This document discusses customer retention and lifecycle management strategies at eircom. It covers:

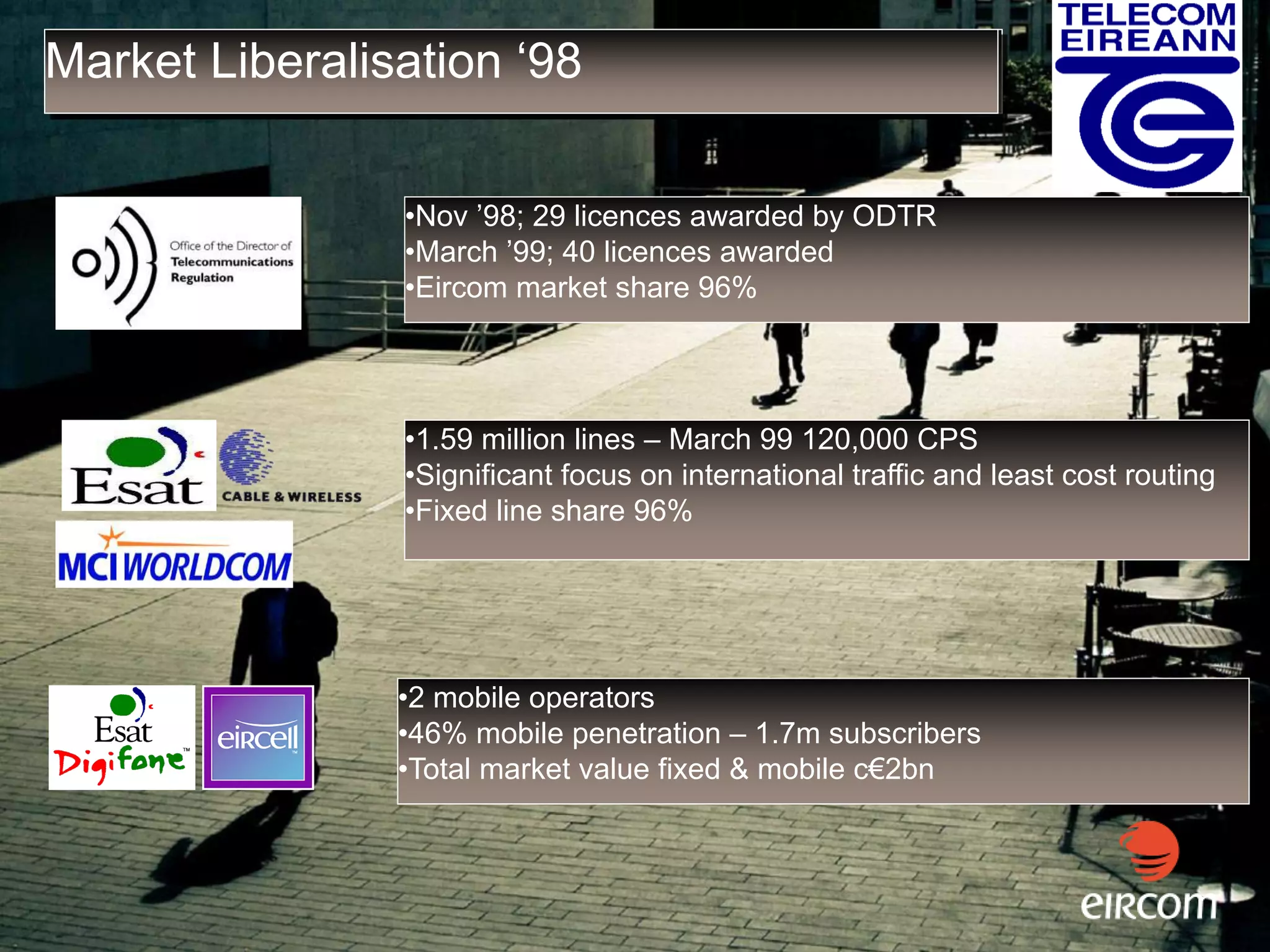

