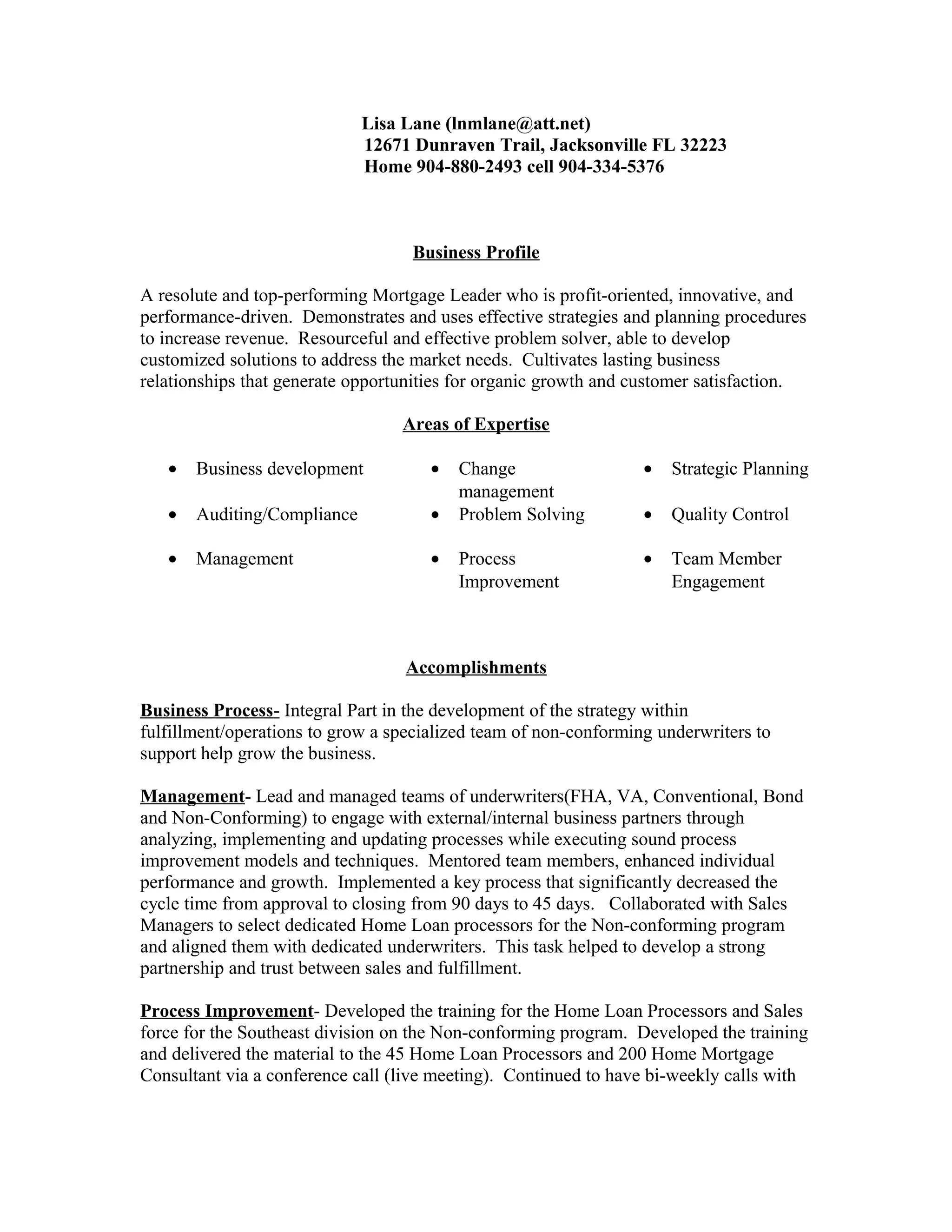

Lisa Lane is a Mortgage Leader with over 20 years of experience in business development, strategic planning, management, process improvement, and risk assessment. She has held various leadership roles such as Underwriting Manager and Lending Manager where she managed teams, improved processes, and increased revenue. Her expertise includes underwriting, training, auditing, and problem solving. She is currently an Underwriting Manager at Everbank where she oversees a team of 15 underwriters and ensures high quality and compliance.