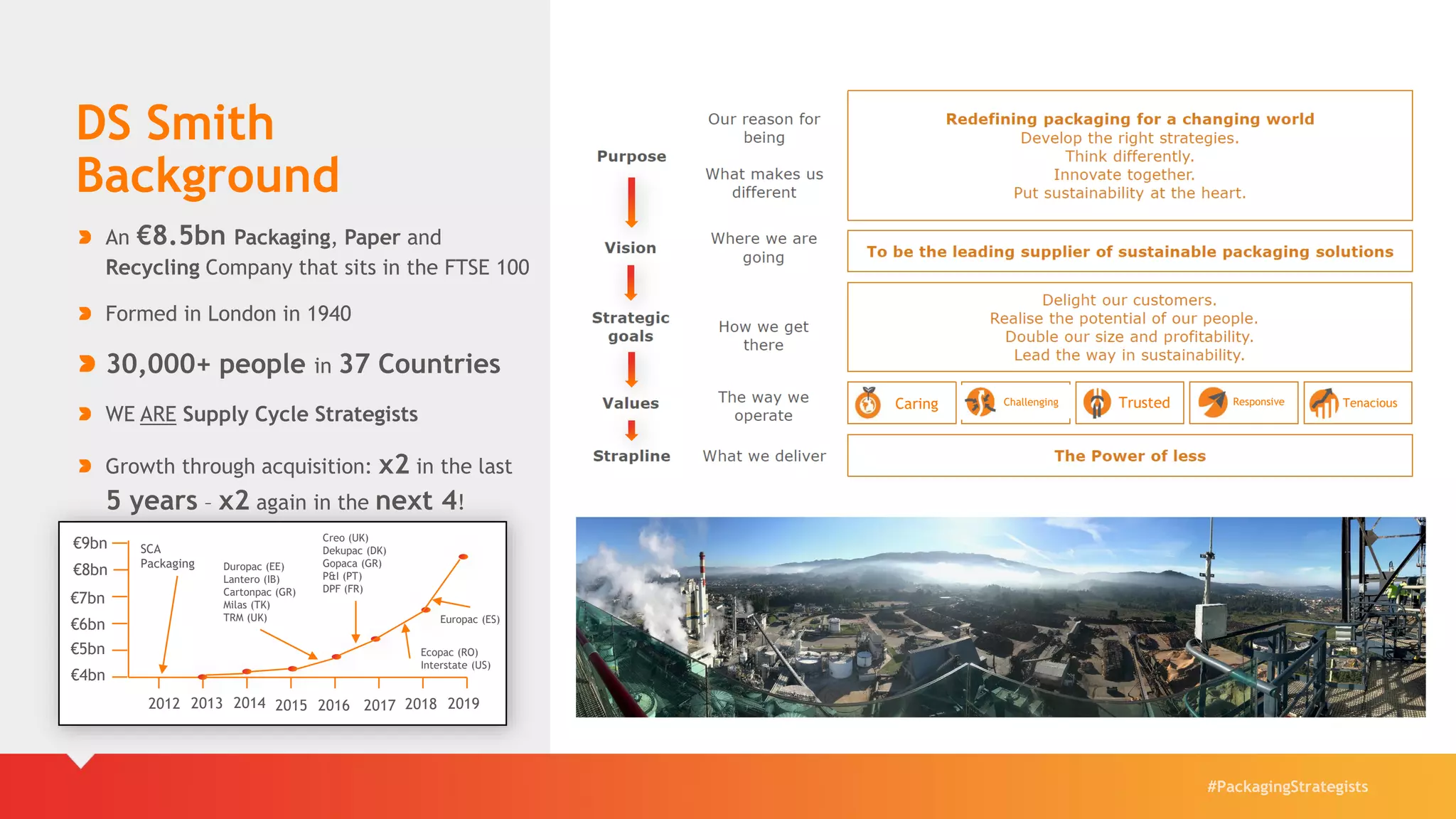

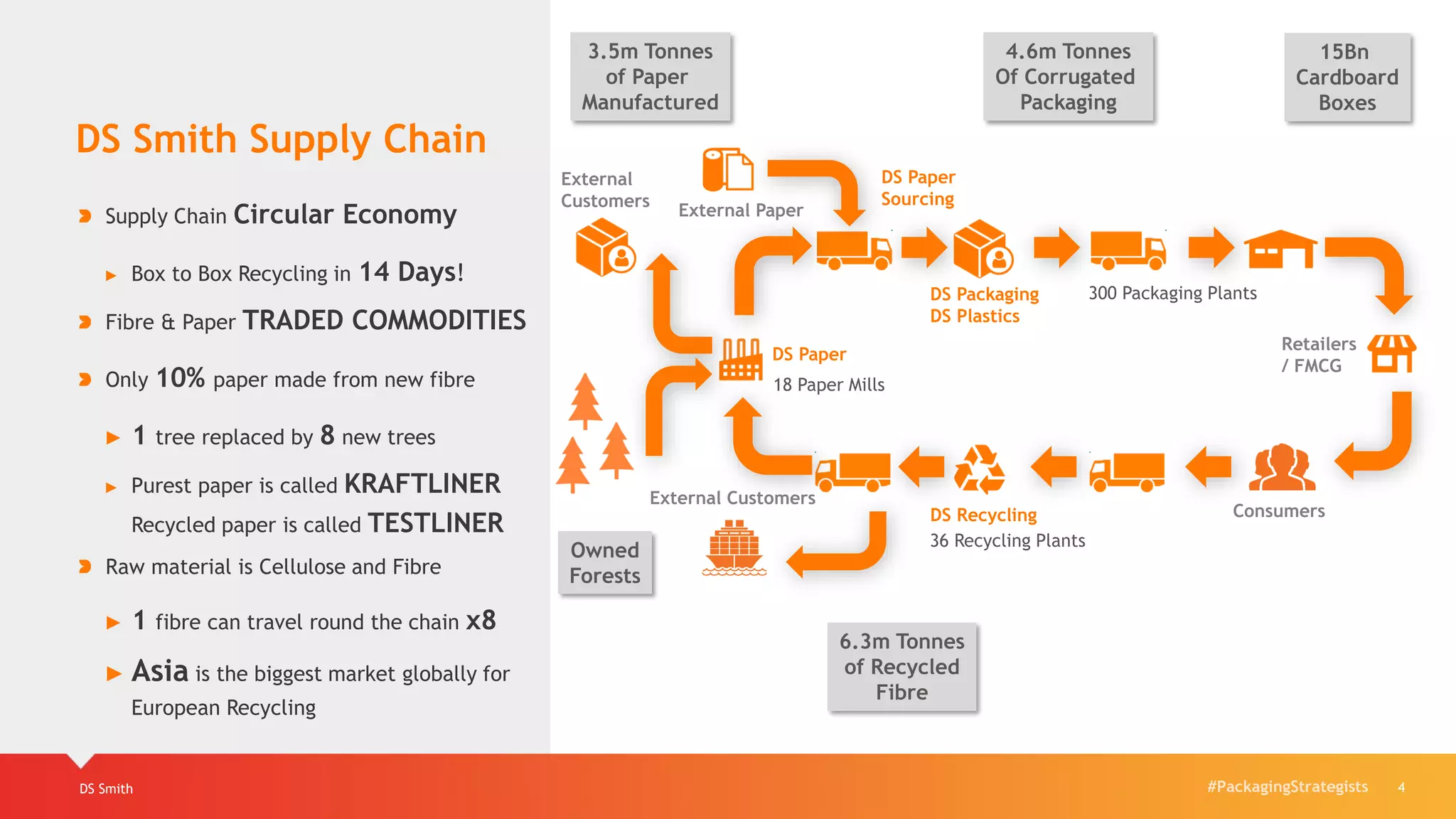

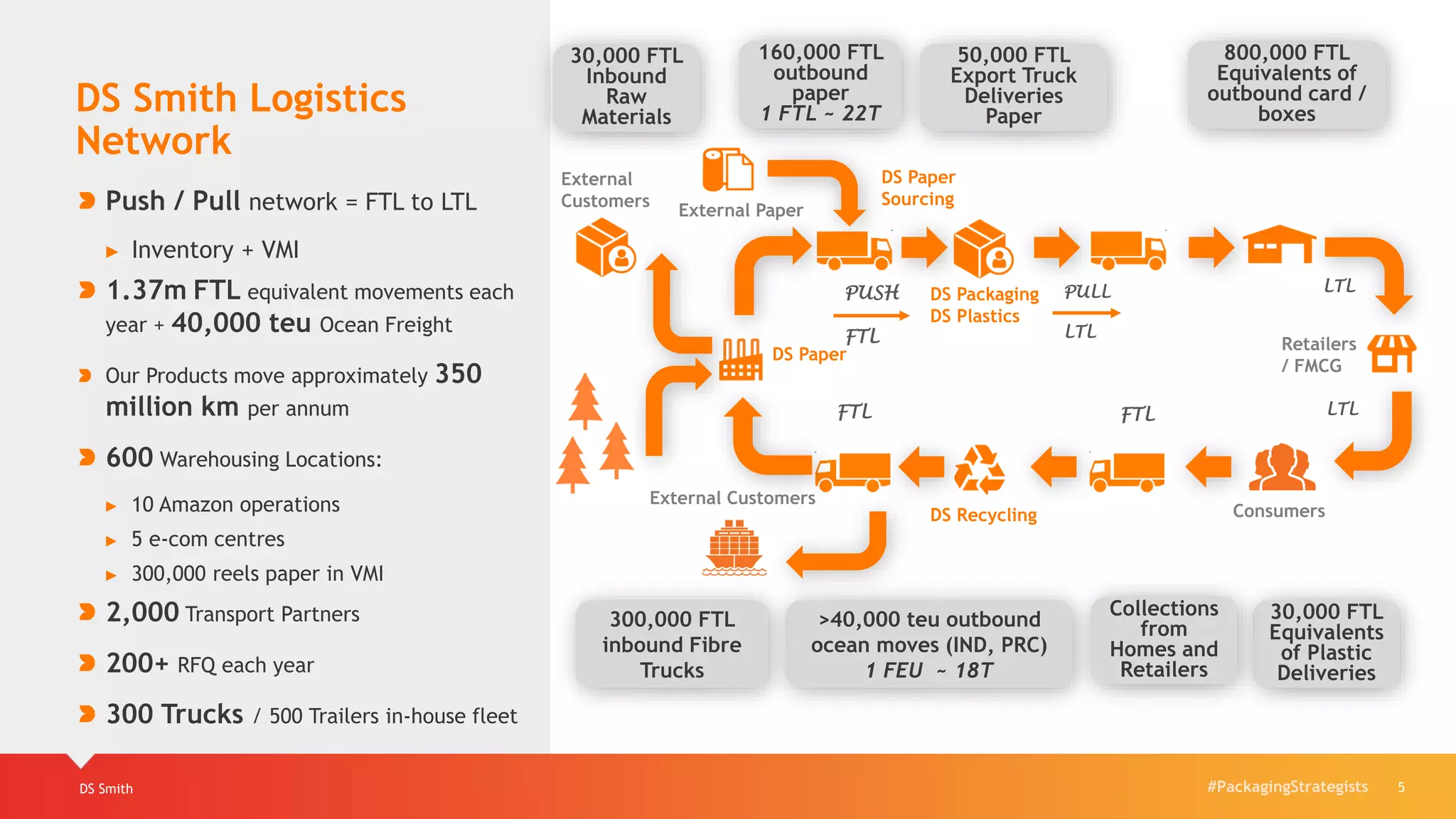

