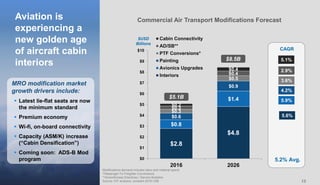

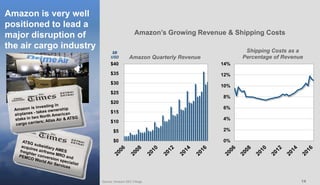

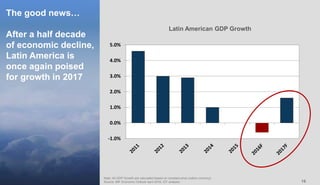

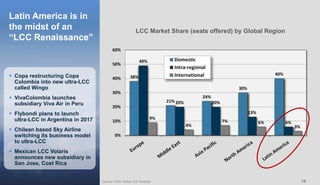

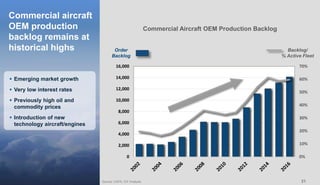

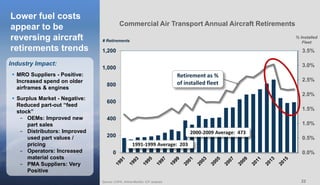

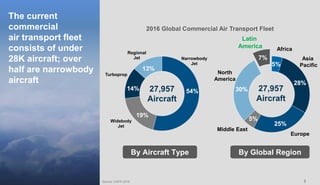

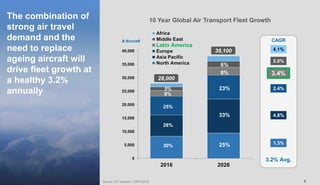

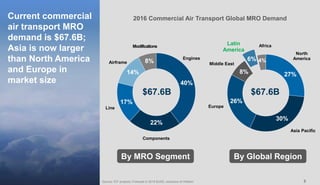

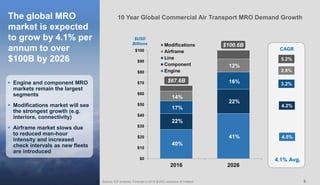

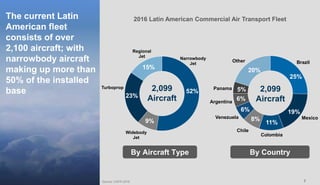

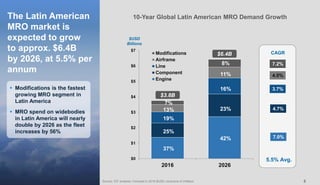

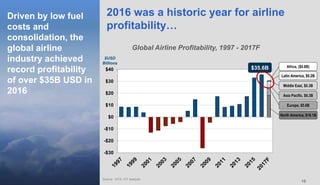

The document presents an MRO market update and industry trends, highlighting the global commercial air transport fleet's growth driven by rising air travel demand, expected to reach over $100 billion by 2026. The Latin American MRO market is projected to grow to approximately $6.4 billion by 2026, with significant investments in cabin modifications and fleet renewals. Overall, the aviation industry is experiencing record profitability, although challenges such as rising costs and macroeconomic factors persist.

![1212

Follow the Money:

Airlines are

spending their hard

earned profits in

three primary areas

Source: Company Reports, ICF Analysis

Airline Profit Spend Analysis

[CELLRANGE],

20%

[CELLRANGE],

38%

[CELLRAN

GE], 42%

Profit Sharing

15%

Wage

Increases

5%Fleet

23%

Equity

Investments

5%

Other capex

10%

Debt

Repayments

16%

Stock Buy-

Back &

Dividends

26%

1. Labor ~ 20%:

Profit sharing

Wage increases

2. Capex ~ 38%:

Fleet renewal & cabin

upgrades

Facilities, offices, lounges

Equity partner investments

3. Investors ~ 42%:

Stock buy-backs

Dividends

Debt repayment](https://image.slidesharecdn.com/j-170208211108/85/MRO-Market-Update-Industry-Trends-13-320.jpg)