New base 1042 special 13 june 2017 energy news

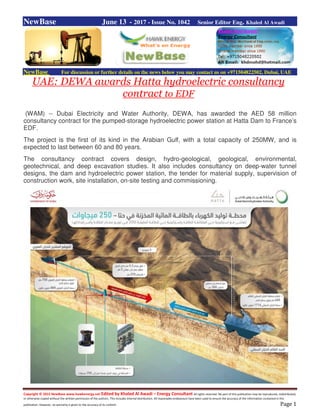

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase June 13 - 2017 - Issue No. 1042 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE: DEWA awards Hatta hydroelectric consultancy contract to EDF (WAM) -- Dubai Electricity and Water Authority, DEWA, has awarded the AED 58 million consultancy contract for the pumped-storage hydroelectric power station at Hatta Dam to France’s EDF. The project is the first of its kind in the Arabian Gulf, with a total capacity of 250MW, and is expected to last between 60 and 80 years. The consultancy contract covers design, hydro-geological, geological, environmental, geotechnical, and deep excavation studies. It also includes consultancy on deep-water tunnel designs, the dam and hydroelectric power station, the tender for material supply, supervision of construction work, site installation, on-site testing and commissioning.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 "The hydroelectric plant costs AED1.92 billion. It is part of the Hatta Comprehensive Development Plan, launched by Vice President, Prime Minister and Ruler of Dubai, His Highness Sheikh Mohammed bin Rashid Al Maktoum ," said Saeed Mohammed Al Tayer, MD and CEO of DEWA. "We are working to achieve the UAE Vision 2021 to make the UAE one of the best countries in the world by 2021, supporting sustainable development, preserving natural resources and achieving economic, social and environmental development, in line with the aspirations of our wise leadership," added Al Tayer. DEWA will build the hydroelectric power station to generate electricity by making use of the existing water stored in the Hatta Dam, which can store up to 1,716 million gallons, and an upper reservoir that will be built in the mountain that can store up to 880 million gallons. The upper reservoir will be 300 metres above the dam level. During off-peak hours, turbines that use clean and cheap solar energy will pump water from the lower dam to the upper reservoir. During peak-load hours, when production costs are high, turbines operated by the speed of waterfall from the upper reservoir will be used to generate electricity and connect it to DEWA’s grid. The efficiency of power production will reach 90 percent with a 90-second response to demand for electricity.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Oman: Orpic launches polymer marketing from Future Liwa Plastics Oman Observer Orpic, the Sultanate’s refining and petrochemicals flagship, plans to establish a worldwide network of offices to support the marketing of the huge quantities of polymers that will be produced when its Liwa Plastics mega venture comes on stream in 2020. As a first step, the wholly government-owned entity has set up a new outfit to secure markets for the company’s output of polymers — notably polyethylene and polypropylene — an estimated 1.5 million tonnes of which will be produced annually when the $6.4 billion Liwa Plastics Industrial Complex (LPIC) is operational, a senior company executive said. “We have created a new legal entity, namely Orpic Polymer Plastics, which will be fully owned by Orpic and tasked with selling the company’s polymer output in international markets,” said Gilles Rochas (pictured), General Manager – Polymer Marketing. “Offices will be opened in key export markets, such as China, Singapore, India, Turkey and so on. Our goal is to have a global marketing footprint by 2020,” Rochas added. Speaking to the Observer, Rochas said Orpic’s decision to directly oversee the marketing of its polymer output — as opposed to the conventional practice of securing long-term offtake arrangements — is designed to ensure optimum returns for the company. By cutting out the middlemen from the marketing and supply chain, Orpic is not only assured better margins on its products, but crucially it can also work towards building longer-term, mutually beneficial relationships with key buyers, he noted. Among the geographical regions being looked at as potential markets for Orpic’s polymer output is Asia where China, well-known for its strong appetite for polyethylene, is particularly promising, says Rochas. Also prospective are countries such as India, Pakistan and Sri Lanka with Orpic hoping to leverage the Sultanate’s geographical proximity and long-standing historical ties with these nations to secure markets for its feedstock. Other regions identified as equally promising include East Africa, the Middle East and North America, he said. The executive noted however that given the current global economic environment, the business of securing lucrative markets for Orpic’s polymer output will not be without its share of challenges. “One key challenge is to carefully ascertain the demand/supply situation in target markets around the world, especially in light of today’s ever-changing market environment. Markets are constantly influenced by trends, such as shale gas dynamics in the US, for instance, the coal-to-ethanol business in China, the situation in Europe, and so on. One needs to understand the macroeconomics of this industry in order to be able to identify the market you want to target,” the

