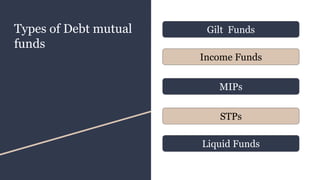

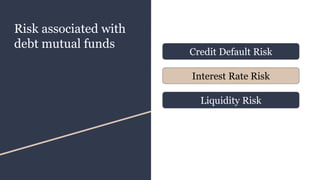

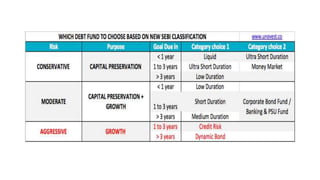

Debt mutual funds invest in fixed income instruments to provide stable income with low risk, making them suitable for risk-averse investors seeking regular returns. They come in various types, including gilt funds and liquid funds, and offer flexibility and short-term financial goal achievement. However, investors should be aware of risks such as credit default and interest rate risks and compare these funds with alternatives like fixed deposits and equity mutual funds before investing.