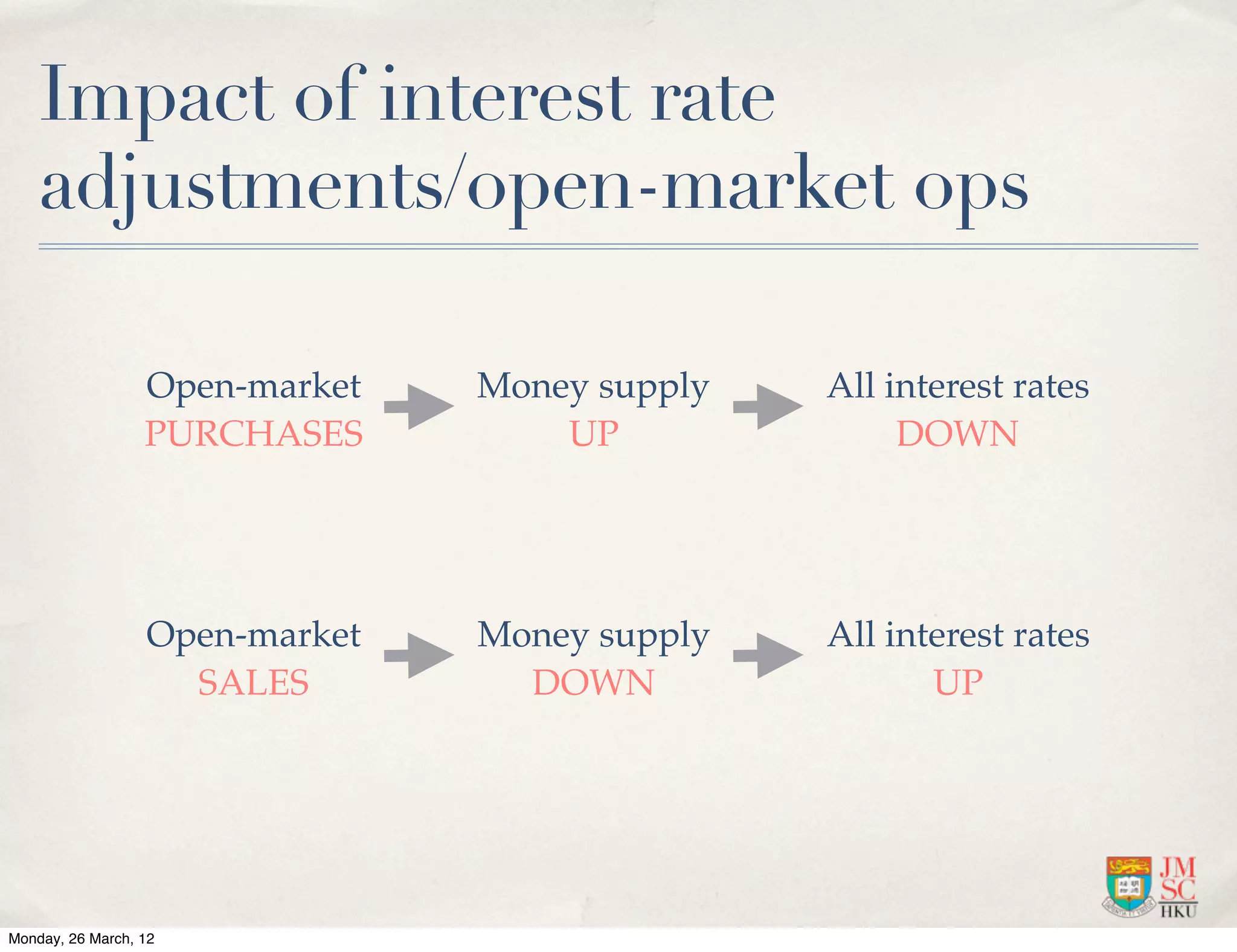

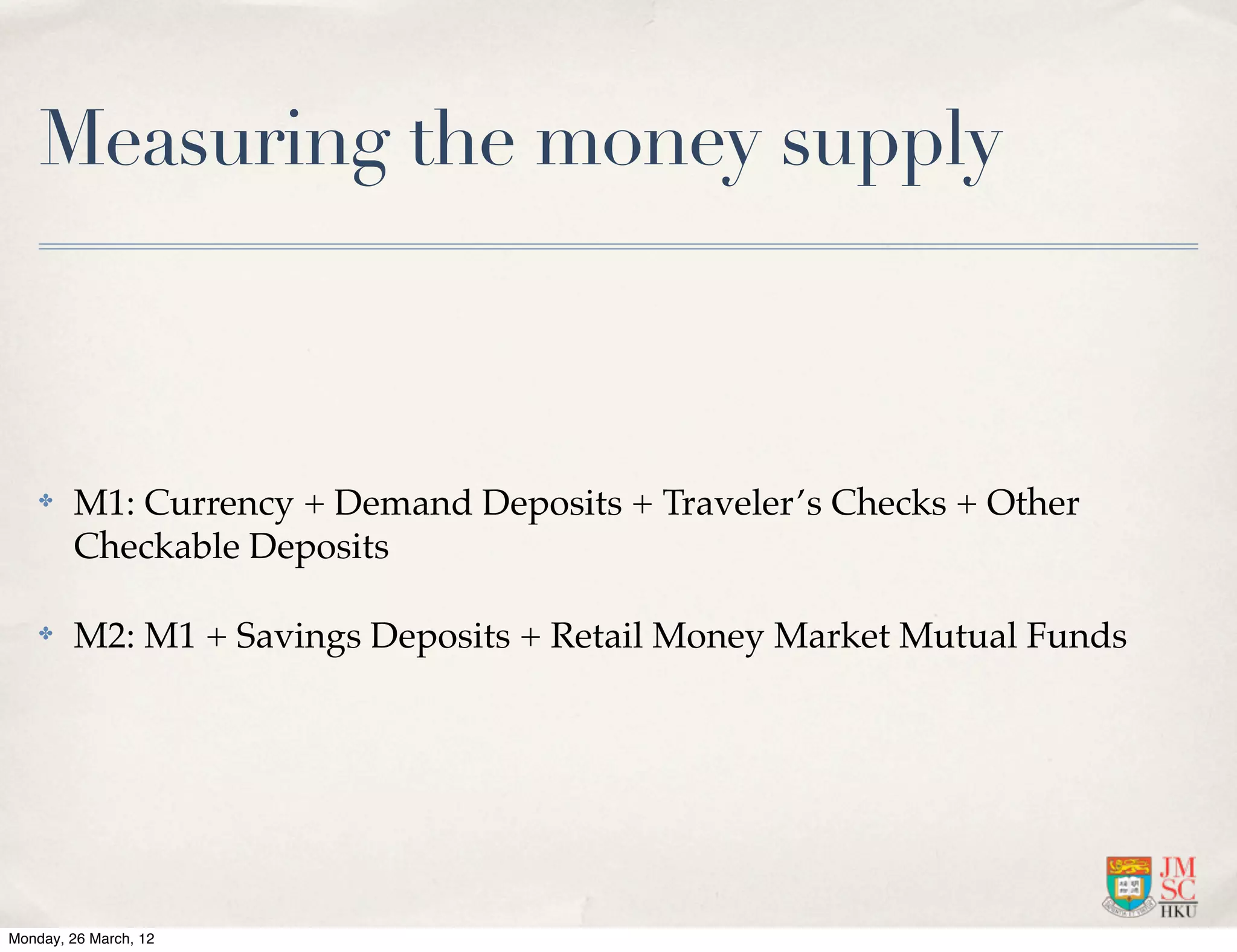

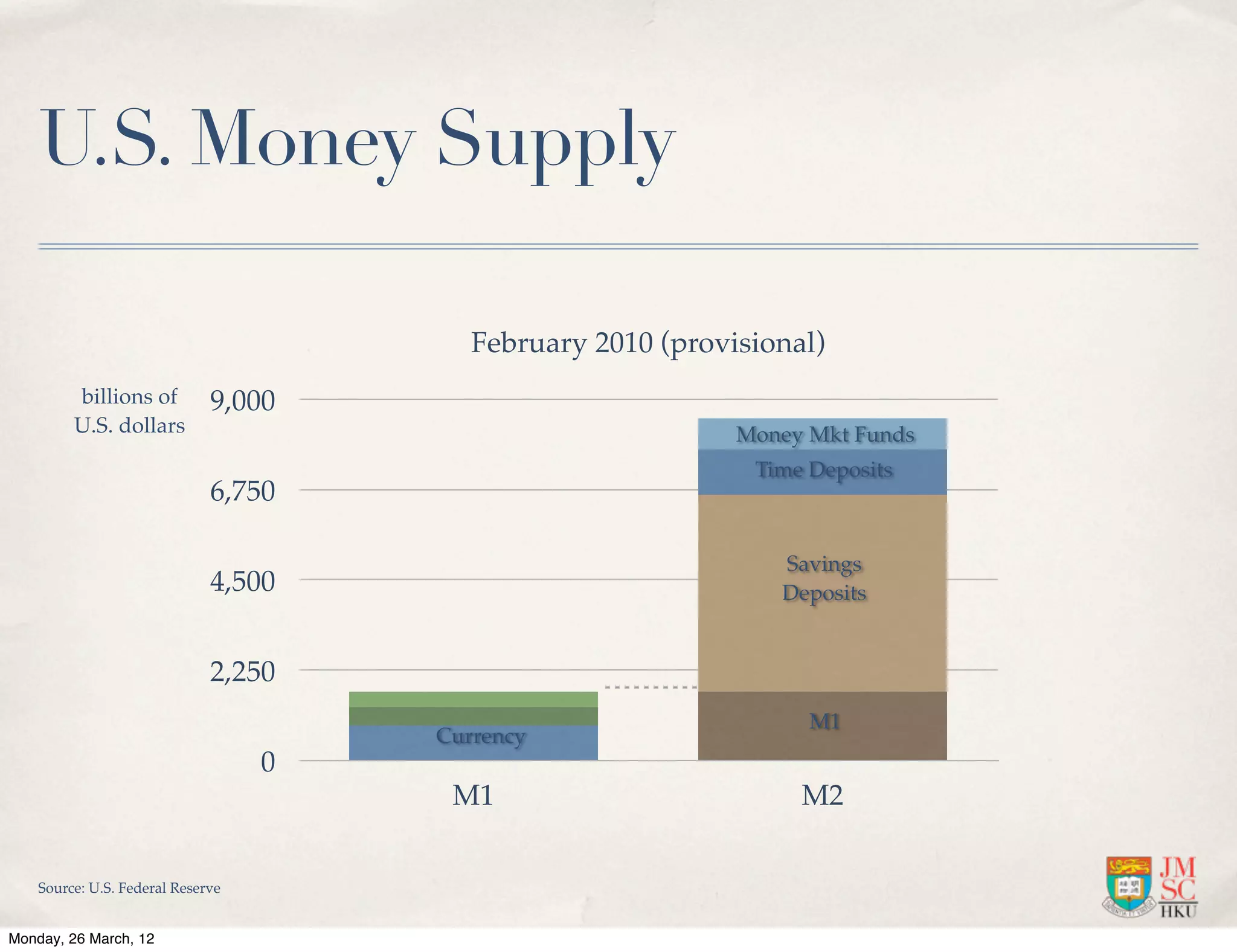