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 General-Manager explained. Side-by-side with its efforts to find export markets for its output, Orpic Polymer Plastics will also look to support the growth of downstream industries that will source its feedstock requirements from Liwa Plastics, according to Rochas. In this regard, he listed three scenarios that if suitably explored and developed could open up an attractive domestic market for locally produced polymer. The first concerns Orpic’s own requirement of bags and pallets, the production of which will necessitate sizable quantities of polymer as raw material, said Rochas. “We also need to attract investors in downstream plastics industries in Oman who can export their goods to international markets. For its part, Orpic will be ready to provide technical and marketing know-how in order to make it attractive for investors to operate in the Sultanate.” Additionally, Orpic is also looking to support the development of new plastics-based products and thereby help generate new demand for its feedstock. One potential area being looked at is the pharmaceutical and healthcare sector where polymer-based packaging is seen as promising. “We see the potential for Oman developing into an innovation hub for polymer-based product applications in areas like pharmaceuticals, and so on,” he added.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Nigeria:LEKOIL receives ministerial consent for OPL310 farm-in Source: LEKOIL AIM-listed LEKOIL, the oil and gas exploration, development and production company with a focus on West Africa, has announced that the Honourable Minister of Petroleum Resources of Nigeria has granted consent to complete the transfer of the original 17.14% participating interest that LEKOIL acquired in OPL 310 in February 2013 to Mayfair Assets and Trust, a subsidiary of LEKOIL. LEKOIL's acquisition of Afren's remaining 22.86% participating interest in OPL 310 (through LEKOIL 310 Limited, a wholly owned subsidiary of LEKOIL) as announced on 1 December 2015 remains conditional upon receiving Ministerial Consent. Lekan Akinyanmi, LEKOIL's CEO, said: 'We are delighted to have received ministerial consent on our original 17.14% participating interest in OPL 310. This is an asset with tremendous potential and I am delighted that we have achieved this significant milestone. We thank the Department of Petroleum Resources for their diligence and fostering an environment that encourages the attraction of investment in the Nigerian Oil and Gas sector.' Background:- • A 3D seismic programme, designed by the partners in OPL 310 - Lekoil, Afren Plc and Optimum Petroleum Development Ltd – commenced on 20 March 2014 to cover the remaining 80% of the block. • Announced on 19 May 2014: the acquisition of a 40% interest in the Otakikpo Marginal Field, in OML 11 in Nigeria, adjacent to the shoreline, with estimated 2C resource estimates of 56.75mmbbls. • Otakikpo Marginal Field scheduled to begin production in Q1 2016. • Announced on 27 October 2015: the acquisition of Interest in OPL 325, Offshore Nigeria. • Announced on 28 October 2015: the completion of US$46 million Placing. • Announced on 1 December 2015: the acquisition of Afren’s Interest in OPL 310, consolidating Lekoil's Participating Interest to 40% pending Ministerial Consent

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Nigeria: Erin Energy planning to drill offshore Nigeria Source: Erin Energy Erin Energy has provided an update on its drilling operations that are expected to double production for the Company, as well as updated its plans for drilling one of its prime exploration prospects. Erin Energy currently produces approx. 6,000 barrels of oil per day (BOPD). Drilling operations for the Oyo-9 development well are planned to commence next month and be completed by year end, pursuant to the drilling contract with Pacific Drilling. Oyo-9 has the potential to increase Oyo field production by 6,000-7,000 barrels of oil per day, which alone would double the Company’s current production. Coincidental with the completion of Oyo-9, the Company will also tie back to its FPSO the Oyo-7 well, which should add approx. 1,200 BOPD. The Company is also discussing a possible extension to the contract with Pacific Drilling, depending on availability of funds, to drill one or two wells in the prolific Miocene geological zone located in OML 120. The drilling rig under contract with Pacific Drilling is the Pacific Bora, a highly efficient sixth generation double-hulled drillship. Femi Ayoade, Erin Energy’s CEO commented: 'We are pleased with the progress in our drilling operations and the possibility to more than double the Company's current production. Additionally, we believe our greatest shareholder value creation opportunities are in our Miocene exploration prospects, where we are working to accelerate the drilling in OML 120 and 121. Solid progress is also being made to restructure the Company's debt, including the reduction in our accounts payable.'

