- YES Bank was founded in 2004 with a mission to cater to future businesses in India. It grew rapidly but also took on significant risks by lending heavily to stressed corporate borrowers.

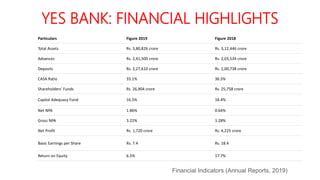

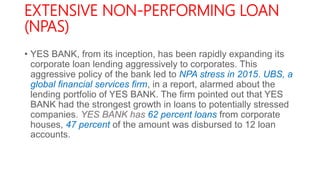

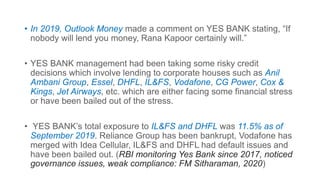

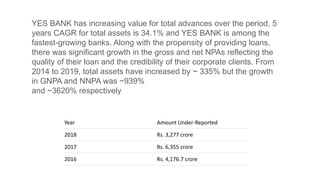

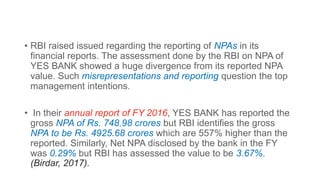

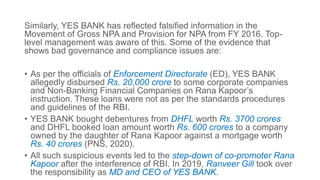

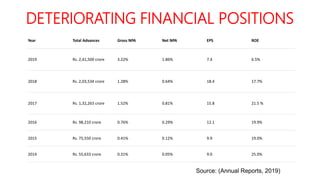

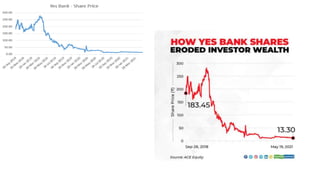

- This led to rising NPAs, losses, and deterioration of financials from 2015 onwards due to poor loan quality. Governance issues including hiding of true NPA levels from regulators exacerbated its problems.

- In 2020, RBI intervened by placing YES Bank under a moratorium and crafting a rescue plan where SBI and other banks invested capital to recapitalize it and restore depositors' confidence in the banking system. This highlighted the need for reforms to address regulatory lapses.