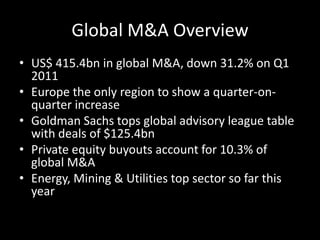

This document discusses mergers and acquisitions (M&A) and the role of advisory firms in the M&A process. It notes that global M&A deal value decreased in the first quarter of 2012 compared to 2011, while Europe was the only region to increase. It also provides an overview of M&A activity and deals in India. The document outlines the services advisory firms provide, such as valuation, due diligence, and negotiations support. It discusses the key success factors and challenges for M&A advisory firms.