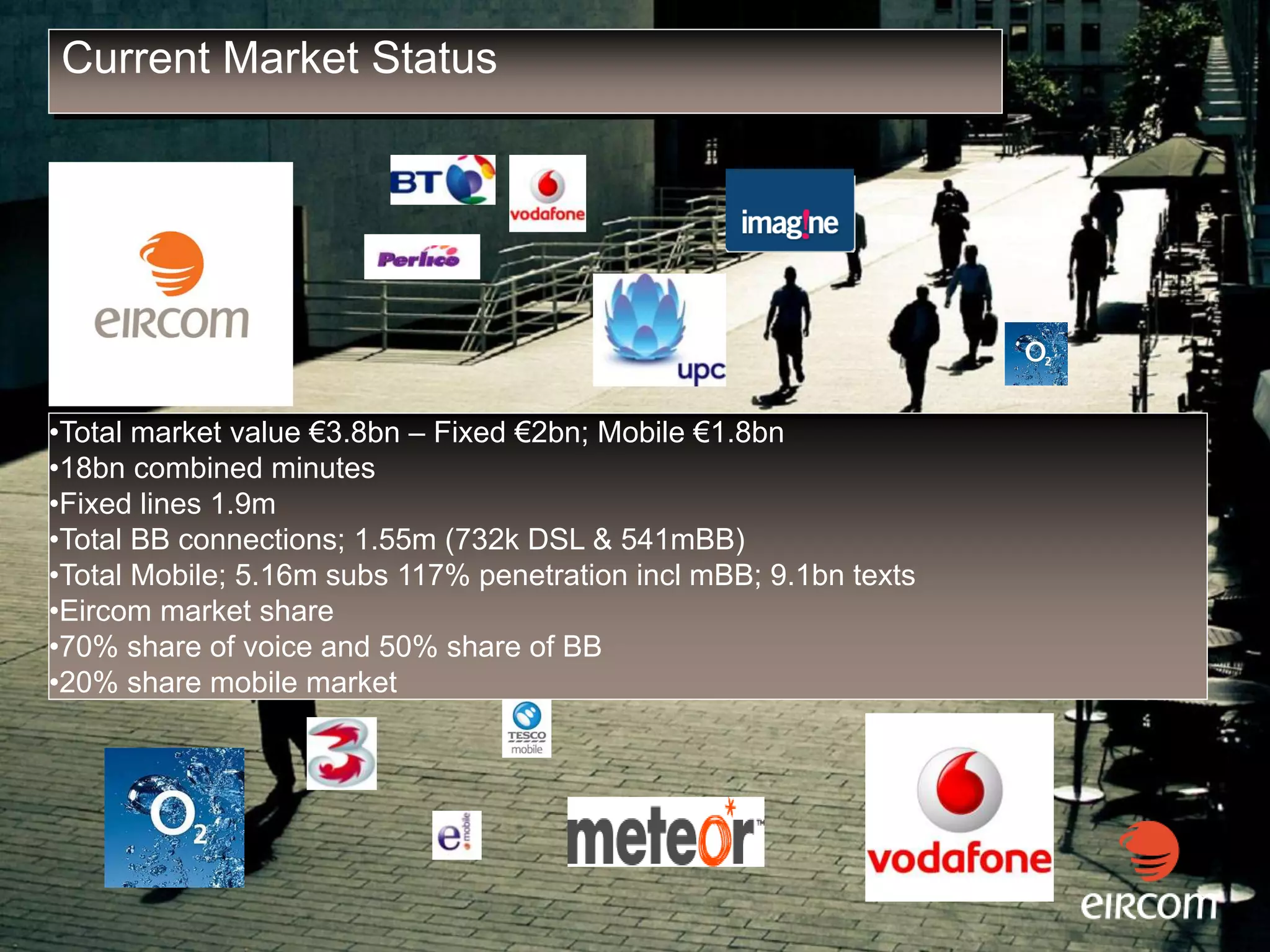

1) A brief history of the telecommunications market in Ireland since liberalization in 1998 and eircom's declining market share.

