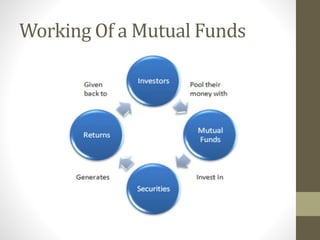

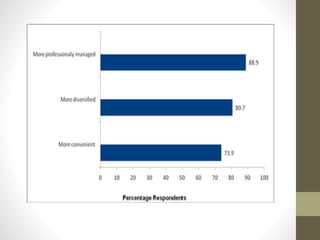

Mutual funds pool money from investors and invest it in a portfolio of stocks, bonds, and other securities. The portfolio is managed by a professional investment manager who buys and sells holdings with the goal of growing the fund over time. Investors receive dividends from profits and see the value of their shares decrease with losses. The first mutual fund in India was introduced in 1963 as a government-run fund, though private funds later emerged. There are several types of mutual funds including open-ended, closed-ended, exchange-traded, and unit investment trusts. Benefits of mutual funds include diversification, professional management, convenience, and liquidity, while disadvantages can include fees, management issues, and tax inefficiency.