Mf0012 taxation management

•Download as DOCX, PDF•

0 likes•106 views

Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 (Prefer mailing. Call in emergency )

Report

Share

Report

Share

Recommended

Mf0012 taxation management

This document provides information about an assignment for a taxation management course. It includes 6 questions related to calculating taxable income and tax liability in India. It provides contextual information to accompany each question, including details about an individual's salary, assets purchased and sold at different times, and expenses incurred. Students are to answer each of the 6 questions, which are worth 10 marks each, for a total of 60 marks.

Mf00121 assignment spring_2016

Mr. X is provided financial information for the previous year ending March 31, 2015. This includes salaries, allowances, loans, and provident fund contributions. The question asks to compute Mr. X's taxable income and tax liability for the assessment year 2015-2016 based on the information given. Capital gains are also to be computed for Ms. B for transferring a property she received as a gift in assessment year 2015-2016. The provisions of advance tax and the need for service tax in India are also explained.

MF 0012 TAXATION MANAGEMENT

We Also Provide SYNOPSIS AND PROJECT.

Contact www.kimsharma.co.in for best and lowest cost solution or

Email: amitymbaassignment@gmail.com

Call: 9971223030

DRIVE SPRING 2016

PROGRAM MBA

SEMESTER III

SSUBJECT CODE & NAME

MF 0012

TAXATION MANAGEMENT

Scope of TI problems

- The document discusses the tax treatment of various incomes for individuals with resident, not ordinary resident, and non-resident tax statuses in India. It provides examples of incomes from different sources and whether they would be taxable under each residential status.

- Tables are presented showing the taxable income for three individuals - Mr. X, Mr. Devilal, and Mr. Deepak - under each residential status. The types of incomes included business income, agriculture, salary, house property, capital gains, and more.

- Whether an income is taxable depends on factors like where it was earned, where it was received, and whether a business or property is controlled from India. In general, more income sources are taxable

Perquisites & allowance

1. Allowances can be fully exempted, fully taxable, or partially taxable depending on the type of allowance. House Rent Allowance is partially taxable with an exempted amount based on rent paid, salary, and location.

2. Perquisites include non-monetary benefits provided by employers like rent-free housing, cars, food, gifts, etc. Some perquisites are fully exempted from tax while others are fully or partially taxable depending on employee type and conditions.

3. For specified employees like directors, perquisites related to rent-free housing, cars, domestic servants are fully taxable based on prescribed valuation methods even if used for official purposes. Perquisites are valued

Perquisites and assessment of individuals

The document defines perquisites as any non-cash benefits provided by an employer to employees in addition to a cash salary. Perquisites are also known as fringe benefits and can include employer-provided housing, cars, health insurance, club memberships, and other assets or services. The document outlines what perquisites are taxable in India, including rent-free housing, cars, interest-free loans, and more. It provides guidance on how to calculate taxable amounts for different perquisites such as housing and vehicle usage. Certain perquisites like medical reimbursements up to 15,000 rupees are fully exempted from tax.

Rent Free Accomodation ppt

This document discusses rent free accommodation provided by employers and its taxation. It defines rent free accommodation and provides rules for valuation of unfurnished, furnished and accommodation provided at concessional rent. For unfurnished accommodation, taxable value is a percentage of salary based on city population size. Furnished accommodation value includes furniture costs. Concessional rent value is the difference between market rent and amount paid. Exceptions for certain government employees are also outlined.

Tax deducted at source on salary

This document summarizes the key aspects of tax deducted at source on salary in India. It discusses what tax deducted at source is, how salary is defined for tax purposes, the relevant section of the Income Tax Act regarding TDS on salary, how TDS is deducted and returns are filed by employers, the structure of a payslip including gross salary calculation and common deductions, the tax treatment of various allowances, perks related to motor vehicles, deductions available under section 80C and other sections of the Income Tax Act, and interest deductions related to housing loans.

Recommended

Mf0012 taxation management

This document provides information about an assignment for a taxation management course. It includes 6 questions related to calculating taxable income and tax liability in India. It provides contextual information to accompany each question, including details about an individual's salary, assets purchased and sold at different times, and expenses incurred. Students are to answer each of the 6 questions, which are worth 10 marks each, for a total of 60 marks.

Mf00121 assignment spring_2016

Mr. X is provided financial information for the previous year ending March 31, 2015. This includes salaries, allowances, loans, and provident fund contributions. The question asks to compute Mr. X's taxable income and tax liability for the assessment year 2015-2016 based on the information given. Capital gains are also to be computed for Ms. B for transferring a property she received as a gift in assessment year 2015-2016. The provisions of advance tax and the need for service tax in India are also explained.

MF 0012 TAXATION MANAGEMENT

We Also Provide SYNOPSIS AND PROJECT.

Contact www.kimsharma.co.in for best and lowest cost solution or

Email: amitymbaassignment@gmail.com

Call: 9971223030

DRIVE SPRING 2016

PROGRAM MBA

SEMESTER III

SSUBJECT CODE & NAME

MF 0012

TAXATION MANAGEMENT

Scope of TI problems

- The document discusses the tax treatment of various incomes for individuals with resident, not ordinary resident, and non-resident tax statuses in India. It provides examples of incomes from different sources and whether they would be taxable under each residential status.

- Tables are presented showing the taxable income for three individuals - Mr. X, Mr. Devilal, and Mr. Deepak - under each residential status. The types of incomes included business income, agriculture, salary, house property, capital gains, and more.

- Whether an income is taxable depends on factors like where it was earned, where it was received, and whether a business or property is controlled from India. In general, more income sources are taxable

Perquisites & allowance

1. Allowances can be fully exempted, fully taxable, or partially taxable depending on the type of allowance. House Rent Allowance is partially taxable with an exempted amount based on rent paid, salary, and location.

2. Perquisites include non-monetary benefits provided by employers like rent-free housing, cars, food, gifts, etc. Some perquisites are fully exempted from tax while others are fully or partially taxable depending on employee type and conditions.

3. For specified employees like directors, perquisites related to rent-free housing, cars, domestic servants are fully taxable based on prescribed valuation methods even if used for official purposes. Perquisites are valued

Perquisites and assessment of individuals

The document defines perquisites as any non-cash benefits provided by an employer to employees in addition to a cash salary. Perquisites are also known as fringe benefits and can include employer-provided housing, cars, health insurance, club memberships, and other assets or services. The document outlines what perquisites are taxable in India, including rent-free housing, cars, interest-free loans, and more. It provides guidance on how to calculate taxable amounts for different perquisites such as housing and vehicle usage. Certain perquisites like medical reimbursements up to 15,000 rupees are fully exempted from tax.

