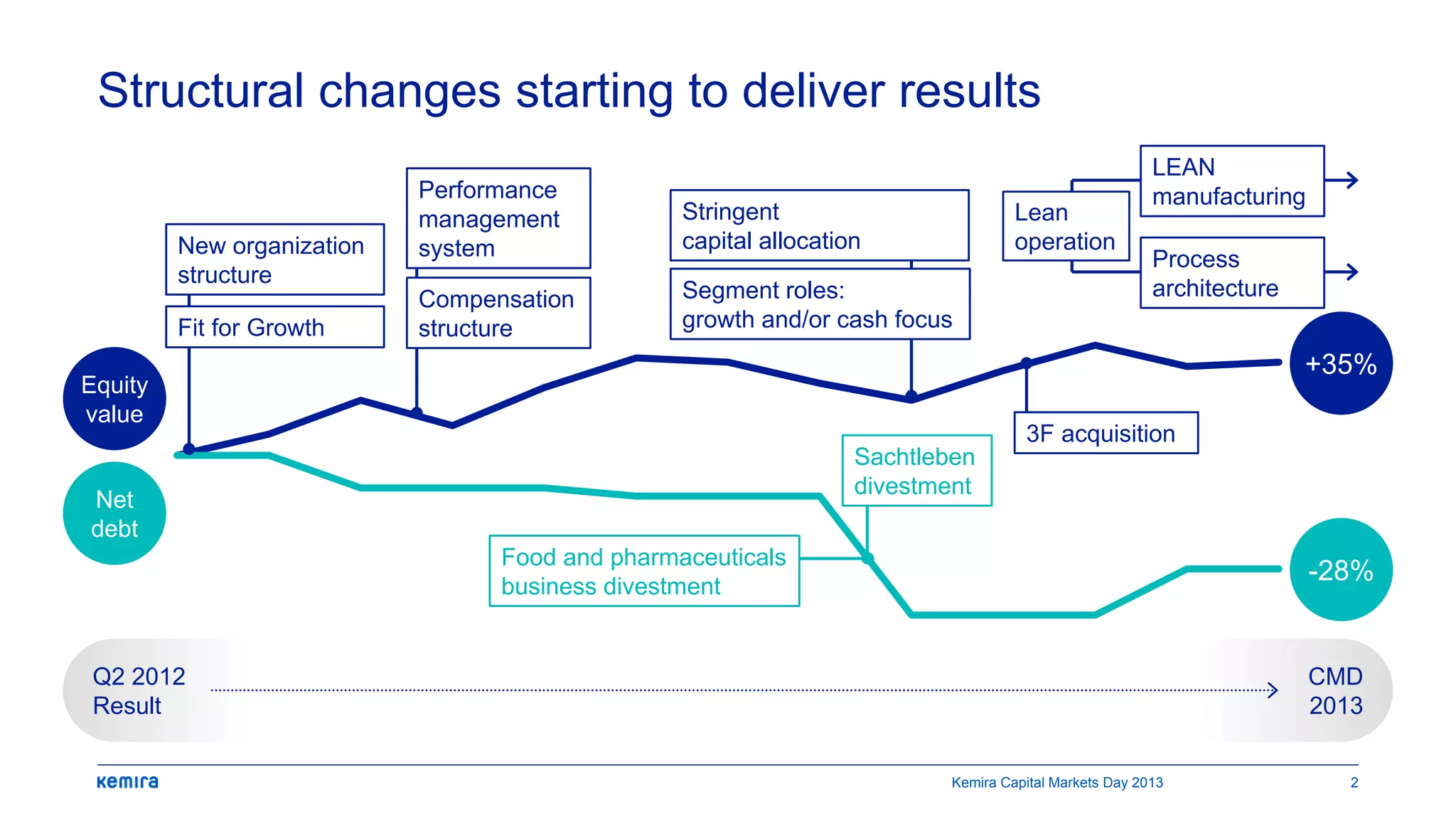

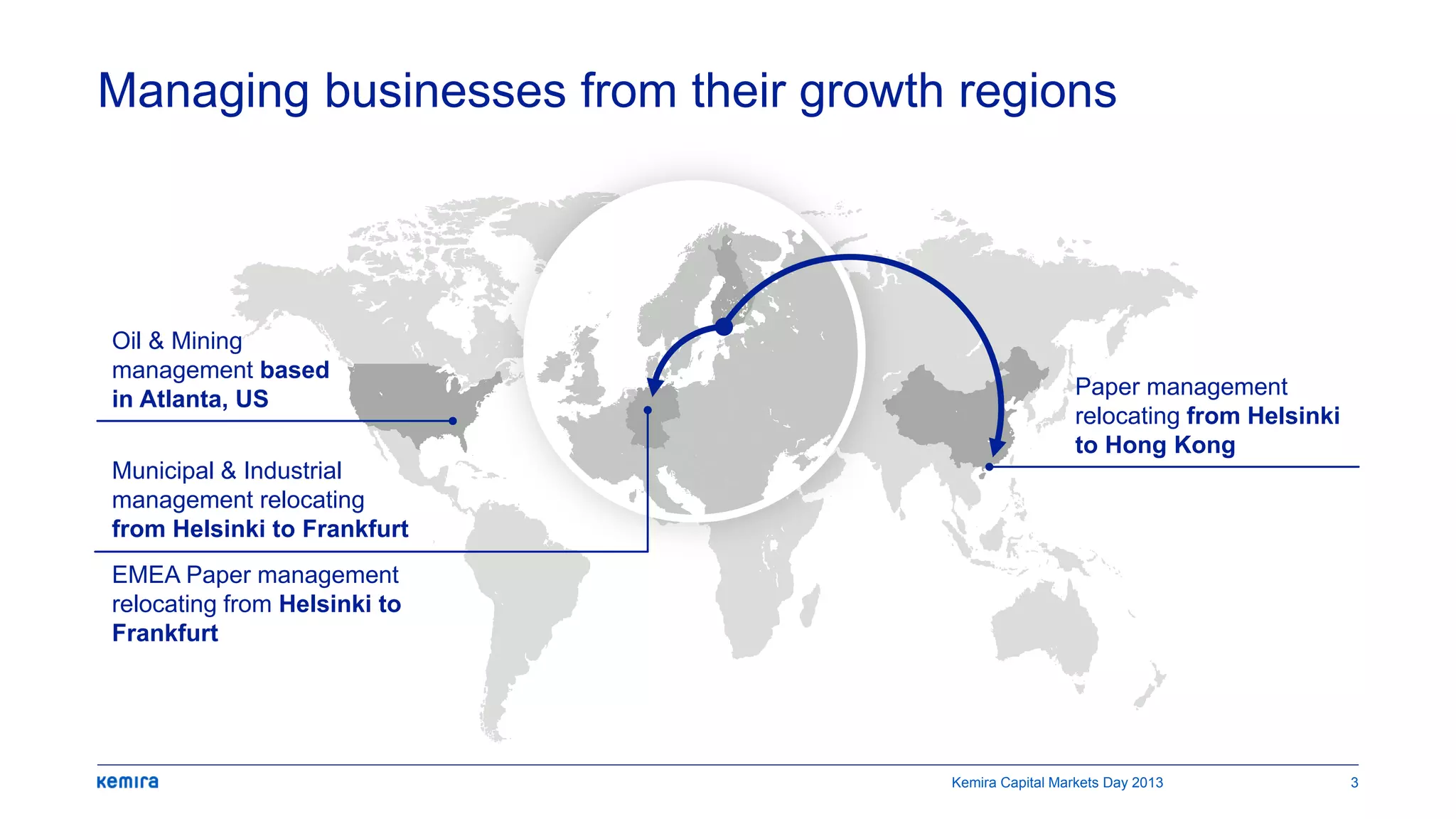

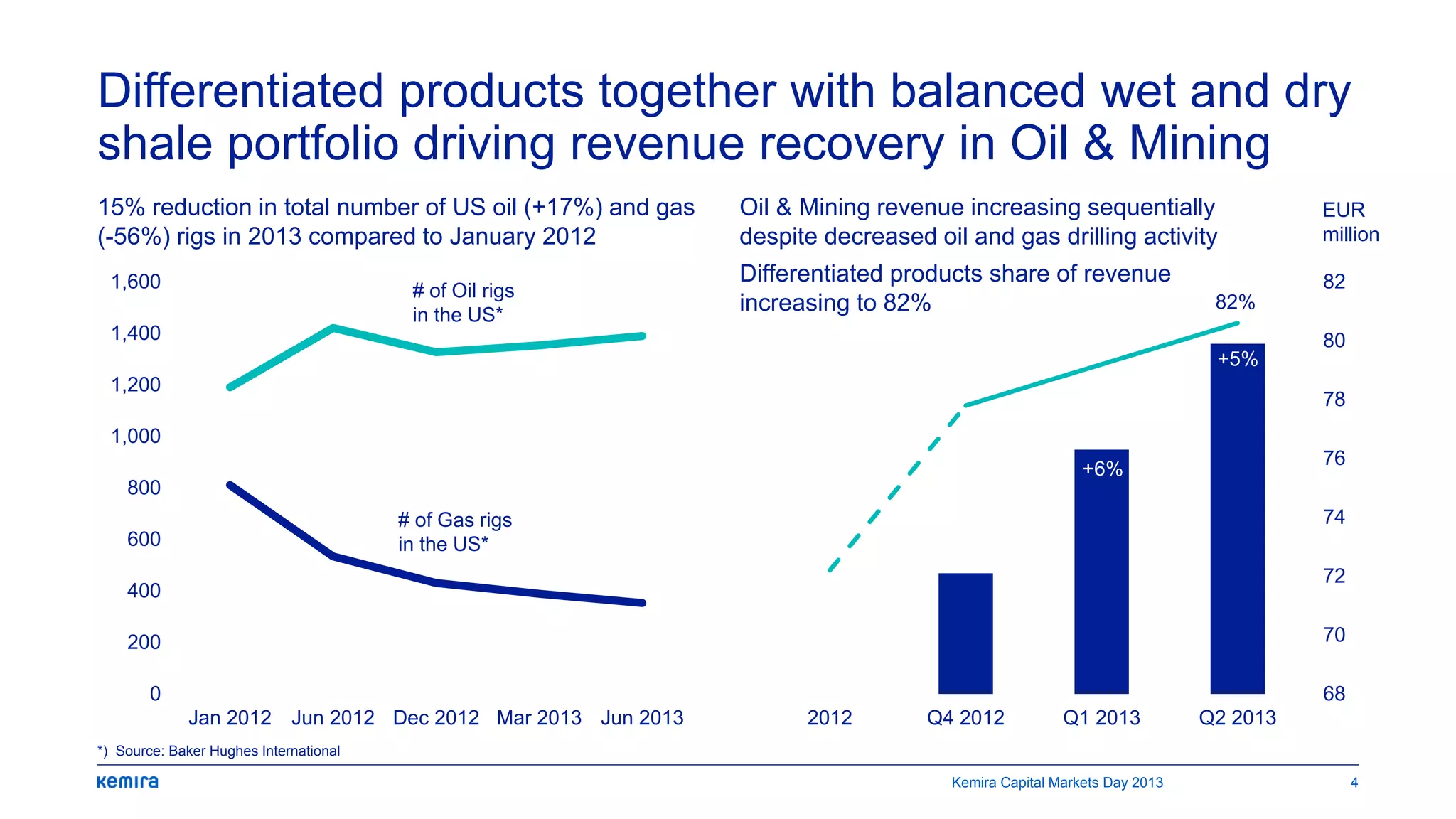

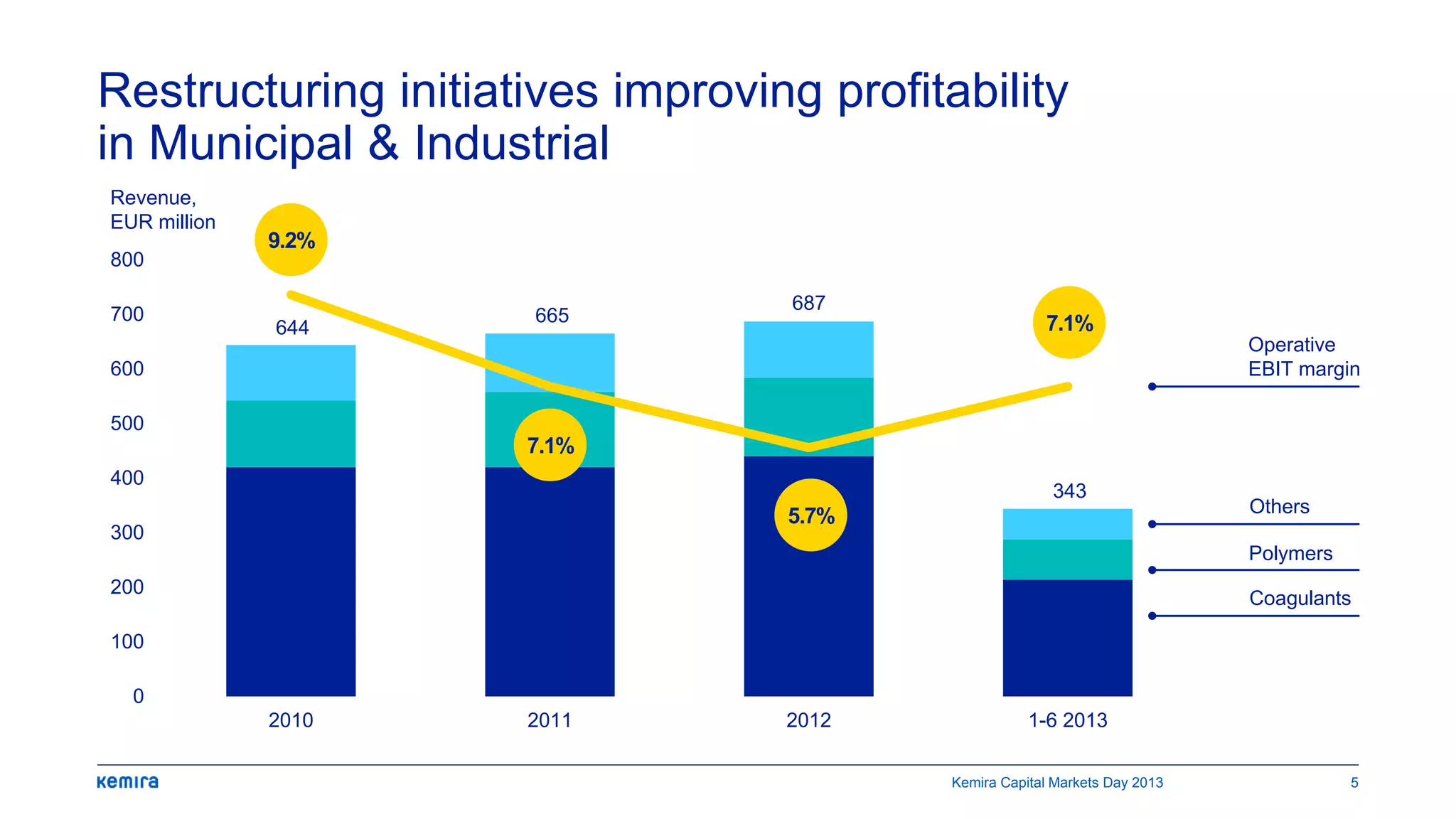

