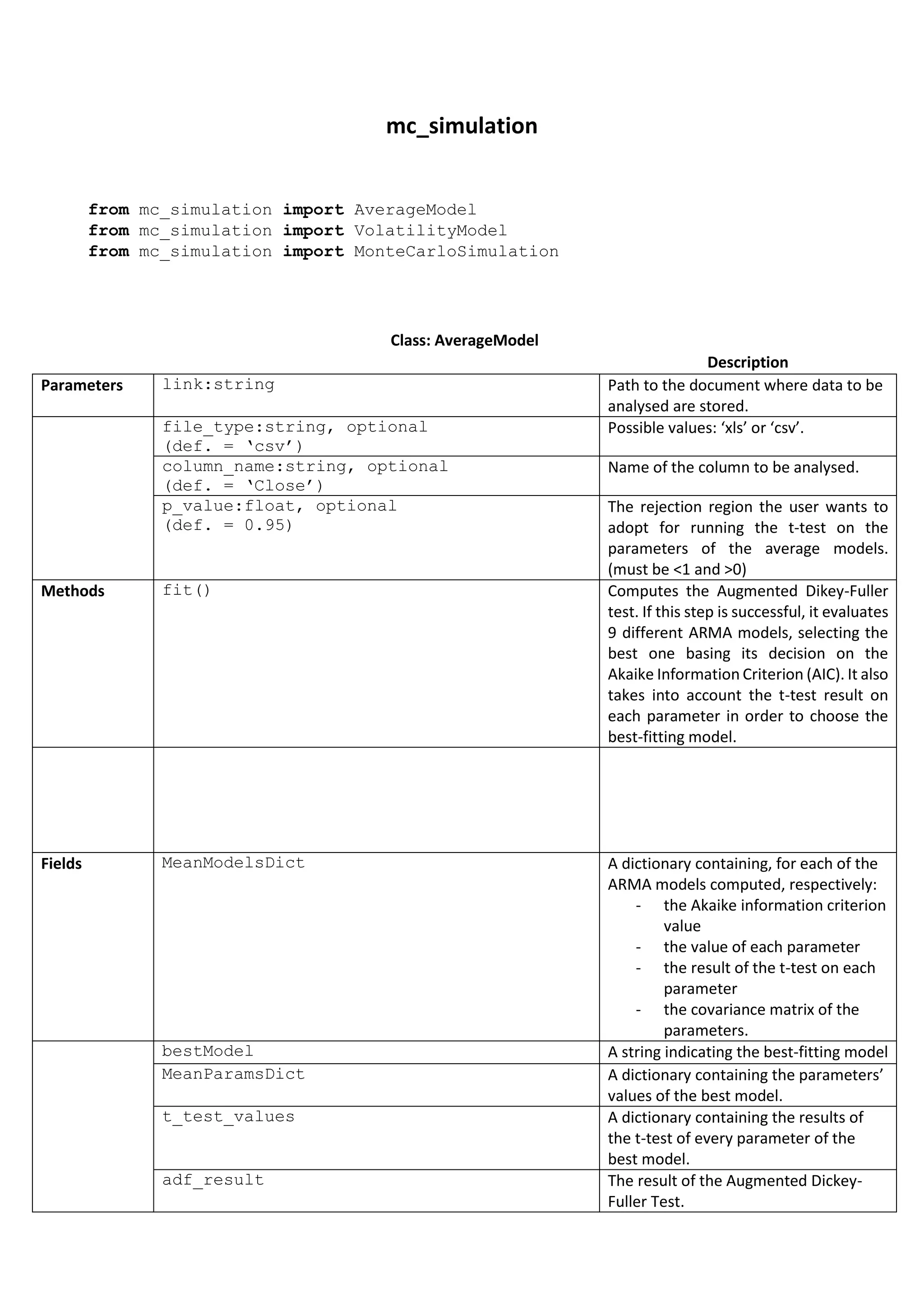

The document describes three Python classes - AverageModel, VolatilityModel, and MonteCarloSimulation - for modeling time series data and performing Monte Carlo simulations.

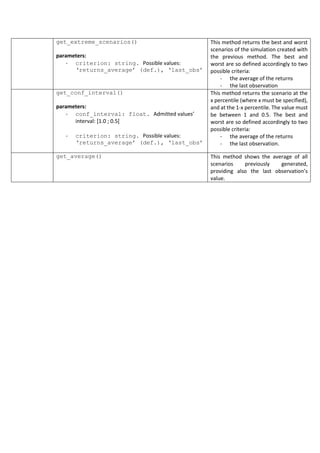

AverageModel fits autoregressive moving average (ARMA) models to time series data to model the average and selects the best model. VolatilityModel fits generalized autoregressive conditional heteroskedasticity (GARCH) models to model volatility and selects the best model.

MonteCarloSimulation uses the selected average and volatility models to generate multiple scenarios through Monte Carlo simulation over a specified time horizon and number of simulations. It provides methods to return simulated scenarios and statistics.