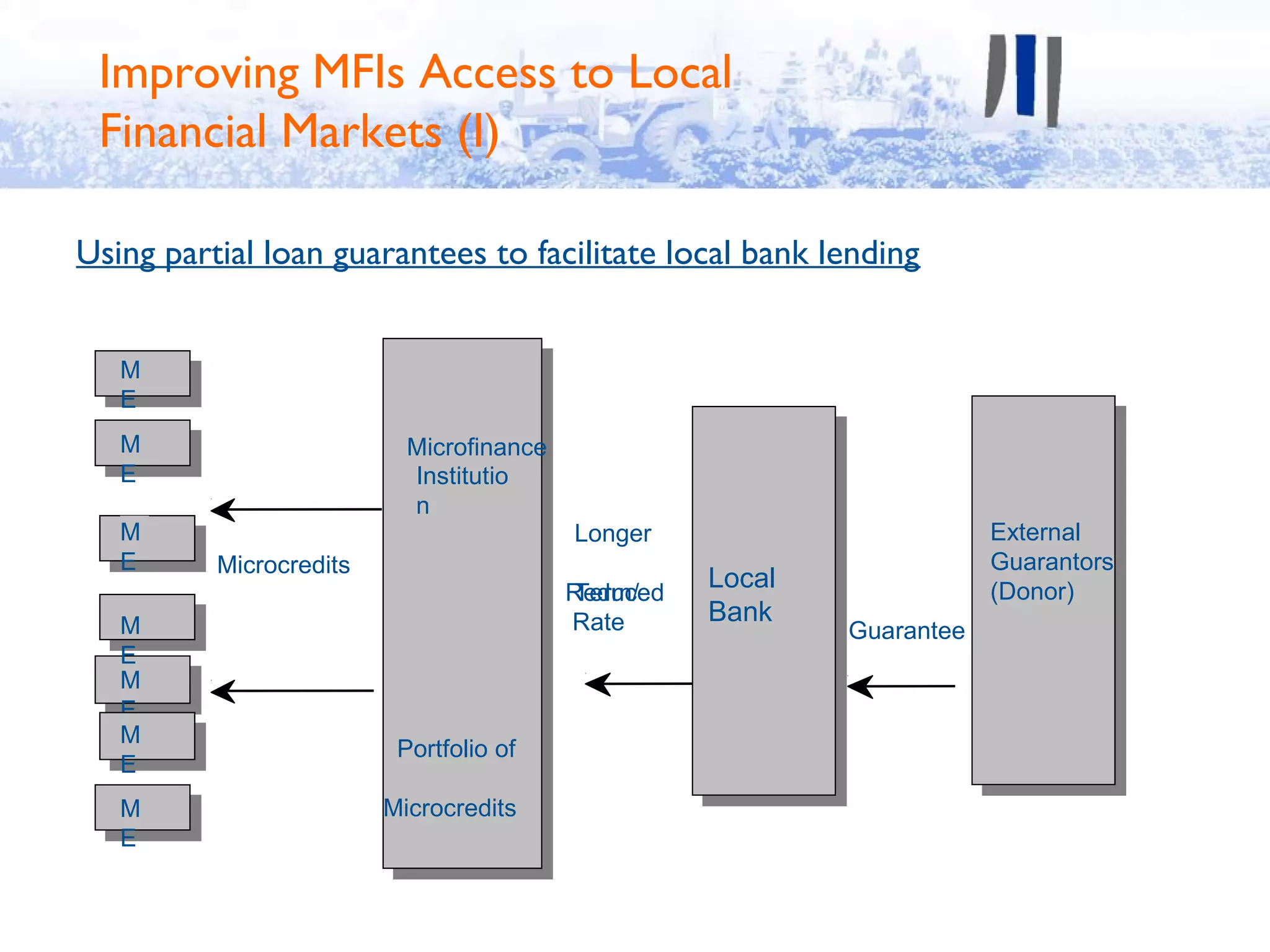

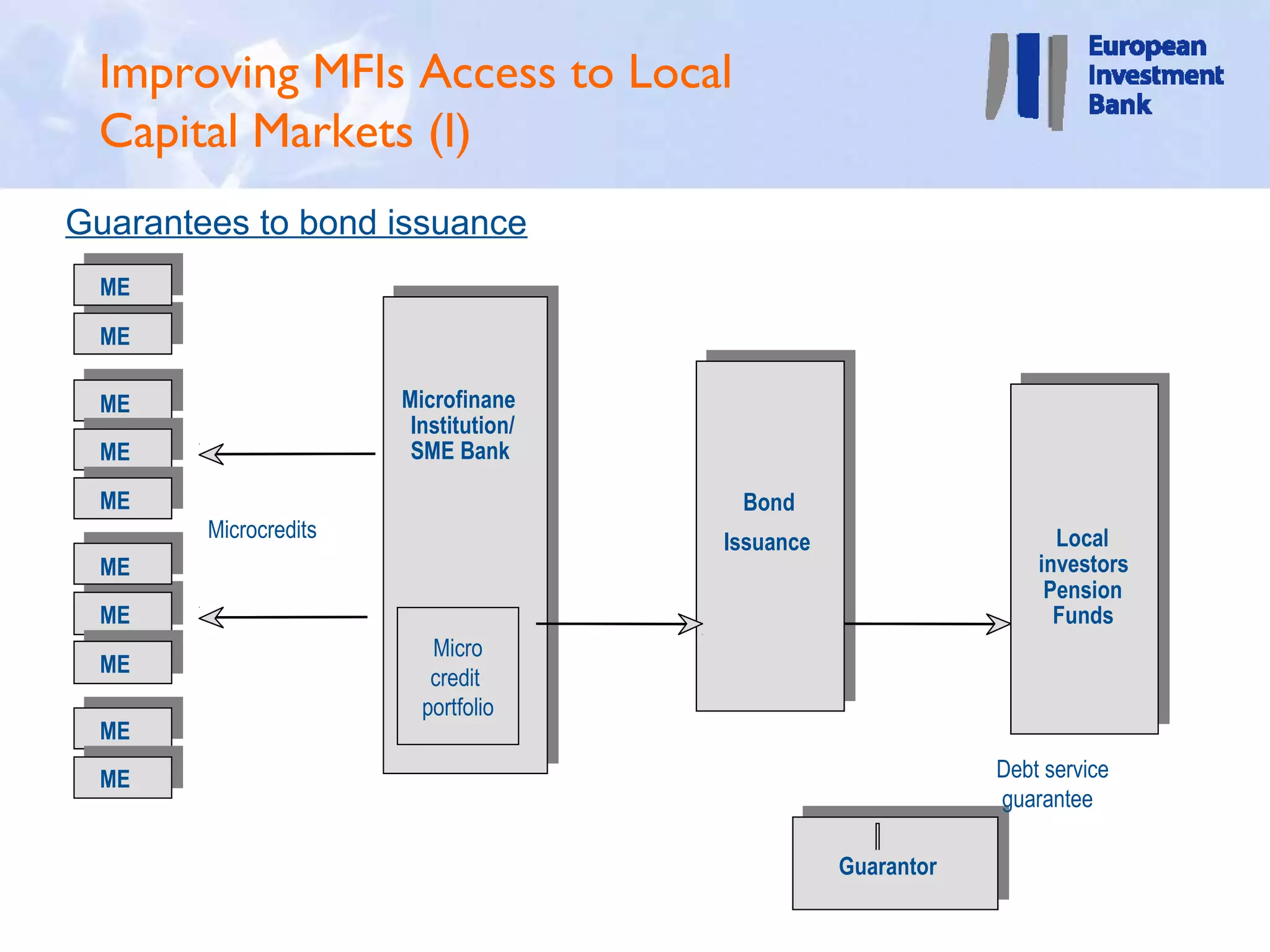

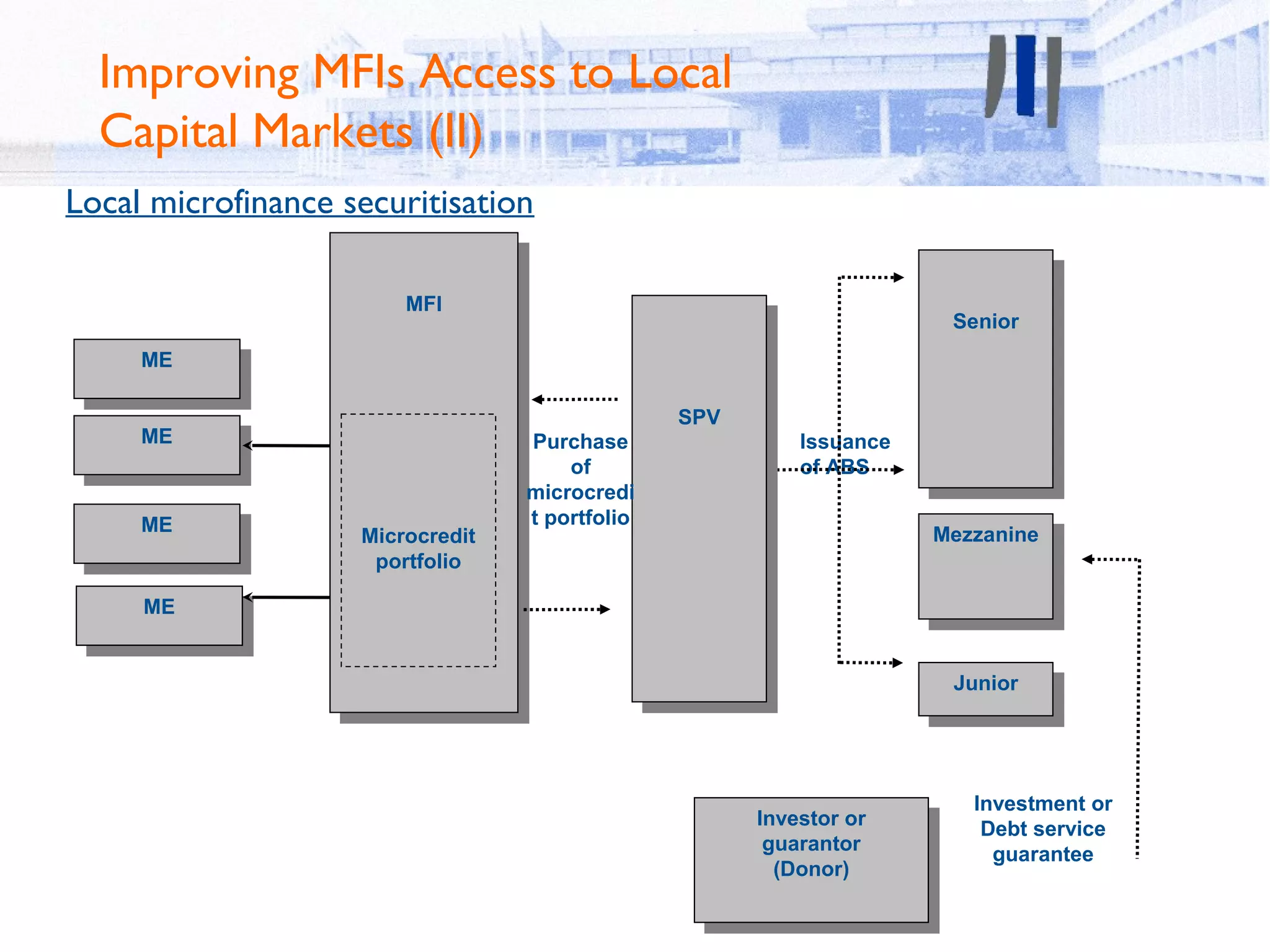

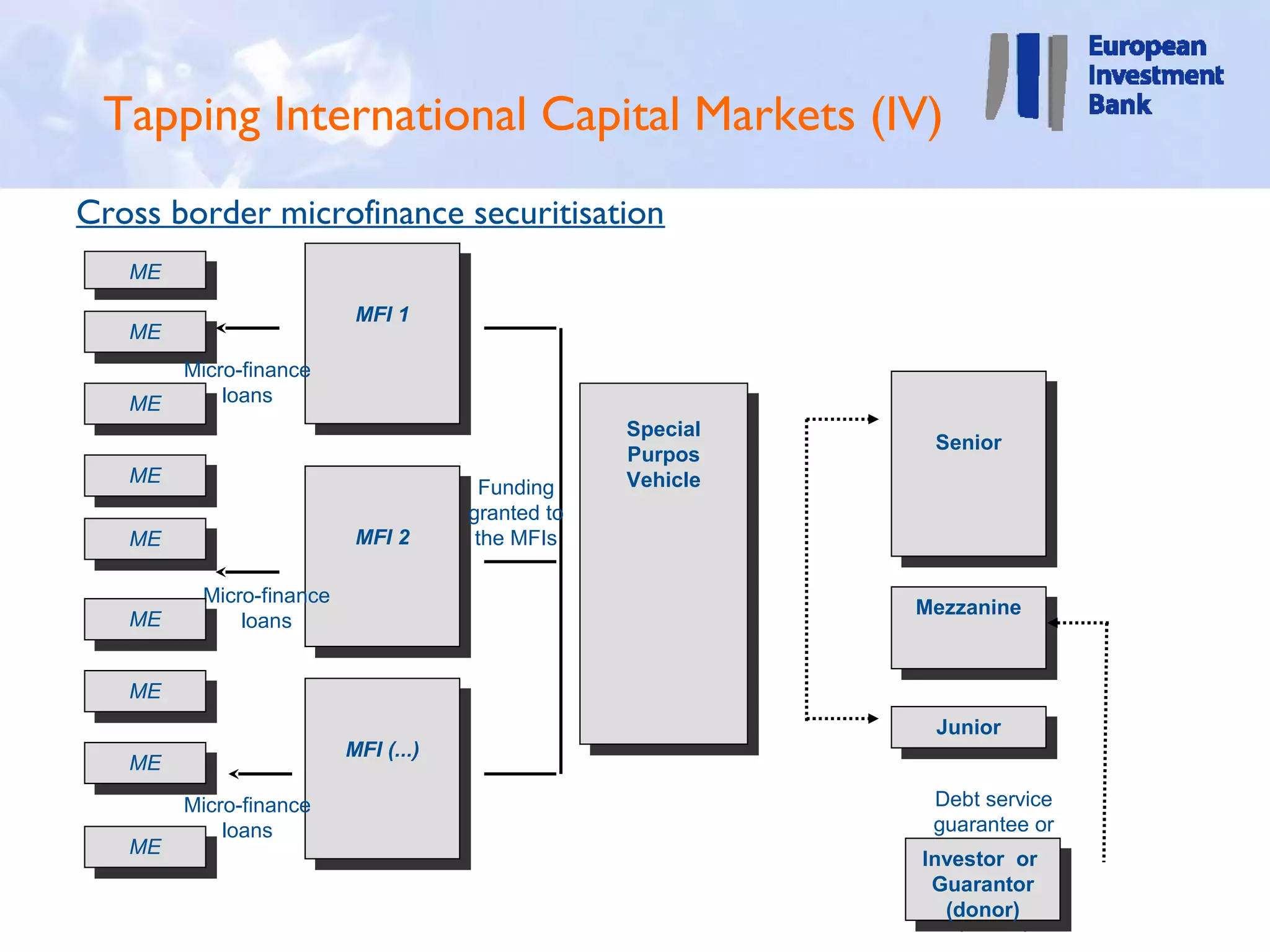

This document discusses mechanisms to mitigate foreign exchange and currency risk for microfinance institutions (MFIs). It outlines traditional options used by donors and MFIs, such as lending in local currency, matching foreign currency liabilities to assets, and creating foreign currency reserves. It also explores other options like improving MFI access to local financial and capital markets through loan guarantees and bond guarantees. Finally, it discusses tapping international capital markets through private equity funds that invest in MFIs in local currency, and microfinance debt funds that provide loans to MFIs across currencies to diversify risk.