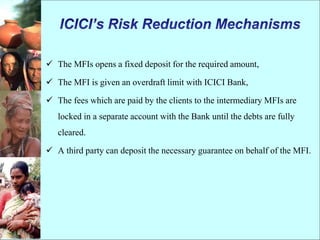

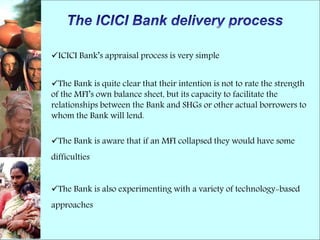

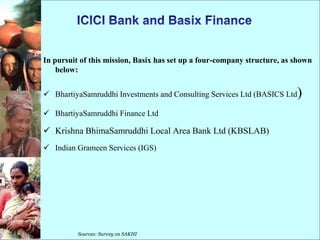

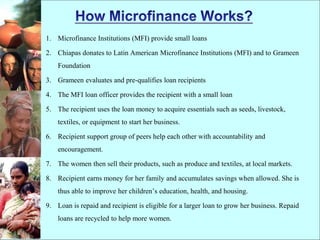

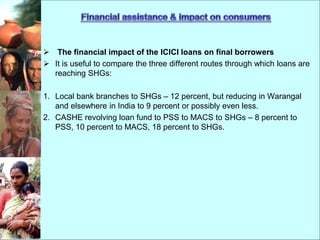

Microfinance serves as a tool for providing financial services to low-income populations that do not have access to mainstream financial services. ICICI Bank was originally promoted in 1994 to offer banking products and services. It has a large presence in India and internationally. ICICI Bank engages in microfinance by providing financial assistance such as loans to select microfinance institutions (MFIs) in India. This helps MFIs extend credit and other services to low-income groups. Examples demonstrate how microloans from ICICI Bank, routed through MFIs, have helped individuals start small businesses and improve their livelihoods and standards of living.