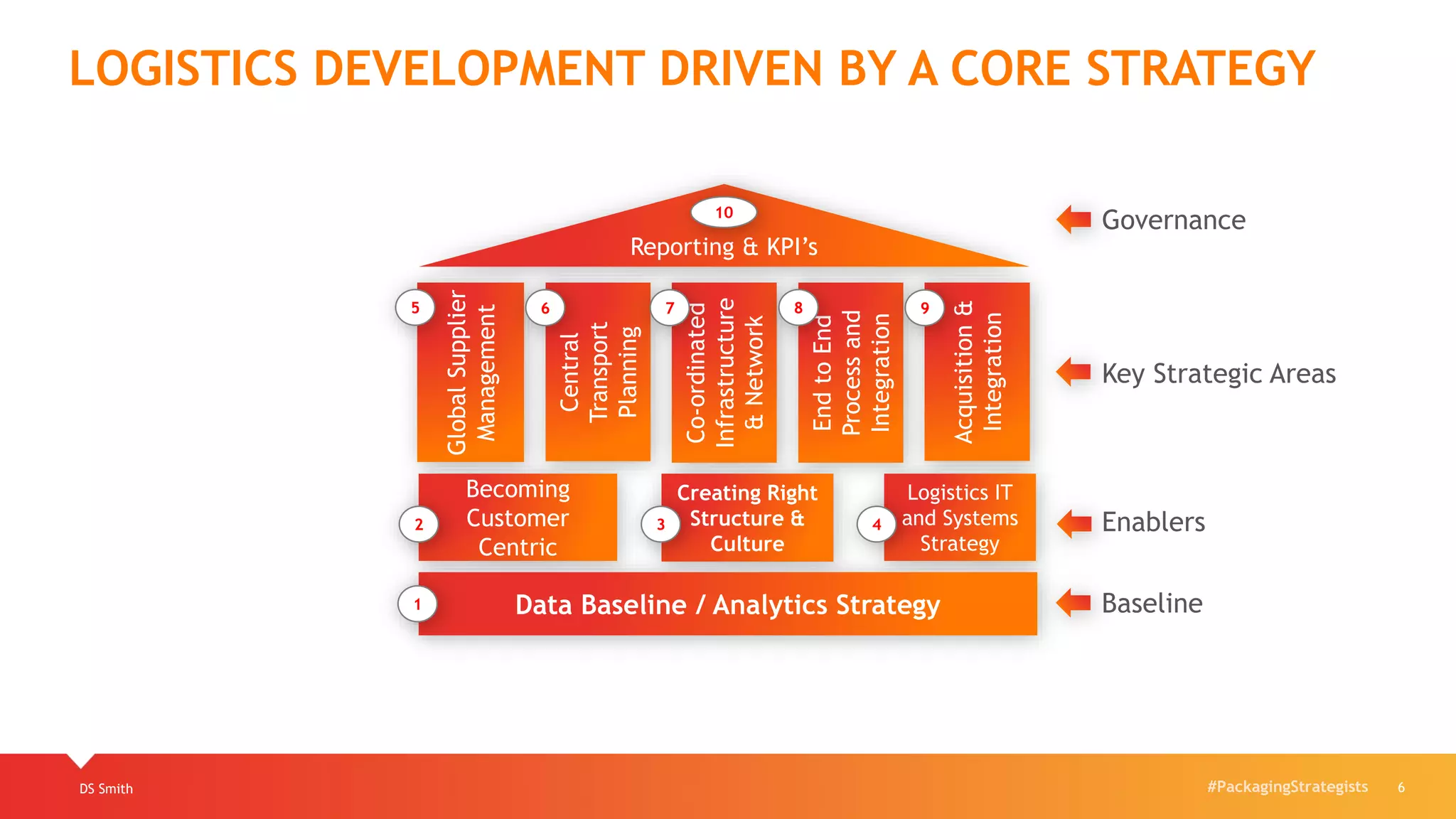

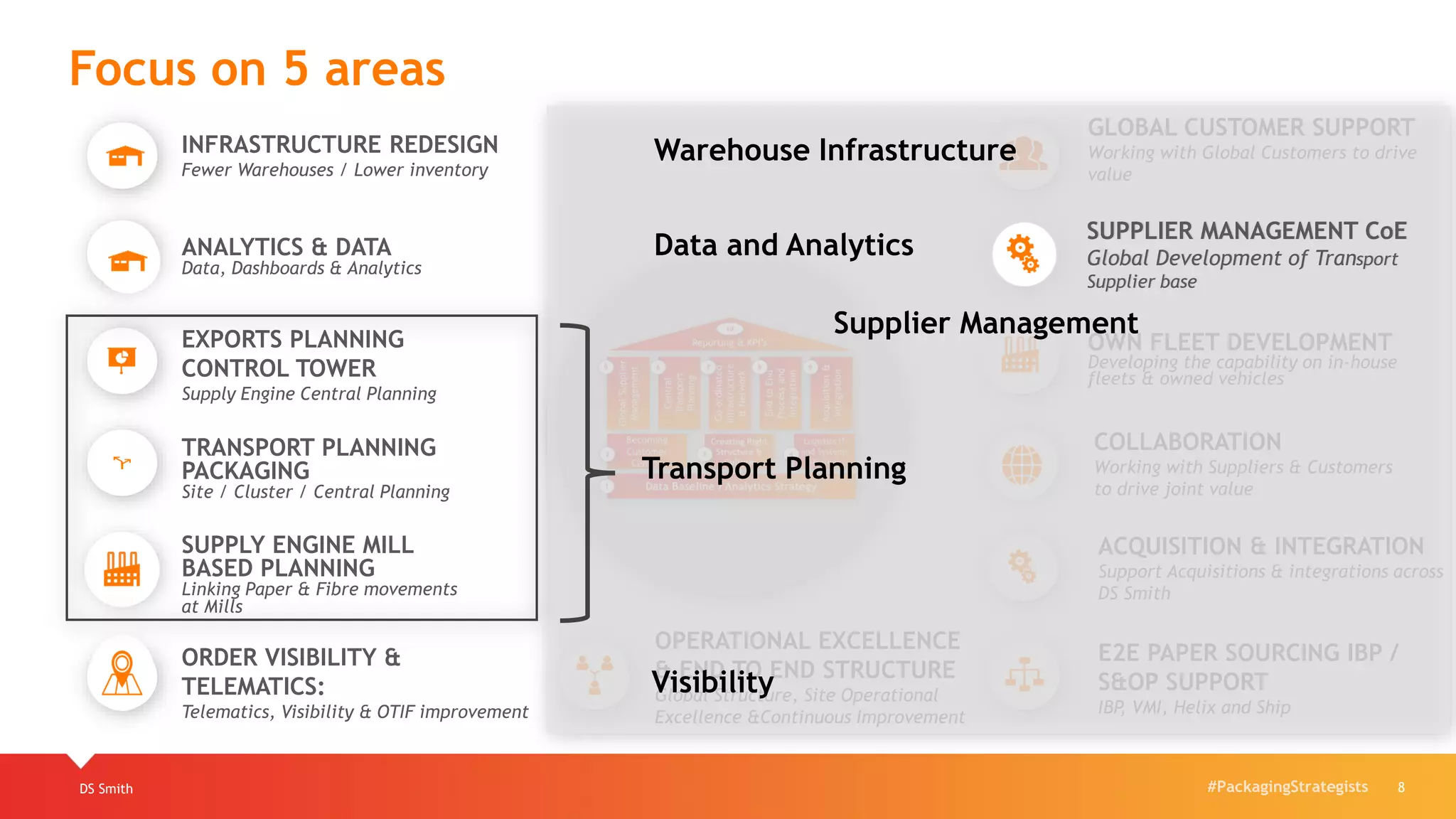

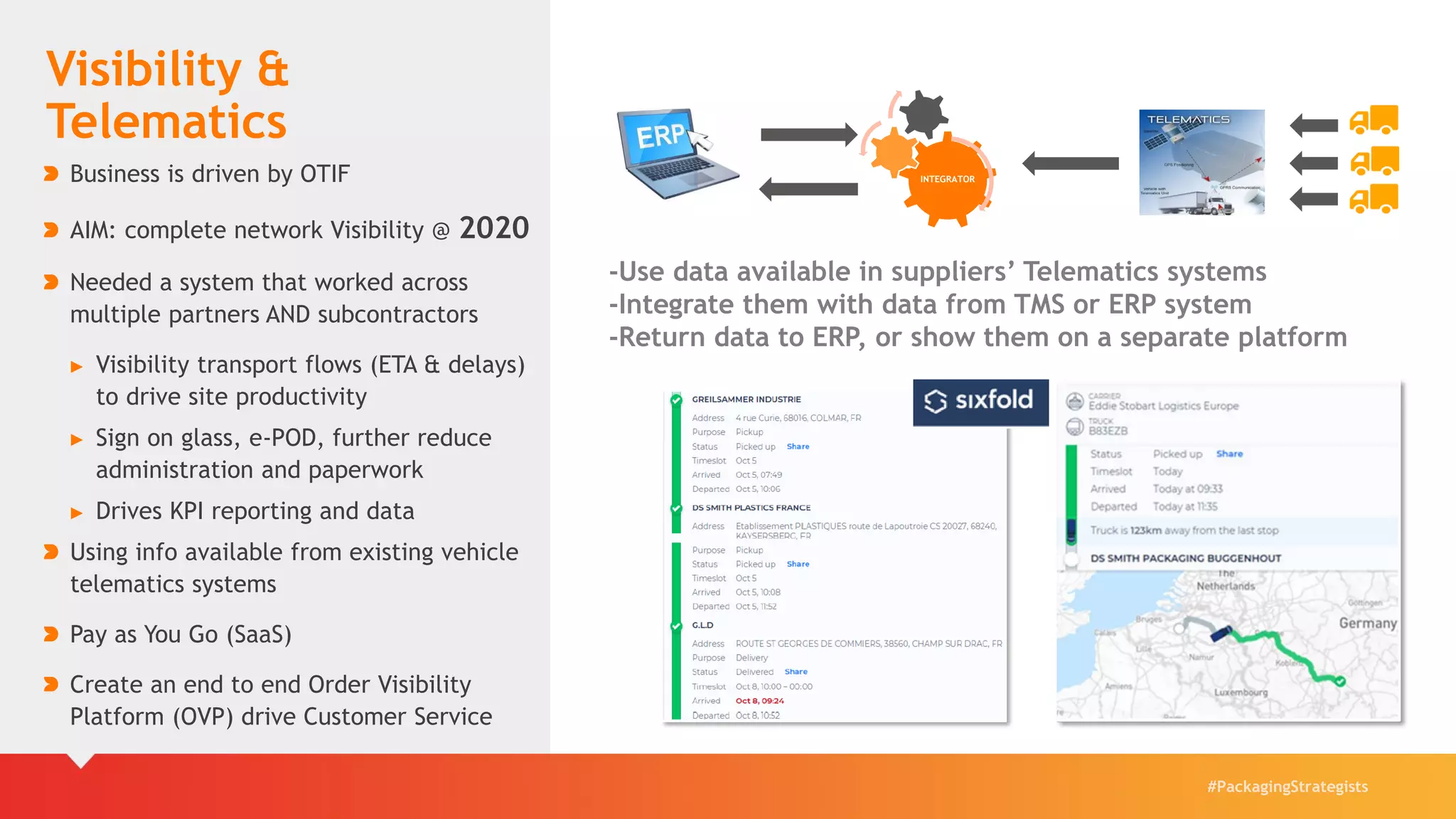

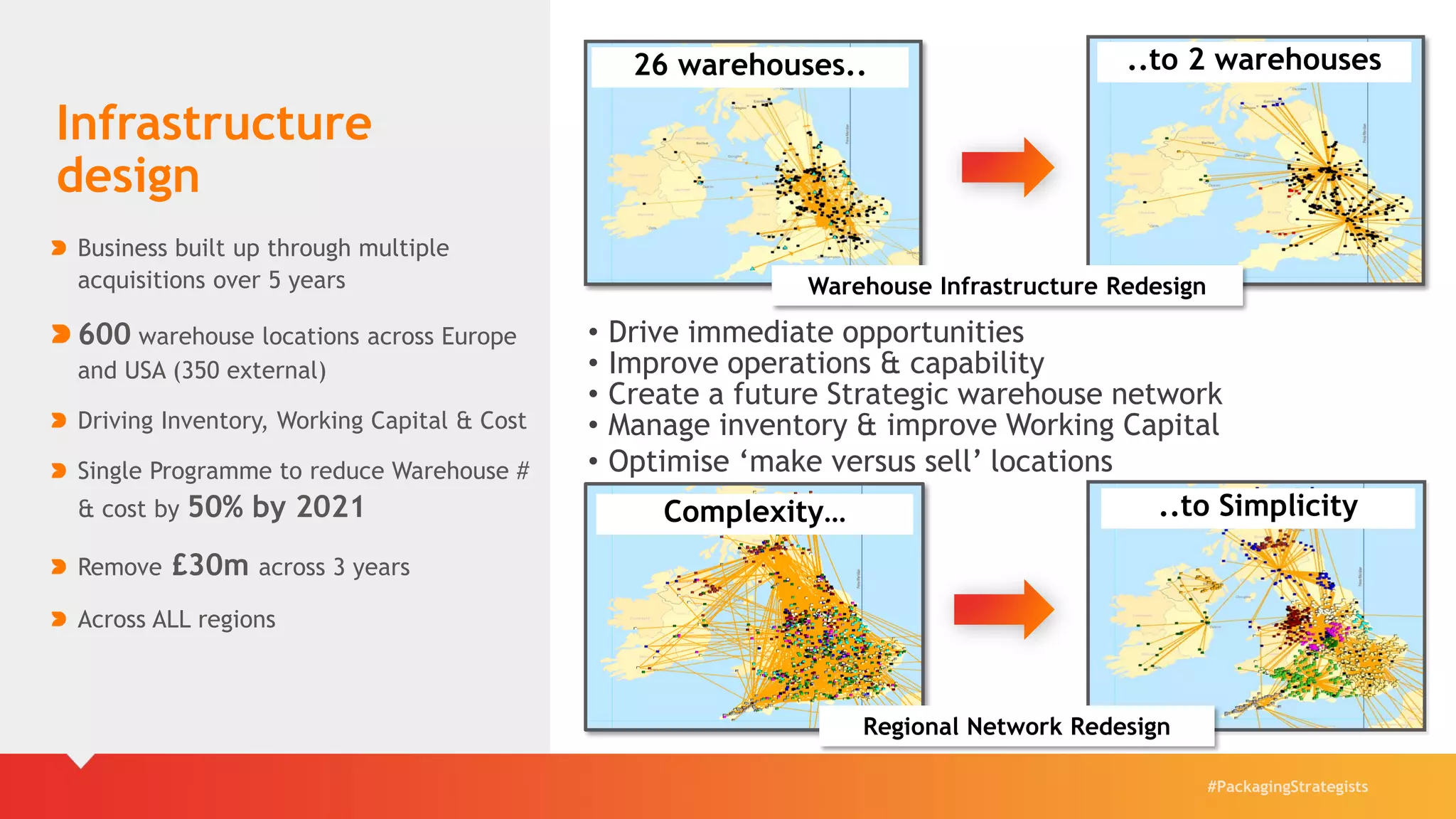

