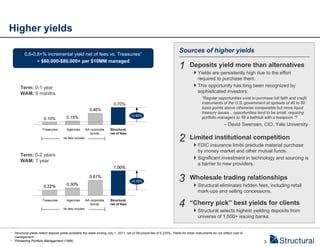

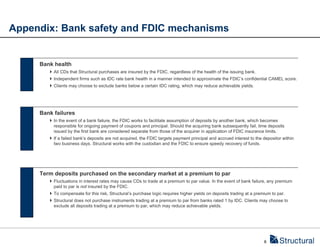

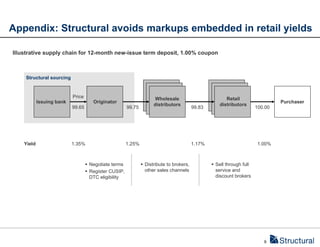

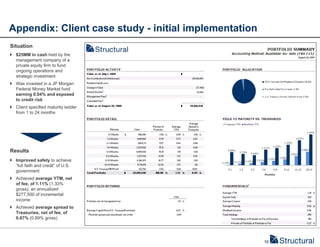

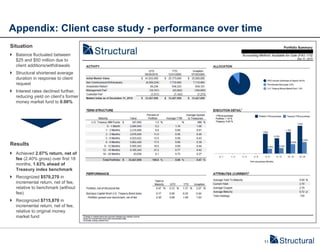

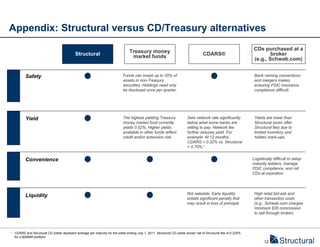

Structural manages FDIC-insured cash portfolios for institutional clients. It offers higher yields than alternatives like Treasuries and money market funds through tailored FDIC-insured deposit portfolios. Assets are held in separate custody accounts under the client's name. The portfolios provide safety through FDIC insurance backed by the full faith and credit of the U.S. government, liquidity through various deposit types including those providing weekly withdrawals, and higher yields through specialized sourcing and trading relationships.