2) eircom's initial customer retention efforts in the late 1990s and 2000s, including establishing win-back teams and a professional development system for employees.

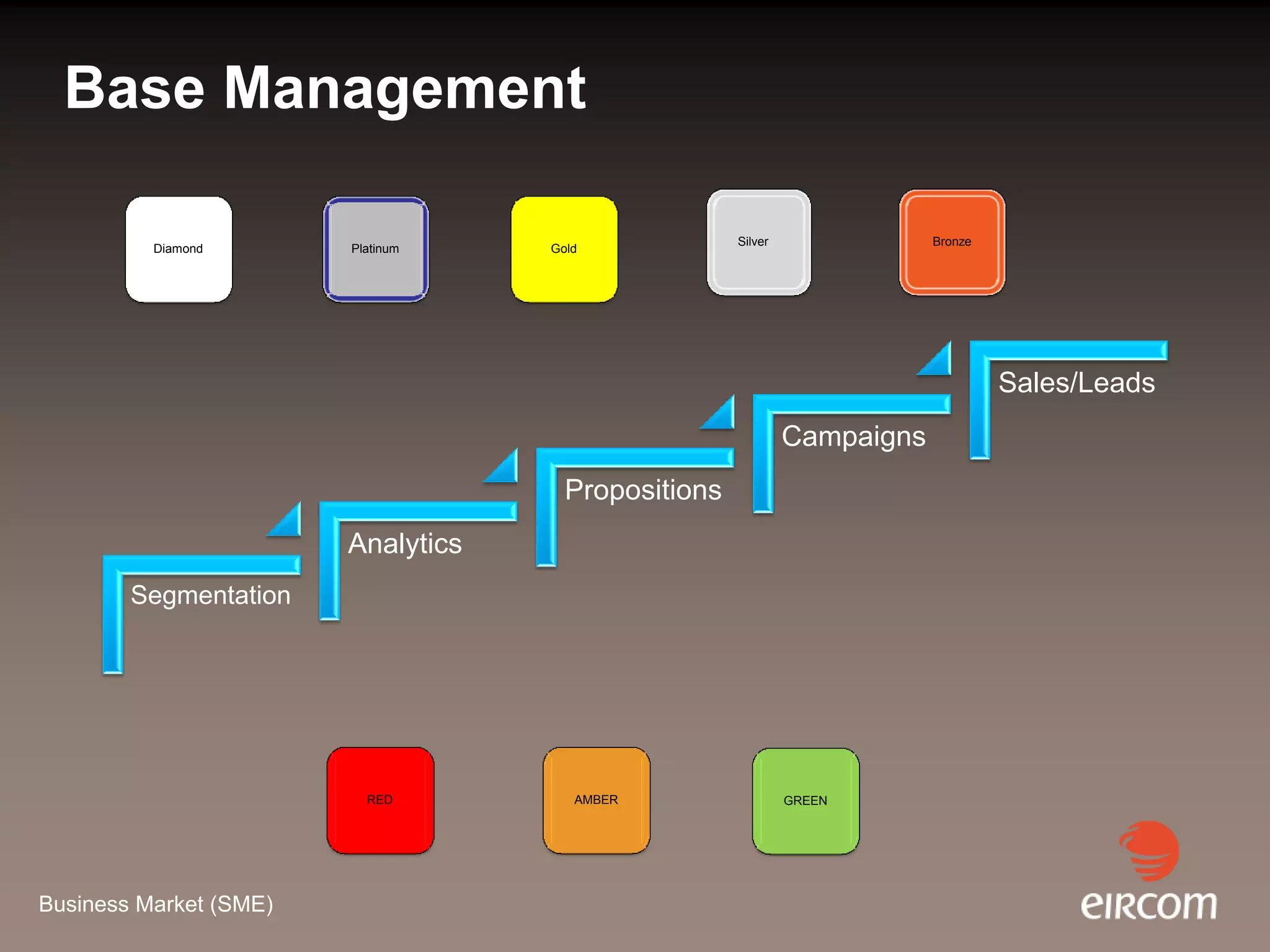

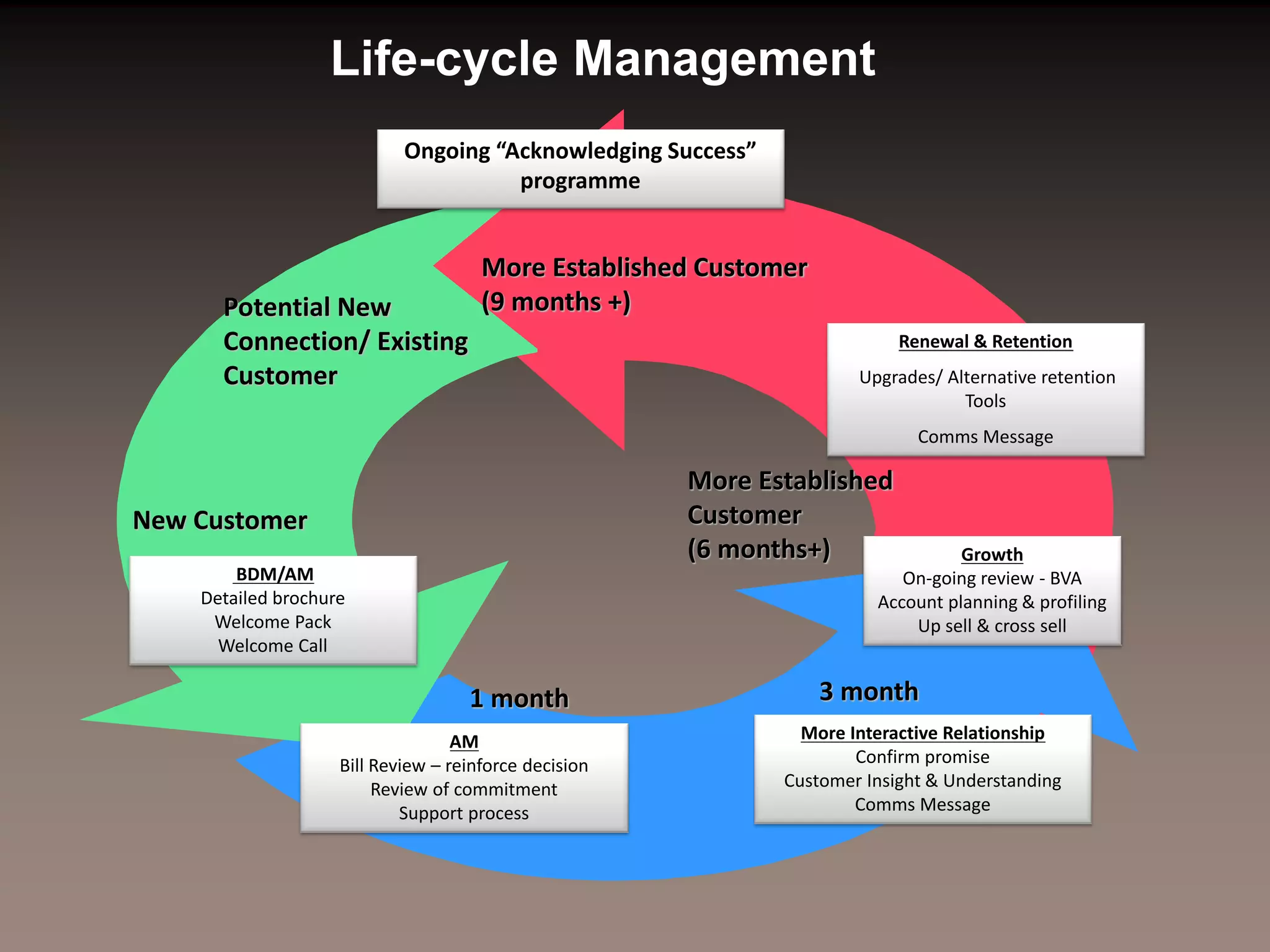

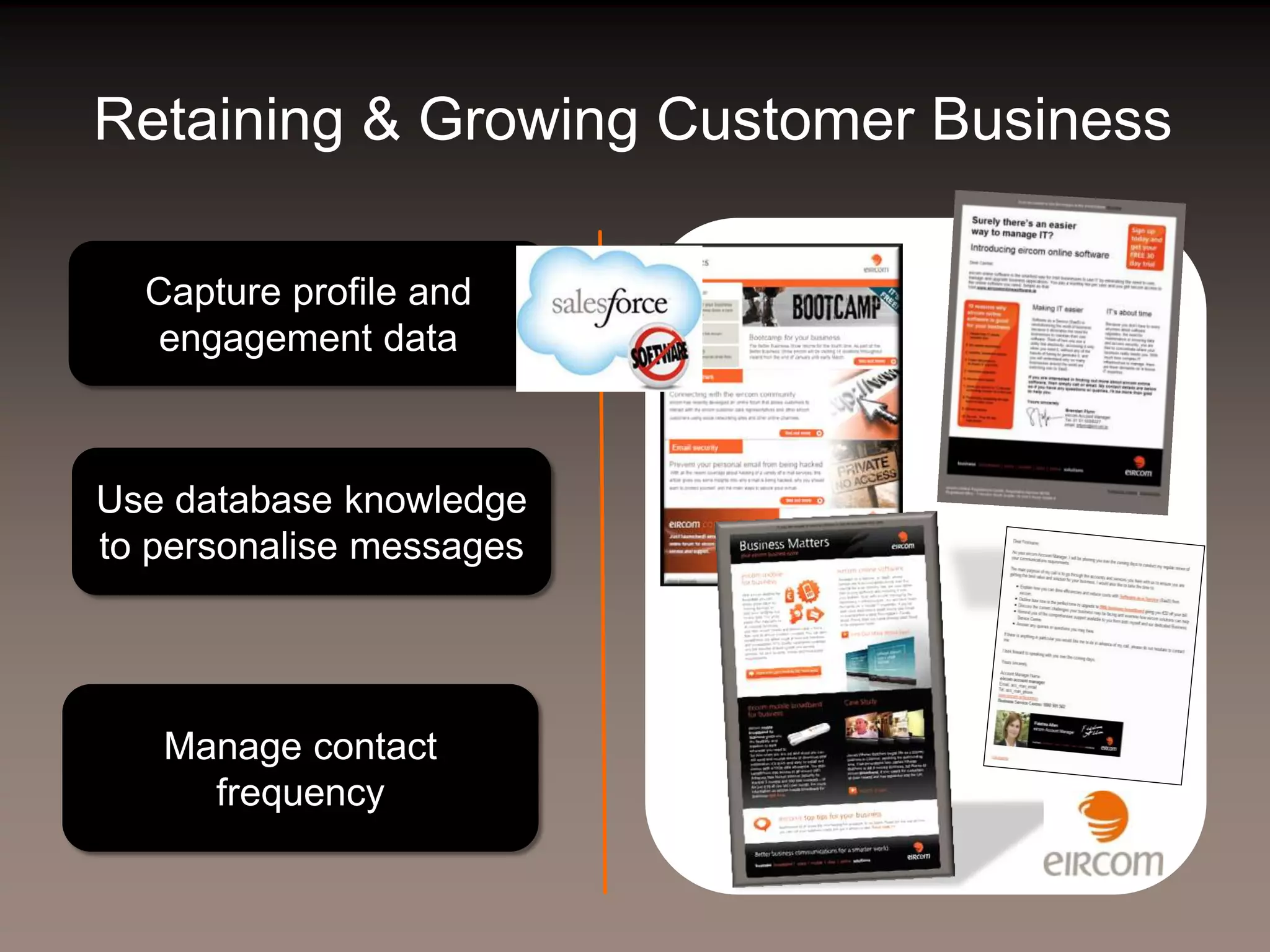

3) More recent strategies like customer profiling and segmentation, targeted lifecycle management, continuous process improvement, and communicating eircom's value proposition.

