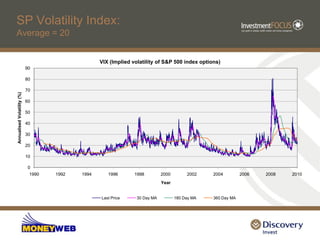

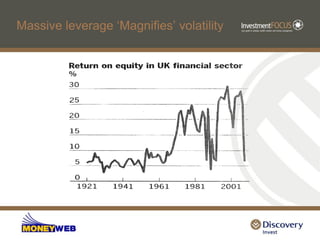

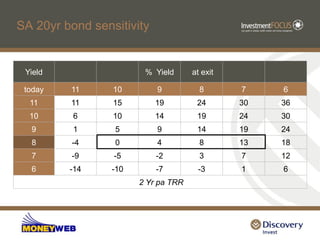

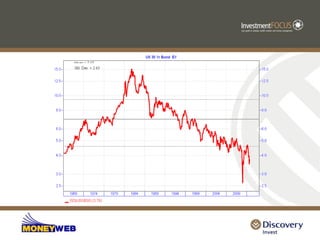

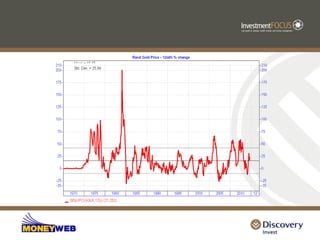

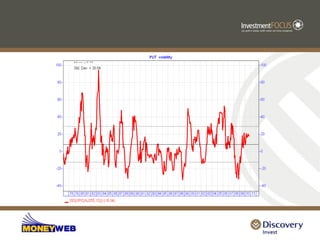

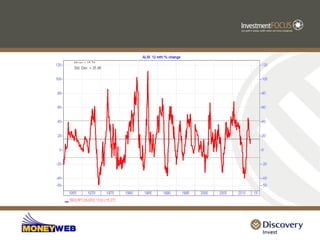

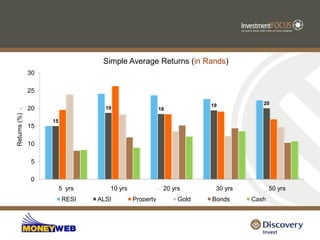

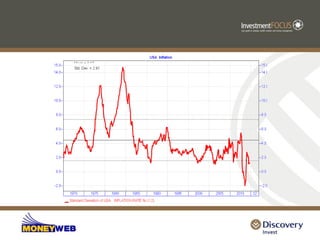

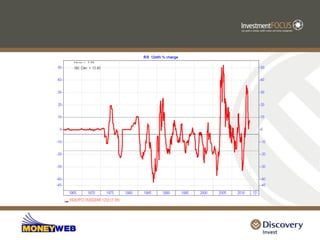

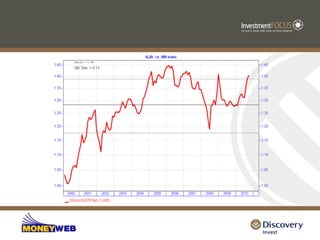

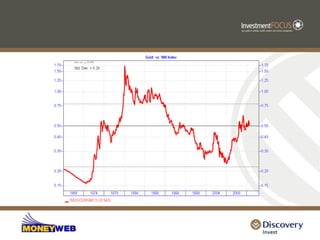

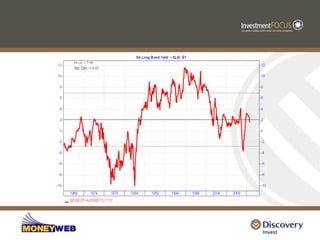

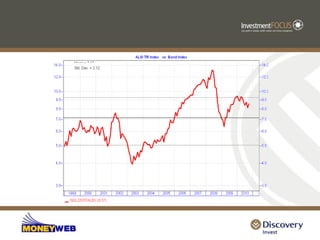

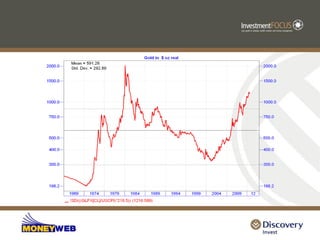

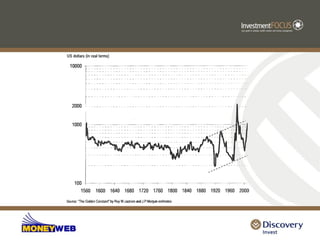

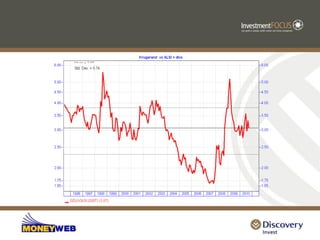

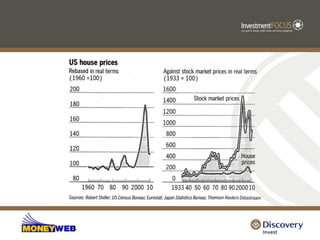

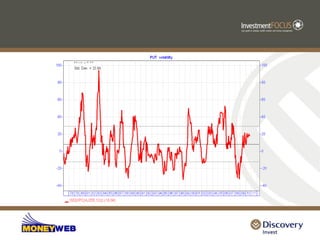

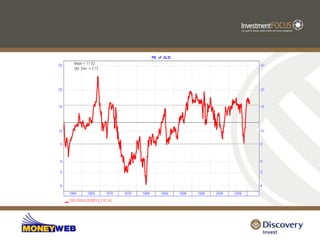

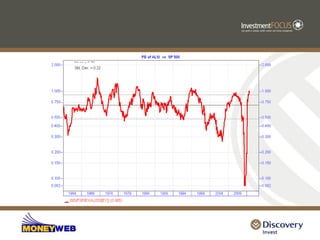

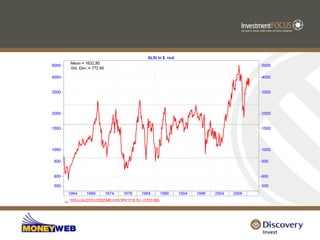

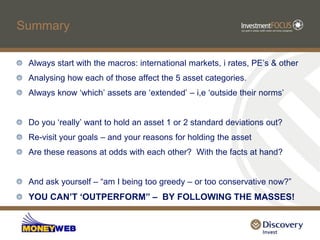

Volatility provides opportunities rather than representing risk alone. It allows multiple chances to gain from price movements by magnifying returns through leverage, though it also magnifies losses. While some assets like cash and bonds have relatively low historic volatility, equities and property have exhibited higher volatility but also higher long-term returns over periods of 20 years or more. Successful investing requires understanding how macroeconomic factors influence different asset classes in order to identify assets priced outside their norms and adjust allocations accordingly based on goals, rather than following the general market. Performance is the ultimate measure of an investment, not promises or explanations.