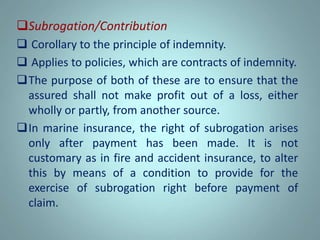

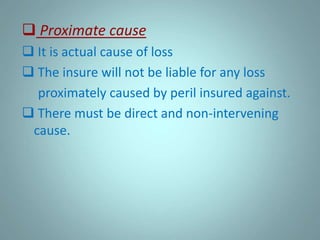

Marine insurance provides coverage for losses to ships and cargo during transportation by sea. It is one of the oldest forms of insurance, originating in England to protect trade. There are several types of marine insurance including hull insurance for ships, cargo insurance, and freight insurance. Policies are based on utmost good faith between insurer and insured and indemnify the actual losses incurred. Warranties must be strictly adhered to otherwise the insurer may avoid liability. Subrogation and contribution ensure the insured does not profit from another source. The proximate cause must be the peril insured against for a valid claim.