Rent Free Accomodation ppt

This document discusses rent free accommodation provided by employers and its taxation. It defines rent free accommodation and provides rules for valuation of unfurnished, furnished and accommodation provided at concessional rent. For unfurnished accommodation, taxable value is a percentage of salary based on city population size. Furnished accommodation value includes furniture costs. Concessional rent value is the difference between market rent and amount paid. Exceptions for certain government employees are also outlined.

Tax deducted at source on salary

This document summarizes the key aspects of tax deducted at source on salary in India. It discusses what tax deducted at source is, how salary is defined for tax purposes, the relevant section of the Income Tax Act regarding TDS on salary, how TDS is deducted and returns are filed by employers, the structure of a payslip including gross salary calculation and common deductions, the tax treatment of various allowances, perks related to motor vehicles, deductions available under section 80C and other sections of the Income Tax Act, and interest deductions related to housing loans.

Rule of salary

This document defines taxable salary and allowances under Indian income tax law. It discusses what constitutes salary and outlines tax treatment of various common allowances such as housing, transport, education and entertainment allowances. It also summarizes valuation and taxability of various perquisites and benefits provided by employers like rent-free housing, use of cars, domestic servants, gas, electricity and water supply. The document also covers taxability of contributions to and payments from provident funds and pension plans as well as gratuity and commuted pension received by government and non-government employees in India.

Perquisites

The document discusses various types of perquisites that are taxable in the hands of an employee. It defines perquisites as casual emoluments or benefits provided to an employee in addition to their salary. Some key points include:

- Rent-free accommodation provided by the employer is taxable as a perquisite. The taxable amount depends on factors like location and whether the property is owned or rented by the employer.

- Other common taxable perquisites include utilities like gas, electricity and water paid by the employer, as well as facilities like transport and education for employees' families.

- There are certain exemptions, like a fixed allowance of up to Rs. 100 per child for education or Rs. 300

Salary income.bose

The document summarizes the tax treatment of income from salary in India. It defines salary and outlines what components are included as salary income. It states that salary income is taxable on a due or receipt basis, whichever is earlier. It provides details on the taxability of various salary allowances and perquisites. Key allowances like house rent allowance and travel allowance are partly exempt from tax up to certain limits. Most other allowances are fully taxable.

Income from Salary

1) Income from salary includes any remuneration received for services rendered to an employer.

2) Key allowances like DA, HRA are fully taxable while some allowances receive partial exemptions.

3) Perquisites provided by employers are also taxed, including rent-free housing, cars, interest-free loans, etc. Valuation methods differ based on type of perquisite.

Income under head salaries

THIS POWERPOINT PRESENTATION IS FOR THE STUDENTS OF CA-IPCC/ CS-EXECUTIVE / CWA INTER & GRADUATION FOR QUICK RECAP OF PROVISION OF SALARY HEAD.

Tax presentation salaries part 2

The document discusses various aspects of taxation related to salaries in India such as taxation of retrenchment compensation, provident funds, perquisites, and more.

It summarizes that retrenchment compensation up to Rs. 500,000 is tax exempt. For provident funds, statutory and recognized funds provide various tax exemptions while payments from unrecognized funds are partially taxable. Perquisites are taxable benefits provided in addition to salary, and some like rent-free housing are taxable for all employees while others only for specified employees.

The document also covers topics like voluntary retirement schemes, superannuation funds, health insurance premiums paid by employers, and various tax exemptions for allowances like education, food

Employee allowances - compensation management - Manu Melwin Joy

Allowance is a sum of money paid regularly to a person, typically to meet specified needs or expenses. Allowances are generally calculated on basic salary.

Computation of income from salaries for assessment year 2016-17

Computation of Income from salaries for assessment year 2015-16 . Based on Goa university Final yea B Com Syllabus of Accounting Major II - Income tax, service tax and Goa Value added tax

Salary Taxation Computation

The document provides a comprehensive overview of salary computation and taxability under the Indian Income Tax Act. It defines salary and outlines what types of payments are included as salary for tax purposes. It discusses the tax treatment of various allowances that may be received as part of compensation, categorizing them as fully taxable, partially exempt or fully exempt. The document also provides an example calculation of gross salary for an individual receiving various payments and allowances. The summary covers the key aspects around definitions, tax treatment of common allowances, and includes an example calculation.

Scope of Total Income - Problems and Solutions (3)

The document discusses the computation of total income for two individuals - Pawan and Jairam - for the assessment year 2020-2021 based on their residential status as resident, not ordinary resident, or non-resident. For Pawan, the total income is ₹464,000 as a resident, ₹254,000 as a not ordinary resident, and ₹254,000 as a non-resident. For Jairam, the total income is ₹751,000 as a resident, ₹505,000 as a not ordinary resident, and ₹285,000 as a non-resident. The document provides details of the income sources and amounts for each individual and the treatment

Income from salary

This document discusses various aspects of salary income under the Indian Income Tax Act. It defines salary and the principles for determining when salary is taxable. It explains the tax treatment of different types of salaries like basic salary, fees, commission, bonus, pension, etc. It also discusses exempted, partially exempted and taxable allowances as well as exempted and taxable perquisites. The document provides details on valuation of perquisites like accommodation and car facilities. It covers provisions related to provident funds like statutory PF, recognized PF and unrecognized PF. It concludes with deductions that can be claimed from gross salary income.

Income exempt under section 10 for assessment year 2016 17

Selected items of income exempted from tax for assessment year 2016-17 for Undergraduate taxation students

Dearness Allowance

The Dearness Allowance is a cost of living adjustment allowance paid to government employees, public sector employees, and pensioners in India to mitigate the impact of inflation. It is calculated as a percentage of the basic salary or pension that increases along with rises in the consumer price index. The Dearness Allowance was introduced after World War 2 and has been revised over time by various pay commissions to account for inflation and be paid out twice yearly.

Income under the head Salary

This document discusses taxation of various payments received by an employee under the head of salary upon retirement. It explains that gratuity up to Rs. 10 lakh, pension commutation, earned leave salary up to Rs. 3 lakh or 30 days per year of service, retrenchment compensation up to 15 days of salary for each year of service, and voluntary retirement compensation up to 3 months salary per year are exempt from income tax. Employer contributions to recognized provident funds are also exempt up to 12% of salary, while interest and lump sum payments are exempt under certain conditions. Examples are provided to illustrate the tax treatment of these retirement payments.

Entrepreneurship Quiz 13 Oct

1. The document discusses the Income Tax of India and provides information about an AFTERSCHO☺OL program in social entrepreneurship.

2. It details the conditions for claiming exemptions under section 10BA of the Income Tax Act and answers questions related to salary income and taxability.

3. The final sections provide information about workshops conducted by AFTERSCHO☺OL and the benefits of its flexible and comprehensive Post Graduate Programme in Social Entrepreneurship.

