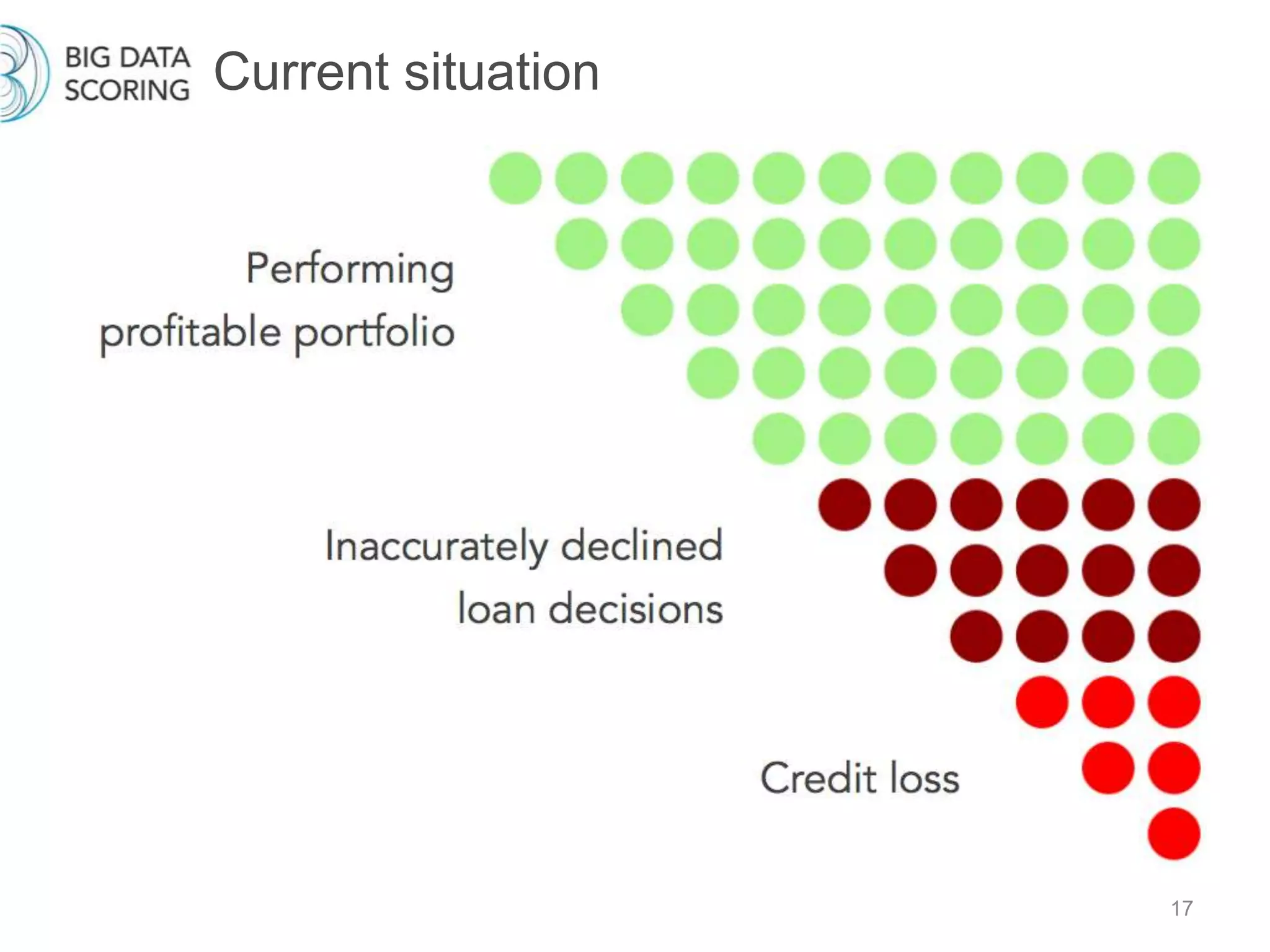

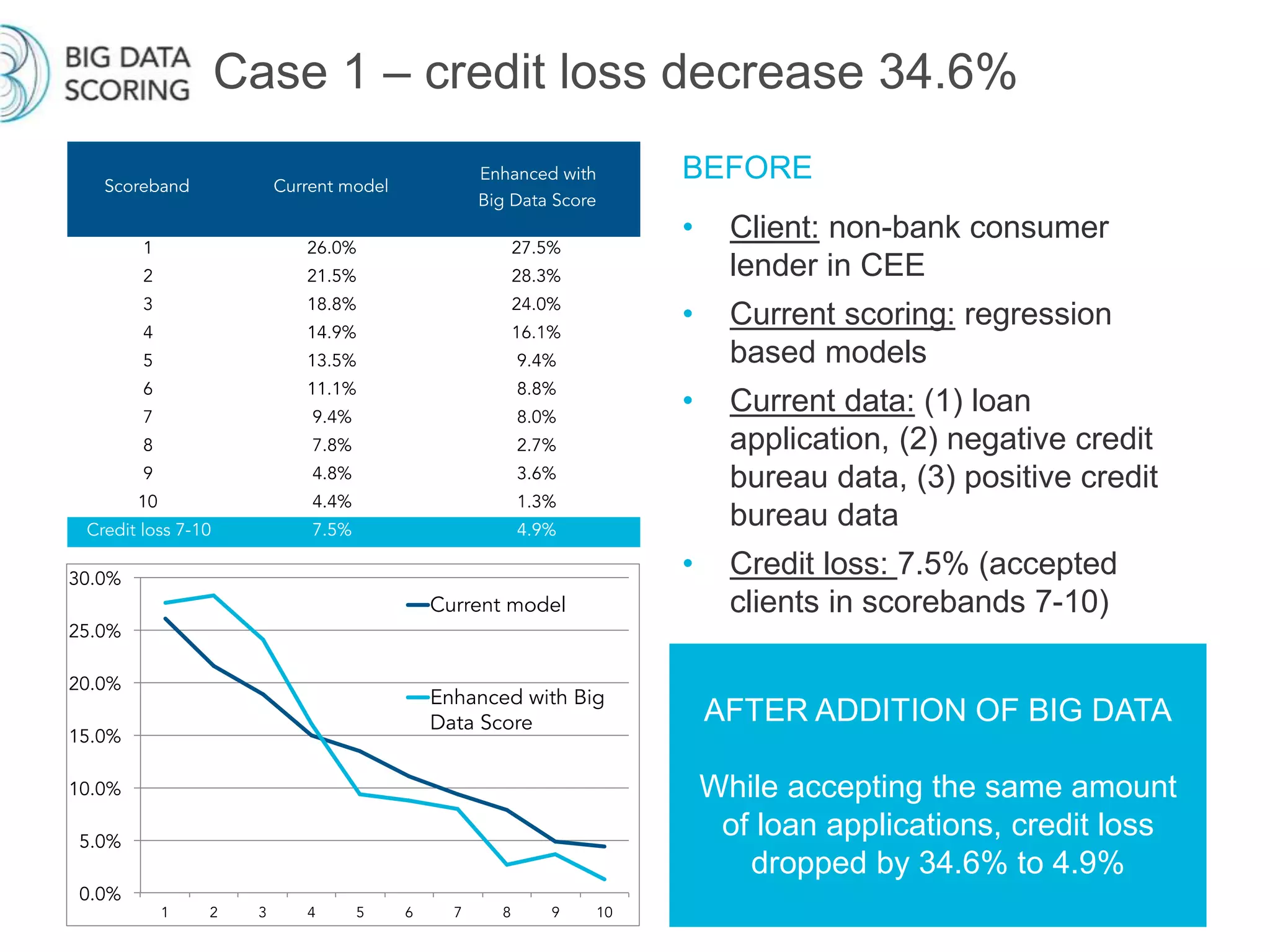

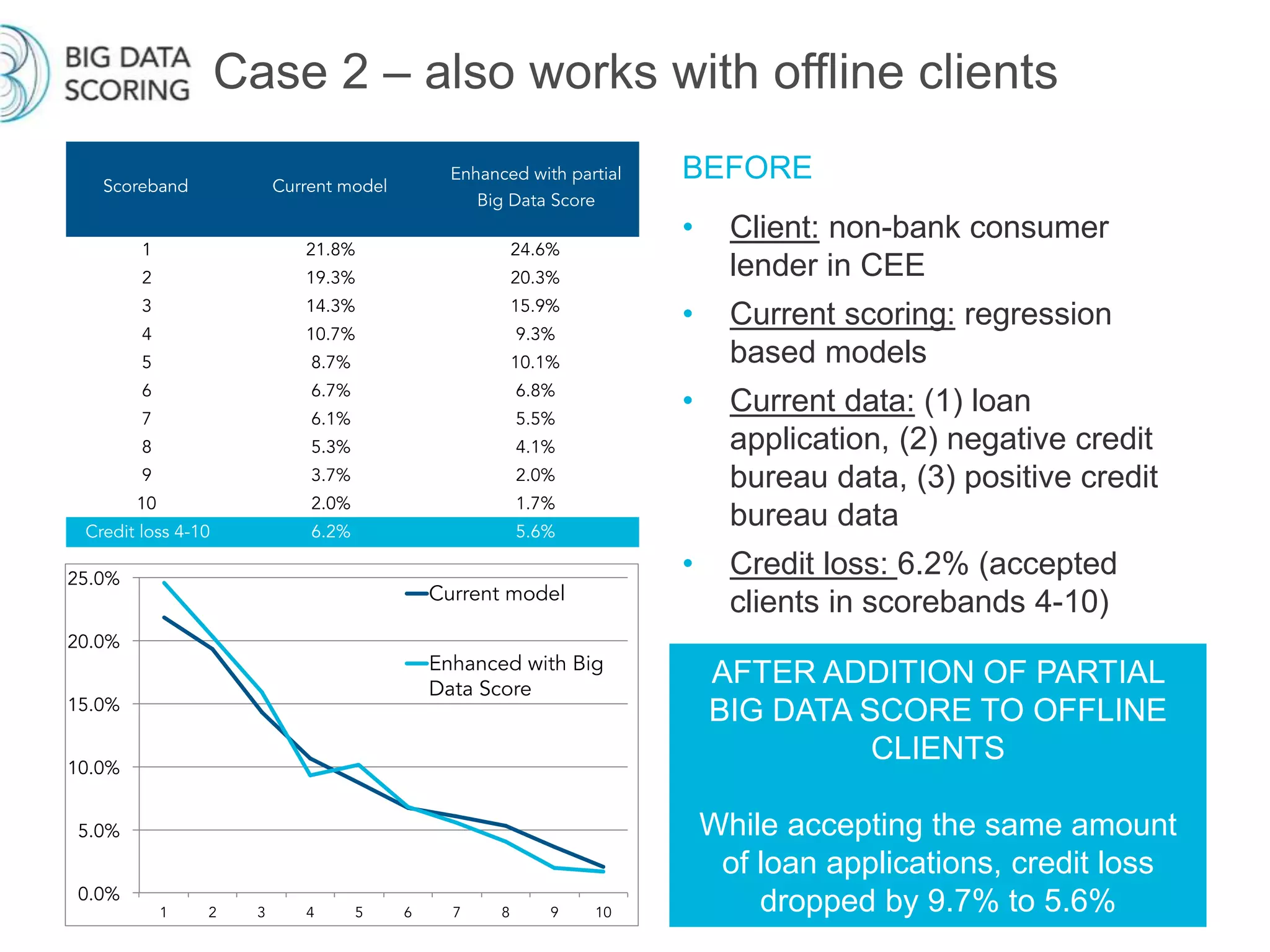