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 UK: Odfjell Drilling awarded contract for platform drilling and maintenance services for TAQA Bratani Source: Odfjell Drilling Odfjell Drilling has been awarded a 2-year fixed contract with no limit of 1-year options from TAQA Bratani for Drilling and Maintenance services on five platforms on the UK continental shelf. The announcement follows an earlier announcement, and gives more detail of the contract. Odfjell Drilling will take over operations from the current contractors in Q3 this year. Mr. Simen Lieungh, President and CEO of Odfjell Drilling say: 'This award from TAQA recognises Odfjell Drilling as a quality provider of platform drilling and maintenance services with a strong focus on safe and efficient operations. We welcome and appreciate this significant contract award from TAQA and look forward to a long and productive working relationship. We know that TAQA expects us to deliver on performance and I can assure that we will demonstrate the company's firm commitment to successful future drilling services to TAQA.' The contract includes drilling and maintenance services on the following fixed installations; Cormorant Alpha - a drilling and production installation for the South Cormorant field in Block 211/26a in the East Shetland Basin of the Northern North Sea. North Cormorant - a drilling and production installation for the North Cormorant field in Block 211/21 in the East Shetland Basin of the Northern North Sea. Eider - a fixed installation serving as a manned production facility for the Eider Field, in Block 211/16a in the East Shetland Basin 114 miles North East of Lerwick. Tern Alpha - a drilling and production installation for the Tern field in block 210/25 in the East Shetland Basin 105 miles North East of Lerwick. The platform also serves as a production facility for the Hudson and Kestrel fields. Harding - a heavy-duty jack-up production unit, resting on a gravity base storage tank capable of holding 600,000 barrels of oil, serving as a manned production facility for the Harding Field, in Block 9/23b, 320 kilometres North East of Aberdeen in the Central North Sea. TAQA is a returning customer for Odfjell Drilling (UK) and it is a much appreciated and welcomed opportunity to expand our platform drilling activities in the UK in addition to the BP and Statoil contracts. With this award, we increase the number of Odfjell Drilling services on platforms from 10 to 15 installations. With this new contract, Clair Ridge (BP) and Mariner (Statoil), it also means that Odfjell will further expand its work force in UK with around 100 people during this year.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 US shale oil output projected to rise by more than 100,000 barrels a day for a fourth straight month Tom DiChristopher | @tdichristopher Shale oil production in the United States is expected to jump again in July, marking the fourth straight month the Department of Energy has forecast monthly growth above 100,000 barrels a day. The department's U.S. Energy Information Administration on Monday projected crude oil output will rise by 127,000 barrels a day next month in several of the nation's shale basins, where producers use advanced drilling methods like hydraulic fracturing to squeeze oil and natural gas from rock formations. In July, total output from these resources is expected to reach nearly 5.5 million barrels a day, according to EIA. Output growth in the shale fields has driven a 10 percent recovery in the country's overall crude production since September. More drillers can break even or turn a profit on new production since oil prices rose above $50 a barrel last winter, when OPEC and 11 other exporters agreed to cut their output in order to balance the market. The biggest gains are once again expected to come from the Permian basin, the center of the U.S. oil recovery located primarily in western Texas and part of eastern New Mexico. EIA projects production in the Permian will rise by 65,000 barrels a day in July. The Eagle Ford area is forecast to be the second biggest contributor to July's gains, with output expected to rise by 43,000 barrels a day next month in the southern Texas oil basin.