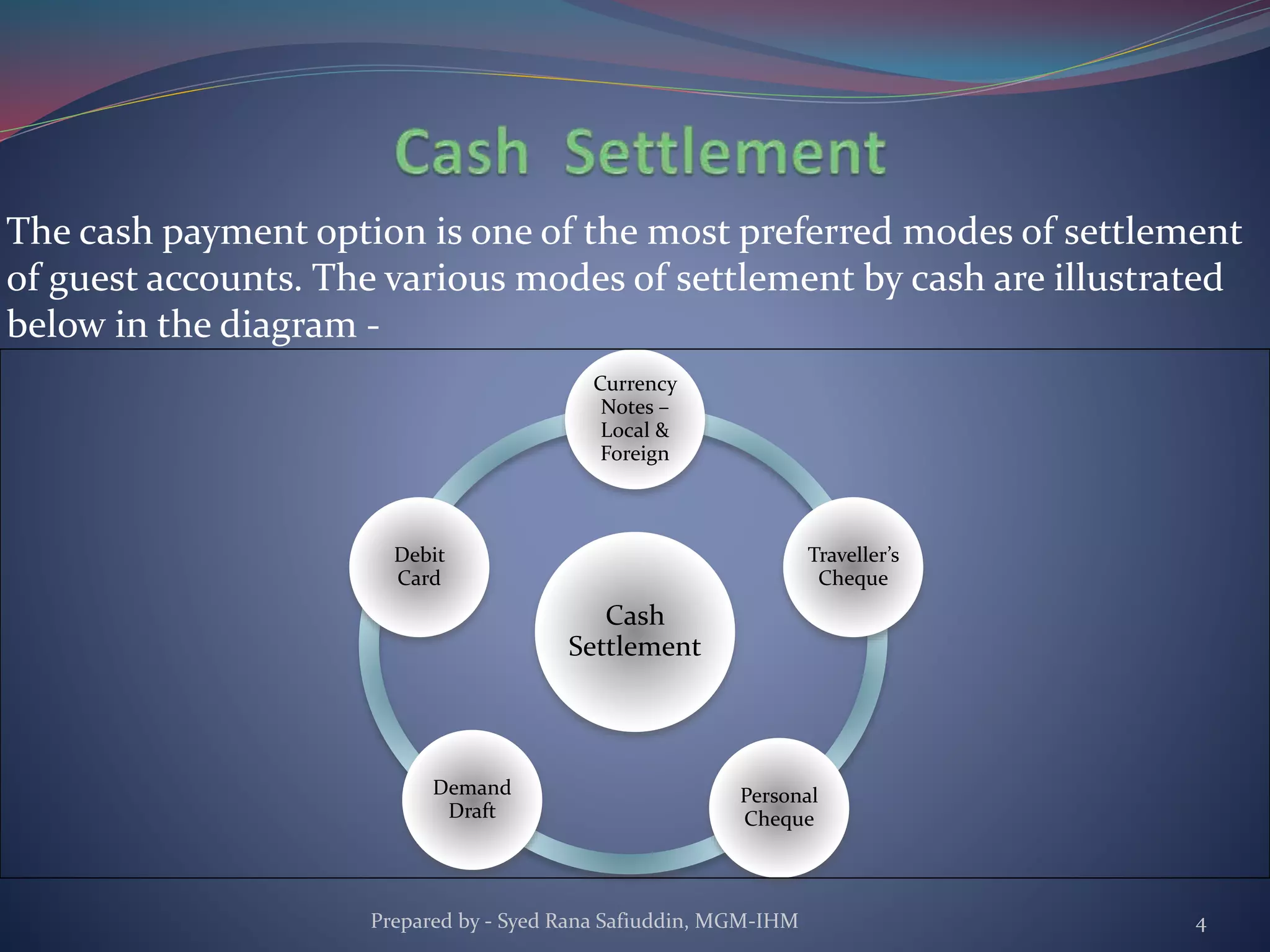

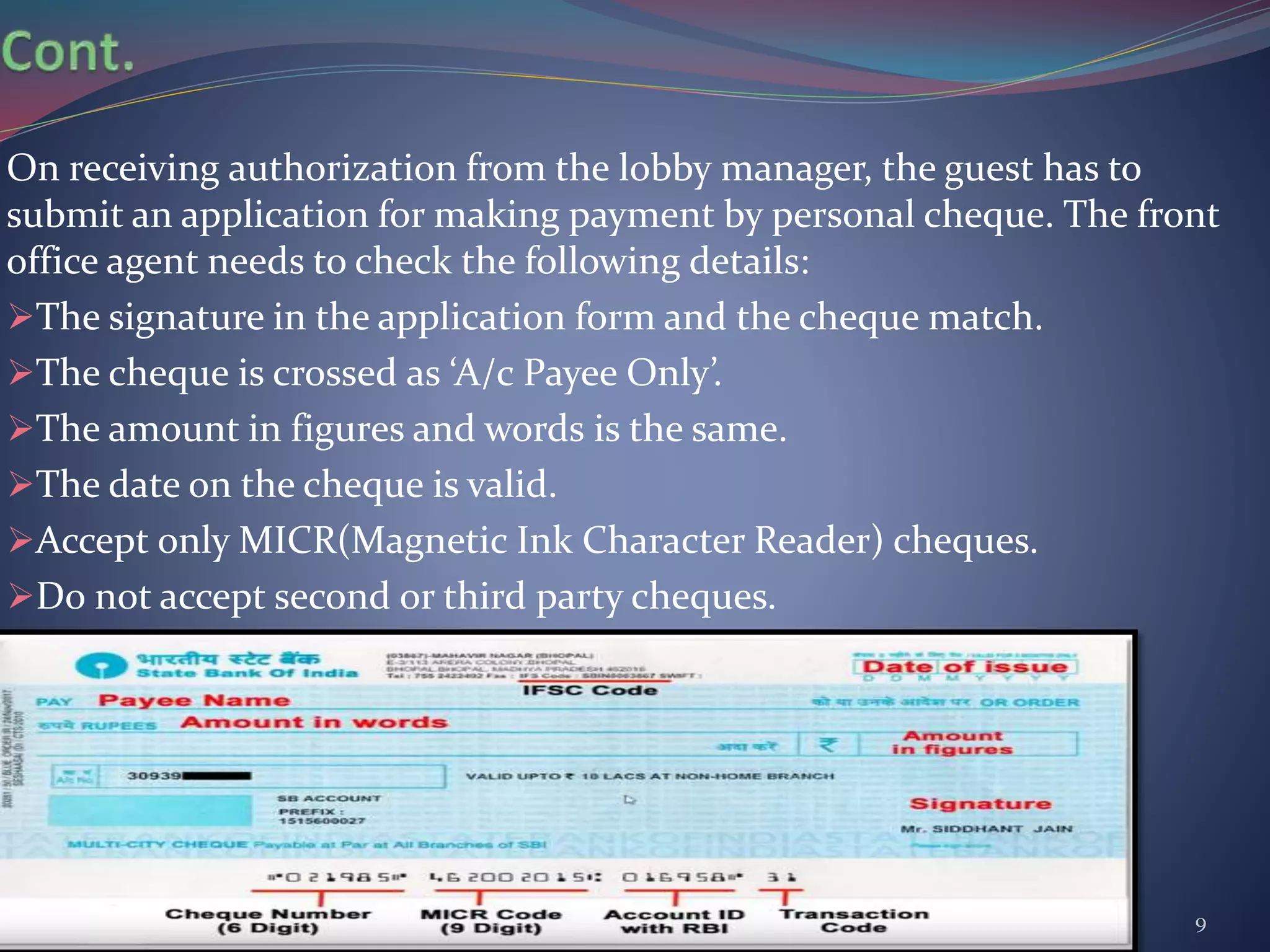

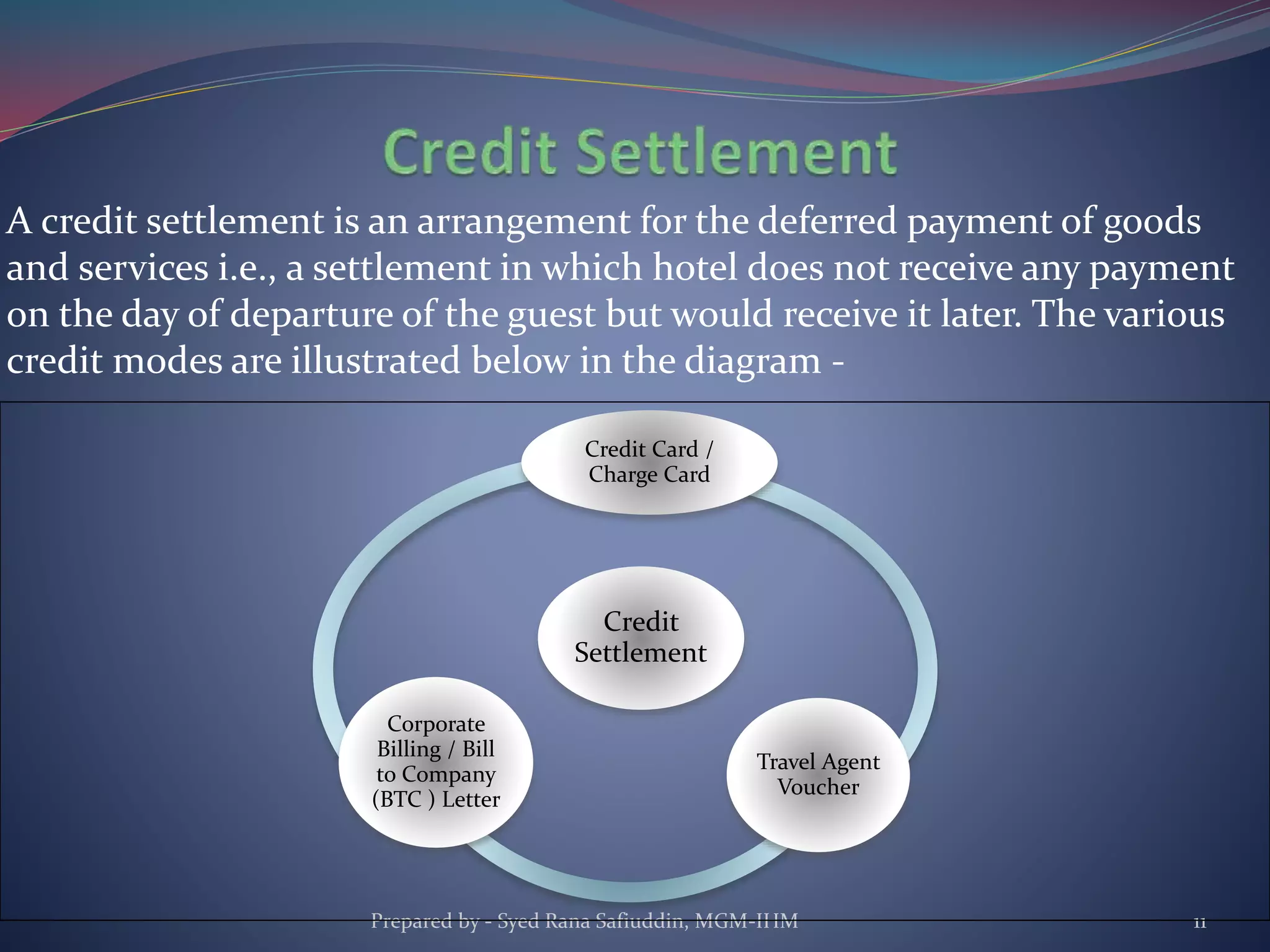

The document discusses various modes of payment that can be used to settle guest accounts in hotels. It describes cash payment options like currency notes, traveler's cheques, personal cheques, and debit cards. It also explains credit settlement options like credit cards, travel agent vouchers, and corporate billing. For each payment method, it provides details on the acceptance process at check-out to ensure secure transactions and avoid disputes.