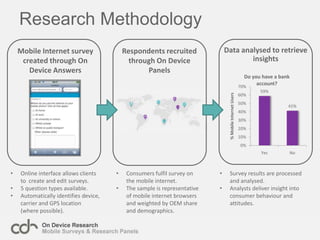

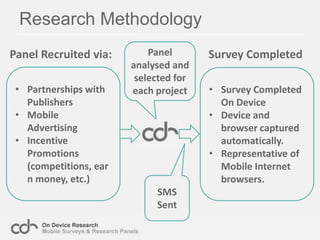

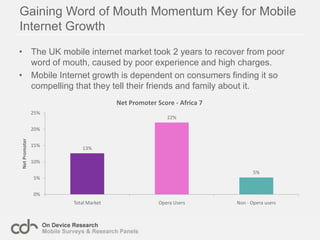

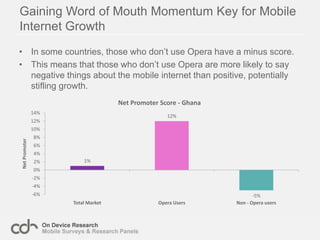

1. The document summarizes research from a survey of 7,325 mobile internet users across 7 African countries about their browsing behaviors and satisfaction with their devices and mobile operators.

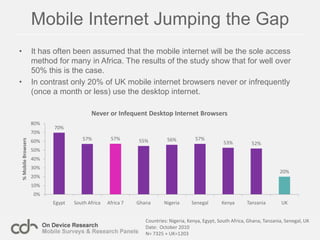

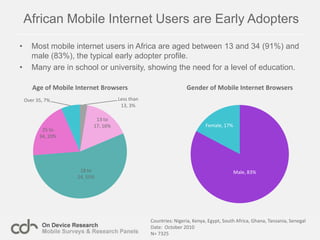

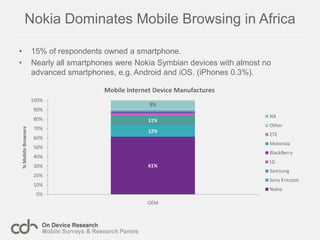

2. It finds that over 50% of users access the mobile internet as their sole way to connect, and that most are young, male, and early adopters. Nokia devices dominate the market.

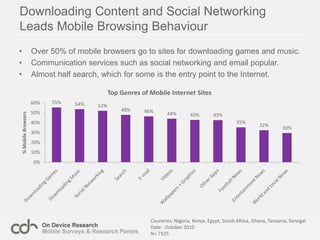

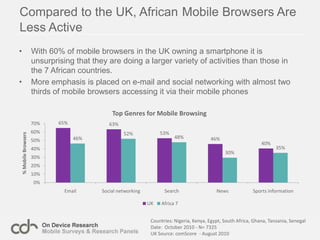

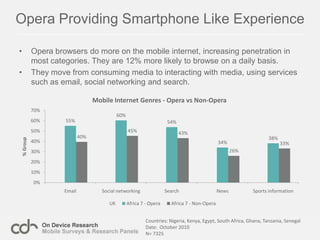

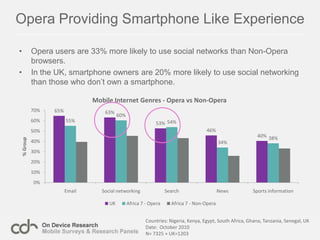

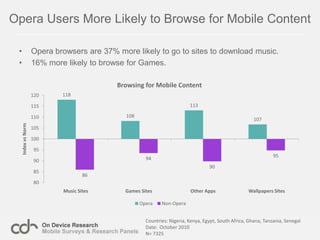

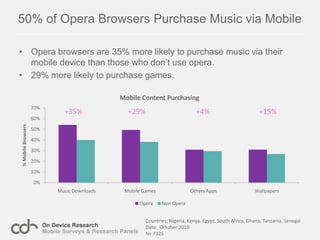

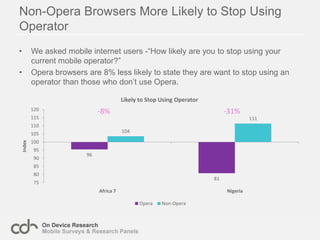

3. Users primarily download content like games and music, or use communication services like social media and email. Opera browsers facilitate more engagement like social networking and purchasing content.