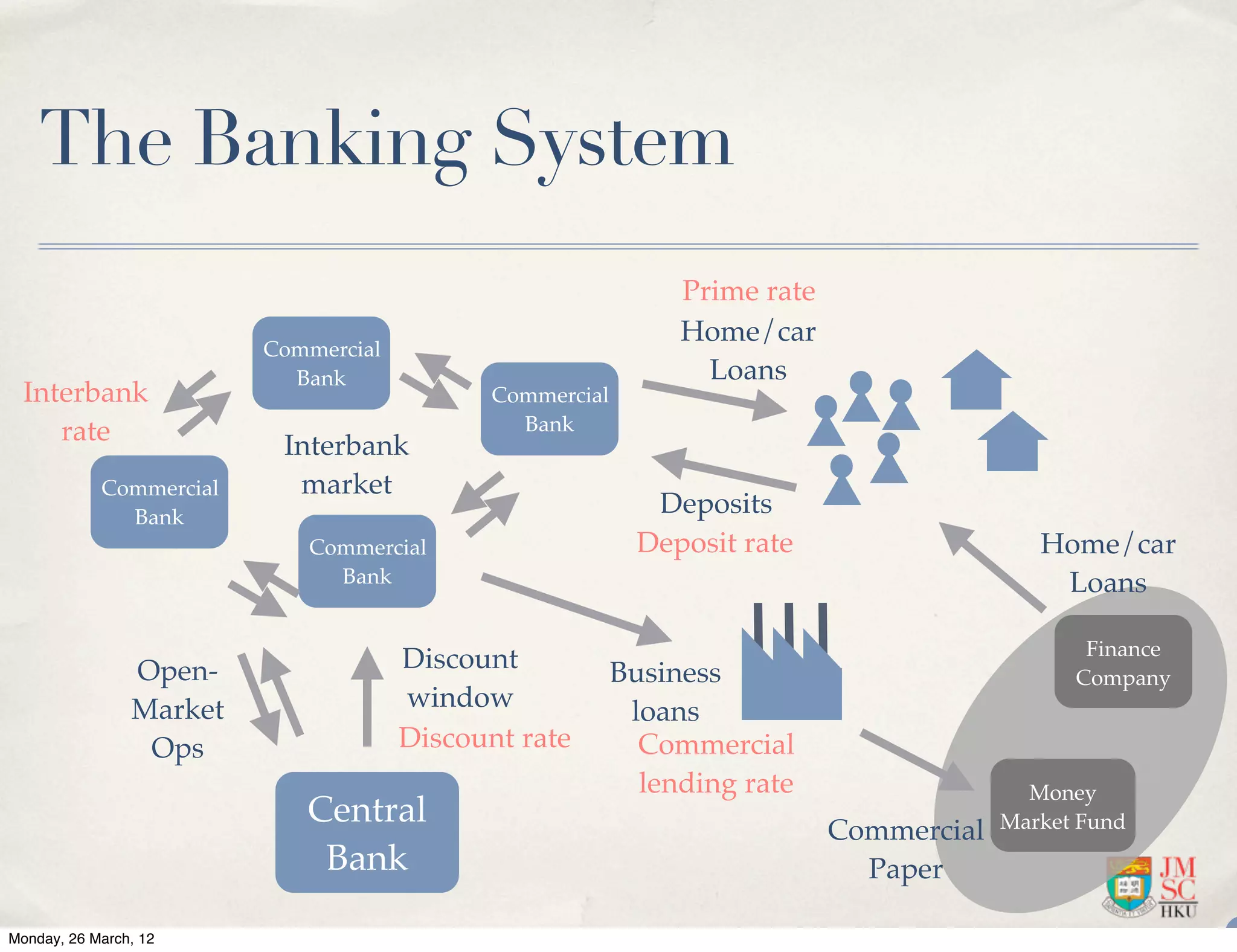

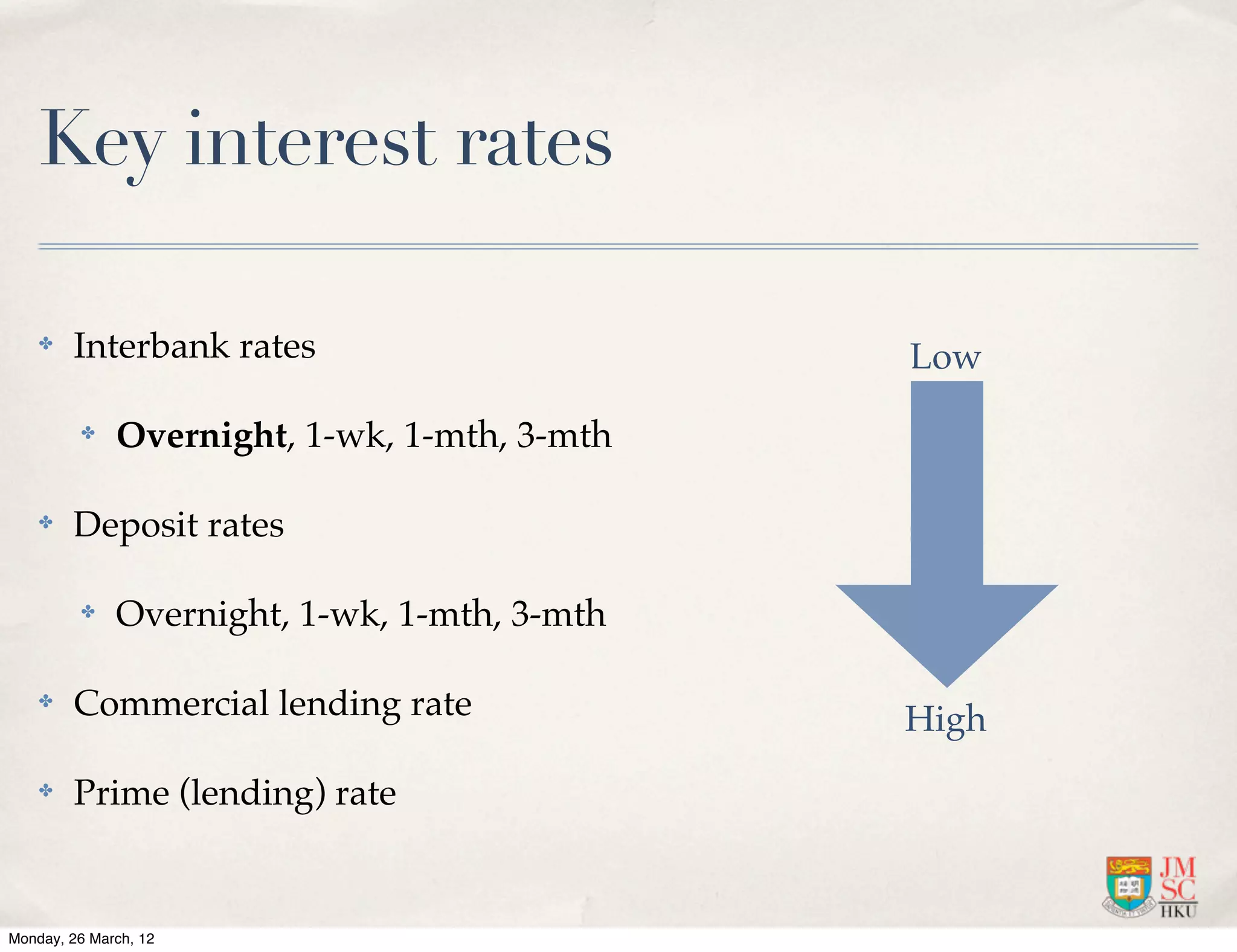

