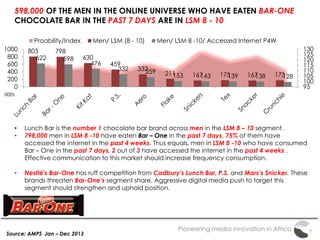

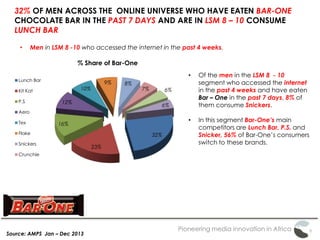

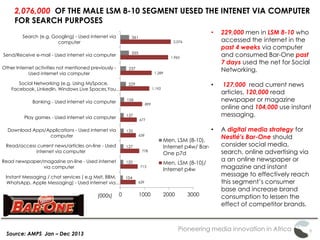

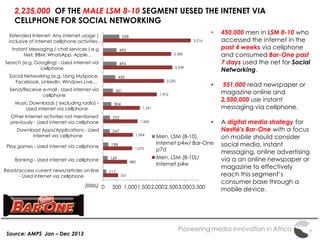

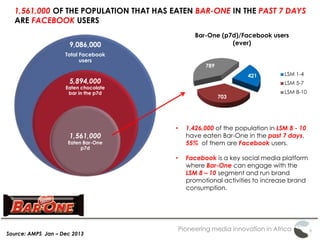

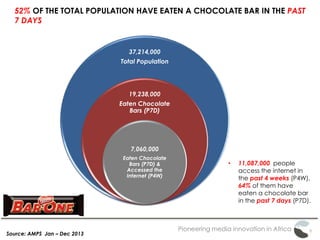

1. The document analyzes chocolate bar consumption and internet usage patterns in South Africa. It finds that 52% of South Africans ate a chocolate bar in the past week, and 64% of internet users also ate chocolate.

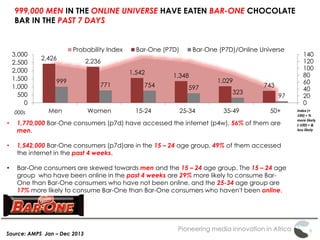

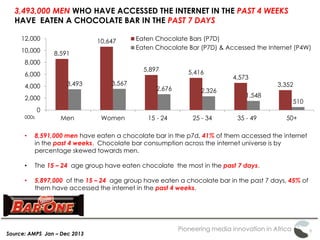

2. Men aged 15-24 who are in LSM socio-economic groups 8-10 (higher income) are the most likely demographic to both use the internet and consume chocolate bars. Specifically, Bar-One chocolate bars.

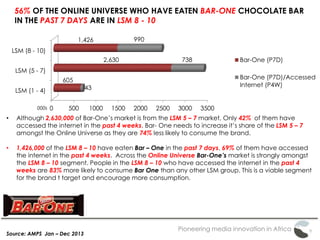

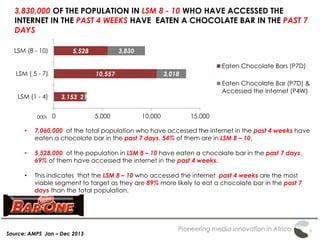

3. The document recommends Nestle target their Bar-One chocolate brand's digital advertising towards men in LSM 8-10 who use the internet, as this group represents a significant portion of Bar-One's consumers and competitors threaten its market share. Focus

