Embed presentation

Downloaded 12 times

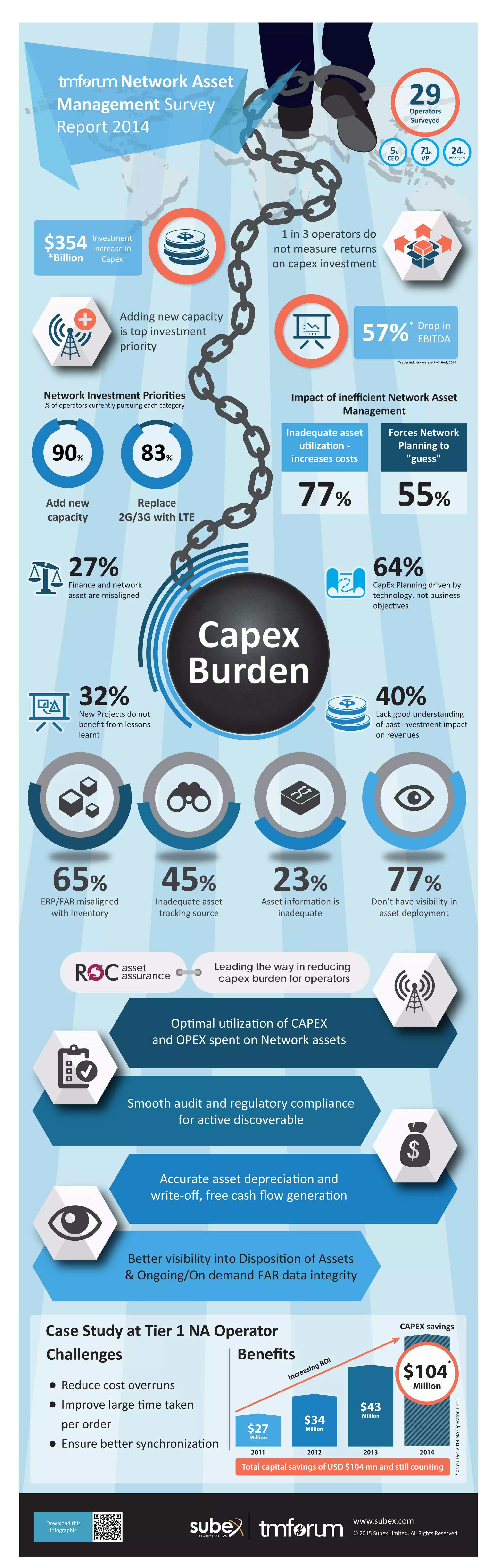

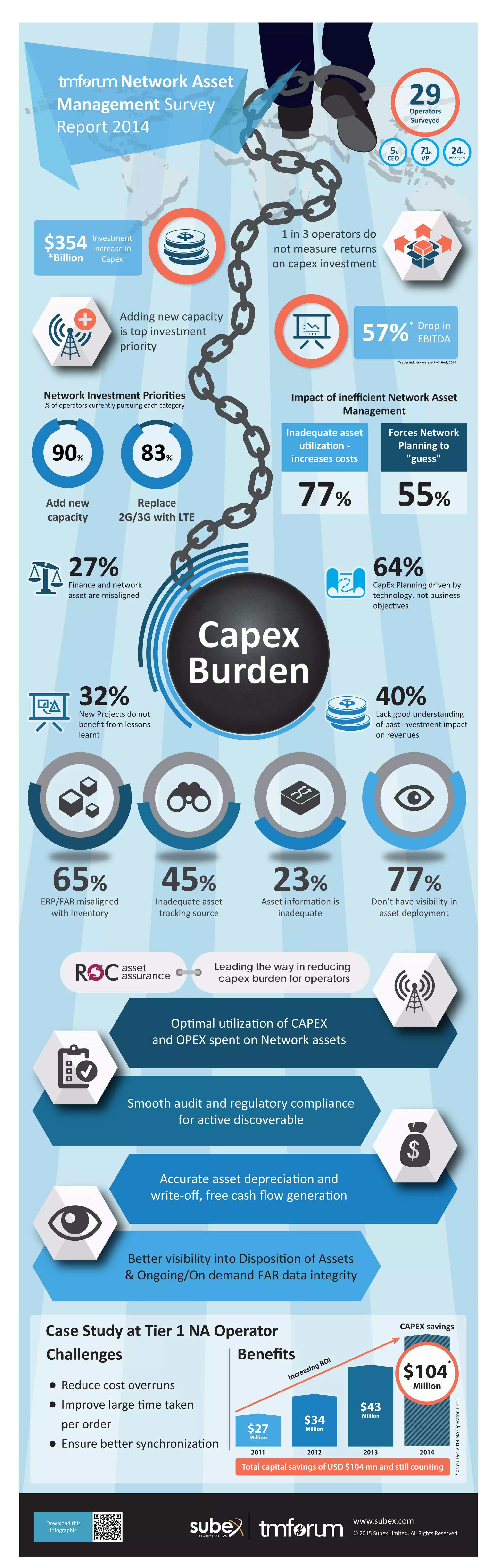

The document highlights the challenges operators face in capital expenditure (capex) management, noting that one in three do not measure returns on their investments. It reveals significant issues such as inadequate asset tracking, misalignment between finance and network assets, and a reliance on technology rather than business objectives for planning. Successful case studies show that improved asset management can lead to substantial cost savings and better utilization of investments.