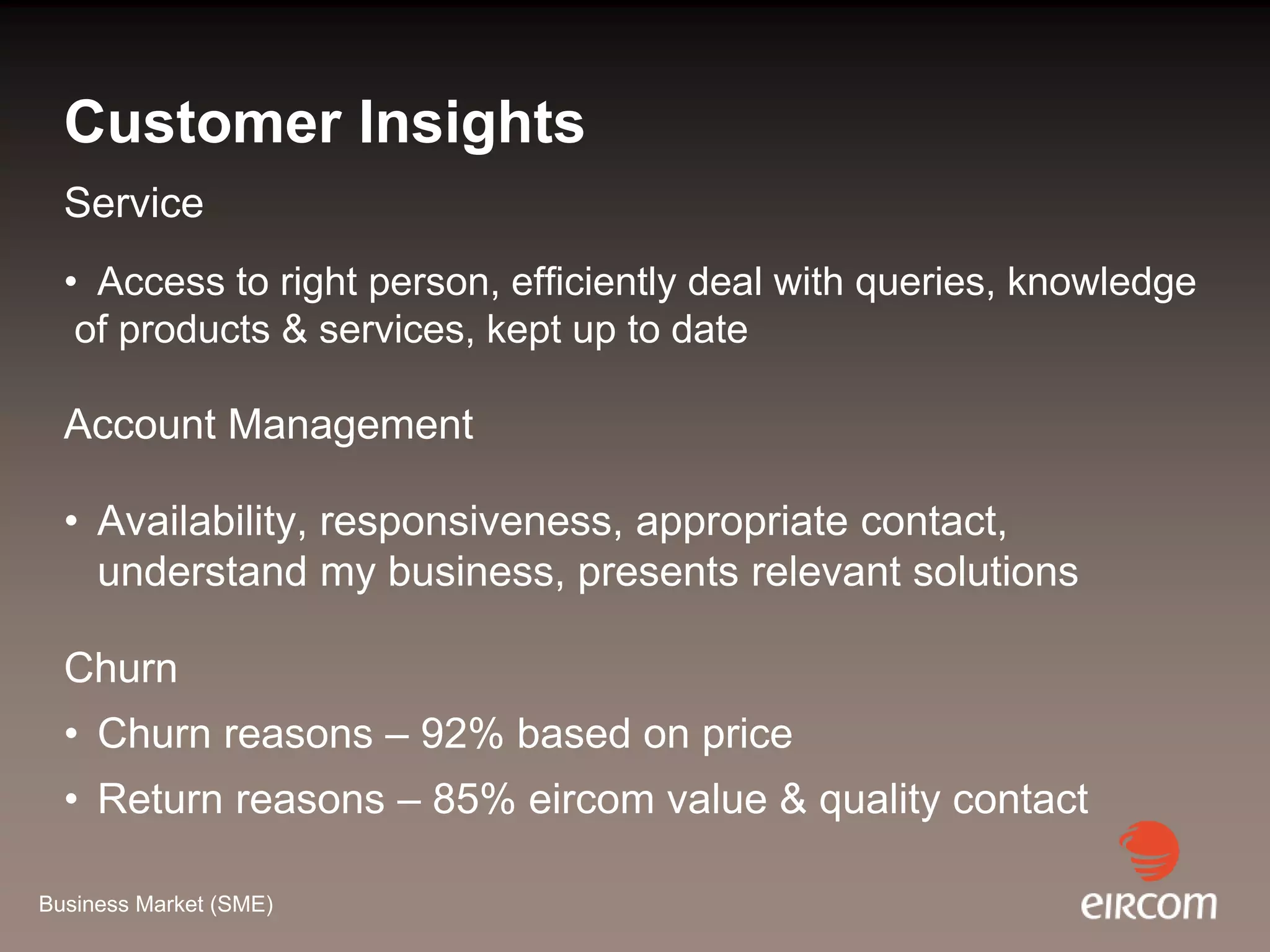

4) The importance of understanding customers, capturing insights, and using data to personalize engagement at different stages of the customer lifecycle.