Computation of income from Salaries

Presentation is on computation of income from Salaries . this presentation is for the benefit of undergraduate commerce students and is based on the B.Com syllabus of Goa University

Income under the head salary

This document summarizes the taxation of various forms of salary income and perquisites in India under the Income Tax Act of 1961. It discusses the tax treatment of advance salary, arrears salary, bonus, commission and various allowances. It also provides details on the valuation and taxability of rent-free accommodations, interest-free loans, use of moveable assets, medical benefits and other perquisites.

TAXATION LAWS - INCOME UNDER THE HEAD SALARY

TAXATION LAWS - INCOME UNDER THE HEAD SALARY

Basic Salary

Allowances

Retirement benefits:

a) Gratuity

b) Pension

c) Leave encashment

d) Provident fund

Perks/Perquisites

Different Forms of salary

House rent allowance

Allowances are provided for a specific purpose or expenditure

They are always taxable unless exemption under section 10 is explicitly provided.

There are two types of allowances where section 10 exemption is provided:-

House Rent Allowance (HRA)

Special Allowances

Income under head salaries

The document discusses various provisions related to income from salaries under the Income Tax Act. It provides definitions and key aspects related to salaries such as the charging section, place of accrual and taxability of various allowances.

Allowances are discussed in detail and classified into categories such as house rent allowance, specified allowances, entertainment allowance and fully taxable allowances. Exemption limits and calculation methods for house rent allowance are provided. Specified allowances that are exempt up to the amount spent or up to specified limits are outlined.

Retirement benefits, deductions and the overall framework for computation of income from salaries are summarized at a high level.

SMU MBA SEM 3 FINANCE SPRING 2016 ASSIGNMENTS

Smu mba sem 3 Finance spring 2016 assignments, Smu solved assignments, smu mba assignments, smu mba spring 2016 assignments, smu assignments

Taxation Assignment.pdf

Mr. Paul's residential status for the past three assessment years must be determined based on his time spent in India from 2017 to 2021 for his work as a commercial artist. Mr. Shastri must report various sources of income earned in India and abroad during the previous year relevant to AY 2022-23 to determine his tax liability. Mr. Chandrakant Mimaye retired from his job in 2021 and details of his salary and retirement compensation are provided to calculate his taxable salary income for AY 2022-23. Mrs. Nadkarni owns two houses, one self-occupied and one rented, and financial details are given to compute her gross total income for PY 2021-22.

Smu mba sem 3 finance spring 2016 assignments

Smu mba sem 3 finance spring 2016 assignments, smu solved assignments ,smu assignments ,smu mba assignments ,smu mba solved assignments ,smu mba spring 2016 assignments

More Related Content

What's hot

Rule of salary

This document defines taxable salary and allowances under Indian income tax law. It discusses what constitutes salary and outlines tax treatment of various common allowances such as housing, transport, education and entertainment allowances. It also summarizes valuation and taxability of various perquisites and benefits provided by employers like rent-free housing, use of cars, domestic servants, gas, electricity and water supply. The document also covers taxability of contributions to and payments from provident funds and pension plans as well as gratuity and commuted pension received by government and non-government employees in India.

Perquisites

The document discusses various types of perquisites that are taxable in the hands of an employee. It defines perquisites as casual emoluments or benefits provided to an employee in addition to their salary. Some key points include:

- Rent-free accommodation provided by the employer is taxable as a perquisite. The taxable amount depends on factors like location and whether the property is owned or rented by the employer.

- Other common taxable perquisites include utilities like gas, electricity and water paid by the employer, as well as facilities like transport and education for employees' families.

- There are certain exemptions, like a fixed allowance of up to Rs. 100 per child for education or Rs. 300

Salary income.bose

The document summarizes the tax treatment of income from salary in India. It defines salary and outlines what components are included as salary income. It states that salary income is taxable on a due or receipt basis, whichever is earlier. It provides details on the taxability of various salary allowances and perquisites. Key allowances like house rent allowance and travel allowance are partly exempt from tax up to certain limits. Most other allowances are fully taxable.

Income from Salary

1) Income from salary includes any remuneration received for services rendered to an employer.

2) Key allowances like DA, HRA are fully taxable while some allowances receive partial exemptions.

3) Perquisites provided by employers are also taxed, including rent-free housing, cars, interest-free loans, etc. Valuation methods differ based on type of perquisite.

Income under head salaries

THIS POWERPOINT PRESENTATION IS FOR THE STUDENTS OF CA-IPCC/ CS-EXECUTIVE / CWA INTER & GRADUATION FOR QUICK RECAP OF PROVISION OF SALARY HEAD.

Tax presentation salaries part 2

The document discusses various aspects of taxation related to salaries in India such as taxation of retrenchment compensation, provident funds, perquisites, and more.

It summarizes that retrenchment compensation up to Rs. 500,000 is tax exempt. For provident funds, statutory and recognized funds provide various tax exemptions while payments from unrecognized funds are partially taxable. Perquisites are taxable benefits provided in addition to salary, and some like rent-free housing are taxable for all employees while others only for specified employees.

The document also covers topics like voluntary retirement schemes, superannuation funds, health insurance premiums paid by employers, and various tax exemptions for allowances like education, food

Employee allowances - compensation management - Manu Melwin Joy

Allowance is a sum of money paid regularly to a person, typically to meet specified needs or expenses. Allowances are generally calculated on basic salary.

Computation of income from salaries for assessment year 2016-17

Computation of Income from salaries for assessment year 2015-16 . Based on Goa university Final yea B Com Syllabus of Accounting Major II - Income tax, service tax and Goa Value added tax

Salary Taxation Computation

The document provides a comprehensive overview of salary computation and taxability under the Indian Income Tax Act. It defines salary and outlines what types of payments are included as salary for tax purposes. It discusses the tax treatment of various allowances that may be received as part of compensation, categorizing them as fully taxable, partially exempt or fully exempt. The document also provides an example calculation of gross salary for an individual receiving various payments and allowances. The summary covers the key aspects around definitions, tax treatment of common allowances, and includes an example calculation.

Scope of Total Income - Problems and Solutions (3)

The document discusses the computation of total income for two individuals - Pawan and Jairam - for the assessment year 2020-2021 based on their residential status as resident, not ordinary resident, or non-resident. For Pawan, the total income is ₹464,000 as a resident, ₹254,000 as a not ordinary resident, and ₹254,000 as a non-resident. For Jairam, the total income is ₹751,000 as a resident, ₹505,000 as a not ordinary resident, and ₹285,000 as a non-resident. The document provides details of the income sources and amounts for each individual and the treatment

Income from salary

This document discusses various aspects of salary income under the Indian Income Tax Act. It defines salary and the principles for determining when salary is taxable. It explains the tax treatment of different types of salaries like basic salary, fees, commission, bonus, pension, etc. It also discusses exempted, partially exempted and taxable allowances as well as exempted and taxable perquisites. The document provides details on valuation of perquisites like accommodation and car facilities. It covers provisions related to provident funds like statutory PF, recognized PF and unrecognized PF. It concludes with deductions that can be claimed from gross salary income.