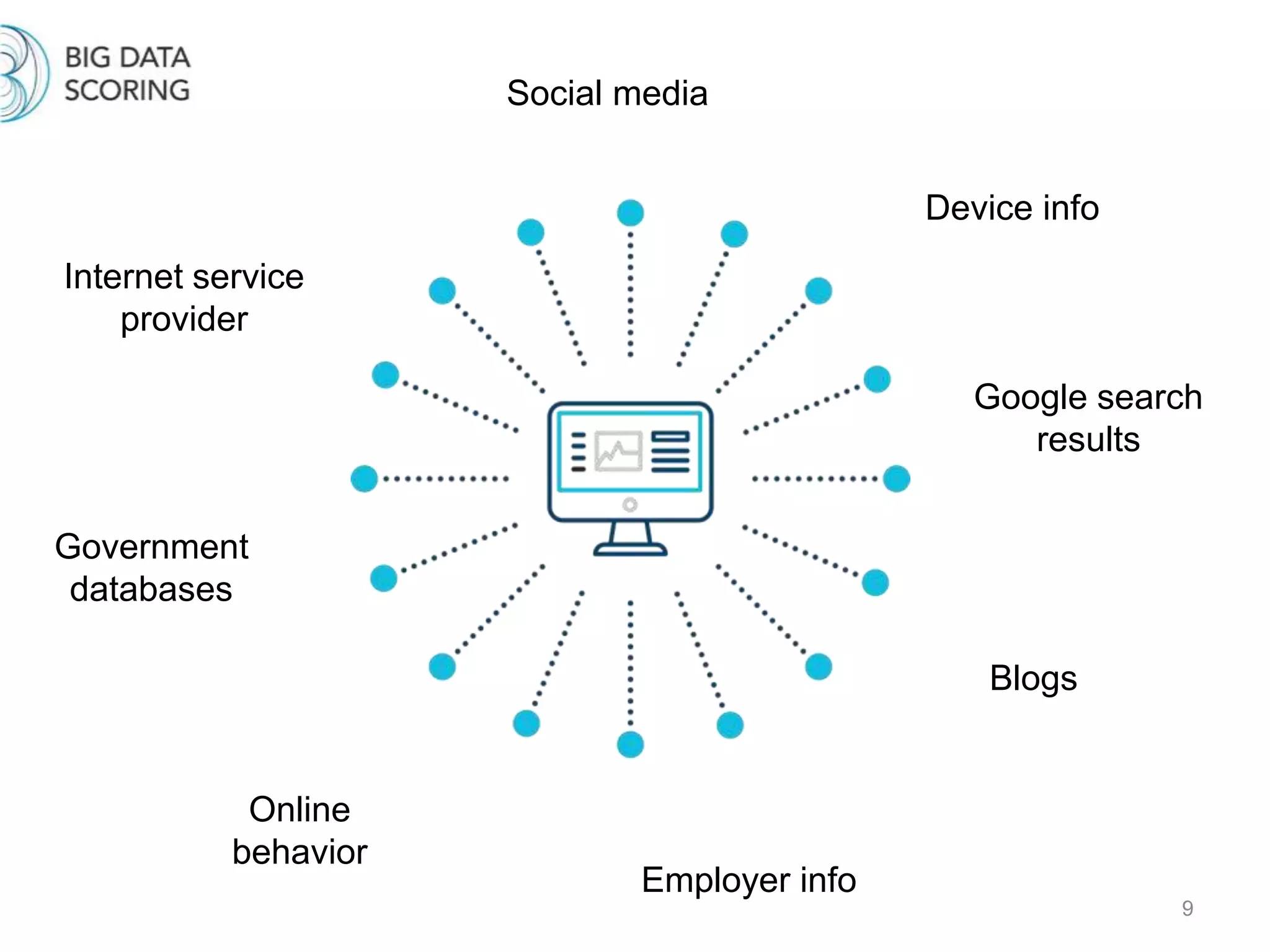

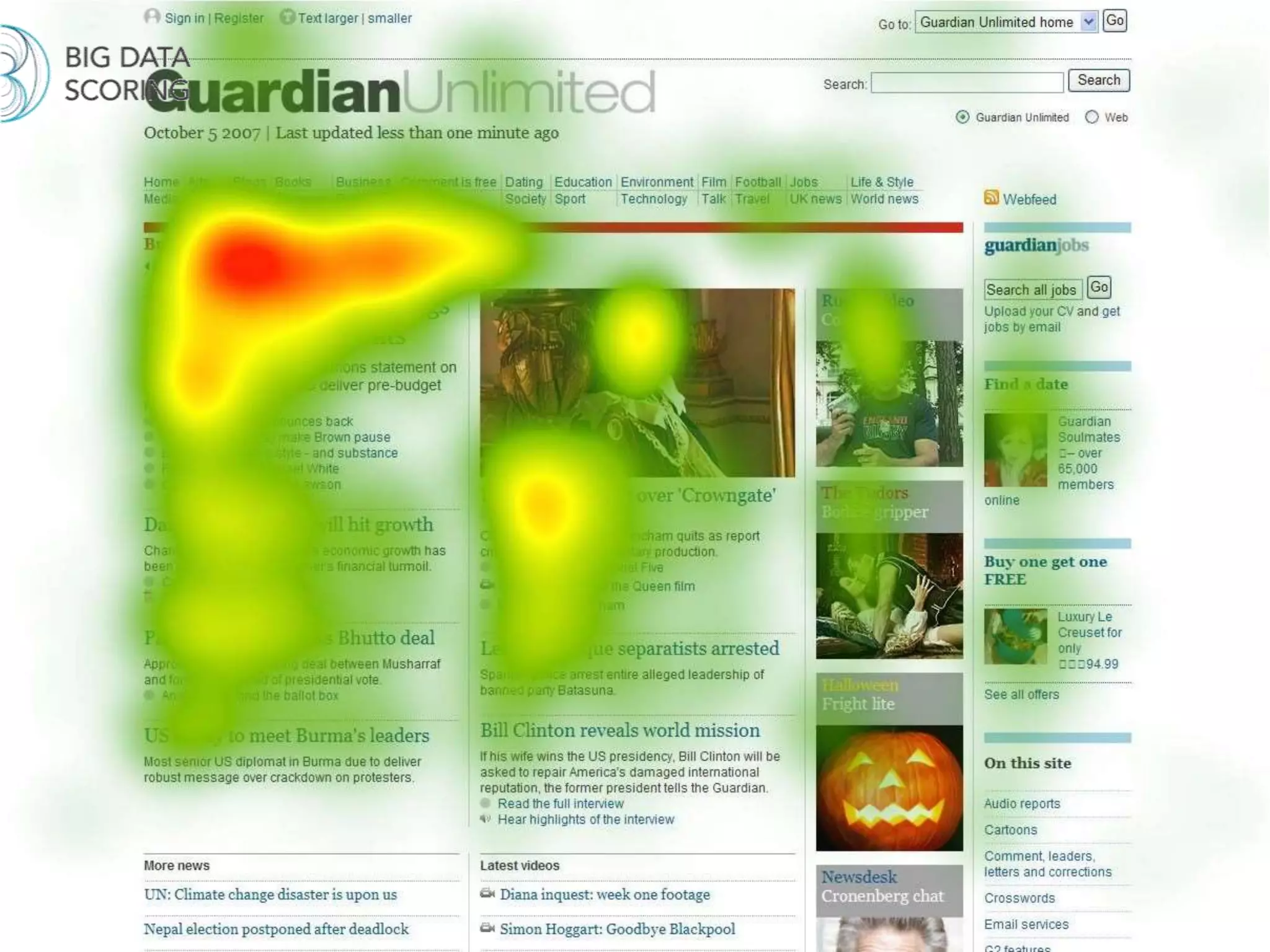

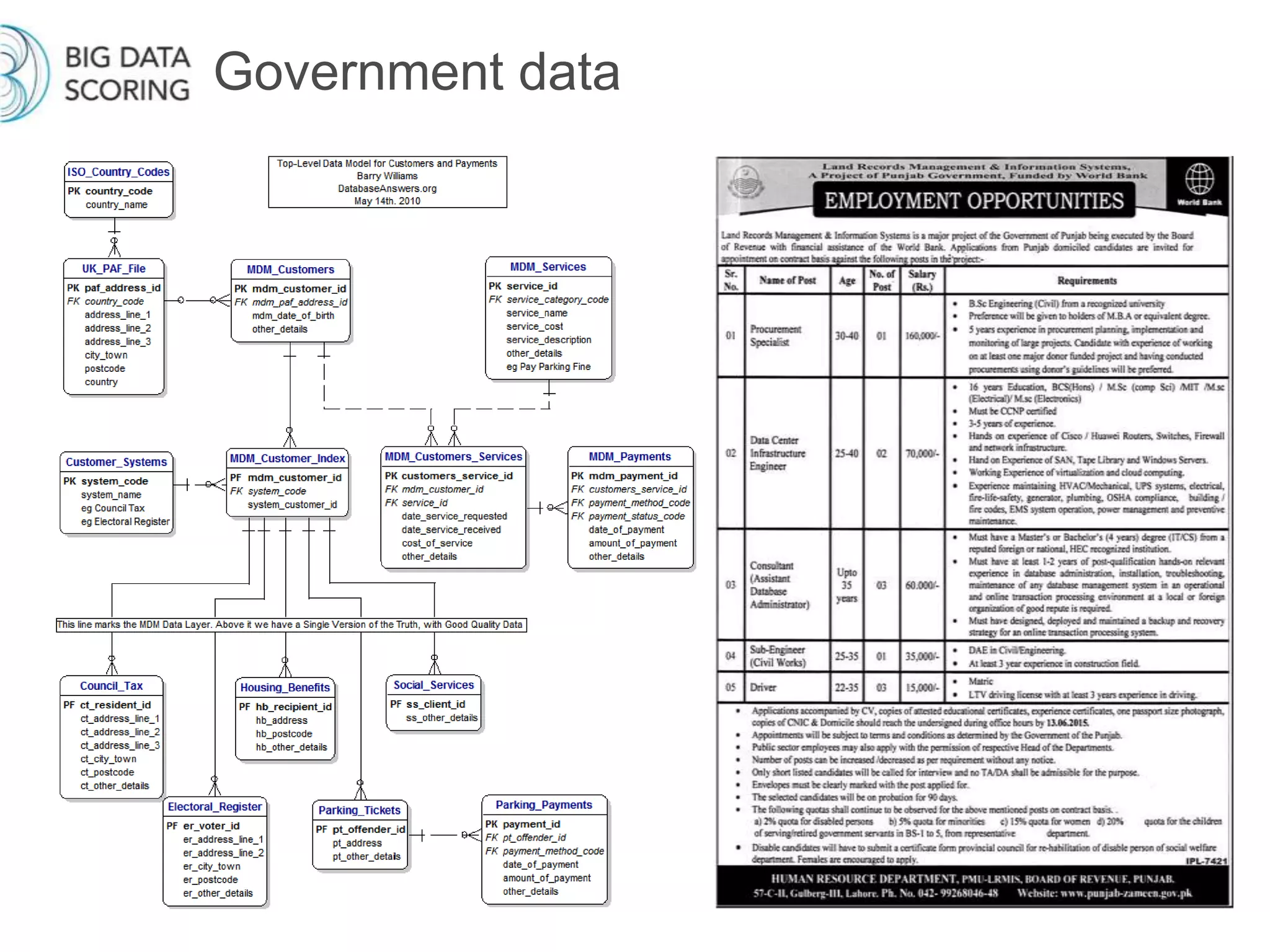