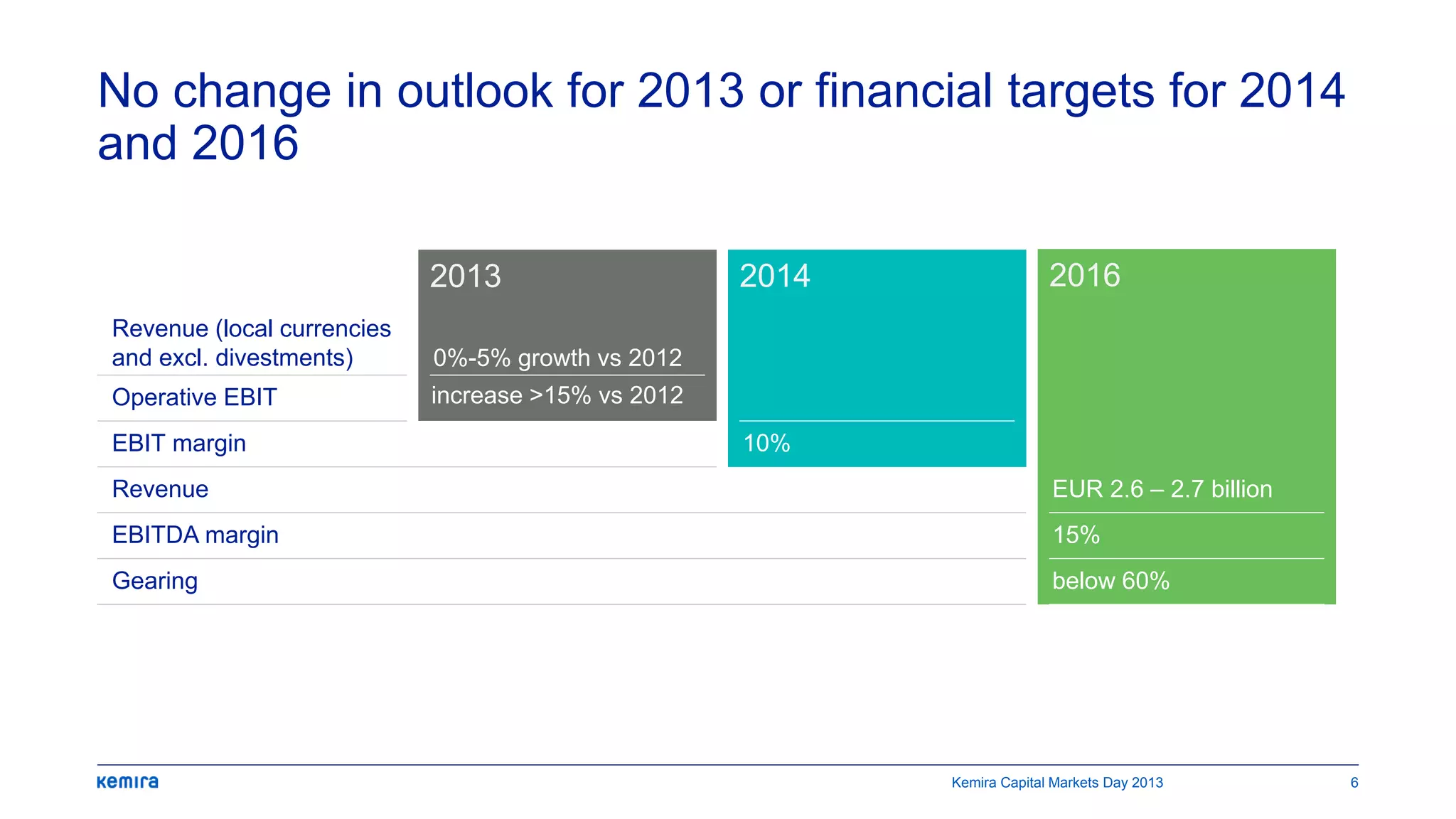

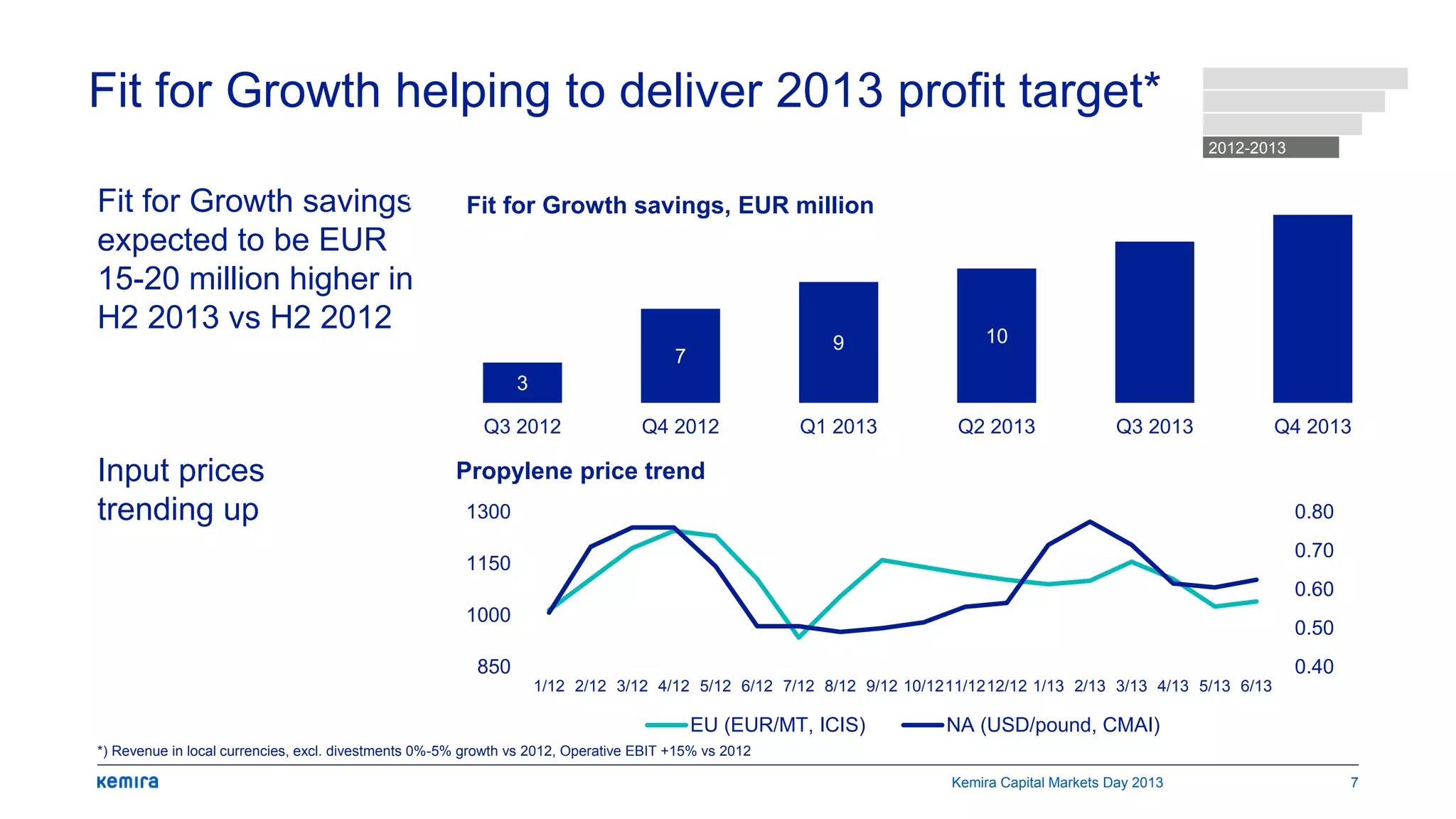

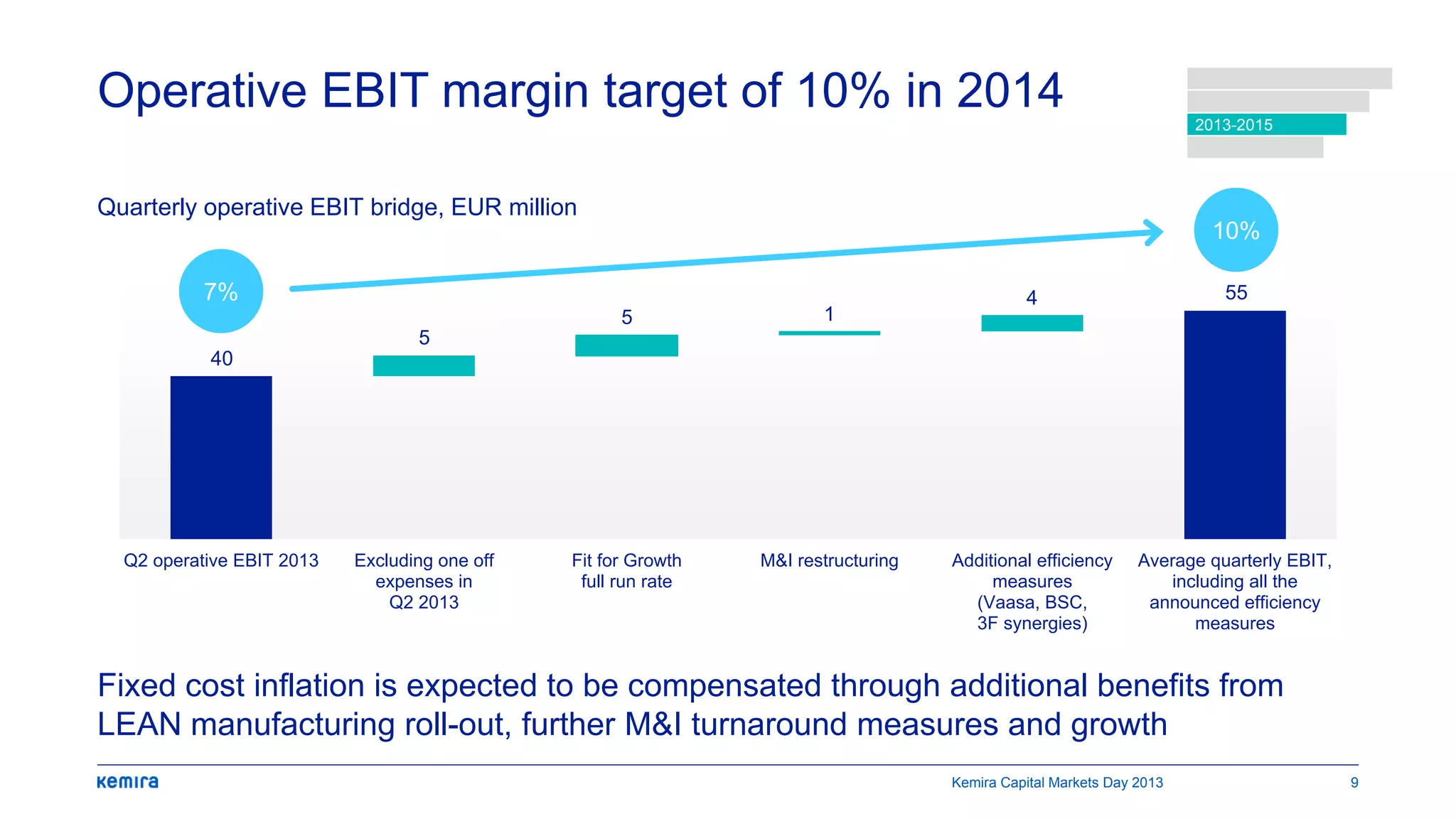

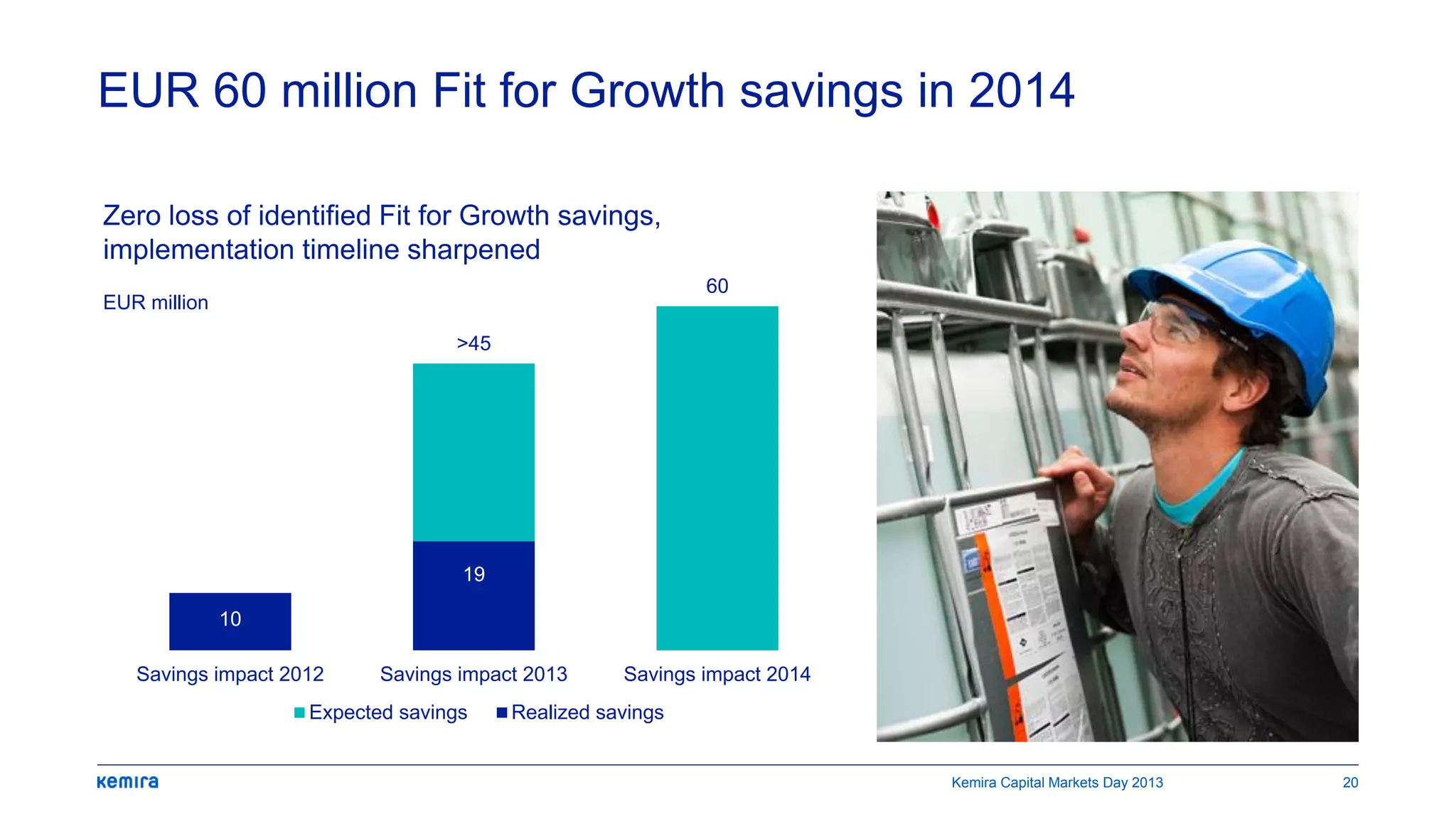

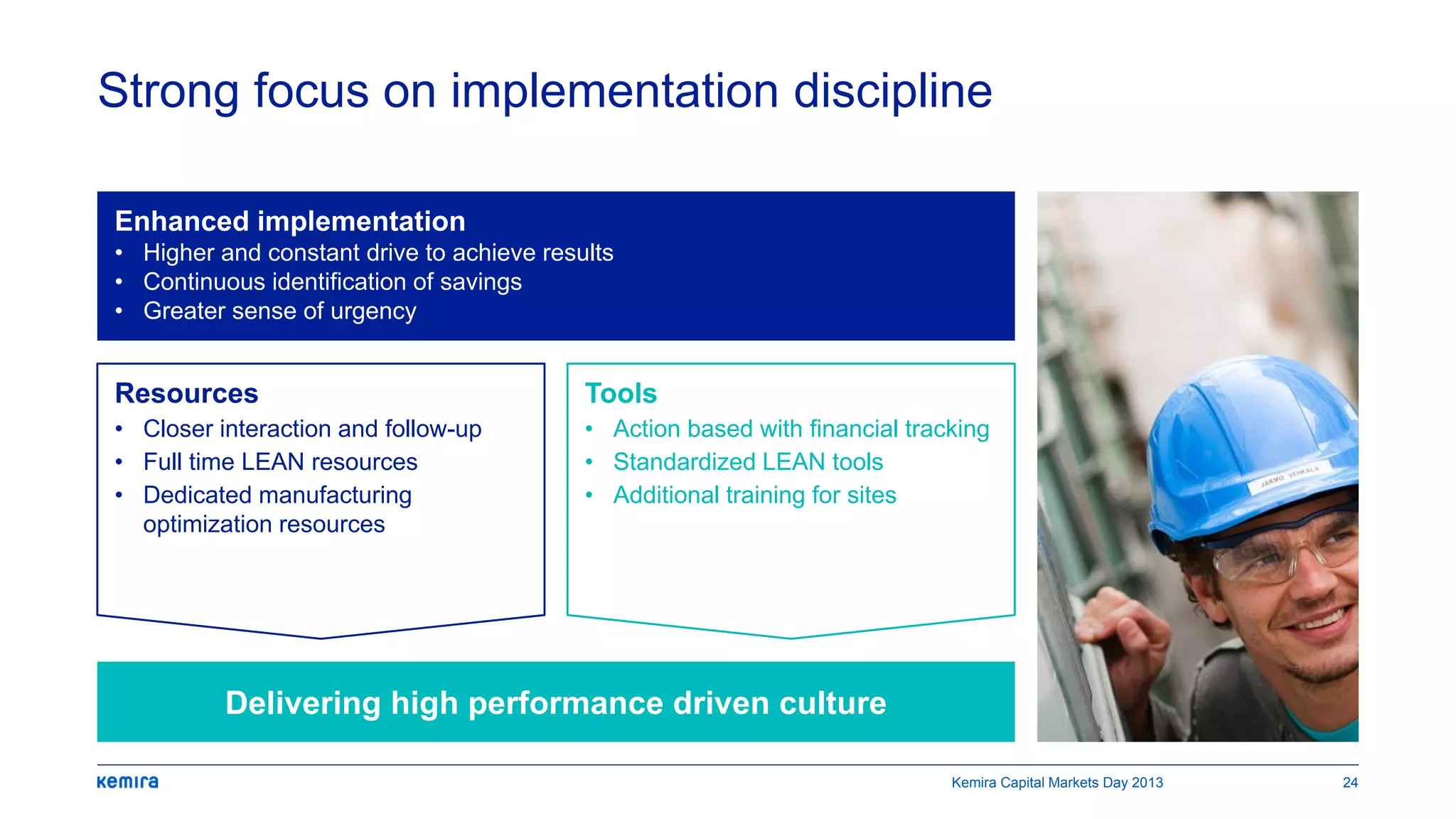