Income exempt under section 10 for assessment year 2016 17

Selected items of income exempted from tax for assessment year 2016-17 for Undergraduate taxation students

Dearness Allowance

The Dearness Allowance is a cost of living adjustment allowance paid to government employees, public sector employees, and pensioners in India to mitigate the impact of inflation. It is calculated as a percentage of the basic salary or pension that increases along with rises in the consumer price index. The Dearness Allowance was introduced after World War 2 and has been revised over time by various pay commissions to account for inflation and be paid out twice yearly.

Income under the head Salary

This document discusses taxation of various payments received by an employee under the head of salary upon retirement. It explains that gratuity up to Rs. 10 lakh, pension commutation, earned leave salary up to Rs. 3 lakh or 30 days per year of service, retrenchment compensation up to 15 days of salary for each year of service, and voluntary retirement compensation up to 3 months salary per year are exempt from income tax. Employer contributions to recognized provident funds are also exempt up to 12% of salary, while interest and lump sum payments are exempt under certain conditions. Examples are provided to illustrate the tax treatment of these retirement payments.

Entrepreneurship Quiz 13 Oct

1. The document discusses the Income Tax of India and provides information about an AFTERSCHO☺OL program in social entrepreneurship.

2. It details the conditions for claiming exemptions under section 10BA of the Income Tax Act and answers questions related to salary income and taxability.

3. The final sections provide information about workshops conducted by AFTERSCHO☺OL and the benefits of its flexible and comprehensive Post Graduate Programme in Social Entrepreneurship.

Computation of income from Salaries

Presentation is on computation of income from Salaries . this presentation is for the benefit of undergraduate commerce students and is based on the B.Com syllabus of Goa University

Income under the head salary

This document summarizes the taxation of various forms of salary income and perquisites in India under the Income Tax Act of 1961. It discusses the tax treatment of advance salary, arrears salary, bonus, commission and various allowances. It also provides details on the valuation and taxability of rent-free accommodations, interest-free loans, use of moveable assets, medical benefits and other perquisites.

TAXATION LAWS - INCOME UNDER THE HEAD SALARY

TAXATION LAWS - INCOME UNDER THE HEAD SALARY

Basic Salary

Allowances

Retirement benefits:

a) Gratuity

b) Pension

c) Leave encashment

d) Provident fund

Perks/Perquisites

Different Forms of salary

House rent allowance

Allowances are provided for a specific purpose or expenditure

They are always taxable unless exemption under section 10 is explicitly provided.

There are two types of allowances where section 10 exemption is provided:-

House Rent Allowance (HRA)

Special Allowances

Income under head salaries

The document discusses various provisions related to income from salaries under the Income Tax Act. It provides definitions and key aspects related to salaries such as the charging section, place of accrual and taxability of various allowances.

Allowances are discussed in detail and classified into categories such as house rent allowance, specified allowances, entertainment allowance and fully taxable allowances. Exemption limits and calculation methods for house rent allowance are provided. Specified allowances that are exempt up to the amount spent or up to specified limits are outlined.

Retirement benefits, deductions and the overall framework for computation of income from salaries are summarized at a high level.

What's hot (19)

Employee allowances - compensation management - Manu Melwin Joy

Employee allowances - compensation management - Manu Melwin Joy

Computation of income from salaries for assessment year 2016-17

Computation of income from salaries for assessment year 2016-17

Scope of Total Income - Problems and Solutions (3)

Scope of Total Income - Problems and Solutions (3)

Income exempt under section 10 for assessment year 2016 17

Income exempt under section 10 for assessment year 2016 17

Similar to Mf0012 taxation management

SMU MBA SEM 3 FINANCE SPRING 2016 ASSIGNMENTS

Smu mba sem 3 Finance spring 2016 assignments, Smu solved assignments, smu mba assignments, smu mba spring 2016 assignments, smu assignments

Taxation Assignment.pdf

Mr. Paul's residential status for the past three assessment years must be determined based on his time spent in India from 2017 to 2021 for his work as a commercial artist. Mr. Shastri must report various sources of income earned in India and abroad during the previous year relevant to AY 2022-23 to determine his tax liability. Mr. Chandrakant Mimaye retired from his job in 2021 and details of his salary and retirement compensation are provided to calculate his taxable salary income for AY 2022-23. Mrs. Nadkarni owns two houses, one self-occupied and one rented, and financial details are given to compute her gross total income for PY 2021-22.

Smu mba sem 3 finance spring 2016 assignments

Smu mba sem 3 finance spring 2016 assignments, smu solved assignments ,smu assignments ,smu mba assignments ,smu mba solved assignments ,smu mba spring 2016 assignments

1A.Taxation Test.pdf

This document contains a test on taxation with multiple choice questions and descriptive questions.

The multiple choice questions are related to income tax calculations for an individual based on information provided about cash withdrawals, payments made for a wedding, purchase and gift of a property, let out of a property, taxable income from bonds.

The descriptive questions require computation of total income and tax payable for an individual based on receipts and payments, capital gains, income from house property let out, salary income and perquisites. Residential status and taxability of various incomes is also asked.

The document tests knowledge of income tax law and ability to calculate taxable income and tax payable in various situations based on information provided.

21913rtp may11 pcc_5

1. The document discusses various tax-related questions regarding residential status, income taxability, capital gains, deductions, and TDS provisions. It provides details of incomes, investments, and payments for multiple individuals to determine their total income and tax liability.

2. Question 1 discusses the taxability of various incomes for an individual based on their residential status in India. Question 2 addresses the taxability of anonymous donations received by a charitable trust.

3. The remaining questions provide additional income, investment, and payment details to calculate total income, capital gains, deductions, carried forward losses, and TDS implications for individuals and an HUF.

21904rtp may2011 ipcc_4

1. Mr. Ganesh's taxable income would vary depending on his residential status - as a resident and ordinarily resident all incomes listed would be taxable in India except interest received in France. As a resident but not ordinarily resident, foreign incomes would be exempt. As a non-resident, only India-sourced incomes would be taxable.

2. To calculate Mr. Viren's taxable salary income for AY 2011-12, his salary, pension, leave encashment and gratuity amounts would be included, assuming he is not covered by the Payment of Gratuity Act.

