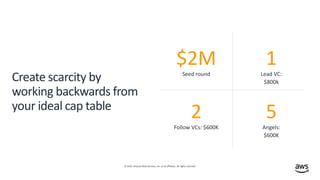

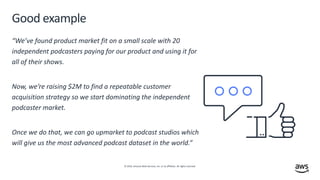

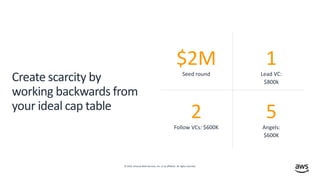

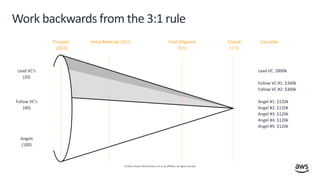

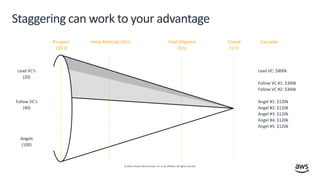

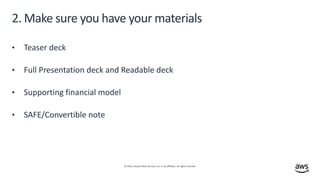

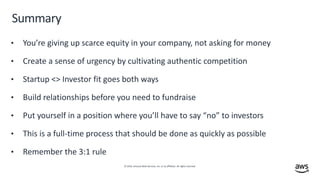

The document provides guidance on efficiently raising a seed round of funding. It discusses that seed funding comes from both venture capital and non-VC sources. An experienced founder can raise a seed round in as little as a month by generating competition among investors. The secret is to establish clear fundraising rules, draft an ideal capital table, craft a concise fundraising narrative, build an initial funnel of prospects, and efficiently stack meetings to pitch to investors and close funding. The goal is to cultivate a sense of urgency for investors and put yourself in a position to turn investors away.