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Production gains have been rising in the Permian as drillers become more efficient, squeezing more oil out of wells for each rig they deploy. But there are signs those efficiency gains may have reached their limit. Production from new oil wells per rig topped out at 704 barrels a day in August, and is expected to fall to 602 barrels per rig in July. This is happening in part because some drillers are moving beyond their best wells as more players pack into the Permian, according to IHS Markit analyst Raoul LeBlanc. At the same time, the high demand for labor and equipment is causing producers to turn to workers who got laid off during the downturn and rigs that need investment after sitting idle. At the start of the recovery last year, a pool of workers and rigs that had not been out of the fields for long was still available, allowing production to rev up quickly early in the cycle. "Technology marches in one direction. We're not getting dumber, but some of the cyclical factors will unwind. We'll see more of it particularly as costs continue to rise," LeBlanc told CNBC. The drilling recovery is beginning to spread beyond the Permian and Eagle Ford to North Dakota's Bakken and the Niobrara, located in northeastern Colorado and parts of three adjoining states. EIA projects production will rise by 6,000 barrels a day in the Bakken and by 11,000 barrels a day in the Niobrara in July. But production gains in these areas will be more muted than in the Permian, LeBlanc warned. A small number of specialist drillers are indeed increasing output, but there are just not enough players drilling in these regions to generate the kind of growth Texas is seeing, he said. The EIA does not forecast output for the Scoop and Stack, two oil-producing regions in Oklahoma where activity has ramped up in recent years.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 NewBase 13 June 2017 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil edges up on Saudi pledge to make real supply cuts Reuters + NewBase + Bloomberg Oil prices edged up early on Tuesday, lifted by statements that OPEC-leader Saudi Arabia was making significant supply cuts to customers, although rising U.S. output meant that markets remain well supplied. Brent crude futures were at $48.42 per barrel at 0044 GMT, up 13 cents, or 0.3 percent, from their last close. U.S. West Texas Intermediate (WTI) crude futures were at $46.21 per barrel, also up 13 cents, or 0.3 percent. Saudi Arabia, the world's top oil exporter, is leading an effort by the Organization of the Petroleum Exporting Countries (OPEC) to cut production by almost 1.8 million barrels per day (bpd) until the end of the first quarter of 2018 in order to prop up prices. Other countries, including top producer Russia, are also participating. During the first half of the year, there were doubts over OPEC's compliance with its own pledges, as supplies, especially to Asia, remained high. Saudi officials now say they are making real cuts, including 300,000 bpd to Asia for July, although several Asian refiners said they were still receiving their full allocations. "Crude oil prices rose on the back of further supportive talk from Saudi Arabia. Energy Minister Khalid Al-Falih said that inventories are declining and reductions will accelerate in the next three week," ANZ bank said. Although other OPEC members, like Libya and Nigeria, are exempt from the cuts, and there have been doubts over the compliance of others, including Iraq, the club's supplies have been falling since the the cut's start in January. Oil price special coverage

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Trade data shows that OPEC shipments to customers averaged around 26 million bpd in the last six months of 2016, while they are set to average around 25.3 million bpd in the first half of this year. Threatening to undermine OPEC's efforts to tighten the market is a relentless rise in U.S. drilling activity, which has driven up U.S. output by more than 10 percent since mid-2016, to over 9.3 million bpd. The U.S. Energy Information Administration (EIA) says production will rise above 10 million bpd by next year, challenging top exporter Saudi Arabia. A sign of ample supplies is the Brent forward curve, which is in a shape known as contango, in which crude for delivery in half a year's time is around $1.50 per barrel more expensive than that for immediate dispatch, making it profitable to charter tankers and store fuel instead of selling it for direct use. Saudi Arabia Sees Supply Glut Easing Oil edged up following its plunge last week after Saudi Arabia and Russia said crude markets will rebalance. Futures rose 0.6 percent in New York after Saudi Energy Minister Khalid Al-Falih said inventories are declining and reductions will accelerate in the next three to four months. Still, the price increase didn’t come close to recovering the 3.8 percent loss last week as investors focused on soaring U.S. stockpiles. “Sentiment in the market is still very bearish,” Amrita Sen, chief oil economist for Energy Aspects Ltd. in London, said by telephone. “We are starting to see stock draws, but the market is kind of saying, the draws aren’t coming fast enough.” Oil has traded below $50 a barrel amid speculation increased U.S. supplies will counter production curbs by the Organization of Petroleum Exporting Countries and allies including

