Embed presentation

Downloaded 19 times

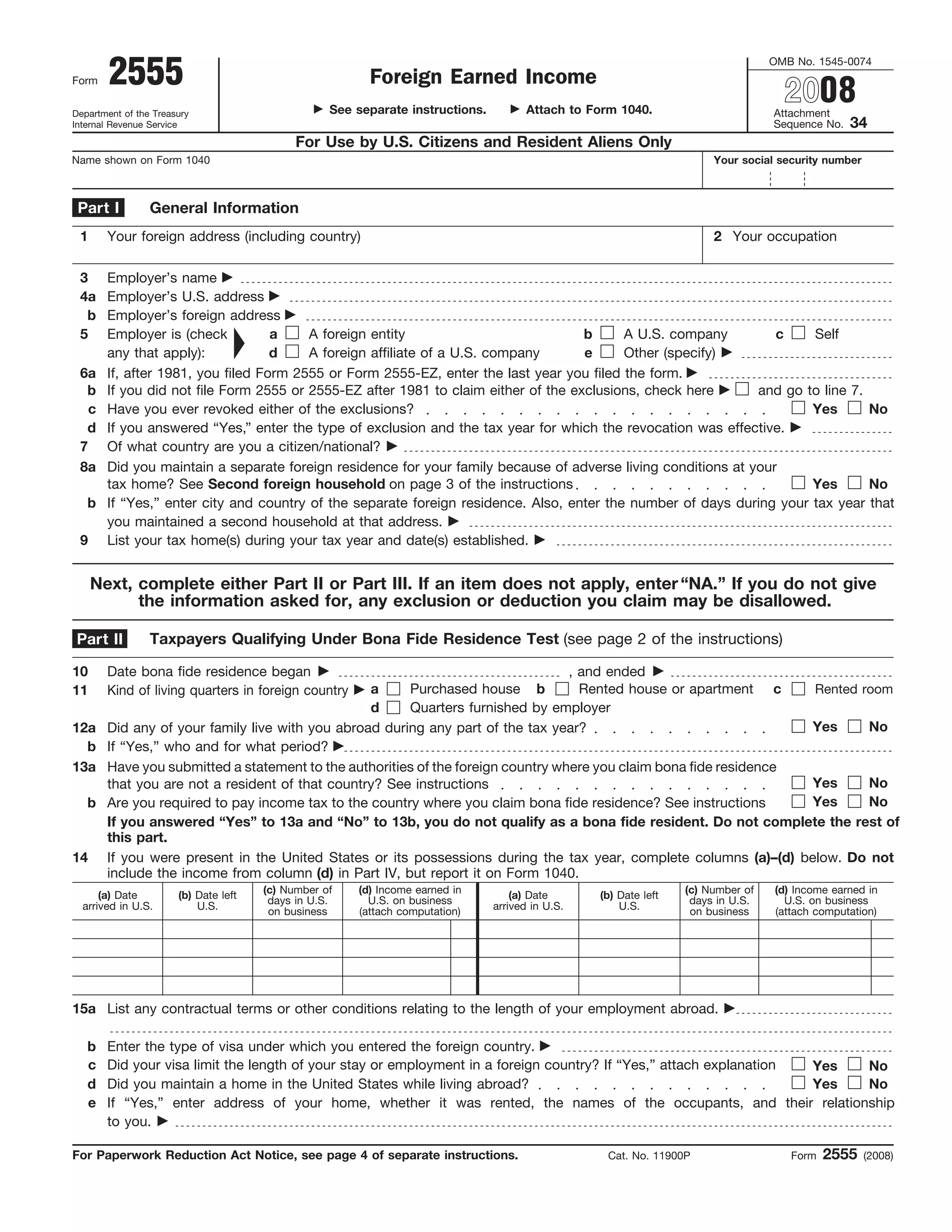

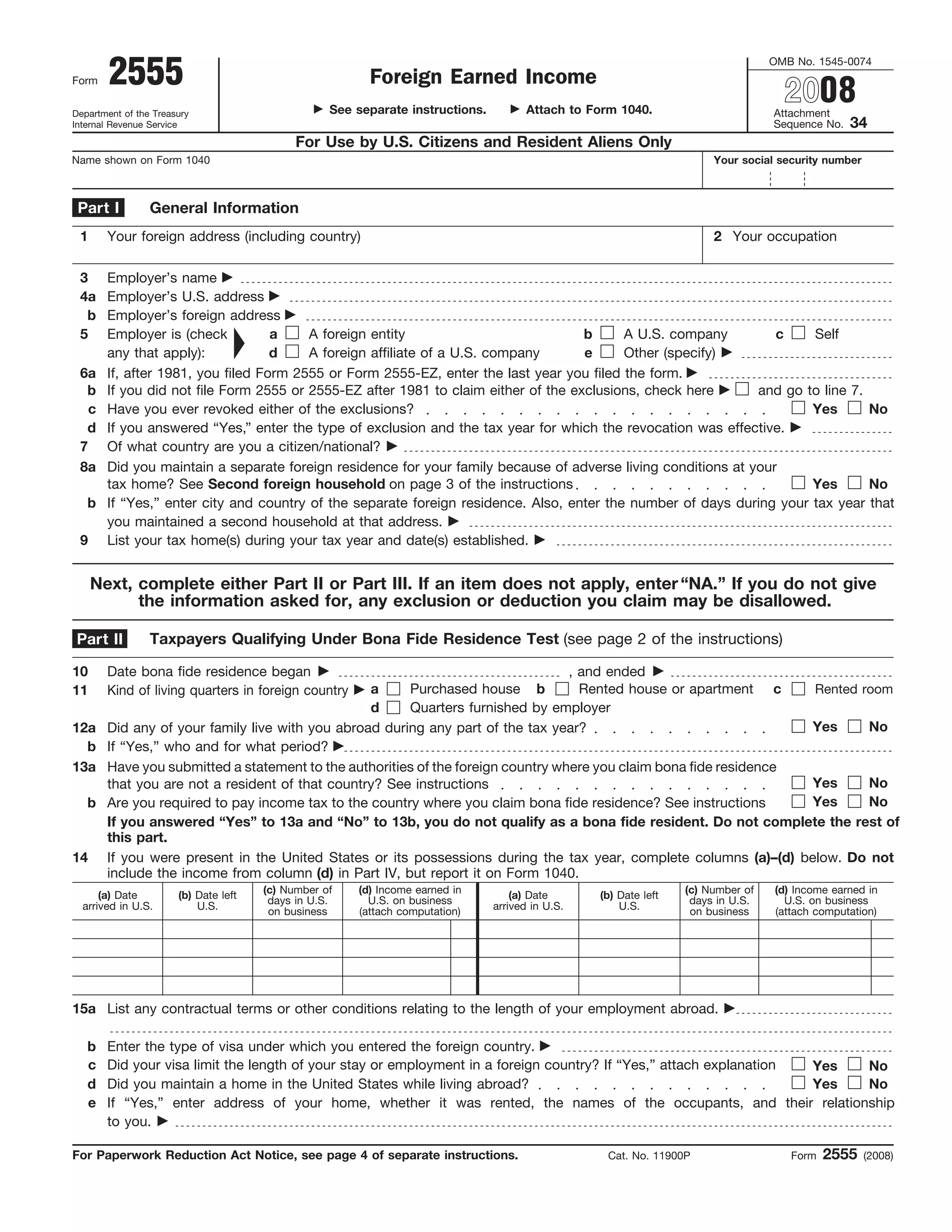

This document is the IRS Form 2555 for foreign earned income. It contains sections for general information about the taxpayer's foreign address and employer. It also contains sections to determine if the taxpayer qualifies under the bona fide residence test or physical presence test. There are sections to report foreign earned income and determine eligibility for the housing exclusion or deduction. The form is used by U.S. citizens and residents to report foreign earned income and claim tax benefits.