3. To calculate Mr. Ramesh's house property income for AY 2011-12, his net

Bba203 financial accounting...

This document provides information about obtaining fully solved assignments. It instructs students to send their semester and specialization name to an email address or call a phone number to receive assignments. It then provides an example assignment for BBA203 Financial Accounting, including sample questions and answers. The assignment covers topics like journal entries, accounting objectives, treatment of goodwill, differentiation of trade and cash discounts, features and objectives of final accounts, and preparation of trading, profit and loss statements and a balance sheet.

Income from salary part 1

This document summarizes provisions related to taxation of salary income in India. It defines key terms related to salary such as basic salary, allowances, perquisites, and retirement benefits. It provides examples of allowances that are fully taxable, fully exempted, and partly taxable. The document also contains examples showing calculations of taxable salary income based on various components of compensation received by employees.

CA IPCC important paper by CA IPCC classes.

Mia Mia has been started with the vision of listing IPCC Classes in Mumbai . We also make sure CPT Classes in Mumbai are also covered in the list. CA IPCC Classes are in great number however to choose the best will make or break your career.

Accounting And Bookkeeping For Business And Management 13 October

1. The document discusses the Income Tax of India and provides information about an AFTERSCHO☺OL program in social entrepreneurship.

2. It details the conditions for claiming exemptions under section 10BA of the Income Tax Act and answers questions related to salary income and taxability.

3. The final sections provide information about workshops conducted by AFTERSCHO☺OL and the benefits of its flexible and comprehensive Post Graduate Programme in Social Entrepreneurship.

CA IPCC Exam Sample Paper

1. The document provides information about a mock test for Category-C of the IPCC exam for AY 2013-14. It contains 7 questions to be answered in 3 hours for a maximum of 100 marks. Question 1 is compulsory and candidates must attempt any 5 of the remaining 6 questions.

2. Question 1 has 4 sub-questions related to computation of total income and tax liability for Mrs. Purvi, a chartered accountant, and computation of service tax payable by Rishi Professionals Ltd. It also provides information needed to solve the sub-questions.

3. The document outlines the instructions that working notes should form part of the answers and wherever required, suitable assumptions may be made by

Income from house property .pptx

Interest on Borrowed Capital for Construction of new houses.

Rules related to interest on Loan set -off

Self Occupied & Deemed to let out House Property - Exercises.

Bba203 financial accounting...

This document provides information about getting fully solved assignments from an assignment help service. Students are instructed to send their semester, specialization name, and course details to the provided email address or call the phone number to receive help with their assignments. It then provides an example assignment question for a financial accounting course, asking students to journalize transactions, explain accounting objectives and categories of users, define goodwill and provide journal entries for admission of a new partner, and differentiate between trade and cash discounts. The document provides an assignment for students to prepare final accounts from a trial balance with various adjustments.

Classification of taxes ppt doms

The document discusses various types of taxes in India including direct taxes like income tax and indirect taxes like sales tax. It explains the key concepts related to income tax like previous year, assessment year, residential status, total income and tax slabs. Residential status is determined based on the number of days spent in India and can be resident, non-resident or resident but not ordinarily resident. Total income includes income from various heads like salary, house property, business, capital gains and other sources after exemptions. Tax is calculated by applying the appropriate tax rates to the net taxable income.

Bba203

This document contains an assignment for a Financial Accounting course with 6 questions. Question 1 asks to journalize transactions, Question 2 explains accounting objectives and user categories, Question 3 defines goodwill and provides a journal entry problem, Question 4 differentiates trade and cash discounts and includes a cash book exercise, Question 5 explains final accounts features and objectives, and Question 6 prepares financial statements from a trial balance with additional information.

Lesson 13

This document provides examples and questions to practice computation of taxable income and assessment of individuals and firms. It includes examples of computing total income for individuals from various sources like salary, house property, capital gains, other sources, and applying deductions. It also provides multiple questions with details of an individual's income from salary and other sources to compute their total income and tax payable.

Scope of Total Income

The document discusses the scope of total income under the Income Tax Act for different residential statuses - resident and ordinarily resident, resident but not ordinarily resident, and non-resident. It provides examples of income that would be taxable for each status, depending on whether the income is received, accrued, or earned in India or abroad. It also contains sample problems calculating total income for individuals with various sources of income under each of the three residential statuses.

I N C O M E T A X L A W O F I N D I A

The document provides an overview of key concepts in India's income tax law, including definitions of tax-related terms like "person", "assessee", "income", and "residential status". It discusses the different sources of income and the tax treatment of various types of compensation, benefits, and loans provided by employers.

Income Tax Law Of India

The document provides an overview of key concepts in India's income tax law, including definitions of common terms like person, assessee, income, residential status, taxable income heads, and tax exemptions. It summarizes procedures for determining tax liability and exemptions for various types of retirement payments like gratuity, pension, and leave encashment.

Industrial Development & Regulation Act & Other Business Laws

The document provides an overview of key concepts in India's income tax law, including definitions of tax-related terms like "person", "assessee", "income", and "residential status". It discusses the different sources of income and the tax treatment of various income types like salary, pension, leave encashment, gratuity, and perquisites. It also summarizes exemptions available under the law.

Similar to Mf0012 taxation management (20)

Accounting And Bookkeeping For Business And Management 13 October

Accounting And Bookkeeping For Business And Management 13 October

Industrial Development & Regulation Act & Other Business Laws

Industrial Development & Regulation Act & Other Business Laws

Recently uploaded

ANATOMY AND BIOMECHANICS OF HIP JOINT.pdf

it describes the bony anatomy including the femoral head , acetabulum, labrum . also discusses the capsule , ligaments . muscle that act on the hip joint and the range of motion are outlined. factors affecting hip joint stability and weight transmission through the joint are summarized.

Chapter wise All Notes of First year Basic Civil Engineering.pptx

Chapter wise All Notes of First year Basic Civil Engineering

Syllabus

Chapter-1

Introduction to objective, scope and outcome the subject

Chapter 2

Introduction: Scope and Specialization of Civil Engineering, Role of civil Engineer in Society, Impact of infrastructural development on economy of country.

Chapter 3

Surveying: Object Principles & Types of Surveying; Site Plans, Plans & Maps; Scales & Unit of different Measurements.

Linear Measurements: Instruments used. Linear Measurement by Tape, Ranging out Survey Lines and overcoming Obstructions; Measurements on sloping ground; Tape corrections, conventional symbols. Angular Measurements: Instruments used; Introduction to Compass Surveying, Bearings and Longitude & Latitude of a Line, Introduction to total station.

Levelling: Instrument used Object of levelling, Methods of levelling in brief, and Contour maps.