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Russia. American explorers added oil rigs for the 21st straight week to the highest level since April 2015, according to Baker Hughes Inc. Output at major U.S. shale plays will reach a record 5.48 million barrels a day in July, according to the Energy Information Administration. While comments from Saudi Arabia and Russia do add some positive sentiment to the market, “nobody really believes them at face-value anymore,” Bob Yawger, director of the futures division at Mizuho Securities USA Inc. in New York, said by telephone. “People aren’t taking the bait.” West Texas Intermediate for July delivery rose 25 cents to settle at $46.08 a barrel on the New York Mercantile Exchange, paring gains from as high as $46.71 during the session. Total volume traded was about 4 percent below the 100-day average. Brent for August settlement climbed 14 cents to settle at $48.29 a barrel on the London-based ICE Futures Europe exchange. Prices lost 3.6 percent last week. The global benchmark crude traded at a premium of $1.97 to August WTI. Oil Allocations Global crude inventories will settle at their five-year historical average -- OPEC’s target -- before the end of the year, Al-Falih said at a briefing in Kazakhstan with his Russian counterpart, Alexander Novak. Still, Saudi Arabia, the group’s biggest producer, may modify its policy if output cuts don’t have the desired effect, he said. Saudi Arabia’s oil allocations to customers will be cut for July by about 600,000 barrels a day from June, according to a person with knowledge of the matter who asked not to be identified because the information is confidential. U.S. July oil allocations are said to be reduced by 300,000 barrels a day. Data from the EIA last week showed that total U.S. crude and product stockpiles jumped by the most since 2008 in the week ended June 2.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 Russia, Saudis See Oil Inventories Falling After Price Drop by Nariman Gizitdinov A deal among oil-producing countries to curb production and balance an oversupplied market will achieve its objective in the first quarter of next year, Russian Energy Minister Alexander Novak said, after prices tumbled on news of a build-up in U.S. inventories. His Saudi counterpart, Khalid Al-Falih, said at a joint news briefing in Astana, Kazakhstan, that inventories were declining worldwide and reductions would accelerate in the next three to four months. Inventories will settle to their five-year historical average -- OPEC’s target -- before the end of the year, though Saudi Arabia, the group’s biggest producer, may modify its policy if output cuts don’t have the desired effect, he said. “If we will see over the number of weeks or months reasons to adjust, we will adjust,” Al-Falih told reporters after the briefing. “If by the fourth quarter we will need to do something different, we will seriously consider.” The Organization of Petroleum Exporting Countries and other crude producers including Russia agreed May 25 to extend the supply deal that they reached last year until the end of the first quarter of 2018. Prices slumped on the news that they wouldn’t cut any deeper, and U.S. crude futures fell 5 percent on June 7 as the nation’s stockpiles unexpectedly grew. International benchmark Brent crude closed at $48.15 a barrel on Friday. The agreement is working and global crude inventories are falling gradually, Novak said at the same event in Astana. Demand will recover in the first quarter, reducing stockpiles, and Russia is committed to doing everything to balance the market, he said. Short-term variations in supply won’t affect the long-term trend of declining inventories, Al-Falih said. U.S. stockpiles of crude and oil products in the week ended June 2 surged by the most since 2008, Energy Information Administration data showed on June 7, after the world’s largest oil consumer boosted imports and trimmed exports. The number of drilling rigs in the U.S. rose by eight to 741 rigs last week, according to Baker Hughes Inc., as shale producers continued to pump more.