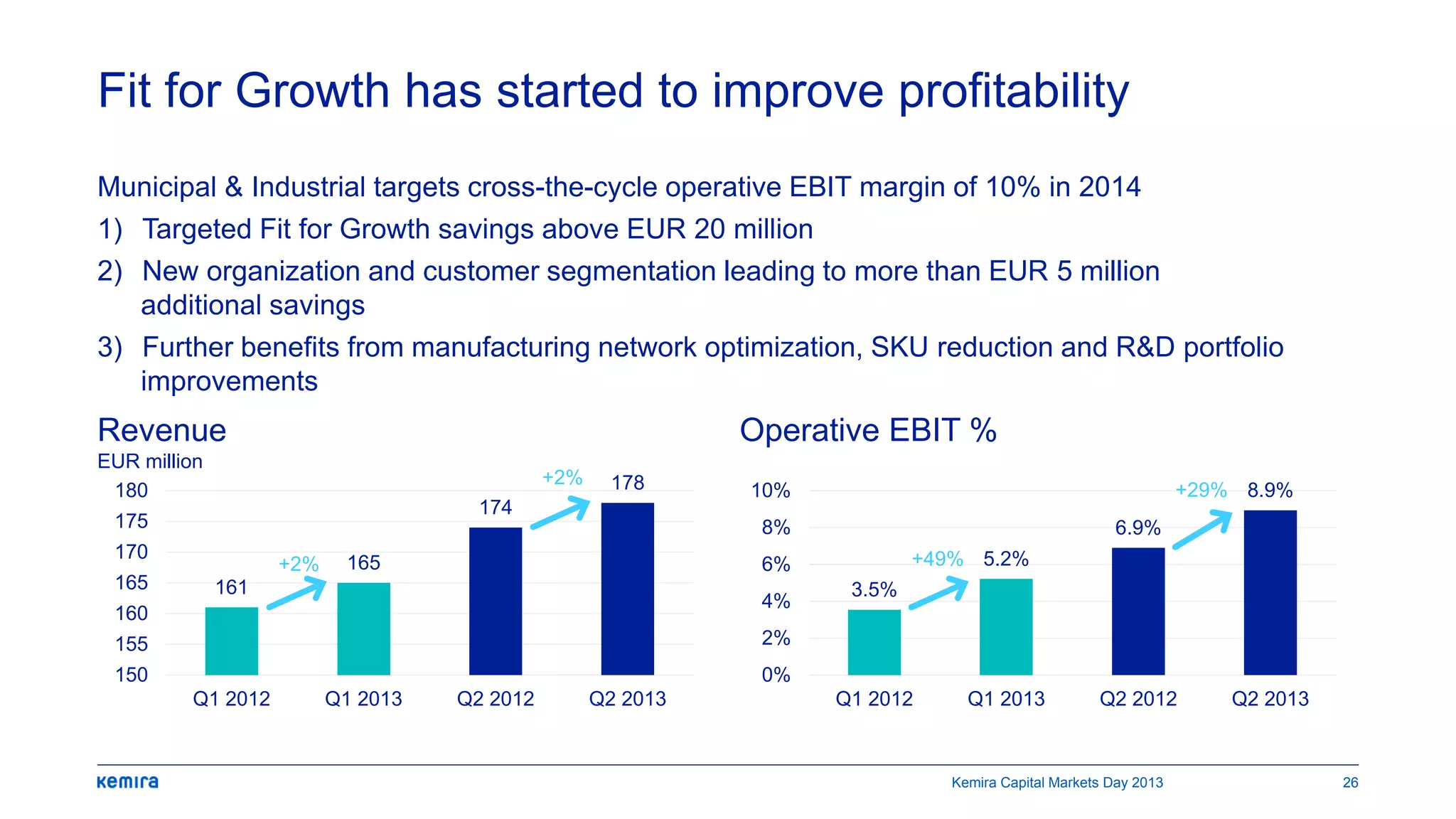

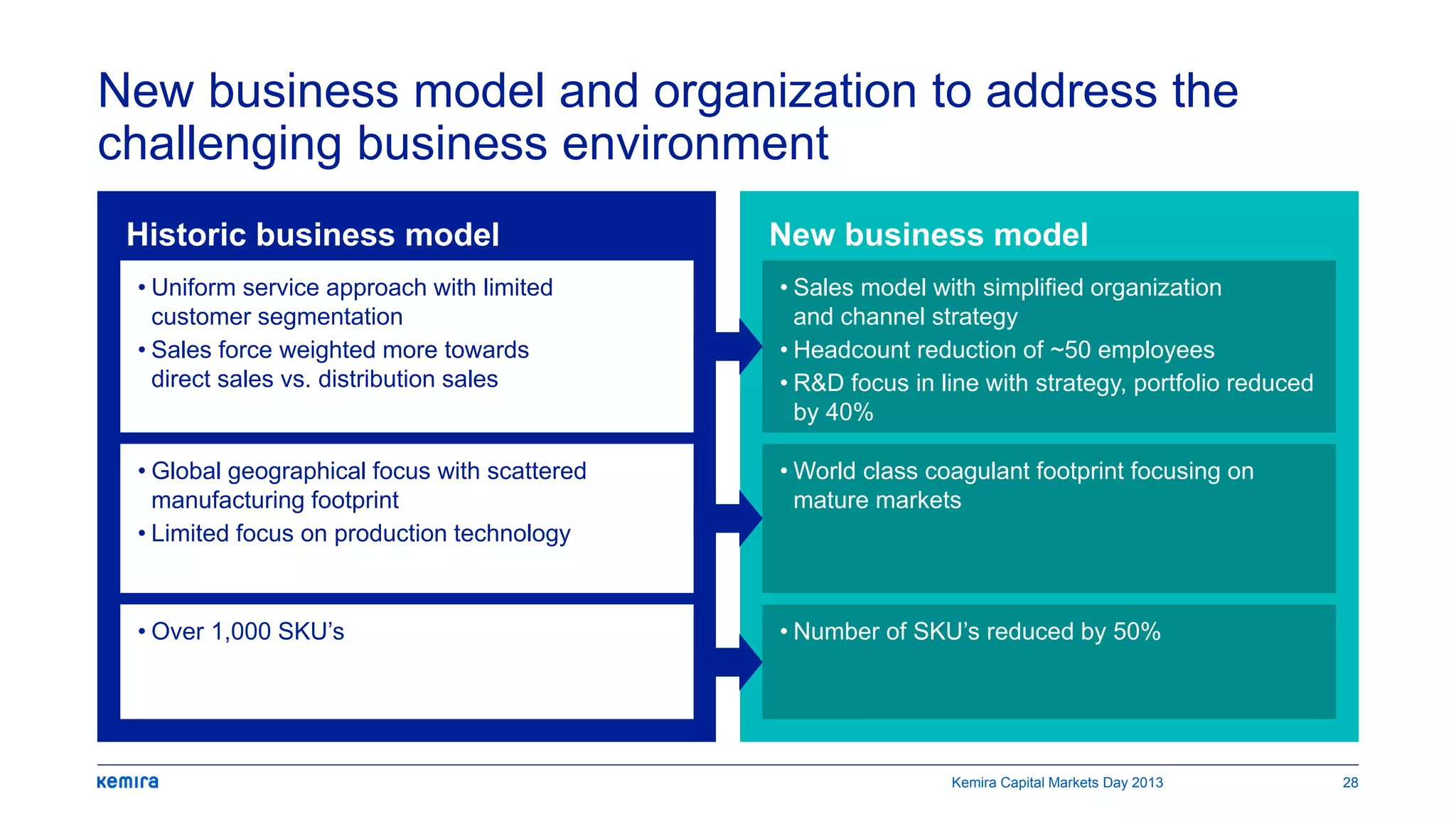

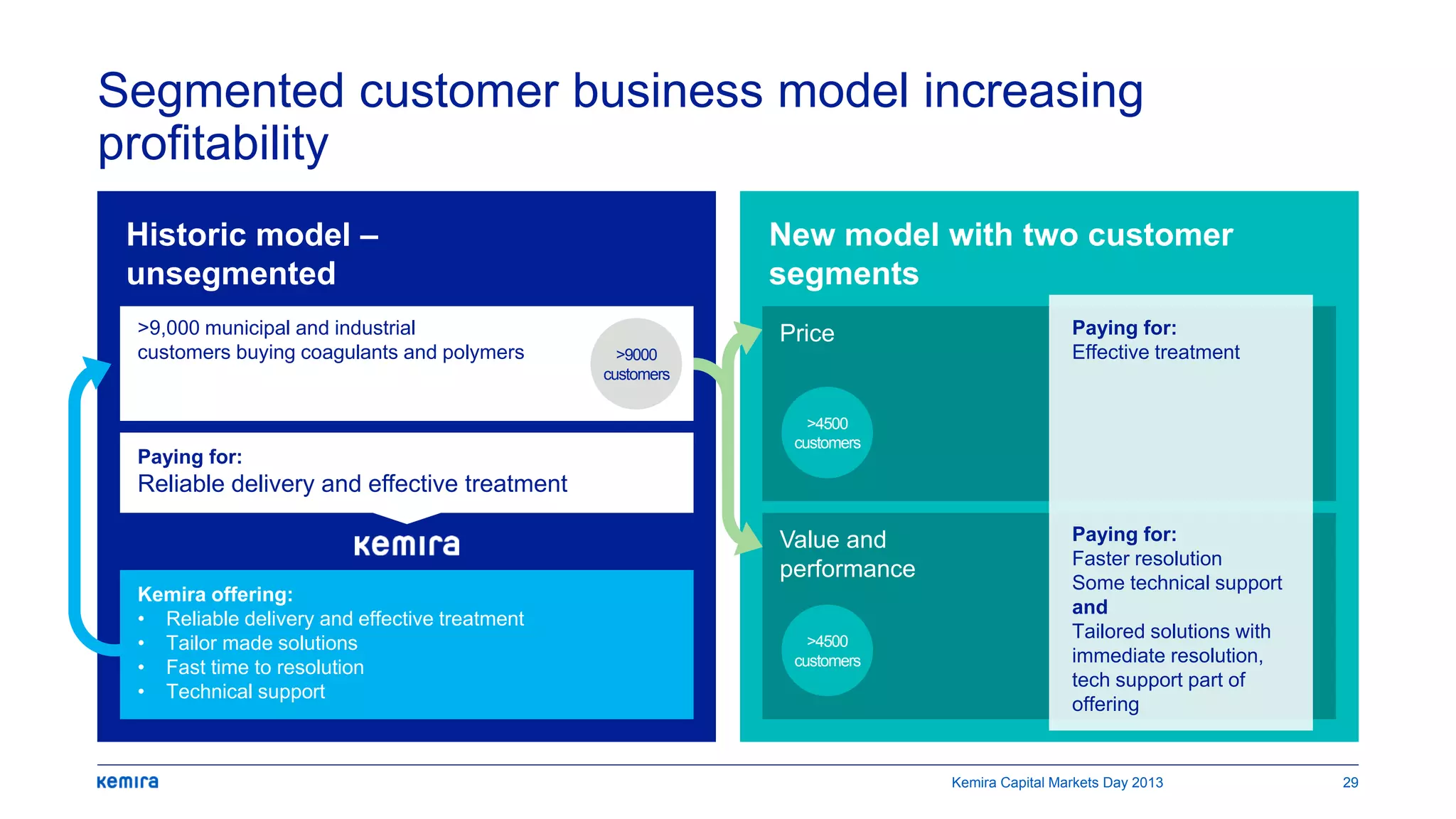

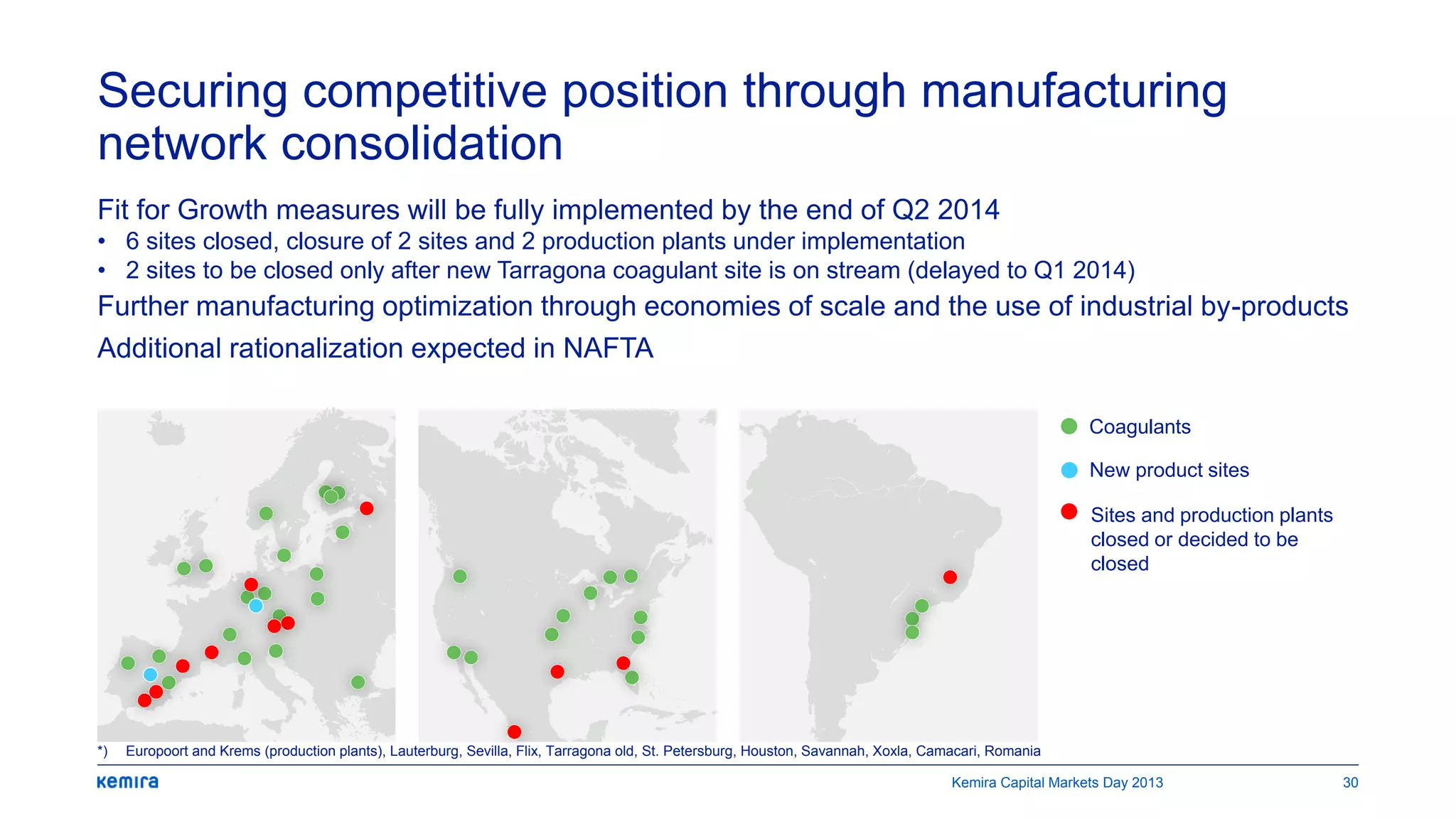