Chapter 4

Buildings: Selection of site for Buildings, Layout of Building Plan, Types of buildings, Plinth area, carpet area, floor space index, Introduction to building byelaws, concept of sun light & ventilation. Components of Buildings & their functions, Basic concept of R.C.C., Introduction to types of foundation

Chapter 5

Transportation: Introduction to Transportation Engineering; Traffic and Road Safety: Types and Characteristics of Various Modes of Transportation; Various Road Traffic Signs, Causes of Accidents and Road Safety Measures.

Chapter 6

Environmental Engineering: Environmental Pollution, Environmental Acts and Regulations, Functional Concepts of Ecology, Basics of Species, Biodiversity, Ecosystem, Hydrological Cycle; Chemical Cycles: Carbon, Nitrogen & Phosphorus; Energy Flow in Ecosystems.

Water Pollution: Water Quality standards, Introduction to Treatment & Disposal of Waste Water. Reuse and Saving of Water, Rain Water Harvesting. Solid Waste Management: Classification of Solid Waste, Collection, Transportation and Disposal of Solid. Recycling of Solid Waste: Energy Recovery, Sanitary Landfill, On-Site Sanitation. Air & Noise Pollution: Primary and Secondary air pollutants, Harmful effects of Air Pollution, Control of Air Pollution. . Noise Pollution Harmful Effects of noise pollution, control of noise pollution, Global warming & Climate Change, Ozone depletion, Greenhouse effect

Text Books:

1. Palancharmy, Basic Civil Engineering, McGraw Hill publishers.

2. Satheesh Gopi, Basic Civil Engineering, Pearson Publishers.

3. Ketki Rangwala Dalal, Essentials of Civil Engineering, Charotar Publishing House.

4. BCP, Surveying volume 1

RHEOLOGY Physical pharmaceutics-II notes for B.pharm 4th sem students

Physical pharmaceutics notes for B.pharm students

BÀI TẬP BỔ TRỢ TIẾNG ANH LỚP 9 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2024-2025 - ...

BÀI TẬP BỔ TRỢ TIẾNG ANH LỚP 9 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2024-2025 - ...Nguyen Thanh Tu Collection

https://app.box.com/s/tacvl9ekroe9hqupdnjruiypvm9rdaneTraditional Musical Instruments of Arunachal Pradesh and Uttar Pradesh - RAYH...

Traditional Musical Instruments of Arunachal Pradesh and Uttar Pradesh

Advanced Java[Extra Concepts, Not Difficult].docx![Advanced Java[Extra Concepts, Not Difficult].docx](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Advanced Java[Extra Concepts, Not Difficult].docx](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

This is part 2 of my Java Learning Journey. This contains Hashing, ArrayList, LinkedList, Date and Time Classes, Calendar Class and more.

Philippine Edukasyong Pantahanan at Pangkabuhayan (EPP) Curriculum

(𝐓𝐋𝐄 𝟏𝟎𝟎) (𝐋𝐞𝐬𝐬𝐨𝐧 𝟏)-𝐏𝐫𝐞𝐥𝐢𝐦𝐬

𝐃𝐢𝐬𝐜𝐮𝐬𝐬 𝐭𝐡𝐞 𝐄𝐏𝐏 𝐂𝐮𝐫𝐫𝐢𝐜𝐮𝐥𝐮𝐦 𝐢𝐧 𝐭𝐡𝐞 𝐏𝐡𝐢𝐥𝐢𝐩𝐩𝐢𝐧𝐞𝐬:

- Understand the goals and objectives of the Edukasyong Pantahanan at Pangkabuhayan (EPP) curriculum, recognizing its importance in fostering practical life skills and values among students. Students will also be able to identify the key components and subjects covered, such as agriculture, home economics, industrial arts, and information and communication technology.

𝐄𝐱𝐩𝐥𝐚𝐢𝐧 𝐭𝐡𝐞 𝐍𝐚𝐭𝐮𝐫𝐞 𝐚𝐧𝐝 𝐒𝐜𝐨𝐩𝐞 𝐨𝐟 𝐚𝐧 𝐄𝐧𝐭𝐫𝐞𝐩𝐫𝐞𝐧𝐞𝐮𝐫:

-Define entrepreneurship, distinguishing it from general business activities by emphasizing its focus on innovation, risk-taking, and value creation. Students will describe the characteristics and traits of successful entrepreneurs, including their roles and responsibilities, and discuss the broader economic and social impacts of entrepreneurial activities on both local and global scales.

Wound healing PPT

This document provides an overview of wound healing, its functions, stages, mechanisms, factors affecting it, and complications.

A wound is a break in the integrity of the skin or tissues, which may be associated with disruption of the structure and function.

Healing is the body’s response to injury in an attempt to restore normal structure and functions.

Healing can occur in two ways: Regeneration and Repair

There are 4 phases of wound healing: hemostasis, inflammation, proliferation, and remodeling. This document also describes the mechanism of wound healing. Factors that affect healing include infection, uncontrolled diabetes, poor nutrition, age, anemia, the presence of foreign bodies, etc.

Complications of wound healing like infection, hyperpigmentation of scar, contractures, and keloid formation.

Gender and Mental Health - Counselling and Family Therapy Applications and In...

A proprietary approach developed by bringing together the best of learning theories from Psychology, design principles from the world of visualization, and pedagogical methods from over a decade of training experience, that enables you to: Learn better, faster!

Solutons Maths Escape Room Spatial .pptx

Solutions of Puzzles of Mathematics Escape Room Game in Spatial.io

BBR 2024 Summer Sessions Interview Training

Qualitative research interview training by Professor Katrina Pritchard and Dr Helen Williams

The History of Stoke Newington Street Names

Presented at the Stoke Newington Literary Festival on 9th June 2024

www.StokeNewingtonHistory.com

LAND USE LAND COVER AND NDVI OF MIRZAPUR DISTRICT, UP

This Dissertation explores the particular circumstances of Mirzapur, a region located in the

core of India. Mirzapur, with its varied terrains and abundant biodiversity, offers an optimal

environment for investigating the changes in vegetation cover dynamics. Our study utilizes

advanced technologies such as GIS (Geographic Information Systems) and Remote sensing to

analyze the transformations that have taken place over the course of a decade.

The complex relationship between human activities and the environment has been the focus

of extensive research and worry. As the global community grapples with swift urbanization,

population expansion, and economic progress, the effects on natural ecosystems are becoming

more evident. A crucial element of this impact is the alteration of vegetation cover, which plays a

significant role in maintaining the ecological equilibrium of our planet.Land serves as the foundation for all human activities and provides the necessary materials for

these activities. As the most crucial natural resource, its utilization by humans results in different

'Land uses,' which are determined by both human activities and the physical characteristics of the

land.