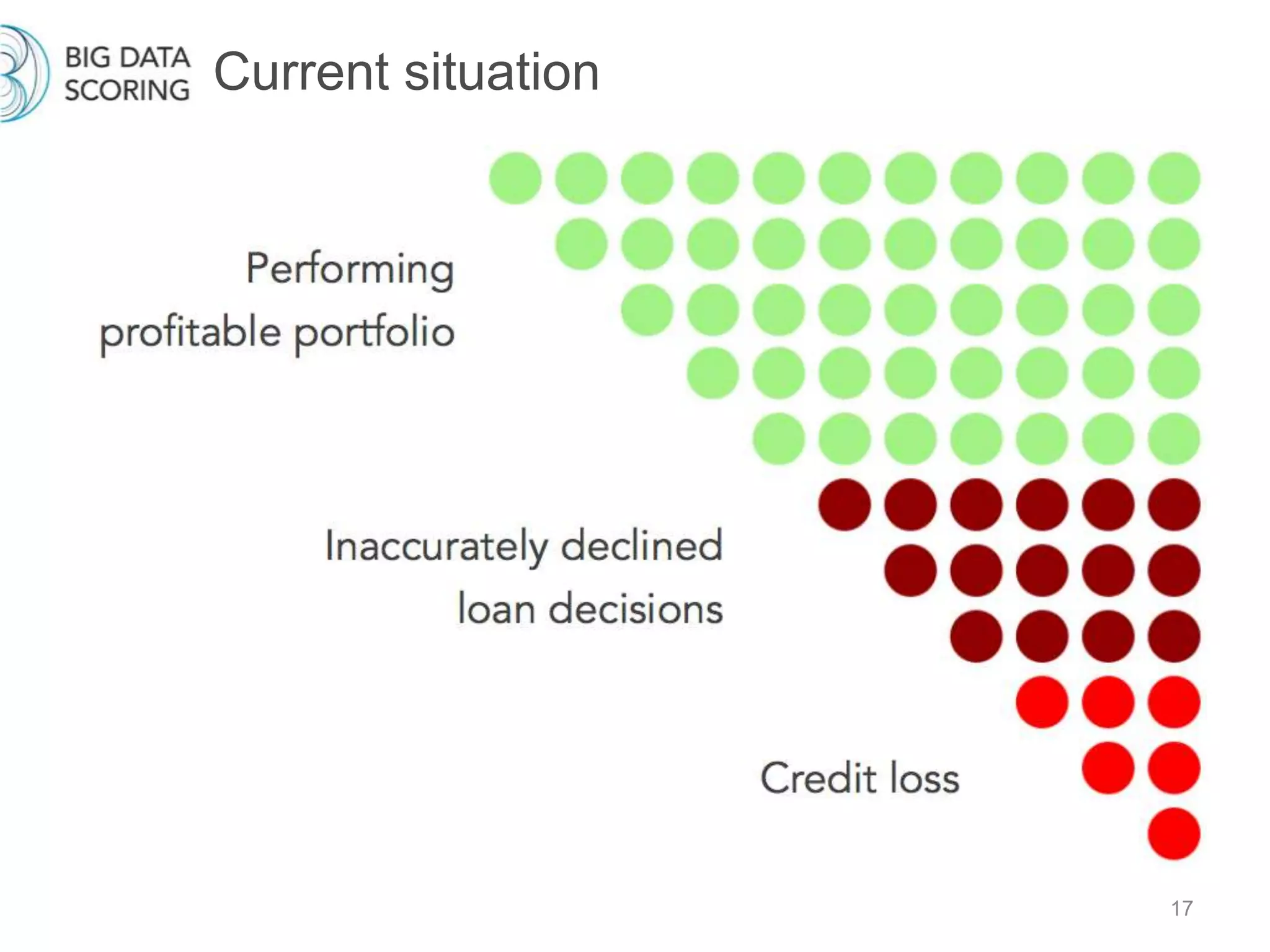

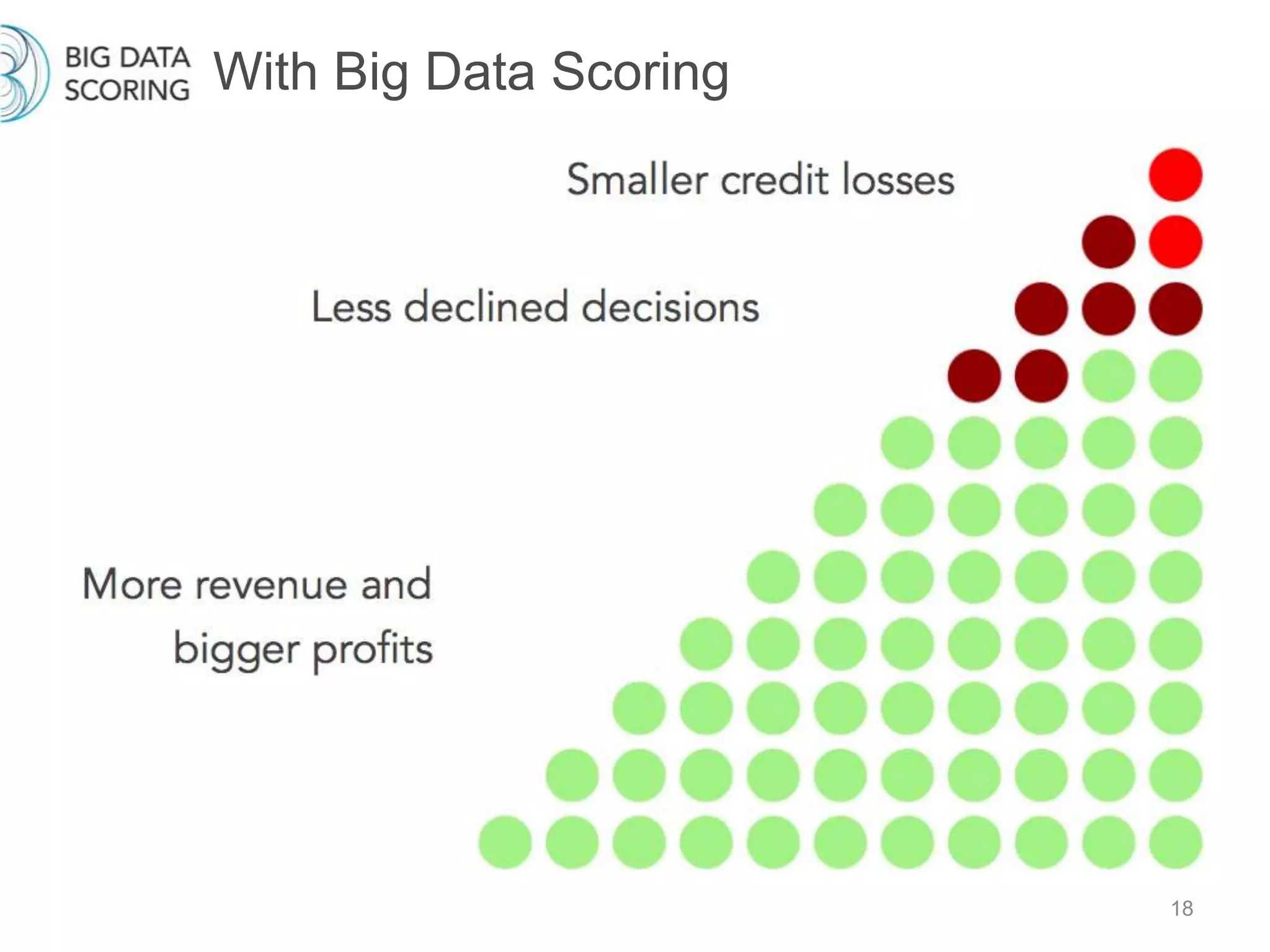

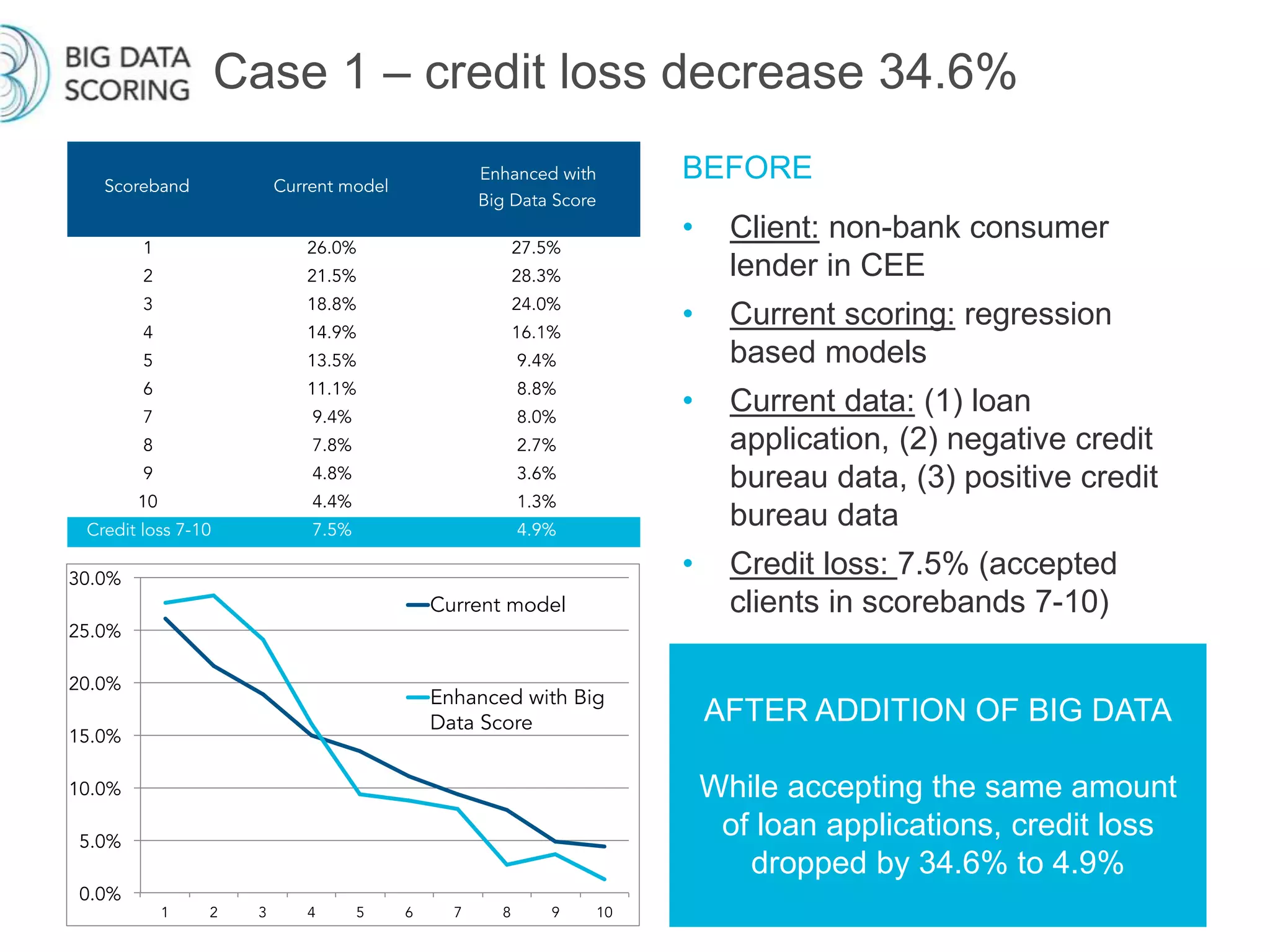

