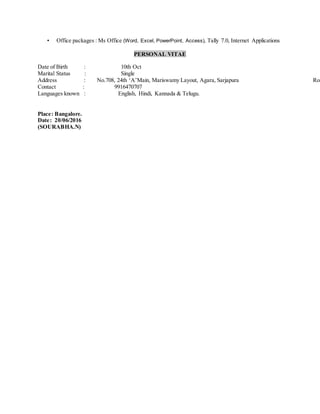

This resume summarizes Sourabha N's experience working as an Operations Analyst for JP Morgan Chase & Co. for over 7 years. Some of Sourabha's key responsibilities have included managing teams to meet business targets, developing strategies to improve process effectiveness, and performing thorough KYC reviews of clients. Sourabha has received several achievement awards for work performance and has demonstrated strong analytical, communication, and problem-solving skills.

![Achievements:

Organizational:

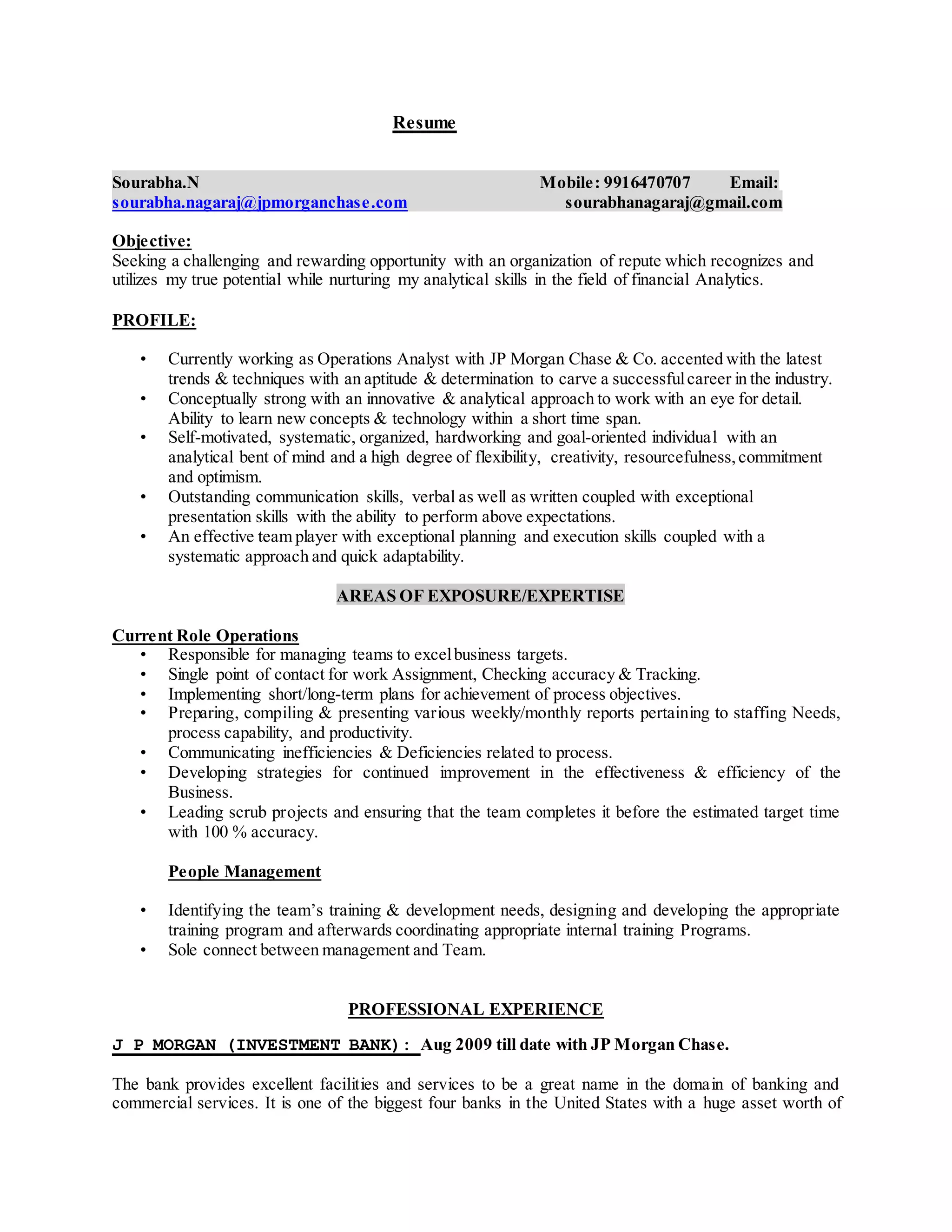

• ACE Award for being best performer.

• Team Player of the Quarter.

• Team won Best Team Award in every Team I was in.

• Won inter-team & inter Department football match.

School:

• Proficiency for being topper in accounts.

• Best student for being topper in class and leading school magazine preparation and launch.

• Awards for debate and Recitation competition at college.

• Rank holder in Junior Typing.

• Inter-School Kho-Kho match.

KEY SKILLS

• Result Driven.

• Ability to get work done from others.

• Ability to handle multiple Projects simultaneously.

• Good understanding of the back field impact of transaction on customer.

• Training

• Presentation Skills.

• Quality check

• Teambuilding & Staff Supervision

• Procedure preparation and Edit.

• Fun loving

ACADEMIC

• 2004 : CBSE Board of secondary Education, Bangalore (75% aggregate marks)

• 2006 : CBSE Board of Higher Education, Bangalore, 75% aggregate marks)

• 2009 : Graduated in BCom from Bangalore University (74% aggregate marks).

Additional Qualification

• Junior Typing (speed 30 words pm) [State Level Rank holder].](https://image.slidesharecdn.com/b227f98a-4cdb-4247-8d3a-b6a2da6ba288-160630133745/85/New-resume-4-320.jpg)