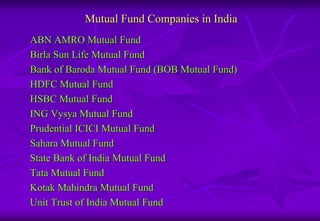

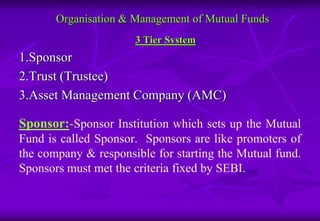

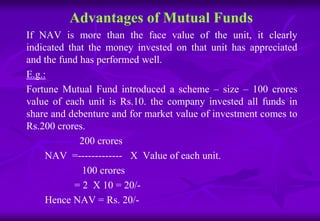

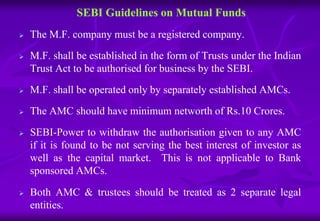

The document discusses mutual funds, providing definitions and describing their key characteristics. It notes that a mutual fund pools money from investors and invests it in a portfolio of securities, allowing small investors to benefit from diversification. It also outlines the typical structure of a mutual fund, which involves a sponsor, a trust responsible for safeguarding investors' interests, and an asset management company that handles the investments. Finally, it lists some advantages of investing in mutual funds, such as professional management, liquidity, and tax benefits.