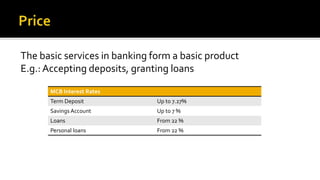

MCB Bank was incorporated in 1947 and later privatized in 1991. It is now one of the top 5 banks in Pakistan with net assets of PKR 1 trillion. The bank has a large branch and ATM network across Pakistan and is listed on the Pakistan Stock Exchange and London Stock Exchange. It offers a variety of personal and business banking products and services including deposits, loans, digital banking and agriculture financing.