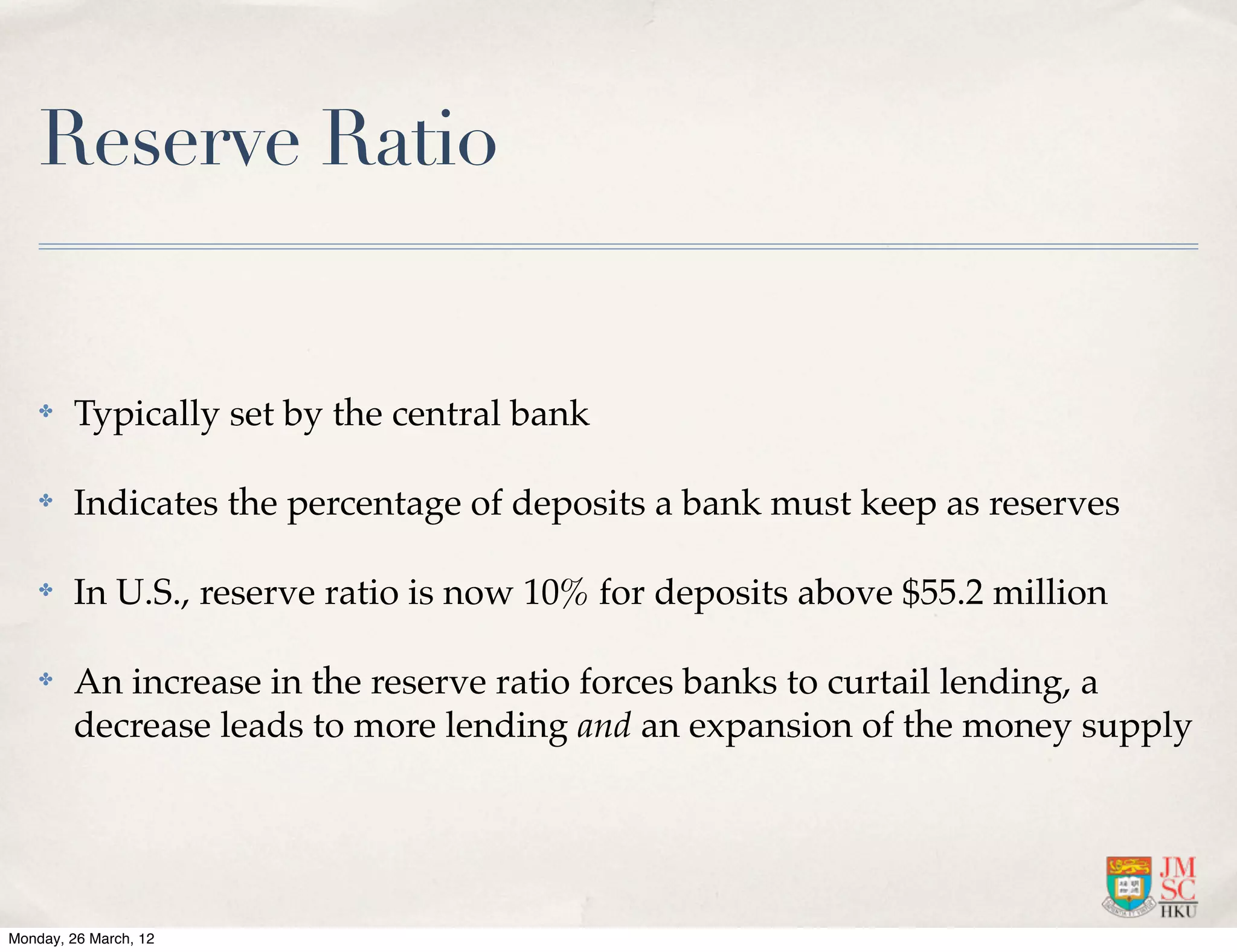

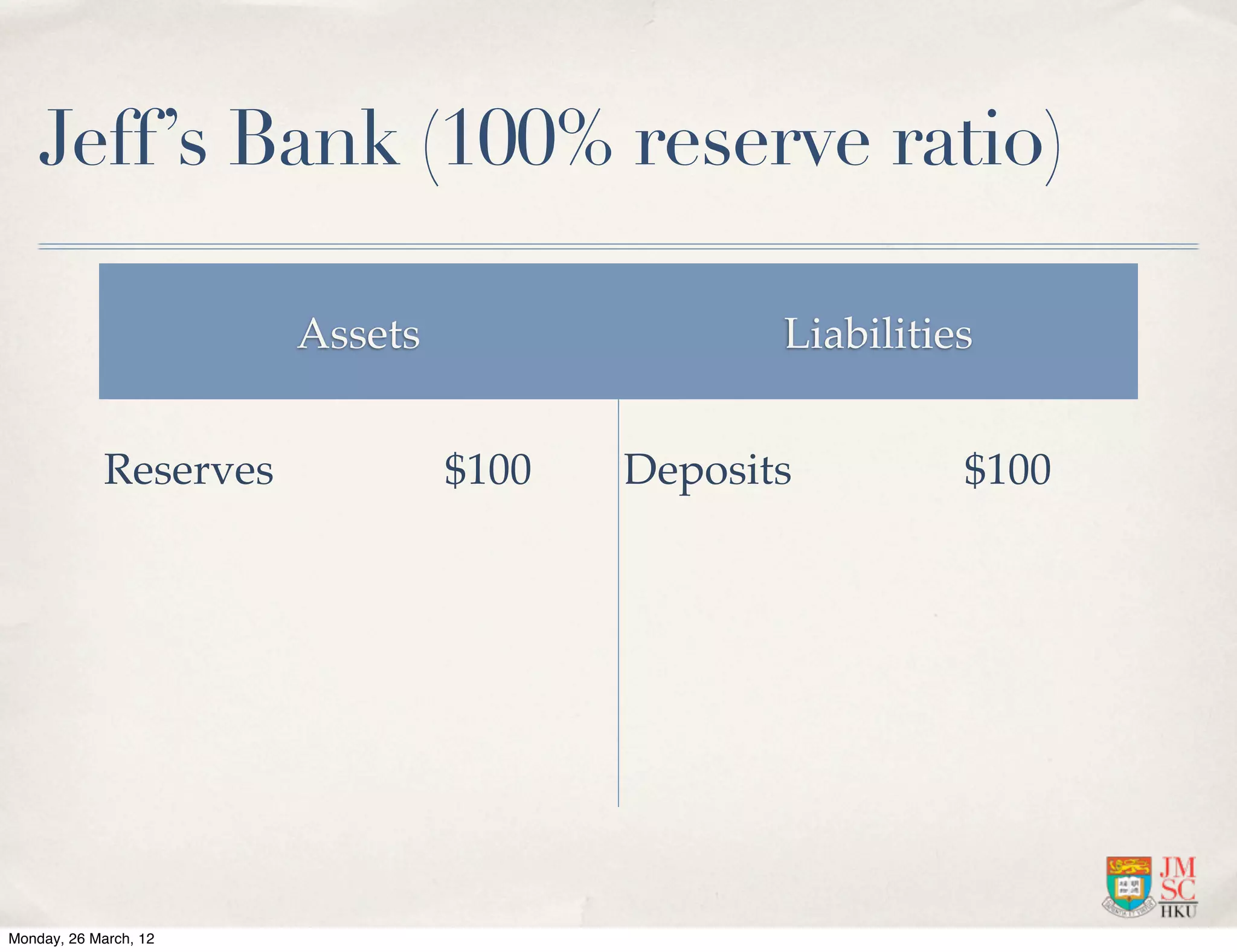

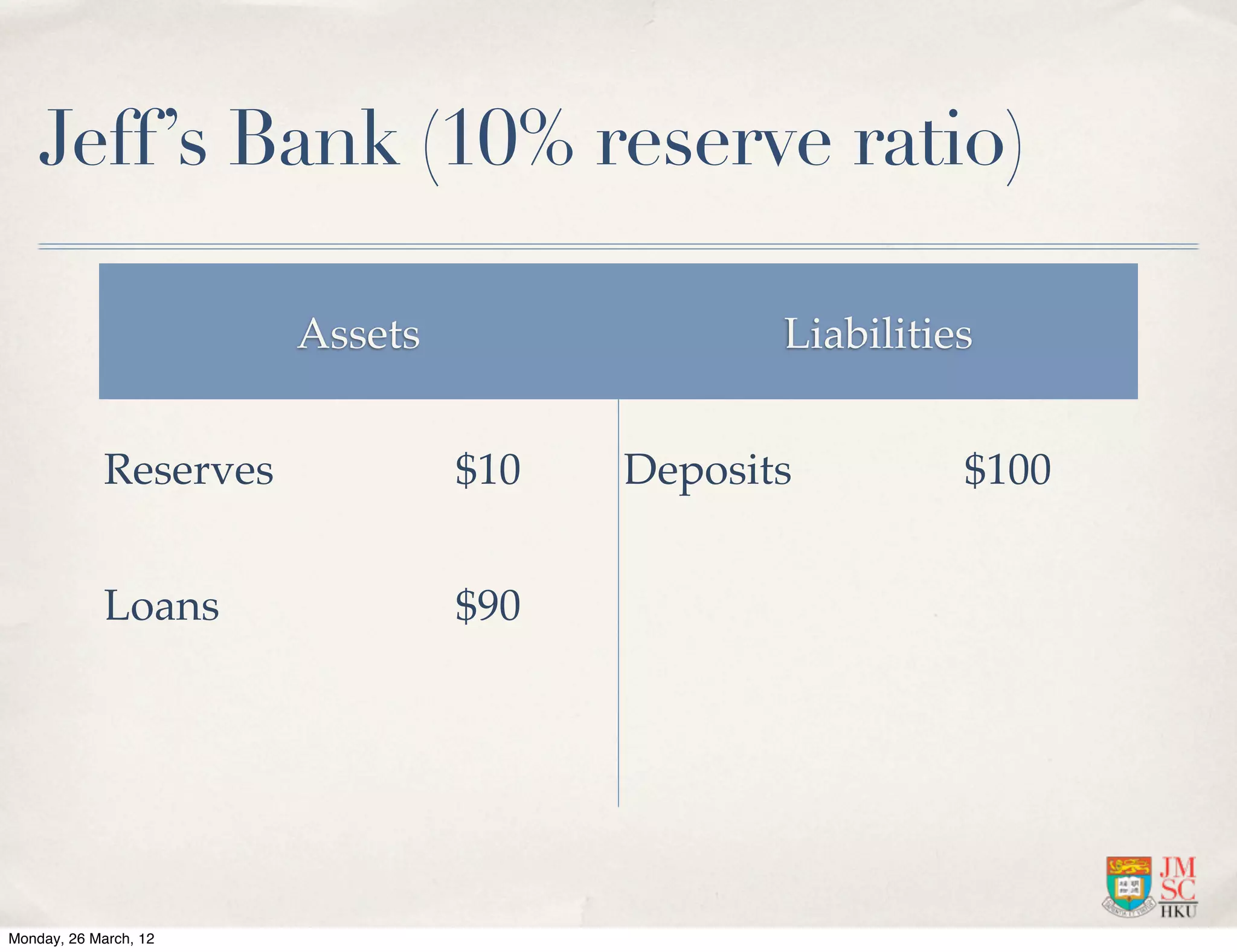