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 NewBase Special Coverage News Agencies News Release 13 June 2017 Reporting oil companies’ proved reserves in 2016 decline for second consecutive year U.S. EIA, based on Evaluate Energy Annual reports of 68 publicly traded oil companies indicated that their aggregate proved liquids reserves declined in 2016 for the second consecutive year. The decline in proved reserves was heavily concentrated in a few companies that reduced their estimated reserves from Canadian oil sands projects. Downward revisions of existing resources, relatively low extensions and discoveries, and relatively high production also contributed to a decline in proved reserves. Note: Rest of world includes associated companies’ reserves with unspecified geographies. The 68 oil companies included in this analysis are listed on U.S. stock exchanges and consequently are required to report their proved reserves annually to the U.S. Securities and Exchange Commission (SEC). Collectively, their global crude oil and other liquids production averaged 24 million barrels per day (b/d) during 2016, or about 25% of the global total.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 Proved reserves are the estimated quantities of oil that, with reasonable certainty, are recoverable under existing economic and operating conditions. These company estimates are based on available geologic and engineering data, which change as technology develops. Price changes and other economic factors can have a significant effect on the economic viability of oil projects, and some companies specifically cited low crude oil prices in 2016 as a reason to revise their proved reserves base downward. Extensions (more resources at existing fields) and discoveries (resources at new fields) represent newly found quantities of oil and totaled 4.9 billion barrels across the 68 companies in 2016. Following the crude oil price decline beginning in mid-2014, companies significantly reduced capital expenditures, especially in their exploration and development budgets. Instead, they focused on extracting additional oil from reserves developed in previous years. Additions from extensions and discoveries and net purchases of reserves from companies not included in this analysis were offset by large negative revisions to company assessments of existing reserves. Reserves also declined as these companies collectively extracted 8.9 billion barrels of liquids in 2016. The combined effect of these changes and other factors was a net reduction of 8.2 billion barrels in proved reserves.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Source: U.S. Energy Information Administration, based on Evaluate Energy Later this year, EIA will issue an annual report that focuses exclusively on proved reserves located in the United States, including all U.S. producers, whether or not they are publicly traded. The relatively small change in the U.S. reserves component of global total reserves for the 68 companies whose reports were reviewed here suggests that EIA’s 2016 proved reserves report for the United States will show only modest changes from the 2015 report. So far in 2017, capital expenditures remain lower than for the same period in 2016. Generally, larger companies with more production are reducing expenditures, while relatively smaller companies are increasing their capital expenditures.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 Note: Two companies merged in the first quarter of 2017, reducing the total number of companies in this analysis. Forty-five of the companies in this analysis produced less than 250,000 b/d in the first quarter of 2017, and 28 of those 45 increased their capital expenditures compared with the first quarter of 2016. In aggregate, those 45 companies increased their capital expenditures by $2.6 billion. In contrast, 17 of the 22 companies producing more than 250,000 b/d in this analysis reduced capital expenditures. Those 22 companies, in aggregate, lowered their capital expenditures by $10.8 billion. For additional oil company financial analysis, see EIA’s Financial Review 2016

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase June 2017 K. Al Awadi

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 Solar power is the key to renewable development in the GCC. Installed solar capacity is expected to reach 76 GW by 2020, representing massive opportunity for suppliers in the region. Co-located with The Big 5 Dubai, The Big 5 Solar launches this November 26 - 29th 2017. 20% of The Big 5 visitors in 2016 were looking for solar technologies making The Big 5 Solar an ideal platform to meet dedicated buyers, get inspired at the Global Solar Leader's Summit and open up to new markets.