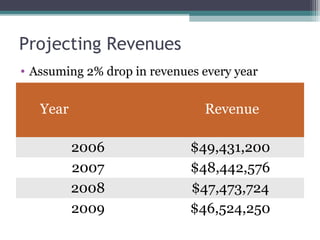

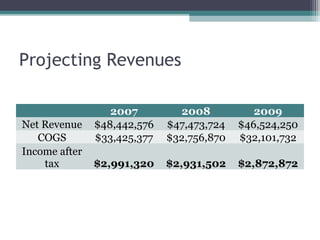

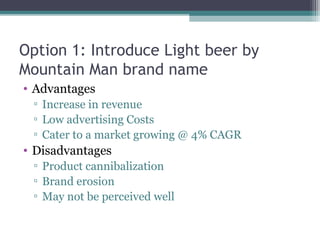

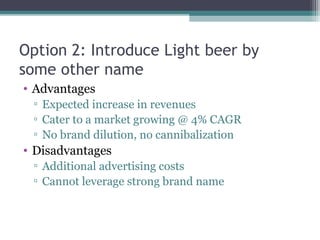

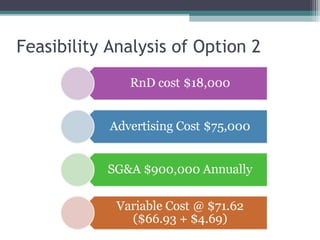

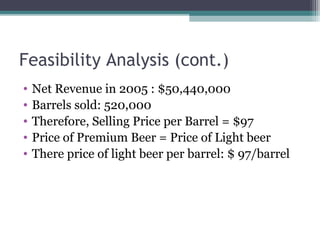

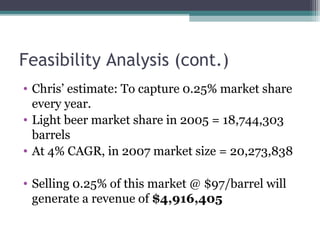

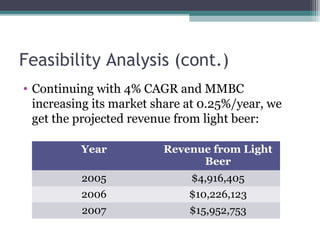

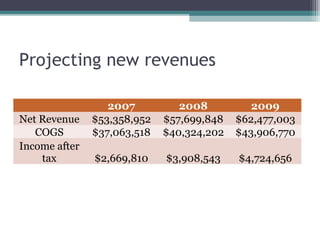

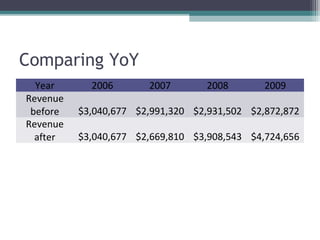

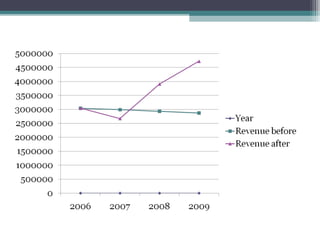

Mountain Man Beer Company (MMBC) is a family owned brewery with a strong brand known for its premium beers. It has seen declining revenues as younger consumers prefer light beers. Two options to address this are introduced: 1) a light beer under the Mountain Man brand, which risks cannibalizing existing sales and brand erosion, or 2) a light beer under a new name, incurring higher advertising costs without leveraging the strong brand. A feasibility analysis shows introducing a light beer under a new brand name could generate over $15 million in additional revenue by 2007 without damaging the core brand. While this option looks promising, introducing light variations on the Mountain Man name could save on advertising costs while leveraging the brand equity.