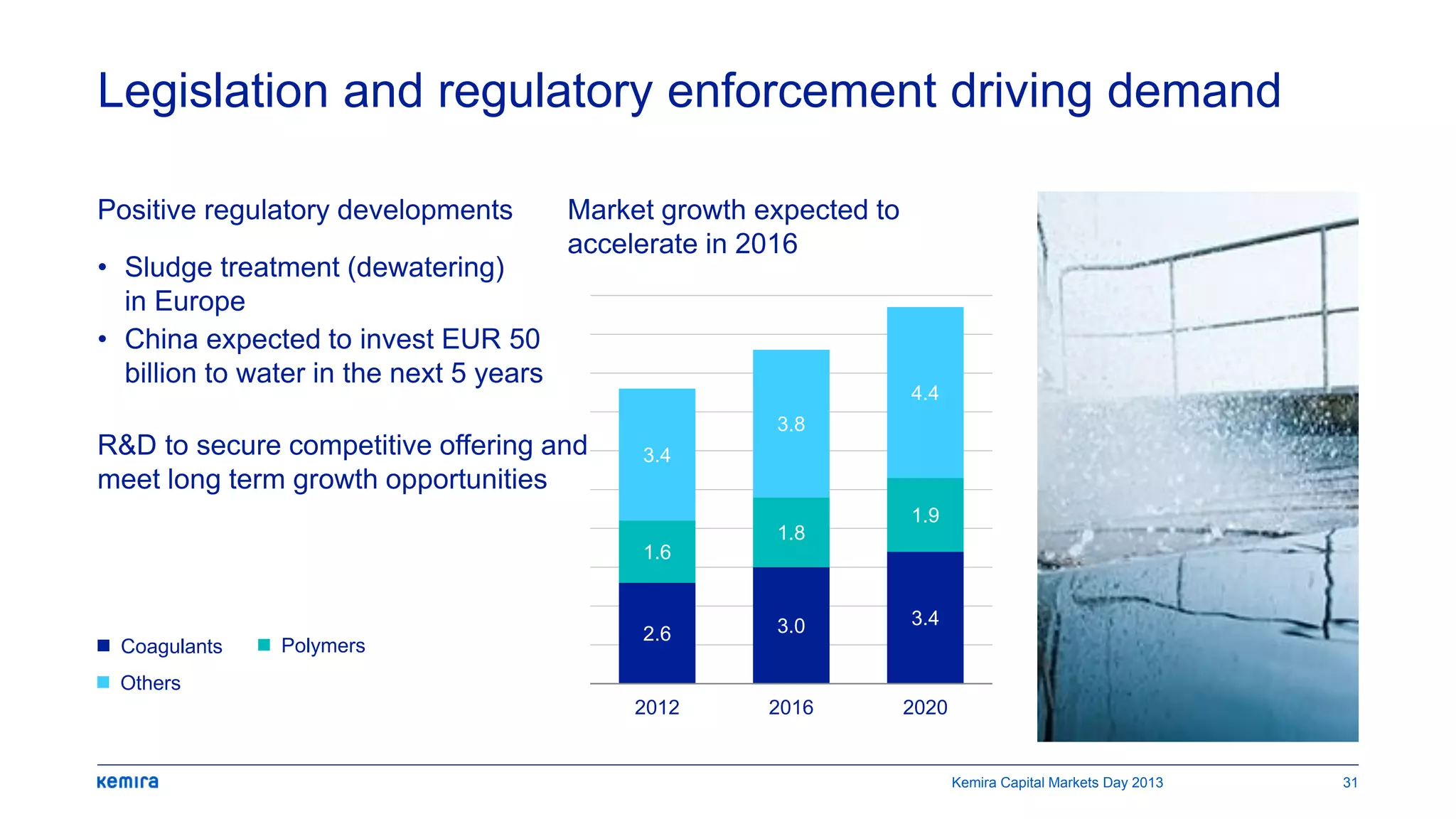

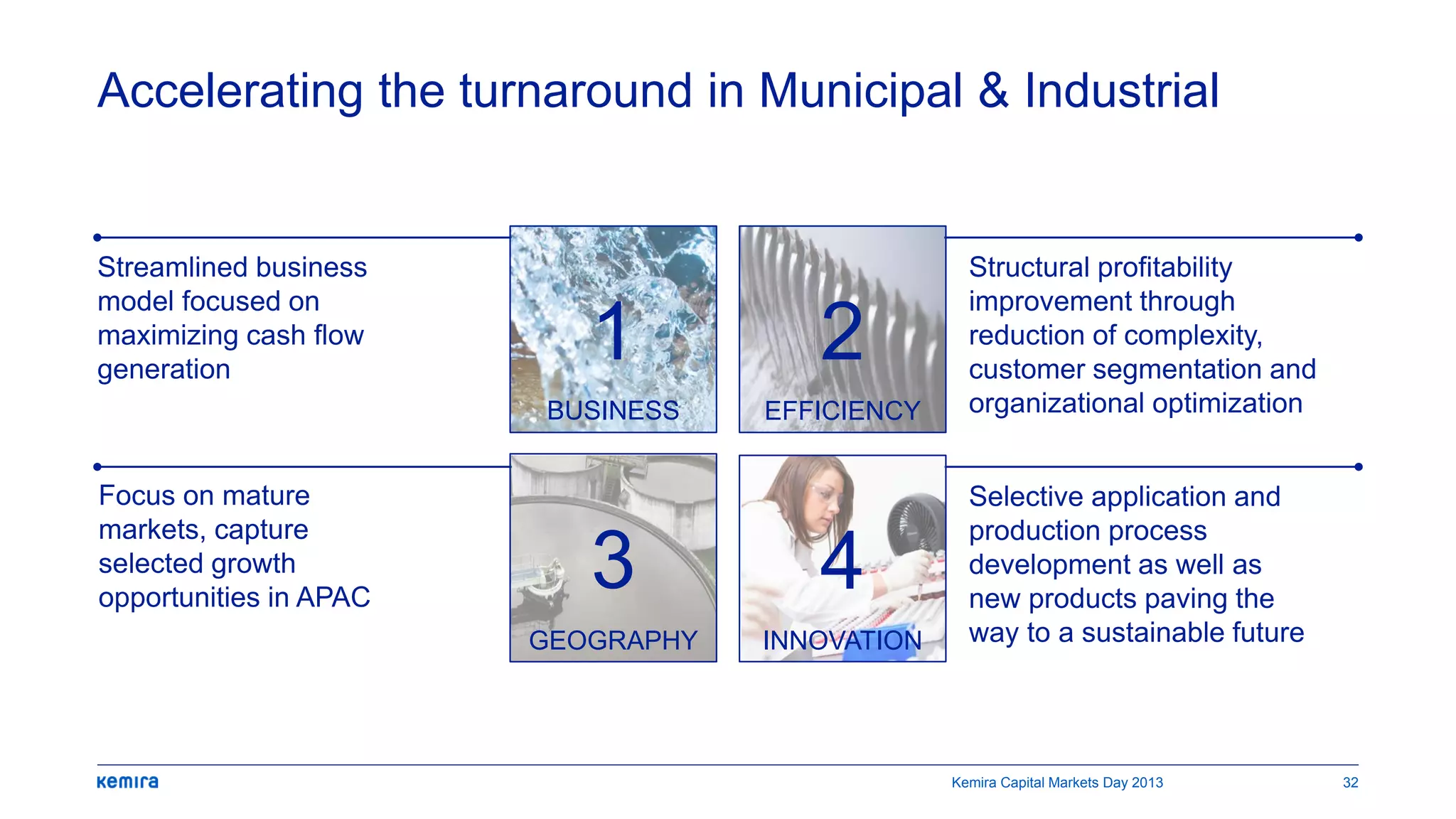

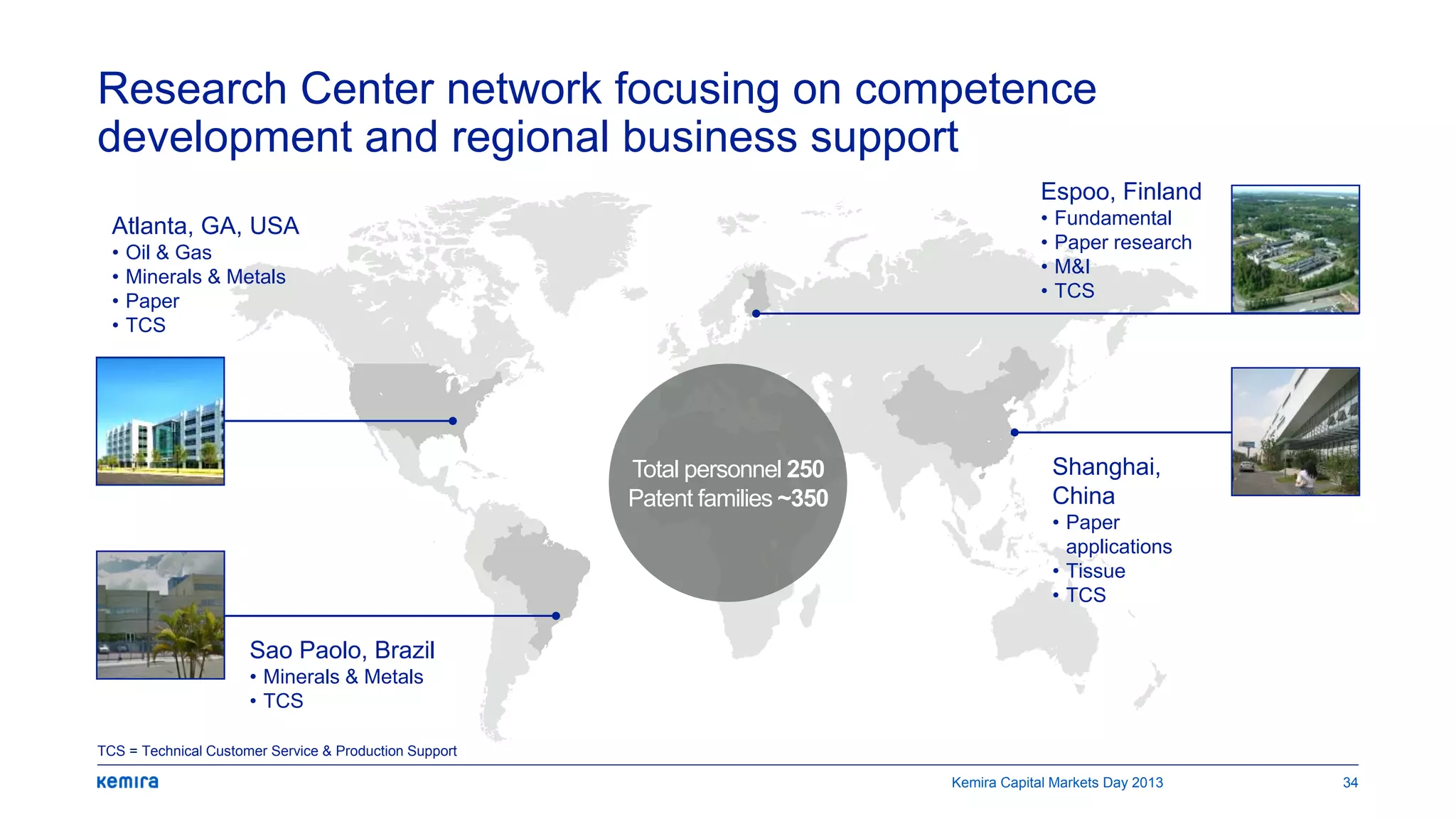

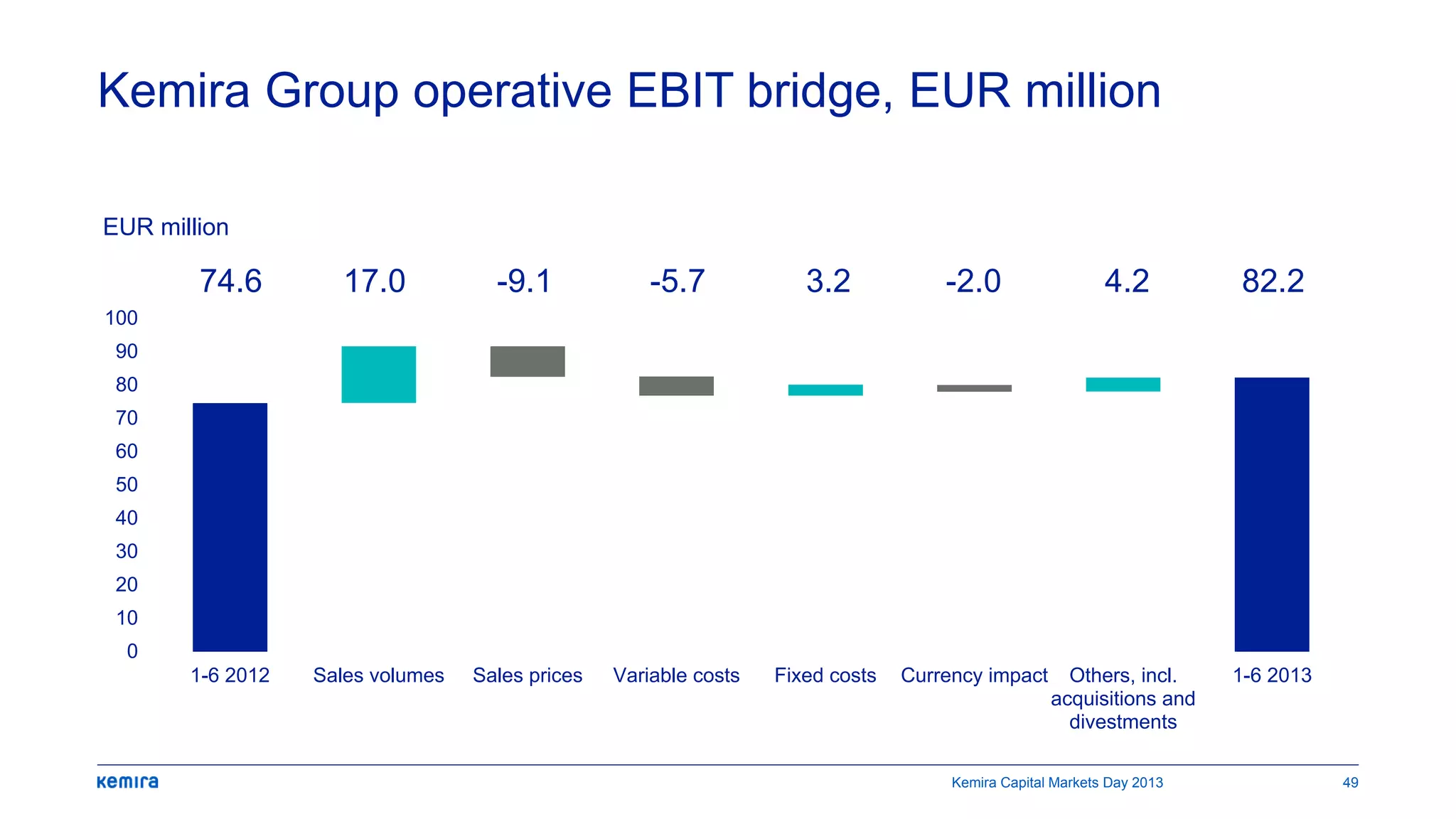