The utilization of land is impacted by human needs and environmental factors. In countries

like India, rapid population growth and the emphasis on extensive resource exploitation can lead

to significant land degradation, adversely affecting the region's land cover.

Therefore, human intervention has significantly influenced land use patterns over many

centuries, evolving its structure over time and space. In the present era, these changes have

accelerated due to factors such as agriculture and urbanization. Information regarding land use and

cover is essential for various planning and management tasks related to the Earth's surface,

providing crucial environmental data for scientific, resource management, policy purposes, and

diverse human activities.

Accurate understanding of land use and cover is imperative for the development planning

of any area. Consequently, a wide range of professionals, including earth system scientists, land

and water managers, and urban planners, are interested in obtaining data on land use and cover

changes, conversion trends, and other related patterns. The spatial dimensions of land use and

cover support policymakers and scientists in making well-informed decisions, as alterations in

these patterns indicate shifts in economic and social conditions. Monitoring such changes with the

help of Advanced technologies like Remote Sensing and Geographic Information Systems is

crucial for coordinated efforts across different administrative levels. Advanced technologies like

Remote Sensing and Geographic Information Systems

9

Changes in vegetation cover refer to variations in the distribution, composition, and overall

structure of plant communities across different temporal and spatial scales. These changes can

occur natural.

বাংলাদেশ অর্থনৈতিক সমীক্ষা (Economic Review) ২০২৪ UJS App.pdf

বাংলাদেশের অর্থনৈতিক সমীক্ষা ২০২৪ [Bangladesh Economic Review 2024 Bangla.pdf] কম্পিউটার , ট্যাব ও স্মার্ট ফোন ভার্সন সহ সম্পূর্ণ বাংলা ই-বুক বা pdf বই " সুচিপত্র ...বুকমার্ক মেনু 🔖 ও হাইপার লিংক মেনু 📝👆 যুক্ত ..

আমাদের সবার জন্য খুব খুব গুরুত্বপূর্ণ একটি বই ..বিসিএস, ব্যাংক, ইউনিভার্সিটি ভর্তি ও যে কোন প্রতিযোগিতা মূলক পরীক্ষার জন্য এর খুব ইম্পরট্যান্ট একটি বিষয় ...তাছাড়া বাংলাদেশের সাম্প্রতিক যে কোন ডাটা বা তথ্য এই বইতে পাবেন ...

তাই একজন নাগরিক হিসাবে এই তথ্য গুলো আপনার জানা প্রয়োজন ...।

বিসিএস ও ব্যাংক এর লিখিত পরীক্ষা ...+এছাড়া মাধ্যমিক ও উচ্চমাধ্যমিকের স্টুডেন্টদের জন্য অনেক কাজে আসবে ...

Recently uploaded (20)

IGCSE Biology Chapter 14- Reproduction in Plants.pdf

IGCSE Biology Chapter 14- Reproduction in Plants.pdf

Film vocab for eal 3 students: Australia the movie

Film vocab for eal 3 students: Australia the movie

Chapter wise All Notes of First year Basic Civil Engineering.pptx

Chapter wise All Notes of First year Basic Civil Engineering.pptx

RHEOLOGY Physical pharmaceutics-II notes for B.pharm 4th sem students

RHEOLOGY Physical pharmaceutics-II notes for B.pharm 4th sem students

BÀI TẬP BỔ TRỢ TIẾNG ANH LỚP 9 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2024-2025 - ...

BÀI TẬP BỔ TRỢ TIẾNG ANH LỚP 9 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2024-2025 - ...

Traditional Musical Instruments of Arunachal Pradesh and Uttar Pradesh - RAYH...

Traditional Musical Instruments of Arunachal Pradesh and Uttar Pradesh - RAYH...

Philippine Edukasyong Pantahanan at Pangkabuhayan (EPP) Curriculum

Philippine Edukasyong Pantahanan at Pangkabuhayan (EPP) Curriculum

Gender and Mental Health - Counselling and Family Therapy Applications and In...

Gender and Mental Health - Counselling and Family Therapy Applications and In...

LAND USE LAND COVER AND NDVI OF MIRZAPUR DISTRICT, UP

LAND USE LAND COVER AND NDVI OF MIRZAPUR DISTRICT, UP

বাংলাদেশ অর্থনৈতিক সমীক্ষা (Economic Review) ২০২৪ UJS App.pdf

বাংলাদেশ অর্থনৈতিক সমীক্ষা (Economic Review) ২০২৪ UJS App.pdf

Mf0012 taxation management

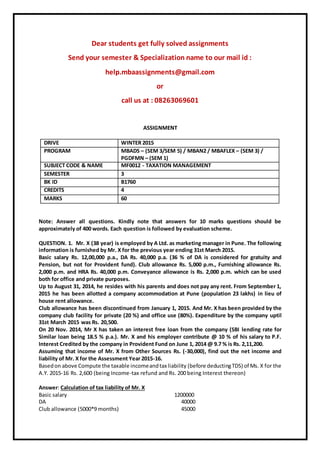

- 1. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : help.mbaassignments@gmail.com or call us at : 08263069601 ASSIGNMENT DRIVE WINTER 2015 PROGRAM MBADS – (SEM 3/SEM 5) / MBAN2 / MBAFLEX – (SEM 3) / PGDFMN – (SEM 1) SUBJECT CODE & NAME MF0012 - TAXATION MANAGEMENT SEMESTER 3 BK ID B1760 CREDITS 4 MARKS 60 Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each question is followed by evaluation scheme. QUESTION. 1. Mr. X (38 year) is employed by A Ltd. as marketing manager in Pune. The following information is furnished by Mr. X for the previous year ending 31st March 2015. Basic salary Rs. 12,00,000 p.a., DA Rs. 40,000 p.a. (36 % of DA is considered for gratuity and Pension, but not for Provident fund). Club allowance Rs. 5,000 p.m., Furnishing allowance Rs. 2,000 p.m. and HRA Rs. 40,000 p.m. Conveyance allowance is Rs. 2,000 p.m. which can be used both for office and private purposes. Up to August 31, 2014, he resides with his parents and does not pay any rent. From September 1, 2015 he has been allotted a company accommodation at Pune (population 23 lakhs) in lieu of house rent allowance. Club allowance has been discontinued from January 1, 2015. And Mr. X has been provided by the company club facility for private (20 %) and office use (80%). Expenditure by the company uptil 31st March 2015 was Rs. 20,500. On 20 Nov. 2014, Mr X has taken an interest free loan from the company (SBI lending rate for Similar loan being 18.5 % p.a.). Mr. X and his employer contribute @ 10 % of his salary to P.F. Interest Credited by the company in Provident Fund on June 1, 2014 @ 9.7 % is Rs. 2,11,200. Assuming that income of Mr. X from Other Sources Rs. (-30,000), find out the net income and liability of Mr. X for the Assessment Year 2015-16. Basedon above Compute the taxable incomeandtax liability (before deductingTDS) of Ms. X for the A.Y. 2015-16 Rs. 2,600 (being Income-tax refund and Rs. 200 being Interest thereon) Answer: Calculation of tax liability of Mr. X Basic salary 1200000 DA 40000 Club allowance (5000*9 months) 45000

