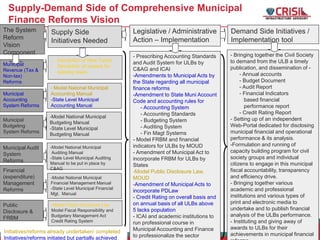

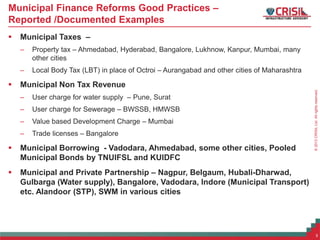

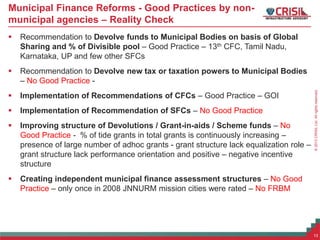

This document discusses comprehensive municipal finance reforms and good practices. It proposes reforms across six areas: municipal revenue, inter-governmental fiscal transfers, municipal financial management, municipal accounting and auditing, municipal legislative and borrowing powers, and public disclosure, credit ratings and budget management. It notes that while some cities have implemented reforms in areas like property taxes, more widespread reforms are needed and existing examples have often not been sustained. A wider view of reforms is needed beyond cities' own revenues to also include central and state devolutions and support systems. Overall, there remain few well-documented examples of municipal finance reforms and many attempts at reforms have been abandoned or failed to replicate at scale.