Embed presentation

Download to read offline

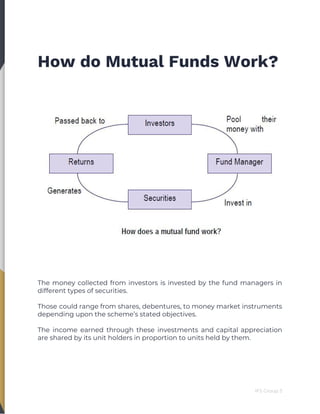

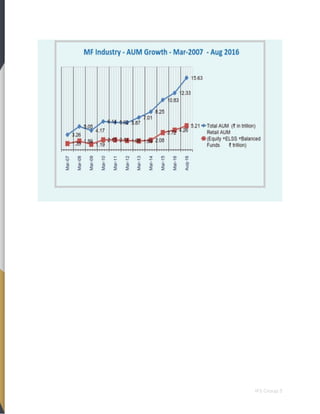

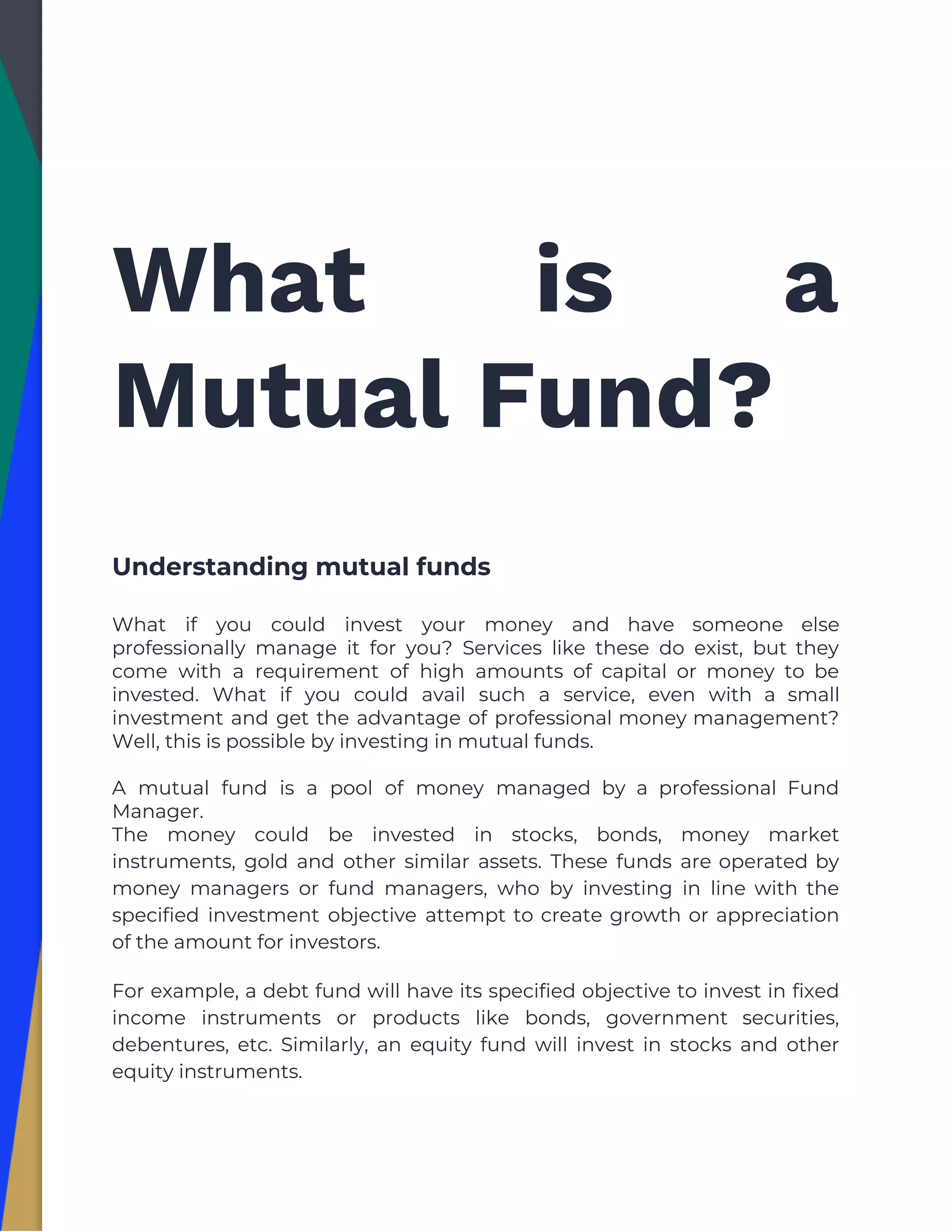

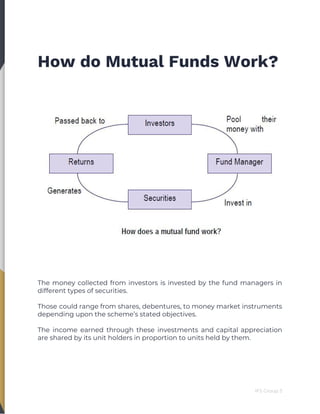

Mutual funds allow investors to pool their money for professional management across various assets like stocks and bonds, making them accessible even for small investors. These funds operate under regulatory frameworks, primarily governed by India's Securities and Exchange Board (SEBI), which ensures transparency and protection for investors. Advantages include diversification, professional management, liquidity, and potential tax benefits, while disadvantages may involve management costs, lock-in periods, and risk of dilution.