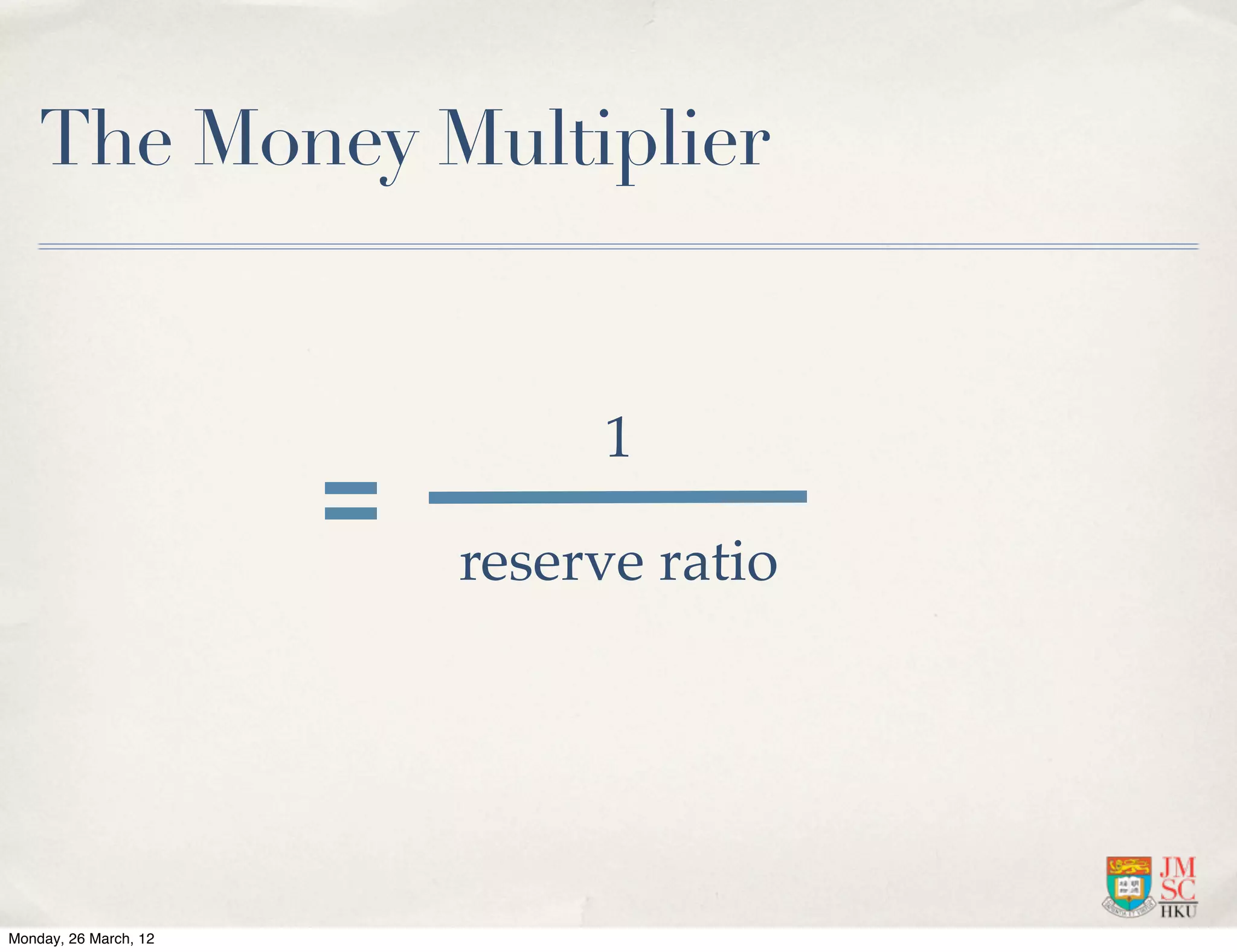

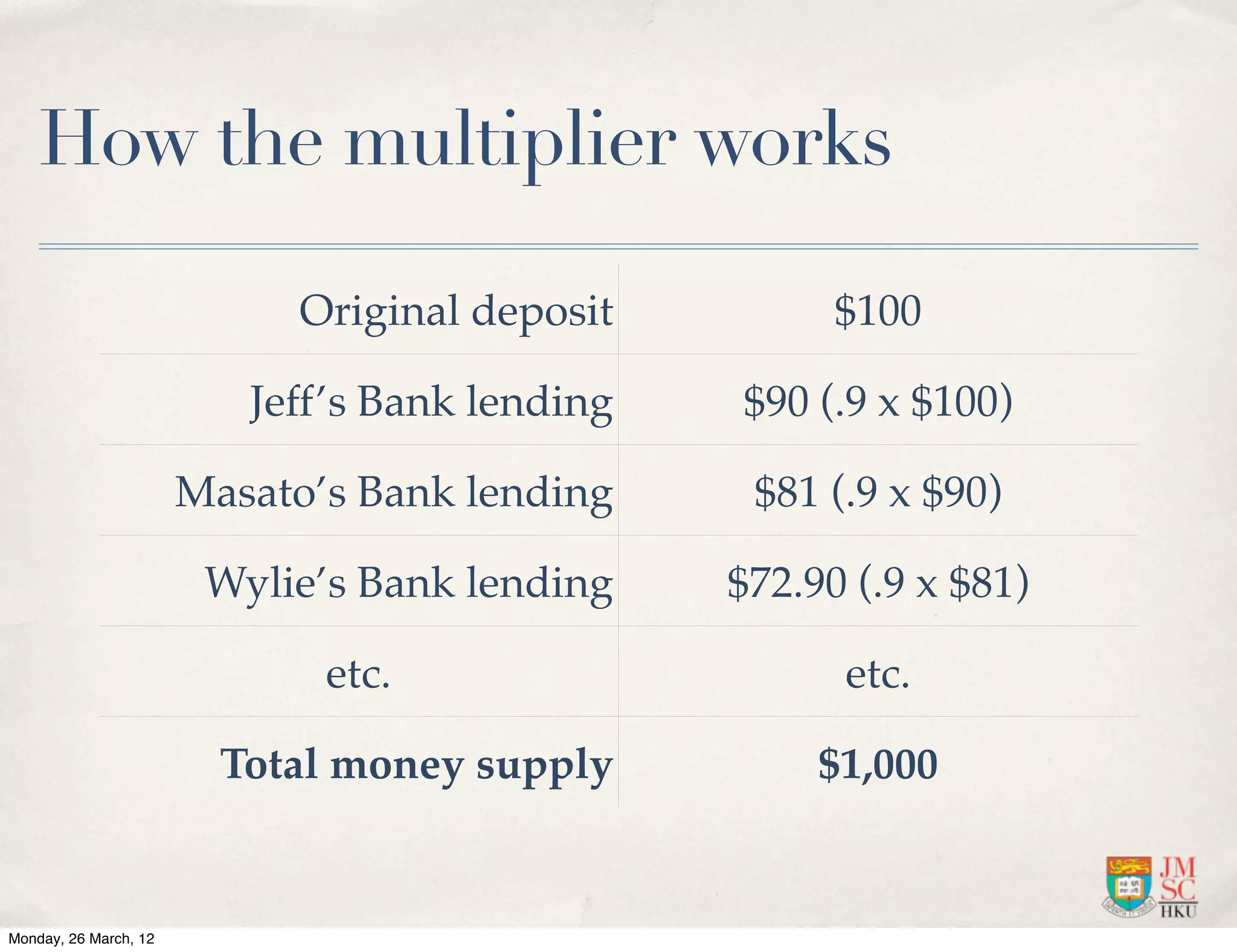

The document discusses the banking system and monetary policy. It explains that central banks influence money supply and interest rates to manage monetary policy. Commercial banks take in deposits and make loans, acting as financial intermediaries. They are required to keep a percentage of deposits as reserves based on the reserve ratio set by the central bank. This reserve ratio and the money multiplier effect determine how much new money banks can create through additional lending.