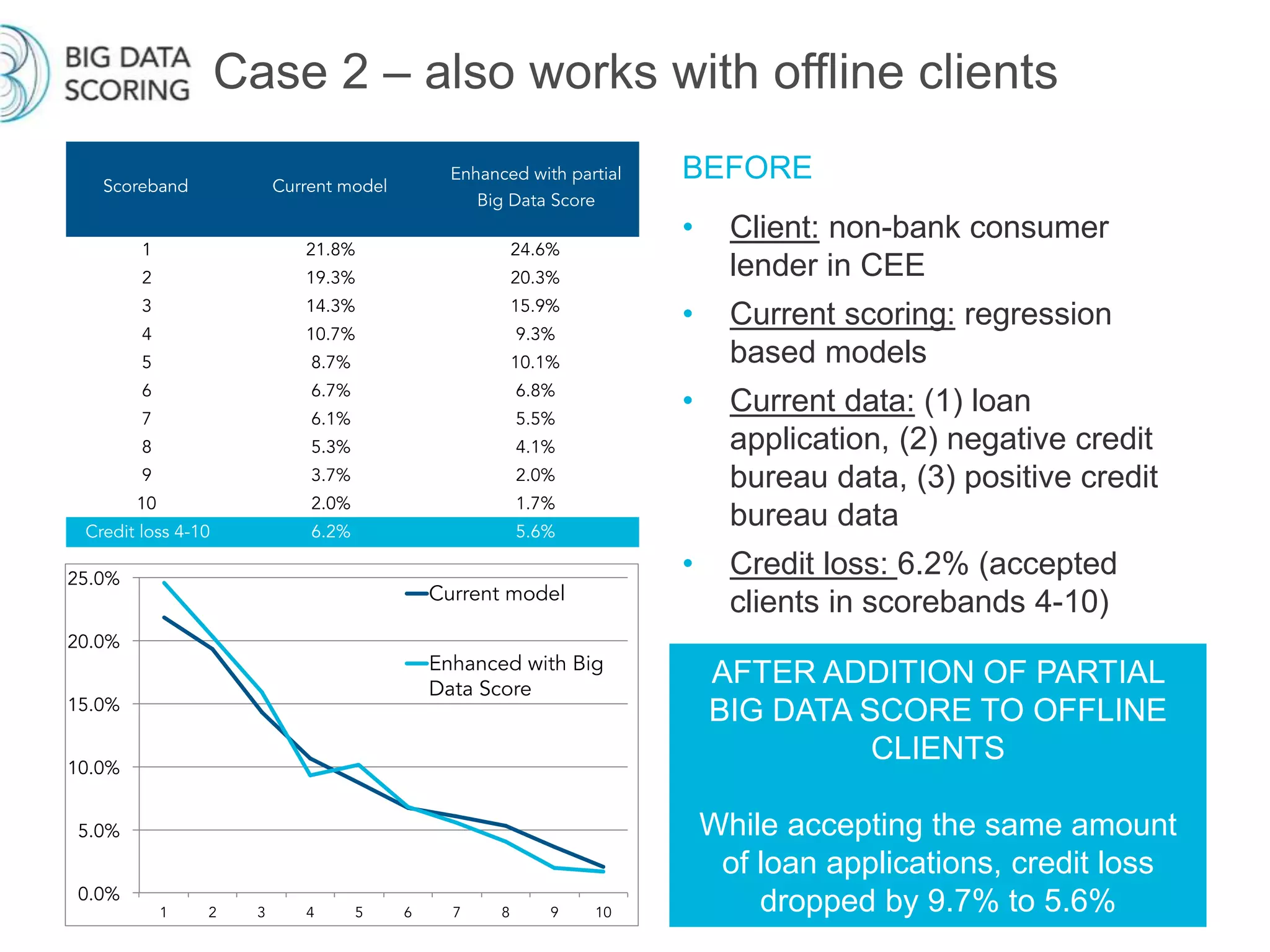

This document discusses using big data scoring to improve lending decisions. It notes that 23% of the UK population and 25% of the US population are underbanked or non-prime customers. Traditional credit scoring uses limited data sources like loan applications and credit reports, but big data scoring analyzes additional sources like social media, online behavior, device info, and public records to generate more accurate risk assessments. The document presents two case studies where adding big data scoring reduced credit losses by 34.6% and 9.7% respectively for non-bank lenders while accepting the same number of loan applications.