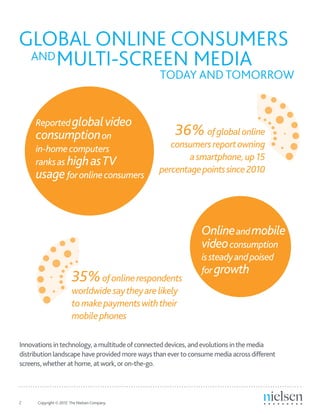

This Nielsen report summarizes the results of a global survey of over 28,000 online consumers in 56 countries regarding their multi-screen media usage. The survey found that watching video on computers has become as popular as watching TV among online users. Reported online and mobile video viewing is rising, with over half of global online consumers watching videos on mobile phones monthly. Smartphone ownership is up significantly since 2010 and tablets are also gaining popularity globally. The report concludes that portable devices will continue affecting media consumption as their adoption increases.