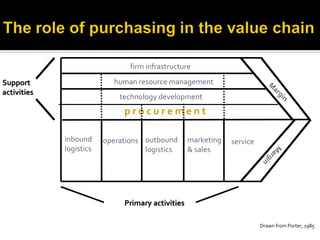

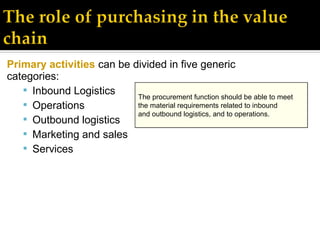

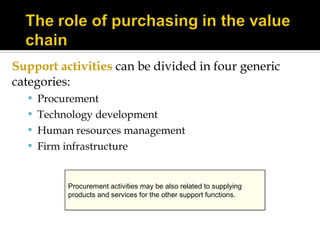

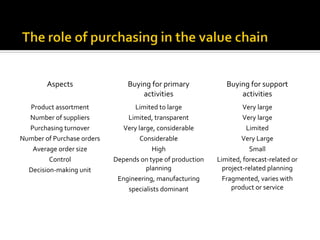

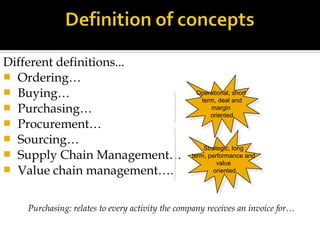

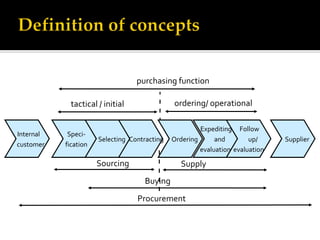

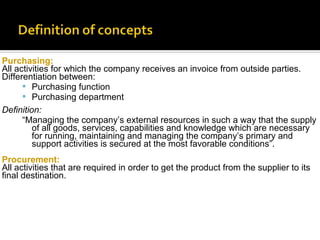

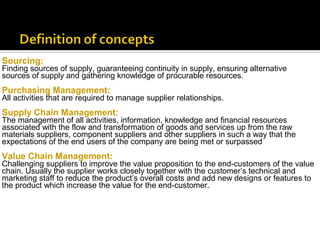

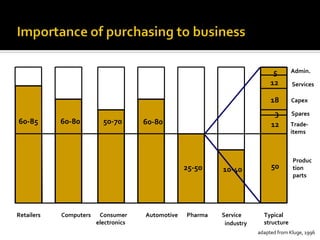

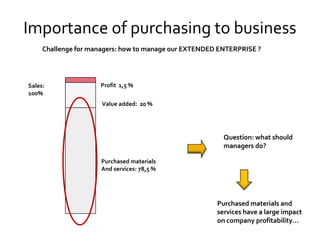

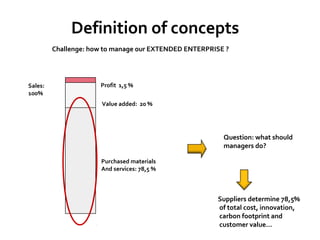

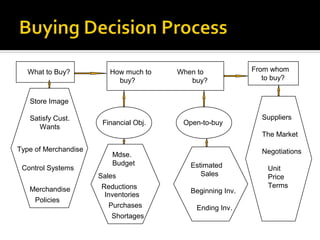

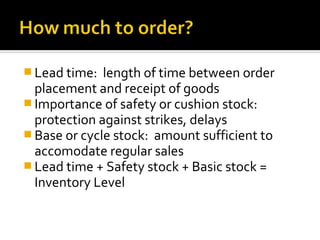

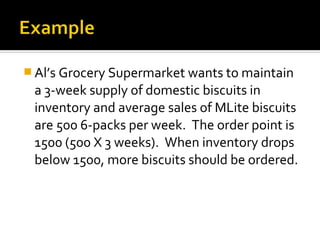

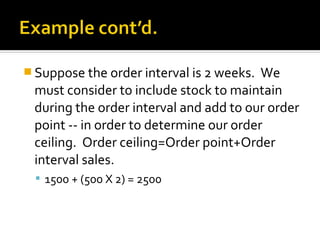

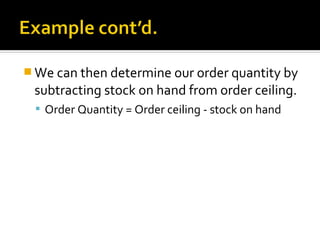

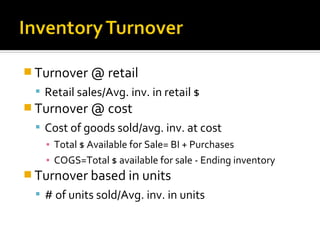

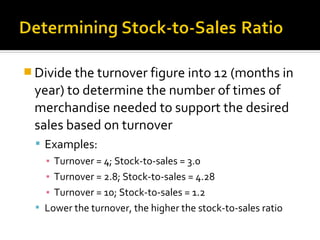

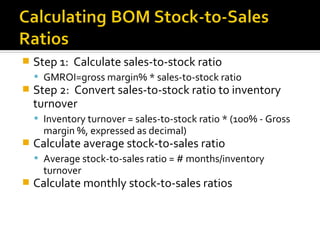

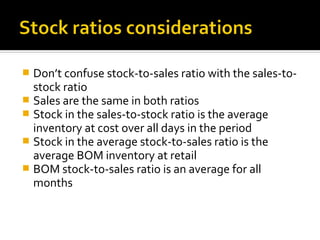

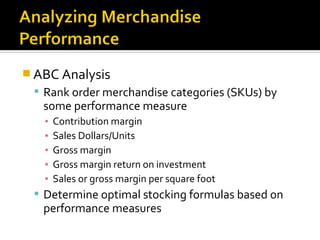

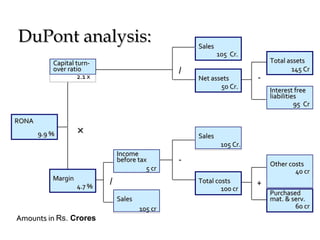

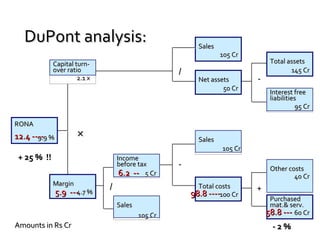

The document provides a detailed overview of supply chain and purchasing management concepts, emphasizing the importance of effective procurement and sourcing strategies in enhancing business profitability. It explores various categories of primary and support activities in the value chain, alongside key metrics for inventory management and sales performance. Additionally, it highlights the qualifications and expertise of Amit, a retail business consultant, underlining his role in driving innovation within the retail sector.