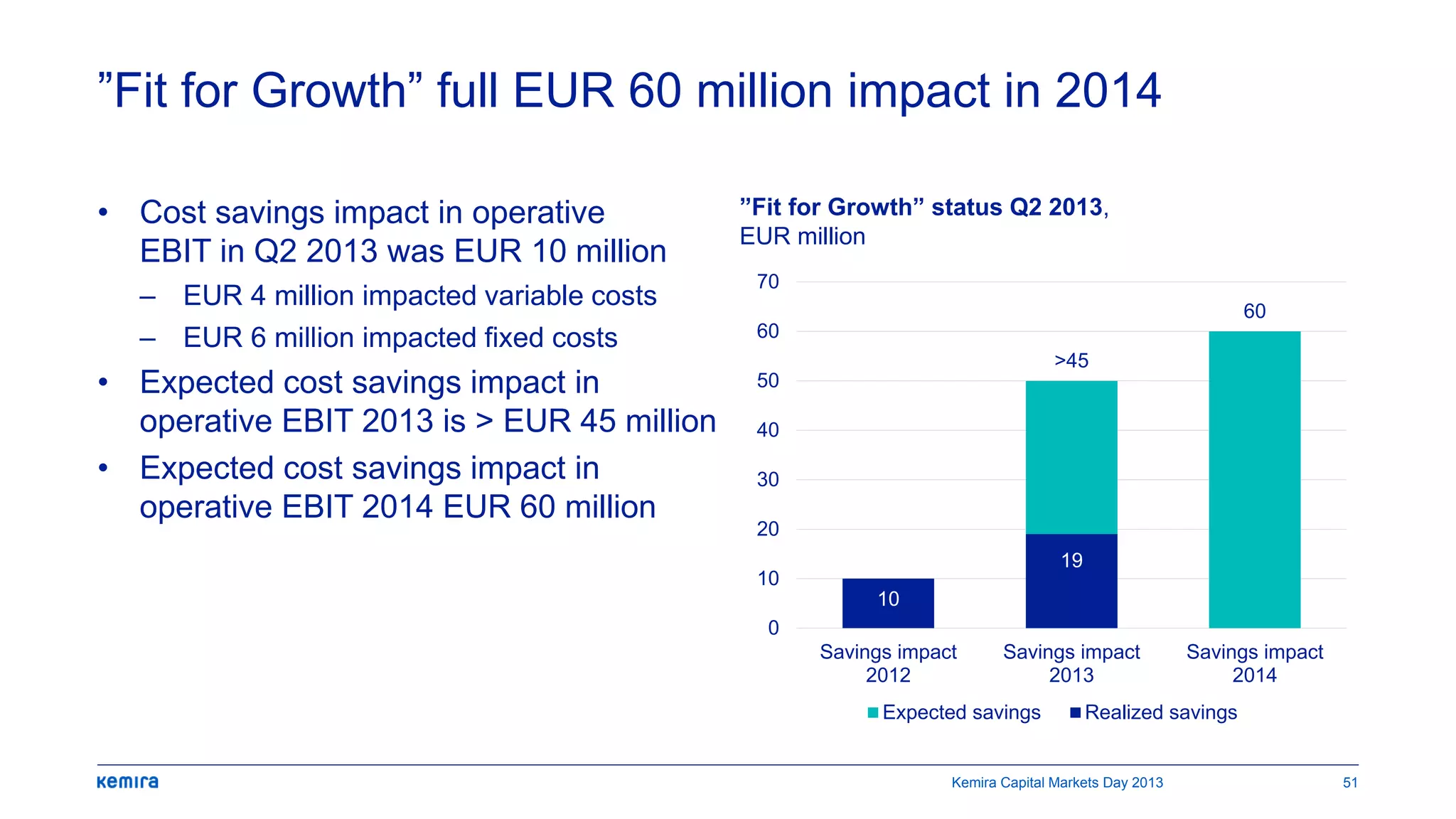

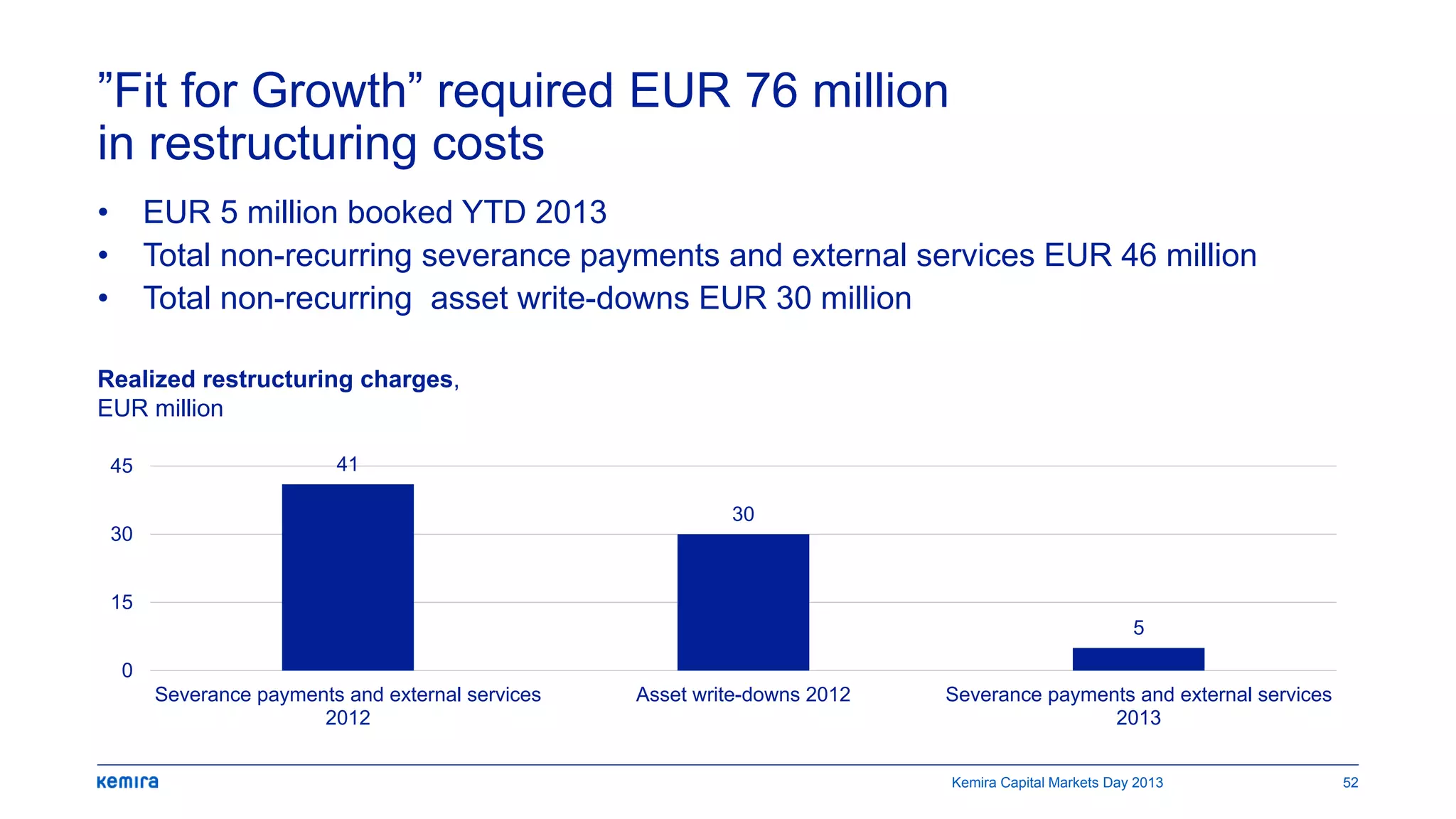

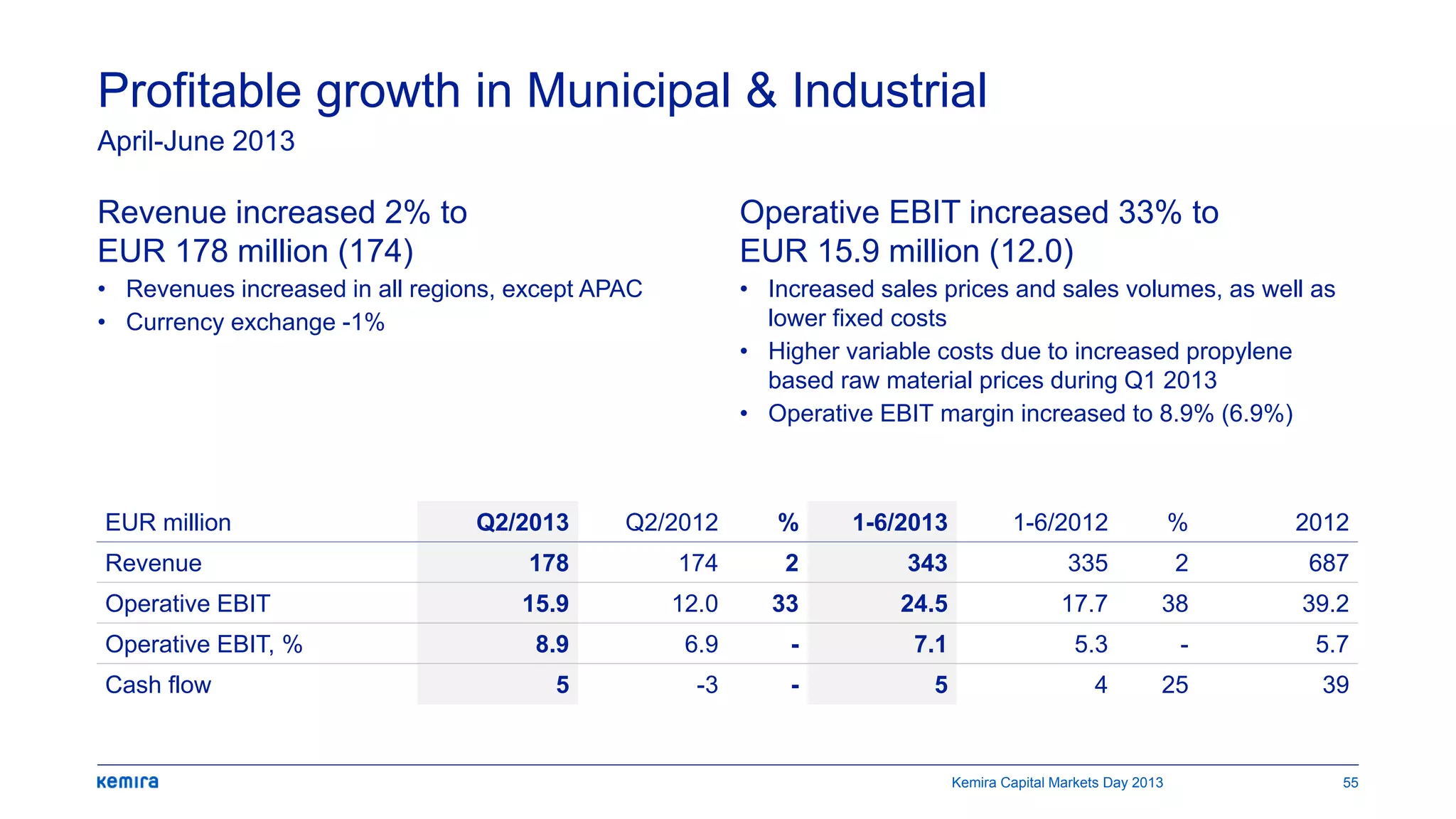

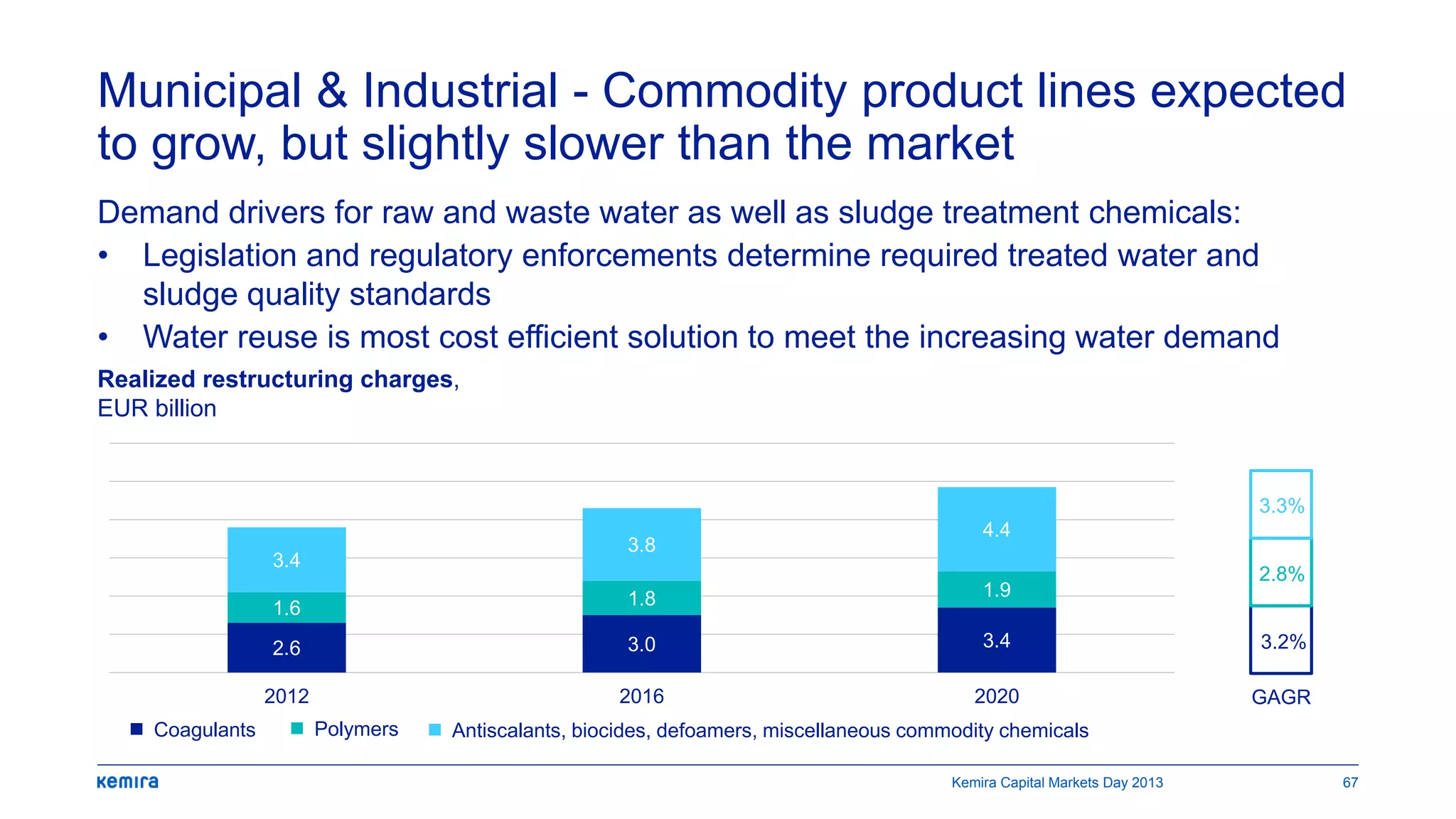

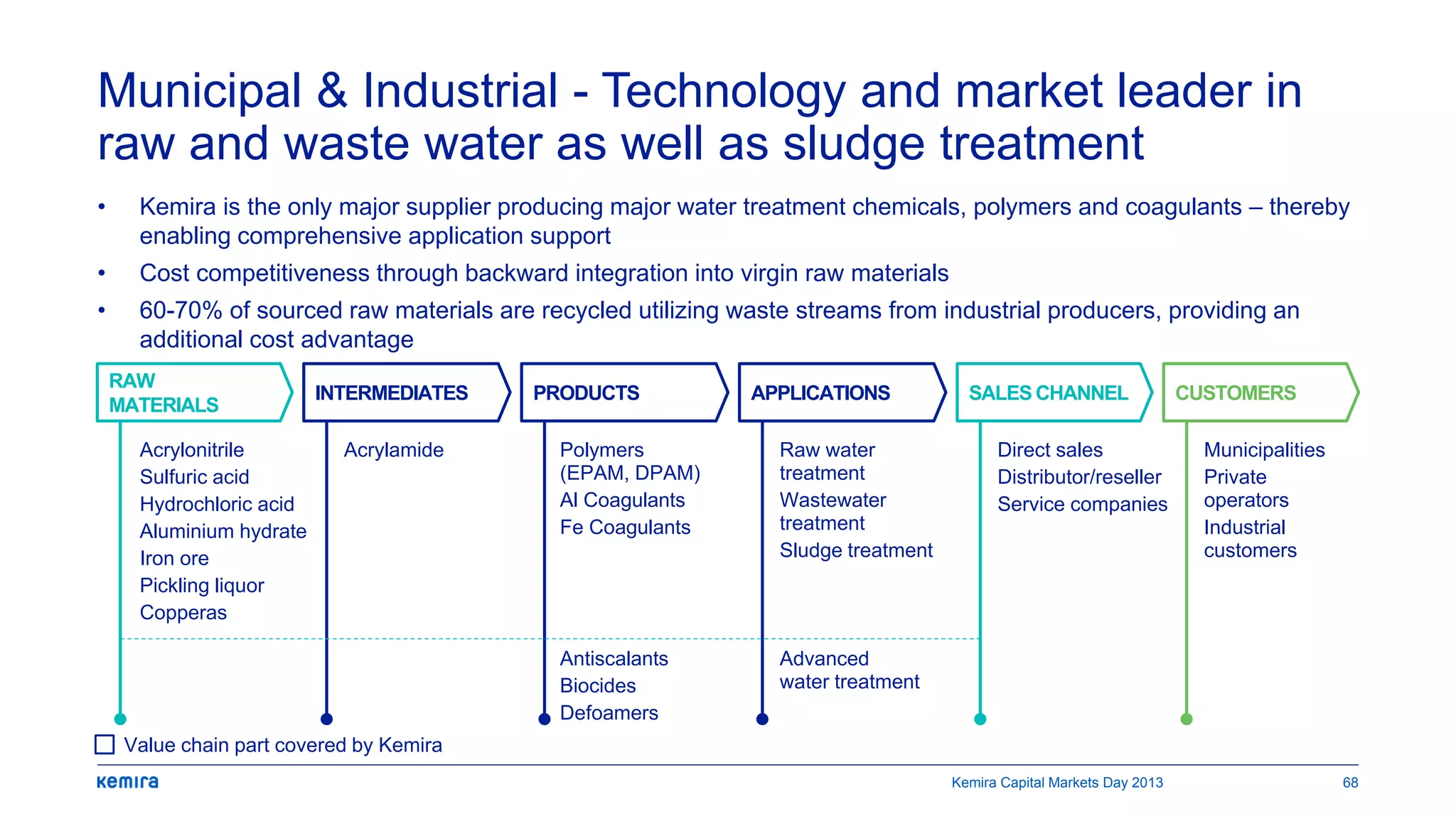

Kemira is restructuring to become a pure-play water company focused on growth markets. It has divested non-water businesses and reorganized operations around key regions. Fit for Growth initiatives have improved profitability and are expected to deliver €60 million in savings by 2014. Kemira is also turning around its Municipal & Industrial segment through a new customer segmentation model, manufacturing optimization, and reduced SKUs. The company aims for an operative EBIT margin of 10% in Municipal & Industrial by 2014.