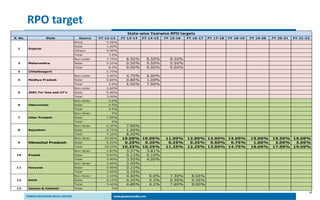

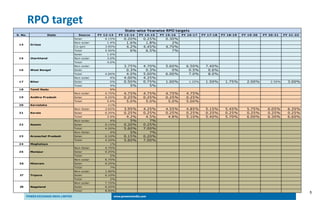

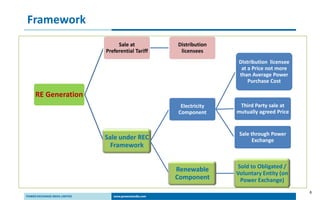

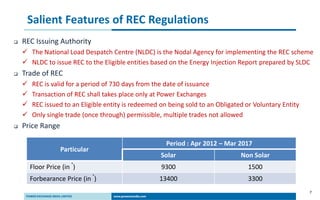

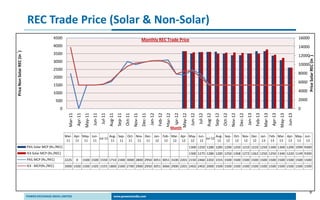

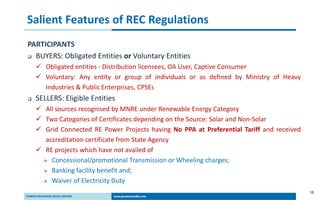

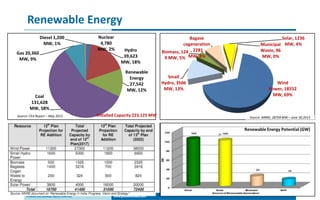

The document discusses renewable energy sources and capacity in India. It notes that as of May 2013, wind power made up the largest share of renewable energy capacity at 18,552 MW or 69% of the total. It also provides details on India's renewable purchase obligation (RPO) targets set by various states, which require distribution companies and obligated entities to purchase a certain percentage of electricity from renewable sources. The document outlines the regulatory framework and features of India's renewable energy certificates (REC) mechanism, which allows obligated entities to purchase RECs on power exchanges to meet their RPO targets. It identifies challenges with REC compliance and discusses potential alternatives and avenues to strengthen the REC framework and further promote renewable energy in India.

![3

Legal & Regulatory provisions

Section 86 (1) (e) of EA 2003 provides the Regulatory framework

“Section 86 (Functions of the State Commission)

Promote co-generation and generation of electricity from renewable sources of energy

by providing suitable measures for connectivity with the grid and sale of electricity to

any person, and also specify, for purchase of electricity from such sources, a

percentage of the total consumption of electricity in the area of a distribution

licensee;”

All SERC’s have notified Regulations on Regulated purchases and RPO

Obligation

Specified categories for promoting different types of RE technologies

Solar, Non Solar [Small Hydro (< 25 MW), Mini Hydro, Bio Mass/Bio Gas & Co-Generation]](https://image.slidesharecdn.com/mgraout-130920022923-phpapp01/85/Day-4-Mr-MG-Raout-3-320.jpg)