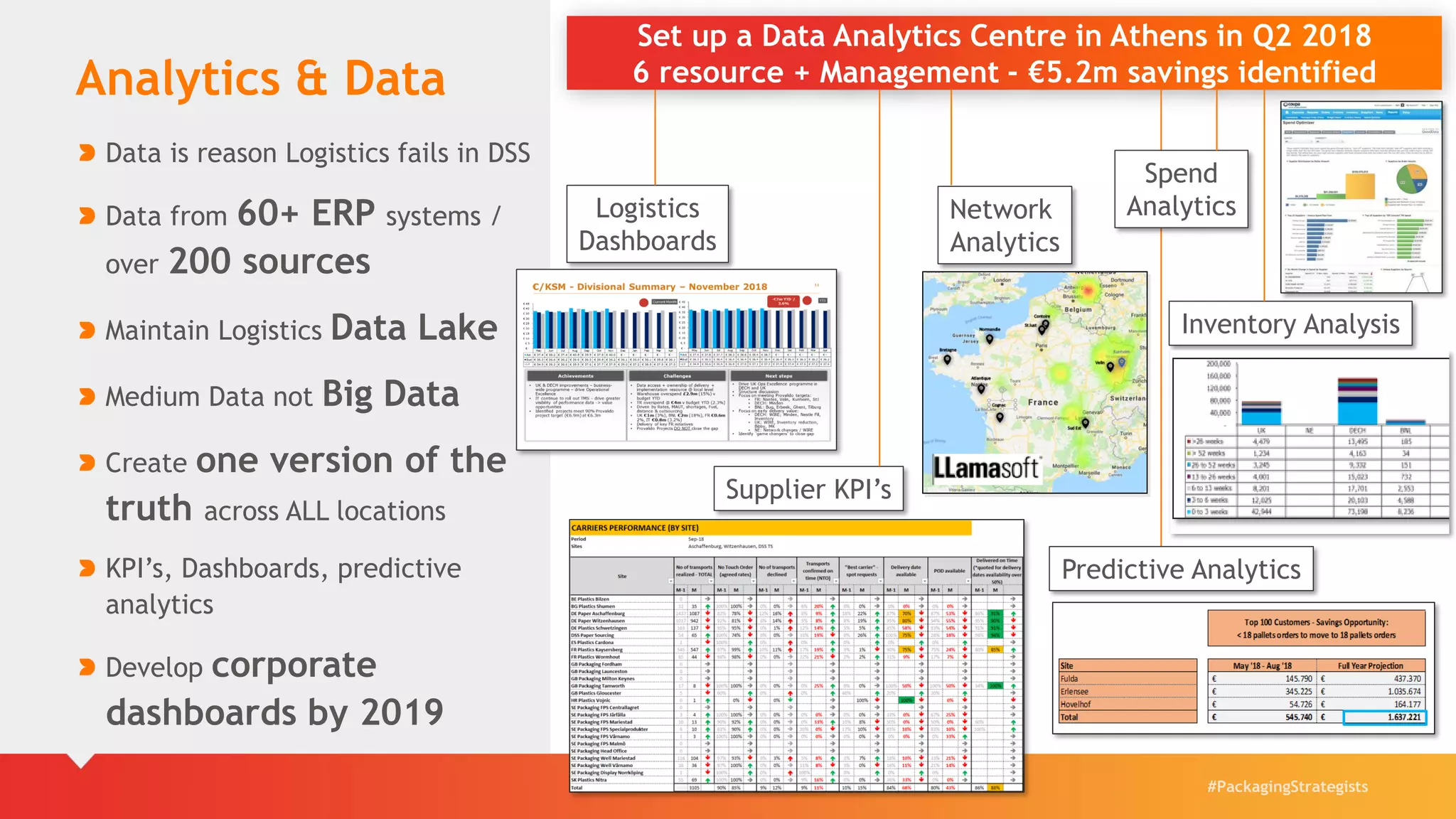

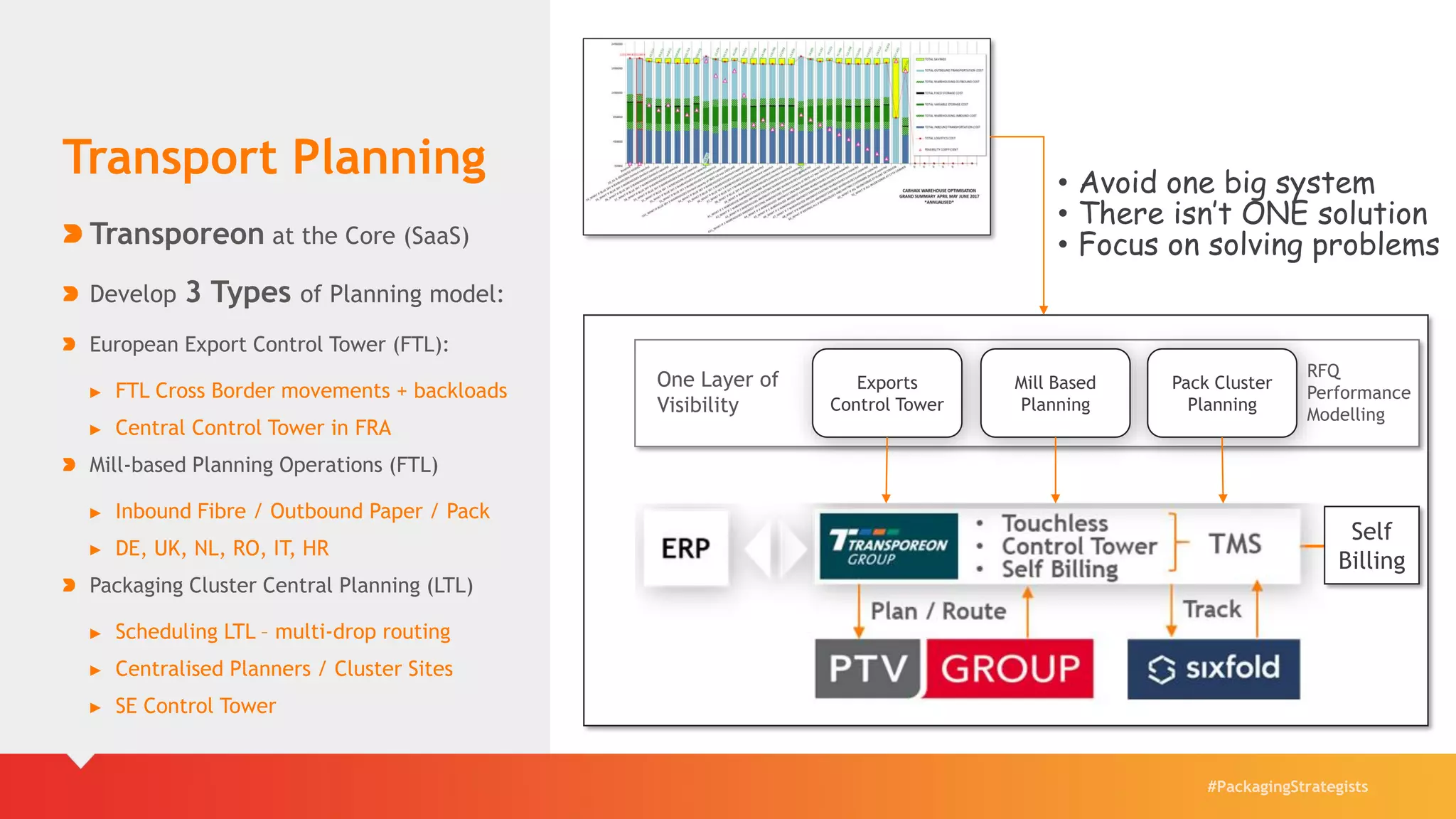

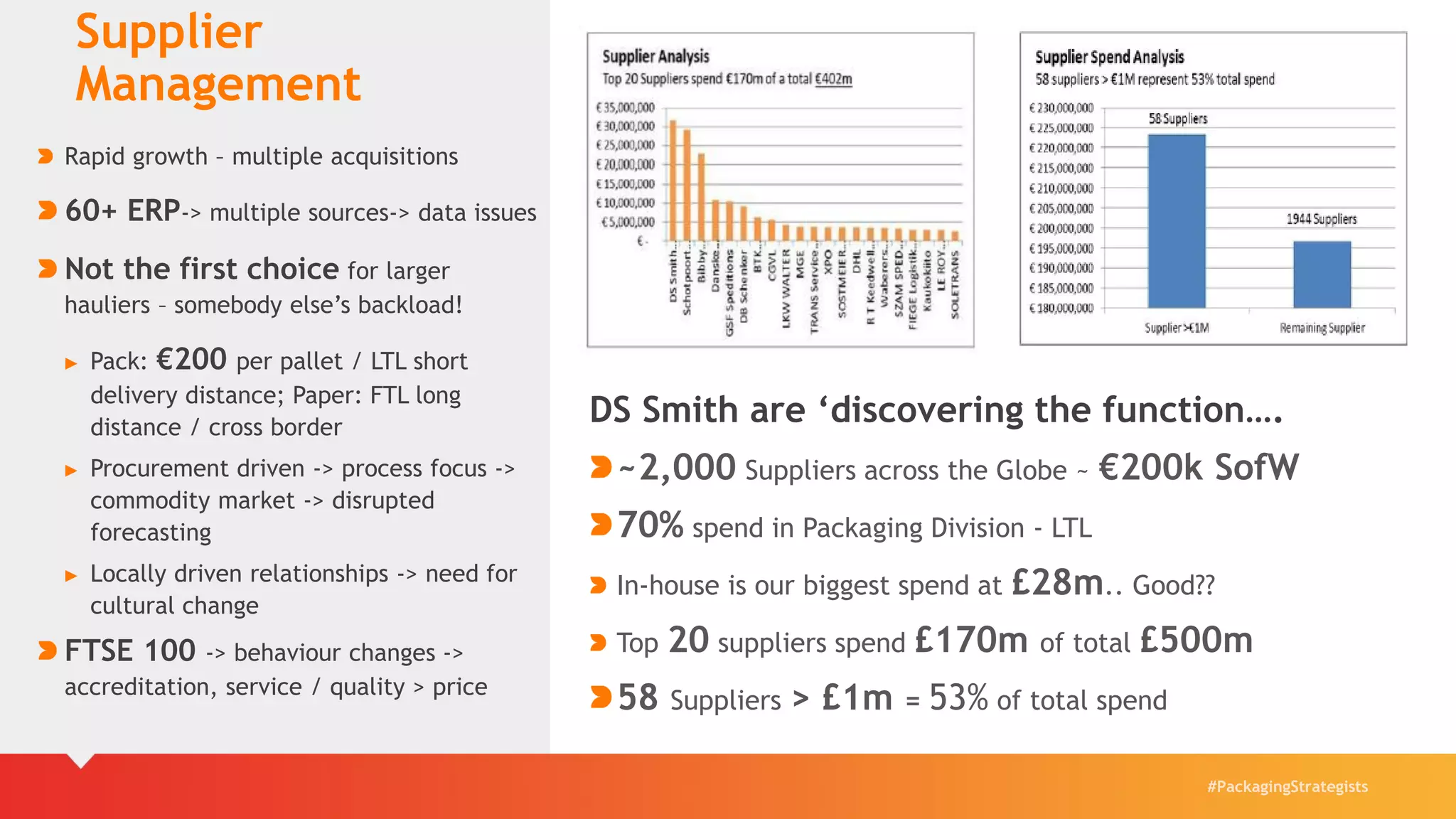