- 2. Furnishingallowance (2000*12 months) 24000 HRA (40000*5 months) 200000 HRA 280000 (least of: 40000*7 months = 280000 1200000*0.40*7/12=280000) Conveyance QUESTION. 2 a) How is advance money received against cost of acquisition adjusted? b) State giving reasons, whether the following assets are Short term or Long term: i) X purchases a house on 10th March 2012 and transfers on 6th June 2014. ii) Y purchases unquoted shares in an Indian company on 10th March 2012 and transfers on 6th June 2012. iii) Z acquires units of mutual fund on 7th July 2013 and transfers those on 10th July 2014. iv) A purchases diamonds on 12 September 2011 and gifts the same to his friend B on 31st December 2014 and B transfers the asset on 20 October 2014. Answer: a) Adjustment of advance money received against cost of acquisition (Section 51) It ispossible foranassessee to receive some advance in regard to the transfer of capital asset. Due to breakdown of negotiations the assessee may have retained the advance. In calculating capital gains the above advance retained by the assessee must be used to reduce the cost of acquisition. QUESTION. 3 Ms. A purchases a house property on 1st January 1976 for Rs. 95,000. She enters into an Agreement for sale of the same property to Mr. X on 1st November 1983 and receives Rs. 10,000 as advance. Following the demise of Mr. X immediately thereafter, the money was forfeited by Ms. A. Later Ms. A gifts her property to her friend Ms. B on 15th May 1985. The following expenses are incurred by Ms. A and Ms. B for improvement of the property: Particulars Cost (Rs.) Additions of two rooms by Ms. A during 1978-79 25,000 Addition of first floor by Ms. A during 1983-84 40,000 Addition of second floor by Ms. B during 1990-91 1,15,000 Ms. B enters into an agreement for sell the property for RS. 8,50,000 to Mr. P on 1st April 1993after receiving an advance of Rs. 50,000. Mr. P could not pay the balance amount within the stipulated time of two months and Ms. B forfeits the amount of advance. Ms. B finally transfers the property to Ms. C for Rs. 14,75,000 on 1st December 2014. Given the Fair Market Value of the property on 1st April 1981 being Rs. 1,15,000; Cost Inflation Index for 1981-82 : Rs. 100; for 1983-84 : Rs.116; for 1985-86 : Rs. 133; for 1990-91 : Rs. 182; for 1993-94 : Rs. 244 and 2014-15: Rs.1,024 compute the Capital gains in the hands of Ms. B for the Assessment Year 2015-16. Compute the Capital gains in the hands of Ms. B for the Assessment Year 2015-16. Answer: Calculation of the capital gain of Ms. B for the A.Y 2015-16 Sale Proceeds 14,75,000 Less:Indexedcostof acquisition 70,356

- 3. QUESTION. 4 i) Ms. Brinda, a U.S. citizen visits India on 1st January 2014 to study and conduct research on Indian folk culture. She has been regularly visiting India for 100 days in the past five consecutive years to carry the research. Advise the residential status of Ms. Brinda under extant rules referring to section 6 of the Income-tax Act 1961. ii) What are the provisions of Advance tax under section 2(1)? Answer: i) Residential status: On the parameter of residence in India, there are three categories: resident,non-resident,andnotordinarilyresident. The definition depends upon physical presence of the person in case of individuals, and upon control and management in case of companies and HUFs. For example,if anindividual is in India during the year for 182 days or more he or she is deemed to be a resident. Alternatively, if he or she has spent QUESTION. 5 Explain the needofService tax inIndia. What are the differentapproaches to Service tax in India? Answer: Service tax is a tax levied by Central Government of India on services provided or to be provided excluding services covered under negative list and considering the Place of Provision of ServicesRules,2012 and collectedasperPointof TaxationRules,2011 from the person liable to pay service tax. Person liable to pay service QUESTION. 6 Mr. X (aged 59 years) furnishes the following Profit and Loss account for the year ended 31st March, 2015. Compute the Gross Total Income of Mr. X under respective heads, his Net Taxable Income and Tax liability in the assessment year 2015-16. Particulars Rs. Particulars Rs. General Expenses 13,400 Gross profit 3,15,500 Bad debts 22,000 Commission 8,600 Advance tax 2,000 Brokerage 37,000 Insurance 600 Miscellaneous Income 2,500 Salary to Staff 26,000 Bad Debt Recovery 11,000 Salary to Mr. X 51,000 Interest on Debenture (Net interest Rs.22,500 + TDS Rs. 2,500) 25,000 Interest on Cash Credit 4,000 Interest on Fixed Deposits (Net interest Rs. 11,700 + TDS Rs. 1,300) 13,000 Interest on loan to Mrs. X 42,000 Interest on Capital of Mr. X 23,000 Depreciation 48,000 Advertisement 7,000

- 4. Contribution to Employees’ Provident Fund 13,000 Net Profit 1,60,600 Total 4,12,600 Total 4,12,600 Supplementary information: Permissible depreciation as per CBDT circular is Rs. 37,300 which includes depreciation of permanent glow sign board. i. Advertisement expenditure includes Rs. 3,000, being cost of permanent glow sign board affixed outside the office premises. ii. Commission accrued but not received Rs. 4,500 is not credited to P & L Account. iii. Mr. X pays premium of Rs. 6,000 on his own life. iv. General expenses includes: a) Rs. 500 spent for arranging a party for Mr. X’s son who arrives from Canada. b) Rs. 1,000 for contribution to a political party. v. Loan availed from Mrs. X was for payment of arrear tax. A Mr. X (aged 59 years) furnishes the above Profit and Loss account for the year ended 31st March, 2015. Compute the Gross Total Income of Mr. X under respective heads, his Net Taxable Income and Tax liability in the assessment year 2015-16. Answer: Computation of Gross Total Income of Mr. X under respective heads, his Net Taxable Income and Tax liability in the assessment year 2015-16 Net profit as per profit and loss account 160000 Add: Inadmissible expenses Expenses for arranging a party for Mr. X’s son 500 Contribution to a political party 1000 Advance tax 2000 Salary to Mr. X 51000 Interest on Capital of Mr. X 23000 Dear students get fully solved assignments Send your semester & Specialization name to our mail id : help.mbaassignments@gmail.com or call us at : 08263069601