![Pioneering media innovation in Africa

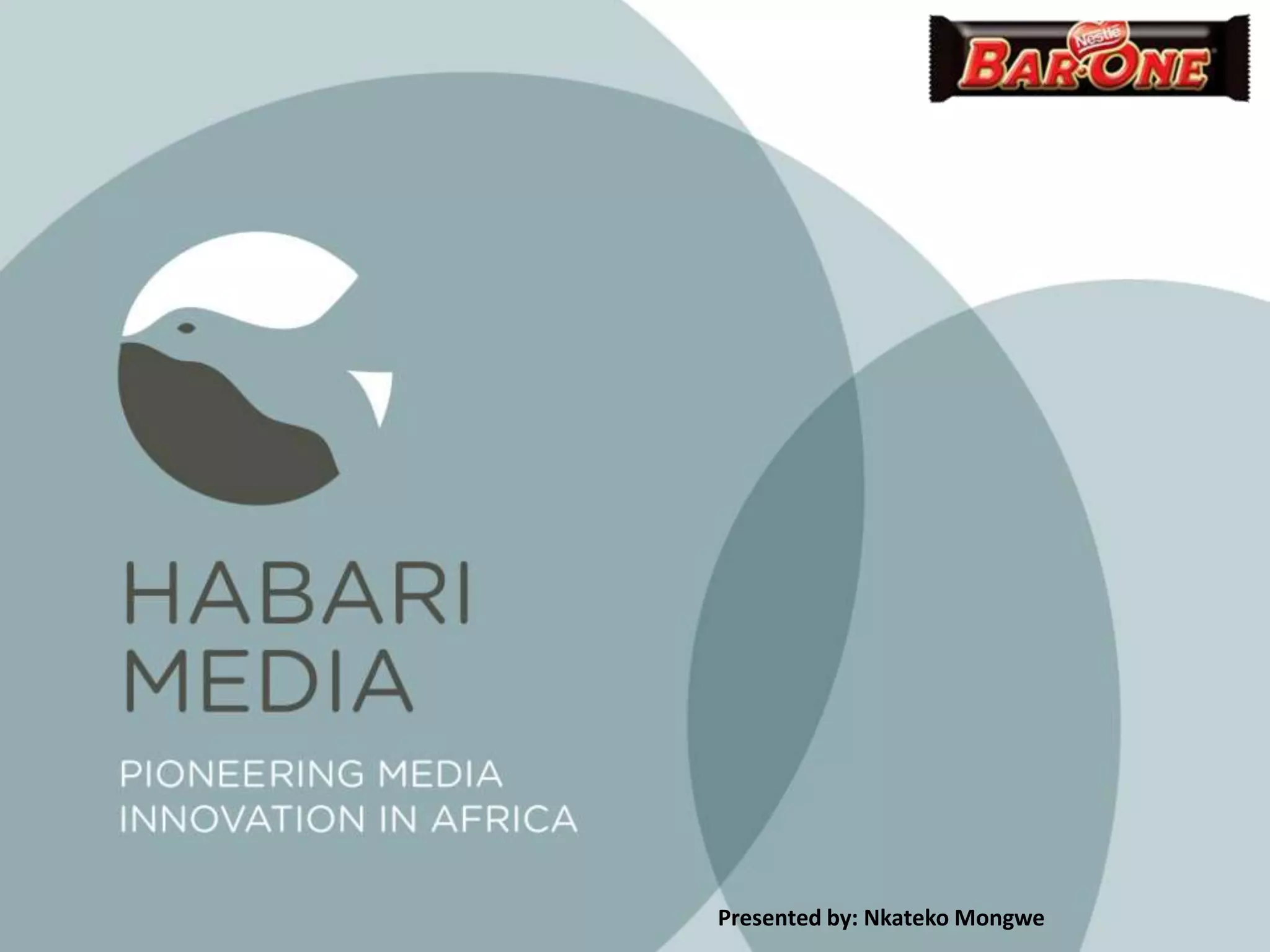

1,934,000 MEN OF THE POPULATION IN LSM 8 - 10 WHO HAVE ACCESSED THE

INTERNET IN THE PAST 4 WEEKS HAVE EATEN A CHOCOLATE BAR IN THE PAST 7

DAYS

Source: AMPS Jan – Dec 2013

1,871

121

1,282

90

5,865

1,550

4,693

1,468

2,911

1,896

2,616

1,934

0 5,000 10,000

Eaten Chocolate Bars

(P7D)/Women

[Eaten Chocolate Bar (P7D) &

Accessed the Internet (P4W)] /

Women

Eaten Chocolate Bars

(P7D)/Men

[Eaten Chocolate Bar (P7D) &

Accessed the Internet (P4W)] /

Men

LSM (8 - 10) LSM ( 5 - 7) LSM (1 - 4)

000s

• 3,493,000 men of the total population who

accessed the internet in the past 4 weeks

have eaten a chocolate bar in the past 7

days, 55% of them are in LSM 8 – 10.

• 2,616,000 men in the LSM 8 – 10 segment

have eaten a chocolate bar in the past 7

days, 74% of them have been online in the

past 4 weeks.

• Amongst the Online Universe chocolate bar

consumption in the LSM 8 -10 segment is

skewed towards men.

• Male oriented web-sites will be mostly

effective for a chocolate bar brand to

communicate it’s message to this market.](https://image.slidesharecdn.com/bf56211f-a854-479e-a519-9ac7e850f02e-150327130547-conversion-gate01/85/Nestle-Bar-One_-5-320.jpg)