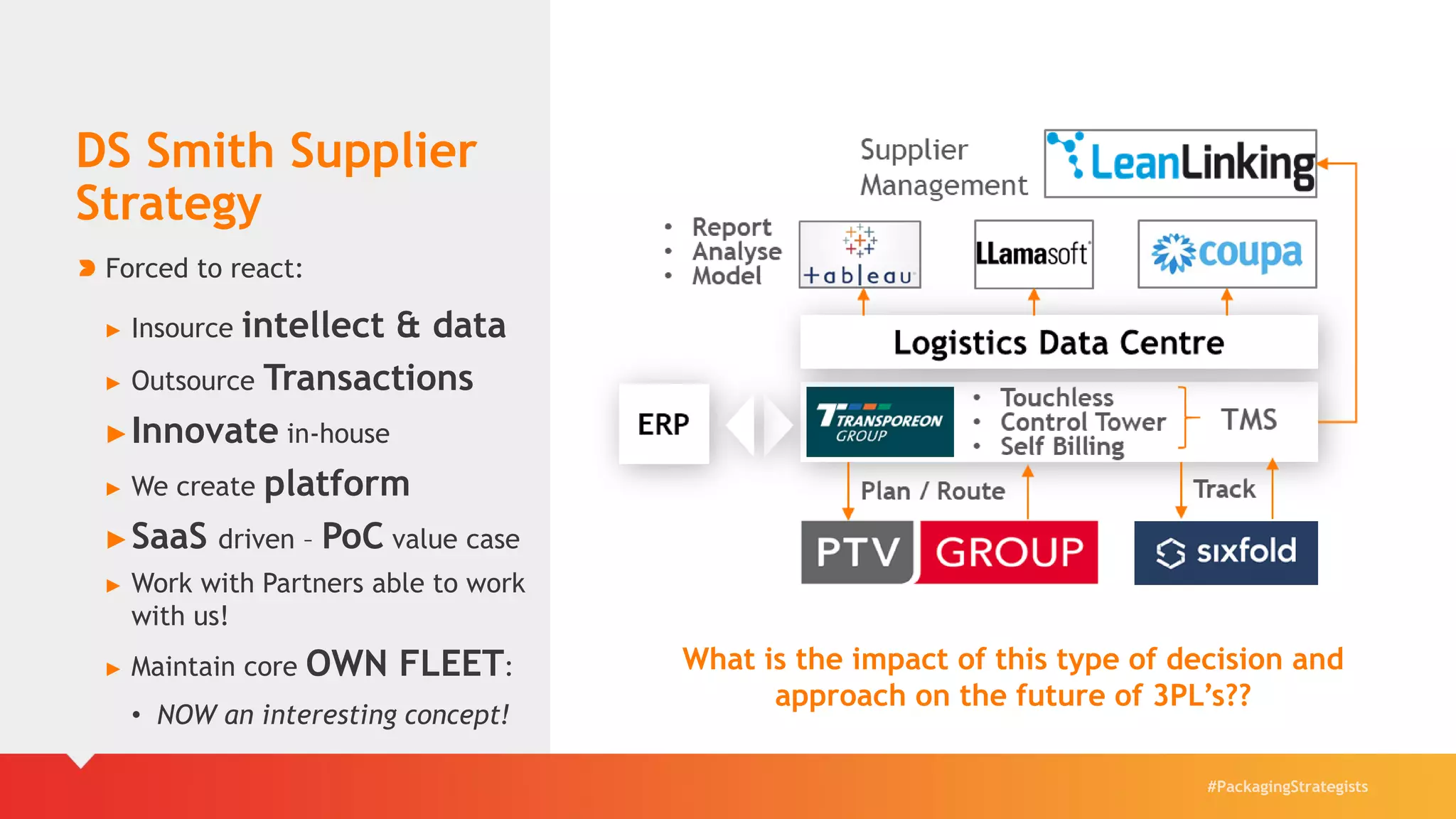

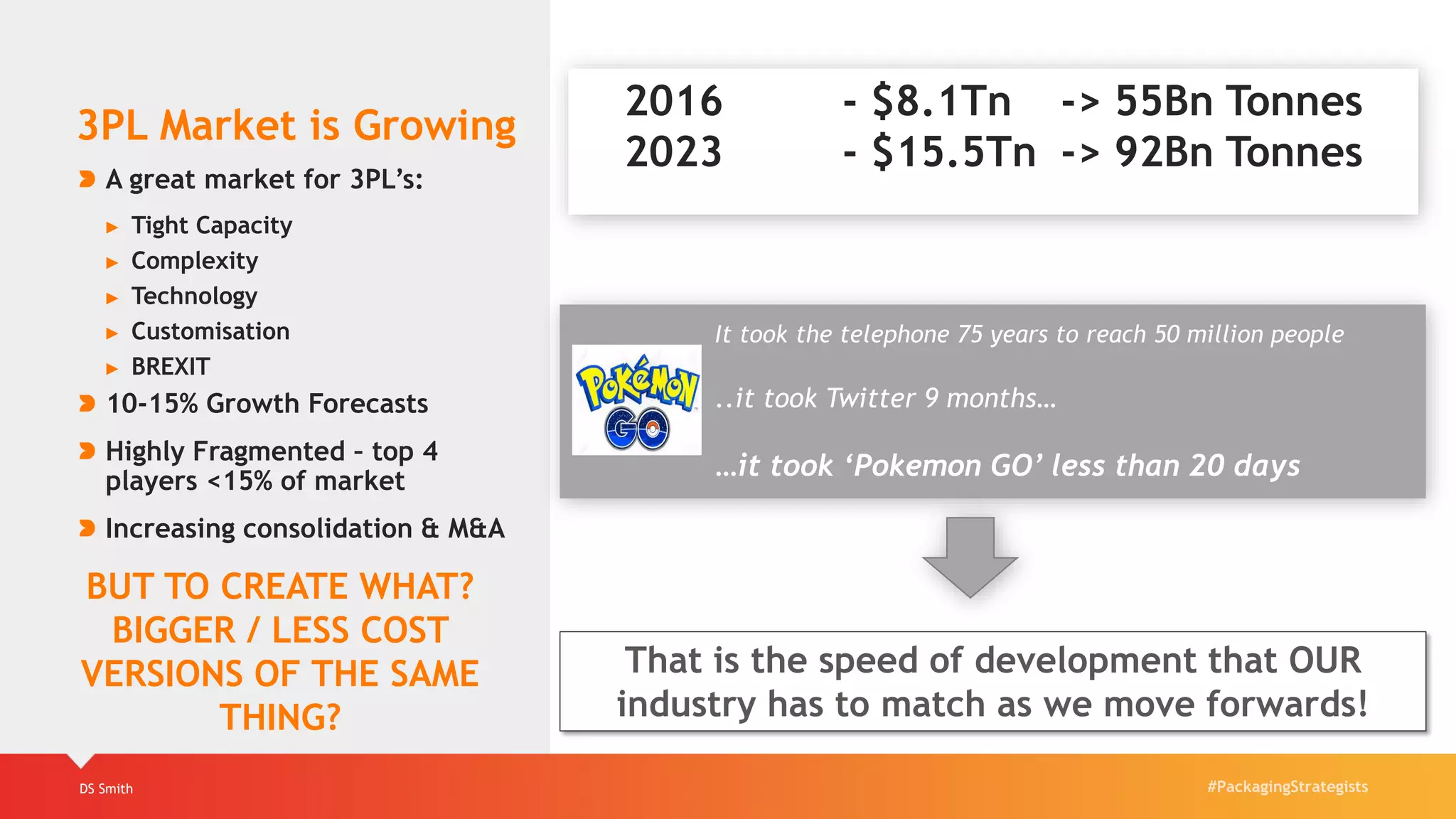

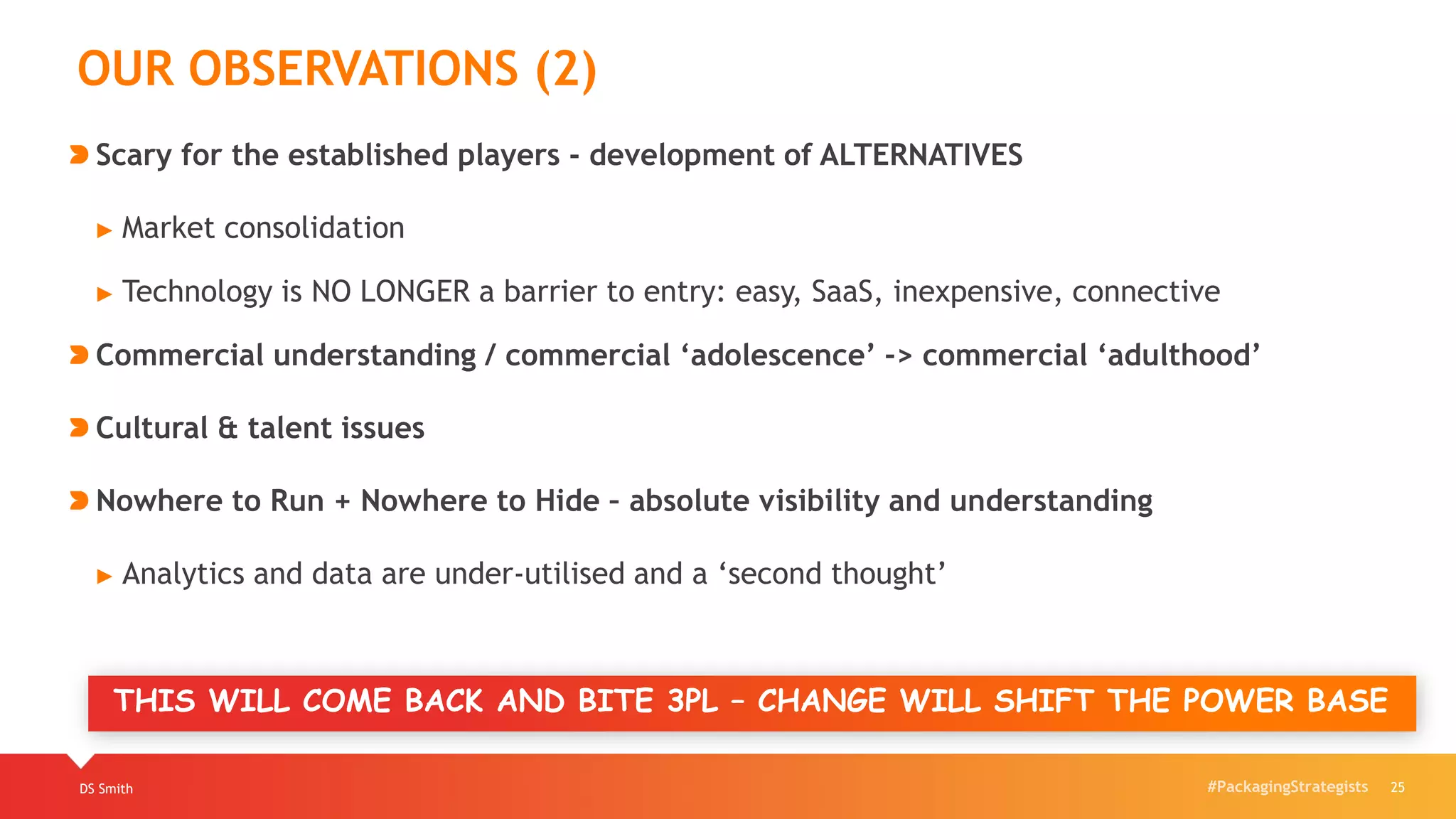

This document discusses DS Smith, a packaging company operating in 37 countries. It summarizes DS Smith's logistics network and strategic plans to improve logistics operations over the next few years. Key focus areas include increasing visibility across the supply chain using telematics, redesigning warehouse infrastructure to reduce costs, improving data analytics capabilities, and developing centralized transport planning. DS Smith also aims to enhance supplier management through a center of excellence and leverage new technologies to make the logistics industry more efficient and less risk averse to change.